Guam Separation Notice for Unemployment

Description

How to fill out Separation Notice For Unemployment?

If you require thorough, download, or printing legal document templates, utilize US Legal Forms, the largest collection of legal forms, available online.

Take advantage of the website’s easy and convenient search to find the documents you need.

A range of templates for business and personal purposes are organized by categories and states, or keywords.

Each legal document format you purchase is yours permanently. You will have access to every form you saved in your account. Click on the My documents section and choose a form to print or download again.

Compete and download, and print the Guam Separation Notice for Unemployment with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- Use US Legal Forms to obtain the Guam Separation Notice for Unemployment in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Download option to find the Guam Separation Notice for Unemployment.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

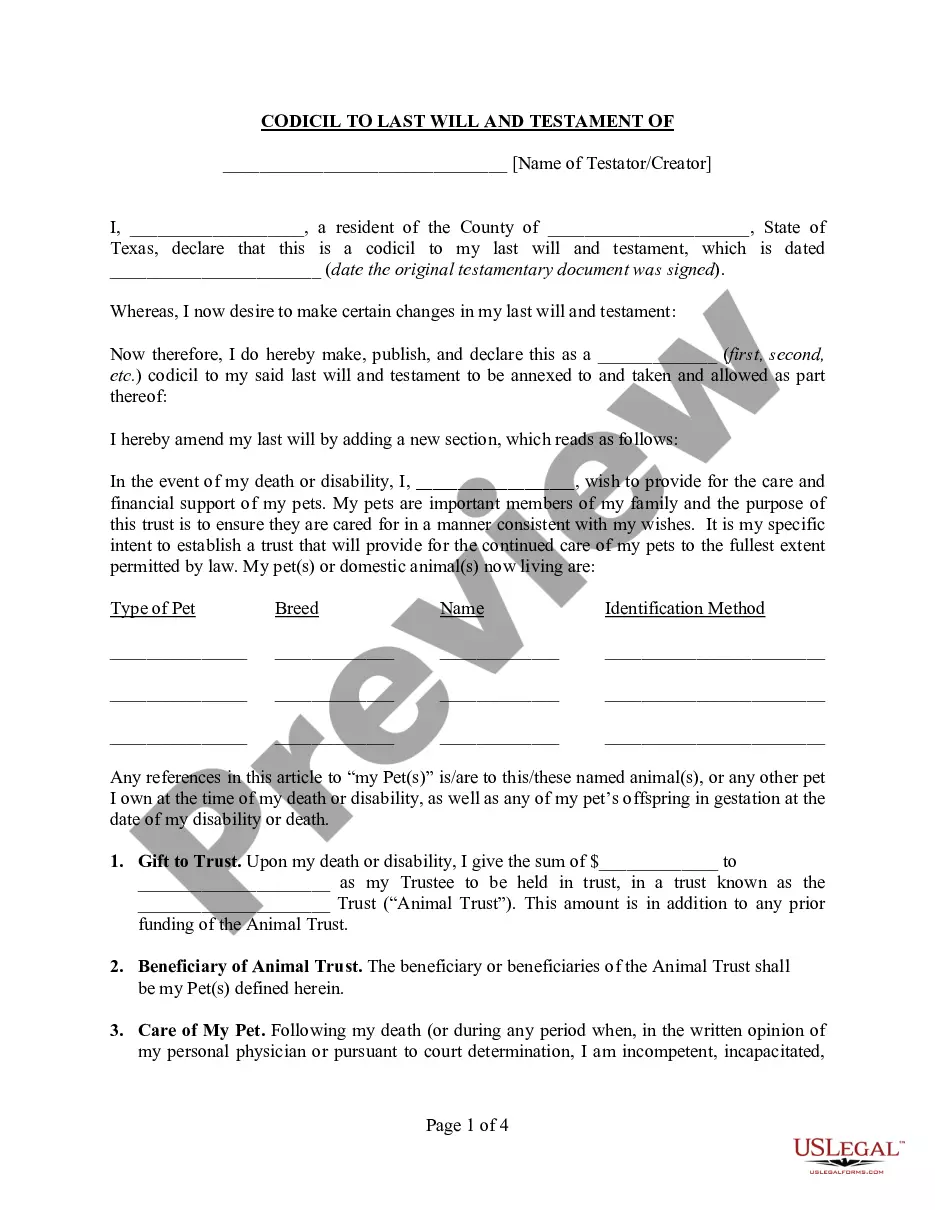

- Step 2. Utilize the Preview option to review the content of the form. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternate versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Select the pricing plan you desire and enter your details to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, modify and print or sign the Guam Separation Notice for Unemployment.

Form popularity

FAQ

To qualify for PUA benefits, you must not be eligible for regular unemployment benefits and be unemployed, partially unemployed, or unable or unavailable to work because of certain health or economic consequences of the COVID-19 pandemic.

A: The PUA program, in general, provides up to 39 weeks of unemployment benefits. Guam's PUA Weekly Benefit Amount (WBA) is $345 a week. Employees who have been laid off or furloughed due to COVID-19 qualify for the full amount. Employees still working but making less than $345 a week qualify for PUA minus their wages.

The original Separation Notice should be given to the separating employee on the employee's last working day, and no later than 3 days after separation. For employees who have quit without notice, the form should be mailed to the employee's last known home address.

What Is a Separation Notice? A general separation notice is a written communication from an employer or an employee saying that the employment relationship is ending.

In Georgia, when the employment relationship ends, employers are required to provide departing employees with a separation notice. Separation notices must be provided if an employee is fired, laid off, or quits.

To receive unemployment benefits, workers also must have been in certain immigration statuses in the base period. Federal law allows states to credit wages earned by (1) immigrants who were admitted for lawful permanent residence at the time services (i.e., work) were performed, (2) immigrants who were lawfully

NOTICE TO EMPLOYEE OCGA SECTION 34-8-190(c) OF THE EMPLOYMENT SECURITY LAW REQUIRES THAT YOU TAKE THIS NOTICE TO THE GEORGIA DEPARTMENT OF LABOR FIELD SERVICE OFFICE IF YOU FILE A CLAIM FOR UNEMPLOYMENT INSURANCE BENEFITS.

A: Because Guam does not have an unemployment insurance system, PUA regulations and administration guidelines must be created. Currently, the U.S. Department of Labor is establishing the procedures for the Guam Department of Labor to administer.

Residents can apply for benefits online at hireguam.com. It may take up to 21 days for a resident to begin receiving assistance checks after their claim is approved, Dell'Isola said.

Working Part Time: You may be eligible for benefits if (1) your regular hours of work are reduced, (2) you are separated from your job and have obtained part-time employment with fewer hours of work, or (3) you are separated from one job but continue to have part-time employment with another employer(s).