Guam Exempt Survey

Description

How to fill out Exempt Survey?

If you wish to completely, download, or create lawful document templates, utilize US Legal Forms, the ultimate repository of legal forms accessible online.

Leverage the site’s straightforward and user-friendly search to find the documents you require.

Various templates for business and personal purposes are categorized by type and state, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the payment. You may use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to obtain the Guam Exempt Survey within a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to retrieve the Guam Exempt Survey.

- You can also access forms you previously saved from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Confirm that you have selected the form for the correct state/region.

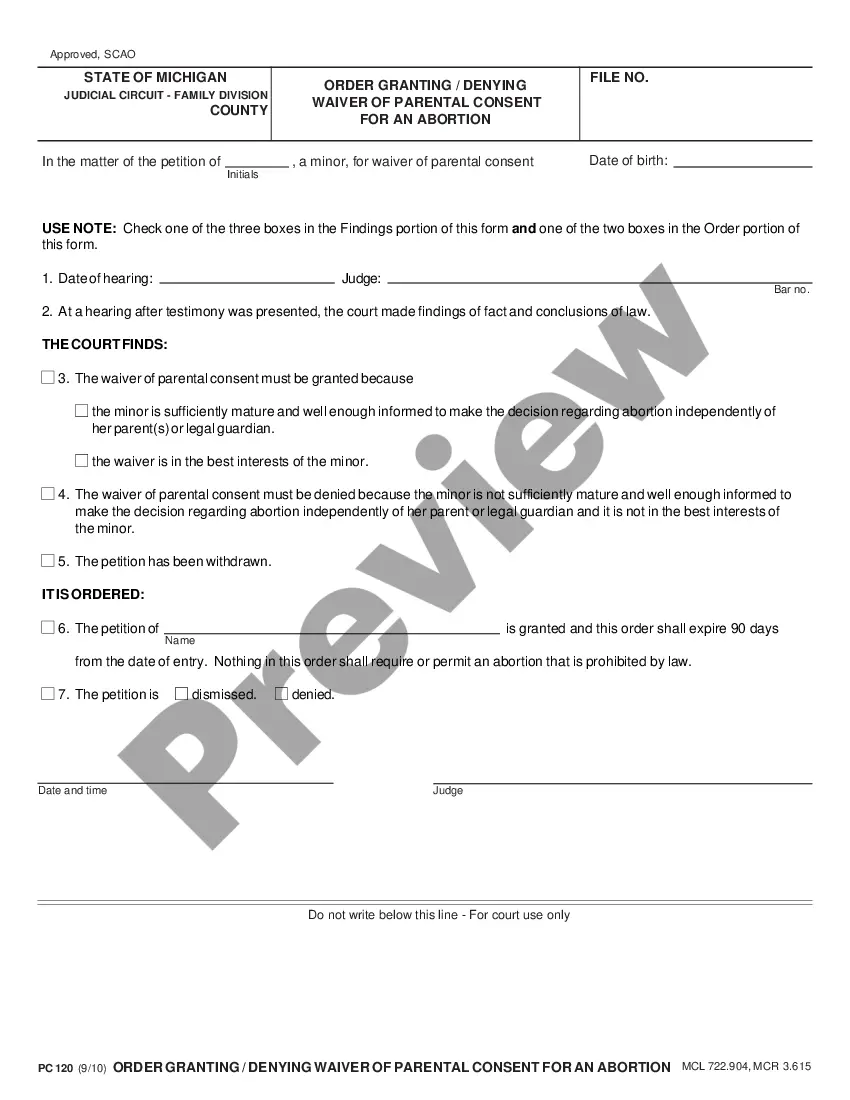

- Step 2. Use the Preview function to review the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

Though Guam pays federal taxes, it doesn't use the United States tax code. The island has its own tax system, which is based on the U.S. laws. The Guam tax system is managed by the Guam Department of Revenue and Taxation.

Other than admissions, use, and hotel occupancy taxes, there is no general sales tax imposed directly on the consumer. Foreign Sales Corporation (FSCs) which are licensed to do business on Guam may qualify for certain exemptions or rebates of income, real property, gross receipts and use taxes.

If you are a bona fide resident of Guam for the entire tax year, then you must file a tax return with Guam reporting gross income from worldwide sources. If you are also a U.S. citizen or resident alien, you must file a U.S. Tax Return reporting your worldwide income, with the exception of income from Guam.

2GU form is used to report wage and salary information for employees earning Guam wages. Example use: Those with one or more employees use this form to report Guam wages and salary with U.S. income tax withheld.

IRS Form W-2VI is used to report wage and salary information for employees earning Virgin Island wages.

An individual who has income from American Samoa, the Commonwealth of the Northern Mariana Islands (CNMI), Guam, Puerto Rico or the U.S. Virgin Islands will usually have to file a tax return with the tax department of one of these territories.

You can file your 1040EZ online using MyGuamTax.com, an official service of the Guam Department of Revenue and Taxation. You will need to create a separate user account on MyGuamTax to file your 1040EZ online.

Employers file this form to report Guam wages. Do not use this form to report wages subject to U.S. income tax withholding.

Guam does not use a state withholding form because there is no personal income tax in Guam.

How can a government agency submit W-3/W-2GU reports online? Complete the E-Filing Registration Form for Government of Guam Agencies and fax it to us at (671) 633-2643 or mail it to the Department of Revenue and Taxation Attn. GuamTax PIN Administrator, P.O. Box 23607 GMF, Guam 96921.