Guam Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate

Description

How to fill out Personal Guaranty - Guarantee Of Contract For The Lease And Purchase Of Real Estate?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal template documents that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the Guam Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate within seconds.

If you already have a subscription, Log In to download the Guam Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate from the US Legal Forms library. The Download button will be visible on each form you view. You can access all previously obtained forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Choose the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Guam Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate. Every template you add to your account has no expiration date and is yours forever. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Guam Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, follow these simple steps to get started.

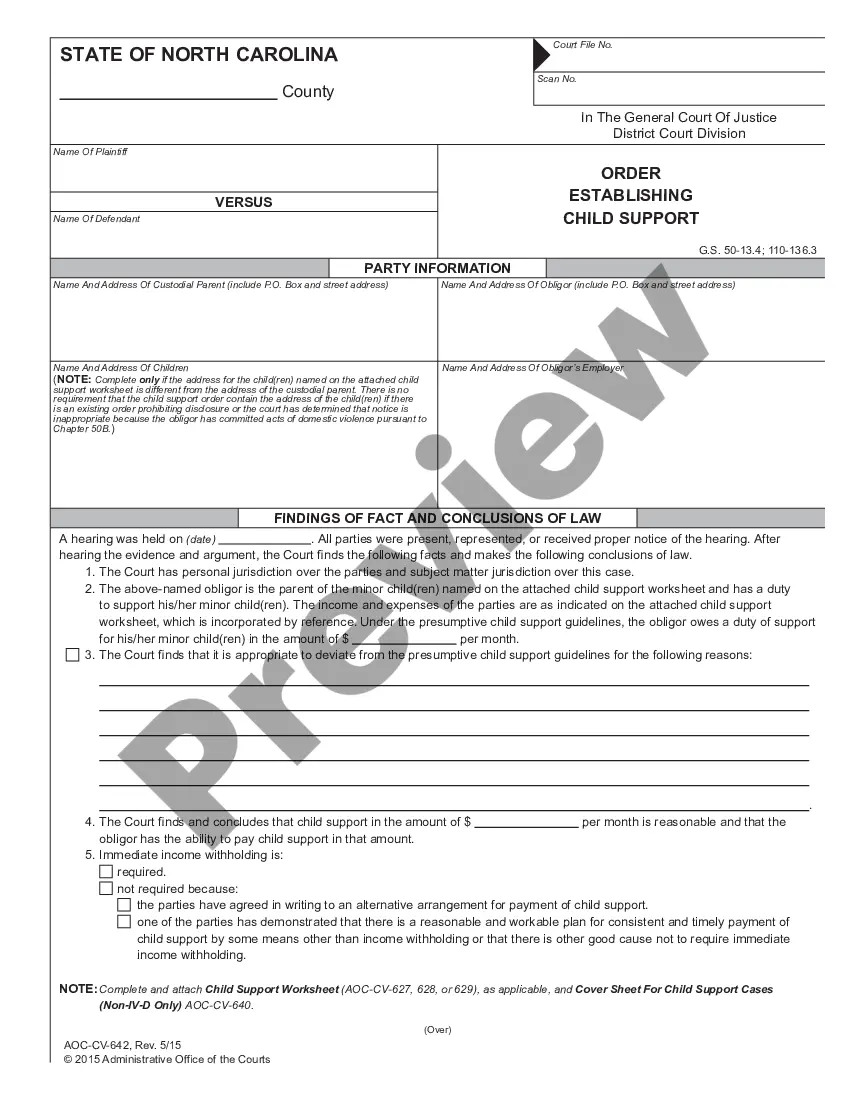

- Ensure you have selected the appropriate form for your city/state. Click the Review button to examine the content of the form.

- Check the form description to make sure you have chosen the right form.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that fits.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

While it is not mandatory to have a guarantor on a commercial lease, it is often recommended. A guarantor can provide additional security for landlords, especially for tenants with limited credit history. Incorporating a personal guaranty, such as the Guam Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, can strengthen your lease application by assuring the landlord of your ability to meet financial obligations.

To complete a personal guaranty effective for real estate matters like the Guam Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, start by entering your legal name and details. Clearly delineate the obligations you are guaranteeing, including the specific lease or purchase agreement. Always review the entire document before signing, as your signature confirms your commitment to the agreement’s terms, making it a binding contract.

Filling out a personal guarantee for real estate transactions, such as the Guam Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, requires careful attention. First, provide your personal information, including your name, address, and contact details. Then, specify the obligations or debts you are guaranteeing. Ensure that you read the terms thoroughly before signing, as this will obligate you to fulfill the lease or purchase agreement.

The enforceability of a personal guarantee can depend on various factors, including the clarity of the agreement and local laws. Generally, a well-drafted personal guarantee is legally binding, provided it meets the necessary legal requirements. It is essential to comprehend the specifics of your Guam Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate to ensure you understand your obligations and rights.

When negotiating a personal guarantee, focus on discussing terms that can limit your financial exposure. You may propose alternative options, such as providing a lower guarantee amount or using collateral to secure the lease. Engaging with a knowledgeable advisor familiar with Guam Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate can significantly enhance your negotiation strategy.

Yes, it is quite common to encounter personal guarantees on commercial leases. Landlords often require these guarantees to mitigate risk and ensure they have recourse in the event of default. Understanding the nuances of Guam Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate can help you navigate these agreements effectively.

Deciding whether to personally guarantee a lease depends on your circumstances and risk tolerance. A personal guarantee can make you more attractive to landlords and may facilitate negotiations, but it also poses potential financial risks. Carefully weigh the benefits and drawbacks, keeping in mind the implications of a Guam Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

To evict a tenant on Guam, you must follow the legal process outlined by local laws. This typically involves providing a written notice that specifies the reason for eviction, followed by filing a complaint in the appropriate court if the tenant does not vacate. Being familiar with the Guam Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate is crucial, as this can affect your rights and obligations during the eviction process.

To protect yourself from a personal guarantee, you should carefully review the lease or purchase agreement before signing. Consider negotiating terms that limit your liability or require additional security from the other party. It is essential to consult a legal professional familiar with Guam Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate to ensure your rights are safeguarded.