Guam Pot Testamentary Trust

Description

How to fill out Pot Testamentary Trust?

If you want to be thorough, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to find the documents you require.

A selection of templates for business and personal purposes are categorized by groups and regions, or keywords.

Every legal document template you purchase is yours indefinitely. You can access every form you’ve downloaded in your account.

Click the My documents section and select a form to print or download again. Complete, download, and print the Guam Pot Testamentary Trust with US Legal Forms. Numerous professional and state-specific forms are available for your business or personal needs.

- Use US Legal Forms to quickly find the Guam Pot Testamentary Trust with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Purchase button to locate the Guam Pot Testamentary Trust.

- You can also access forms you have previously downloaded under the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your specific city/state.

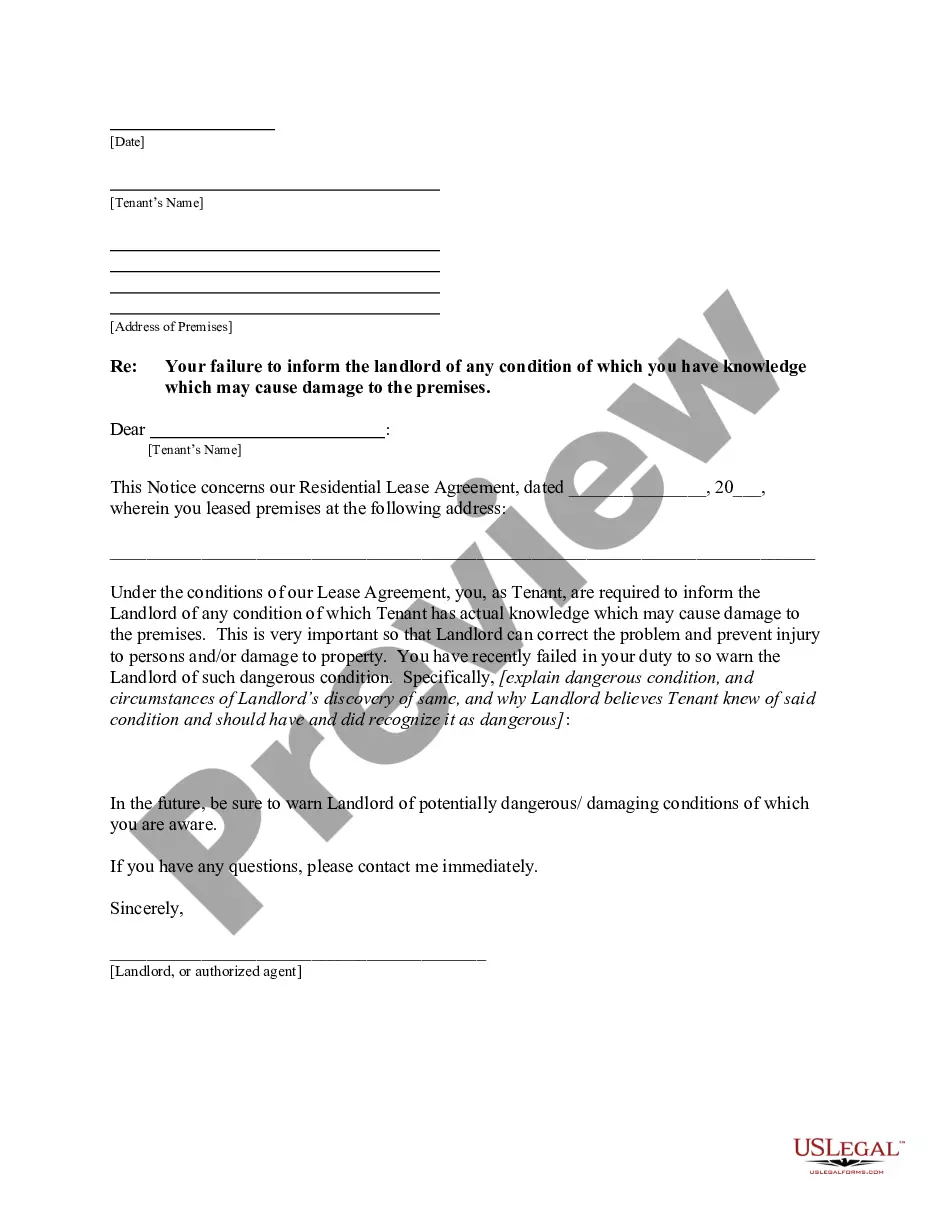

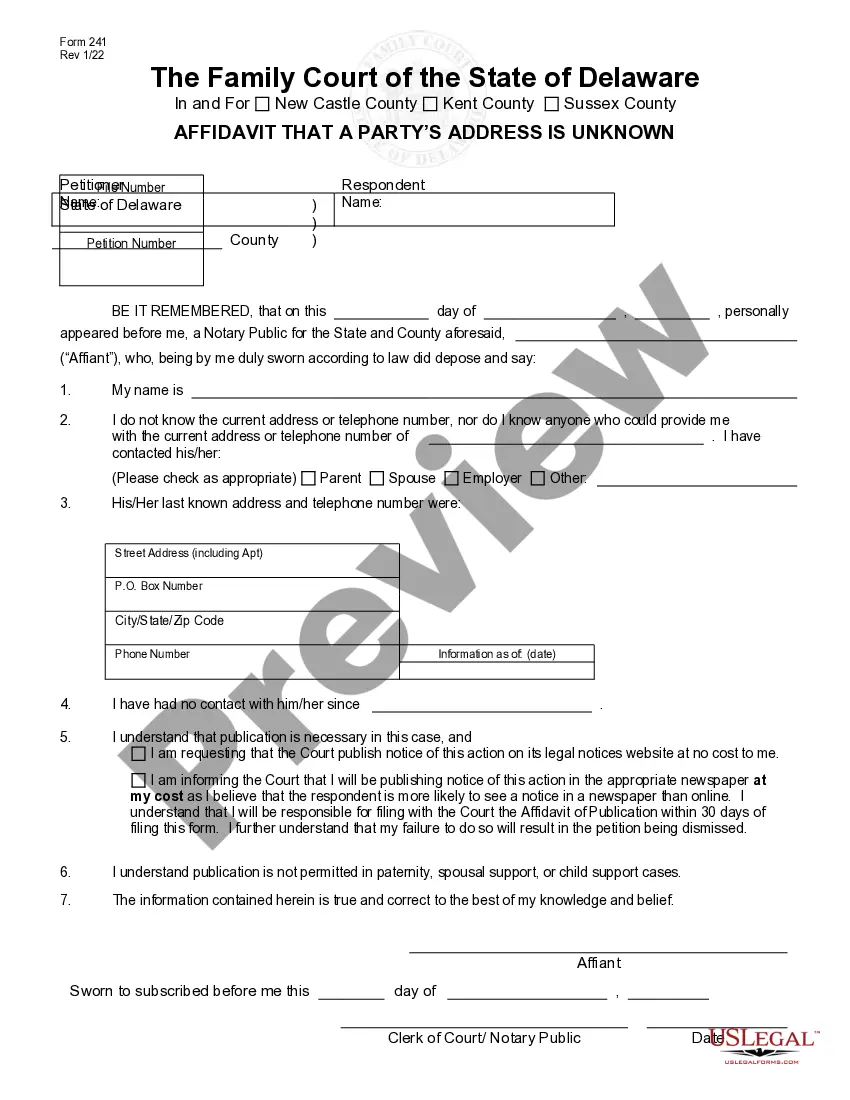

- Step 2. Use the Preview option to review the form’s details. Don’t forget to read the summary.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative types of the legal document template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose your preferred pricing plan and provide your information to create an account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finish the purchase.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Fill out, edit, and print or sign the Guam Pot Testamentary Trust.

Form popularity

FAQ

Yes, there are options to avoid probate using a Guam Pot Testamentary Trust. By establishing this type of trust, you can ensure that your assets transfer smoothly to your heirs without the need for probate court. This can save time and reduce stress for your loved ones. Consider consulting with a legal expert to explore how this trust can fit your estate planning needs.

You may still be wondering, what are the advantages of a Testamentary Trust? The answer is Testamentary Trusts can be a great way to bolster your Estate Planning and ensure your assets are distributed according to your wishes.

Living trusts and testamentary trustsA living trust (sometimes called an inter vivos trust) is one created by the grantor during his or her lifetime, while a testamentary trust is a trust created by the grantor's will.

Naming Your Testamentary TrustThe name of the trust (this must be listed first);The words created in my last will and Testament' (do not include a date created);The name of the trustee, followed by the word trustee;The trustee's address and phone number.

Example of a Testamentary Trust in a WillYou specified that upon your death, Bob will manage your assets for the benefit of your daughter until she reaches the age of 21. You want Bob to be in charge of giving your daughter monthly income for education and expenses.

To create a testamentary trust, the settlor first must select the trustee and the beneficiary and specify the assets that are to be placed in trust. The settlor also has the ability to specify when and how to disburse the trust to the beneficiary. The last will and testament should detail all of this information.

A pot trust is a type of trust that lists children as beneficiaries, with the trustee using his or her discretion as to how trust assets should be spent. If you have minor children, you might consider setting up a pot trust to meet their financial needs, if something should happen to you.

A testamentary trust is created to manage the assets of the deceased on behalf of the beneficiaries. It is also used to reduce estate tax liabilities and ensure professional management of the assets of the deceased.

The trust can also be used to reduce estate tax liabilities and ensure professional management of the assets. A disadvantage of a testamentary trust is that it does not avoid probatethe legal process of distributing assets through the court.