Guam Stock Option and Award Plan

Description

How to fill out Stock Option And Award Plan?

If you wish to finalize, retrieve, or print legitimate document formats, utilize US Legal Forms, the largest assortment of legal templates available online.

Take advantage of the site's user-friendly and straightforward search feature to find the documents you require.

A selection of templates for commercial and personal purposes is categorized by groups and states, or keywords.

Step 4. Once you have located the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to locate the Guam Stock Option and Award Plan in just a few taps.

- If you are already a US Legal Forms member, Log Into your profile and click the Download button to access the Guam Stock Option and Award Plan.

- You can also reach forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form appropriate for your city/region.

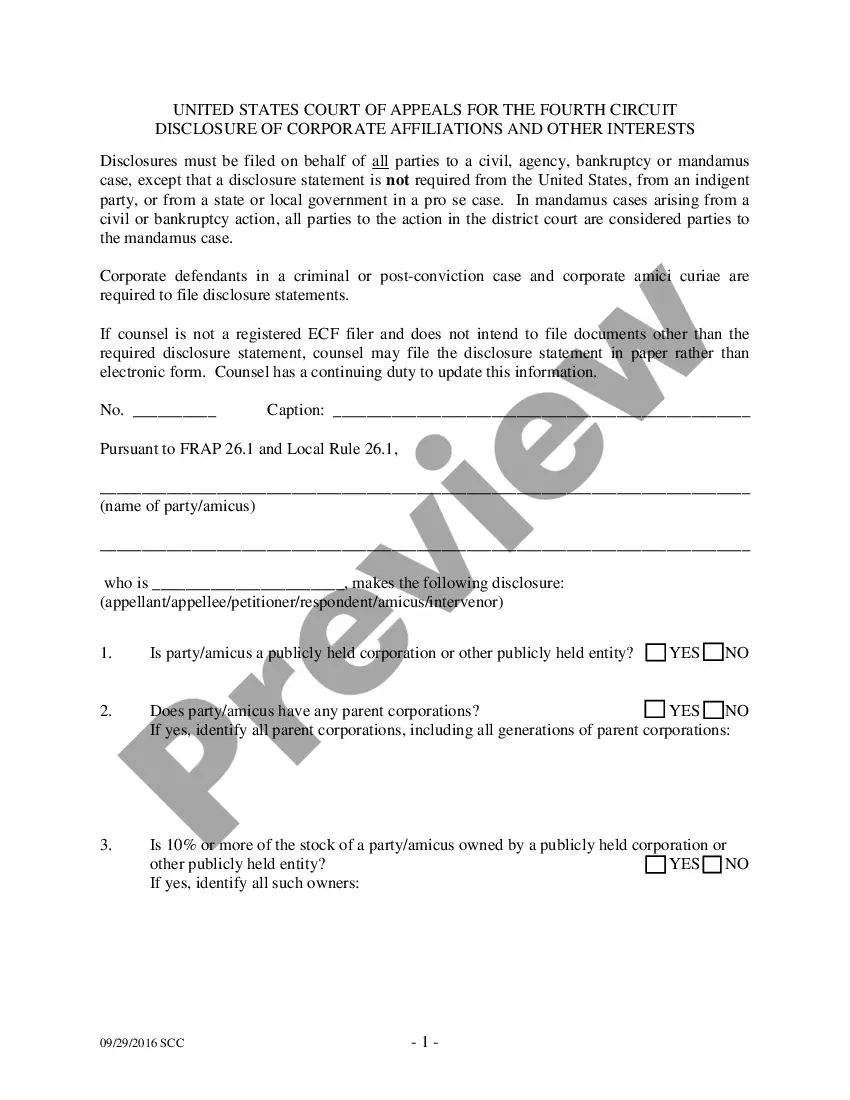

- Step 2. Use the Preview option to review the content of the form. Don’t forget to read the description.

- Step 3. If you are not satisfied with the document, take advantage of the Search area at the top of the screen to find alternative versions of the legal document template.

Form popularity

FAQ

Setting Up Your Employee Stock Option PlanYour company's mission and values should be a major factor in your stock option's plan design. Determine how much of the company you plan to share with early employees and employees that will join your company later. Regular stock grants are sold in shares of 100.

The value of the options is typically determined using Black-Scholes or similar valuation formulas, which take into account such factors as the number of years until the option expires, prevailing interest rates, the volatility of the stock price, and the stock's dividend rate.

Share-option schemesA share option is the right to buy a certain number of shares at a fixed price, some period of time in the future, within a company. Employees can generally exercise their share options - ie buy the shares - after a specified period, known as the vesting period.

Call example The current price of the stock is $30. If the price of the stock shoots up to $55 on the day of expiration, Jon can exercise his option to buy 100 shares of CSX at $45 and then sell them at $55 on the day of expiration, making a profit of $10 per share.

1: SetupDevelop your philosophy. Your stock option plan is an expression of your company philosophy.Paper it. Adopt your stock plan and option agreements and get board and stockholder approval.Make it official. Work with your lawyers to obtain all relevant state permits for your option plan.

With a stock option, an employee is given a certain percentage of ownership in the company they work for in the form of shares. If the company grows, the employee will see their shares increase in value. Basically, as the company profits, employees profit as well.

Key Takeaways. Before options can be written, a stock must be properly registered, have a sufficient number of shares, be held by enough shareholders, have sufficient volume, and be priced high enough. The specifics of these rules can change, but the general idea is to protect investors.

Stock options are usually granted for a specific period (option term) and must be exercised within that period. A common option term is 10 years, after which, the option expires. While time-based vesting remains popular, companies are increasingly granting equity that vests upon meeting certain performance criteria.

ESOs are a form of equity compensation granted by companies to their employees and executives. Like a regular call option, an ESO gives the holder the right to purchase the underlying assetthe company's stockat a specified price for a finite period of time.

200bFor companies that choose to retain control of their stock plan administration, we offer the simultaneous exercise and sell options (SESO) program to provide you and your employees with an easy-to-use solution for selling shares received from the exercise of stock options.