Guam Separation Notice for 1099 Employee

Description

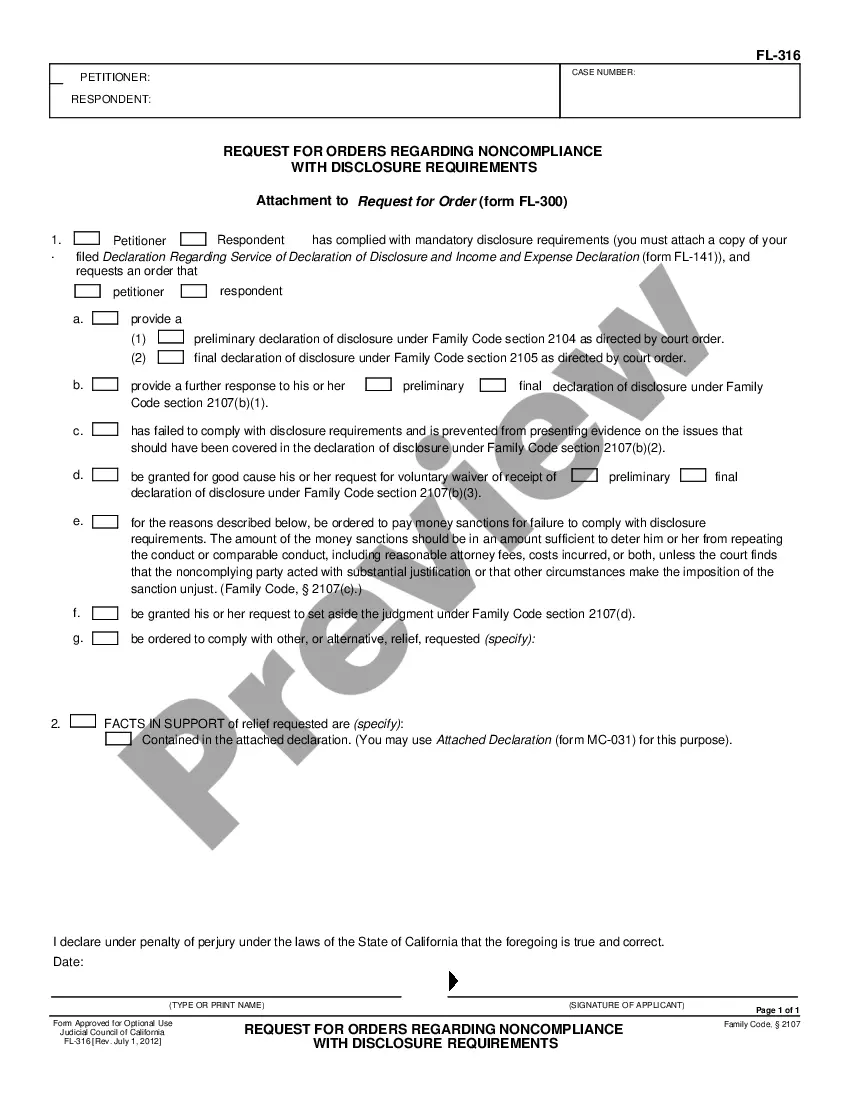

How to fill out Separation Notice For 1099 Employee?

If you need to thorough, obtain, or print legal document templates, utilize US Legal Forms, the biggest collection of legal documents available online.

Take advantage of the site’s straightforward and convenient search feature to find the papers you need.

Multiple templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to acquire the Guam Separation Notice for 1099 Employees in just a few clicks.

Step 5. Complete the payment process. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

Step 6. Choose the format of the legal document and download it to your device. Step 7. Fill out, modify, and print or sign the Guam Separation Notice for 1099 Employees. Each legal document format you download is yours permanently. You can access each form you have downloaded in your account. Click the My documents section and select a form to print or download again. Participate and obtain, and print the Guam Separation Notice for 1099 Employees with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms member, Log In to your account and click the Download button to access the Guam Separation Notice for 1099 Employees.

- You can also retrieve forms you have previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your specific city/state.

- Step 2. Utilize the Preview option to review the form’s content. Remember to read the details.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find other variations of the legal document template.

- Step 4. Once you have found the form you need, click the Buy Now button. Select the pricing plan you prefer and enter your credentials to register for an account.

Form popularity

FAQ

If you have a written contract to complete a specific task or project for a predetermined sum of money, you are probably a 1099 worker. However, if your employment is open-ended, without a contract and subject to a job description, you will typically be considered an employee.

Any employer who pays you during the year for employment must send you a 1099 form by January 31st.

If you paid someone who is not your employee, such as a subcontractor, attorney or accountant $600 or more for services provided during the year, a Form 1099-NEC needs to be completed, and a copy of 1099-NEC must be provided to the independent contractor by January 31 of the year following payment.

A 1099 worker is one that is not considered an employee. Rather, this type of worker is usually referred to as a freelancer, independent contractor or other self-employed worker that completes particular jobs or assignments. Since they're not deemed employees, you don't pay them wages or a salary.

If you have not received an expected 1099 by a few days after that, contact the payer. If you still do not get the form by February 15, call the IRS for help at 1-800- 829-1040. In some cases, you may obtain the information that would be on the 1099 from other sources.

Beginning with tax year 2020, Form 1099-NEC must be filed by January 31 of the following year whether you file on paper or electronically. If the deadline falls on a weekend or holiday then it is moved to the next business day.

According to IRS guidelines, it is possible to have a W-2 employee who also performs work as a 1099 independent contractor so long as the individual is performing completely different duties that would qualify them as an independent contractor.

Because independent contractors pay self-employment tax, employers typically do not have to withhold taxes from their wages. There is, however, an exception known as backup withholding.

A 1099 worker is one that is not considered an employee. Rather, this type of worker is usually referred to as a freelancer, independent contractor or other self-employed worker that completes particular jobs or assignments. Since they're not deemed employees, you don't pay them wages or a salary.

The main difference between W2 and 1099 workers is that a W2 is a payroll employee and a 1099 is a non-payroll worker. The names W2 employee and 1099 worker come from their respective tax forms. Every tax season, employers file a Form W2 to the IRS on behalf of their payroll staff.