Guam Authority of Partnership to Open Deposit Account and to Procure Loans

Description

How to fill out Authority Of Partnership To Open Deposit Account And To Procure Loans?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast array of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for both business and personal purposes, categorized by types, states, or keywords. You can find the latest documents such as the Guam Authority of Partnership to Open Deposit Account and to Procure Loans in just moments.

If you possess a monthly membership, Log In to download the Guam Authority of Partnership to Open Deposit Account and to Procure Loans from the US Legal Forms collection. The Download button will appear for every form you view. You have access to all previously downloaded forms in the My documents section of your account.

Once you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, choose the subscription plan that you prefer and provide your details to register for an account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase. Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Guam Authority of Partnership to Open Deposit Account and to Procure Loans.

Each document added to your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print another version, simply navigate to the My documents section and click on the form you need.

Access the Guam Authority of Partnership to Open Deposit Account and to Procure Loans with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize a myriad of professional and state-specific templates that cater to your business or personal needs and requirements.

- Before using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your locality/region

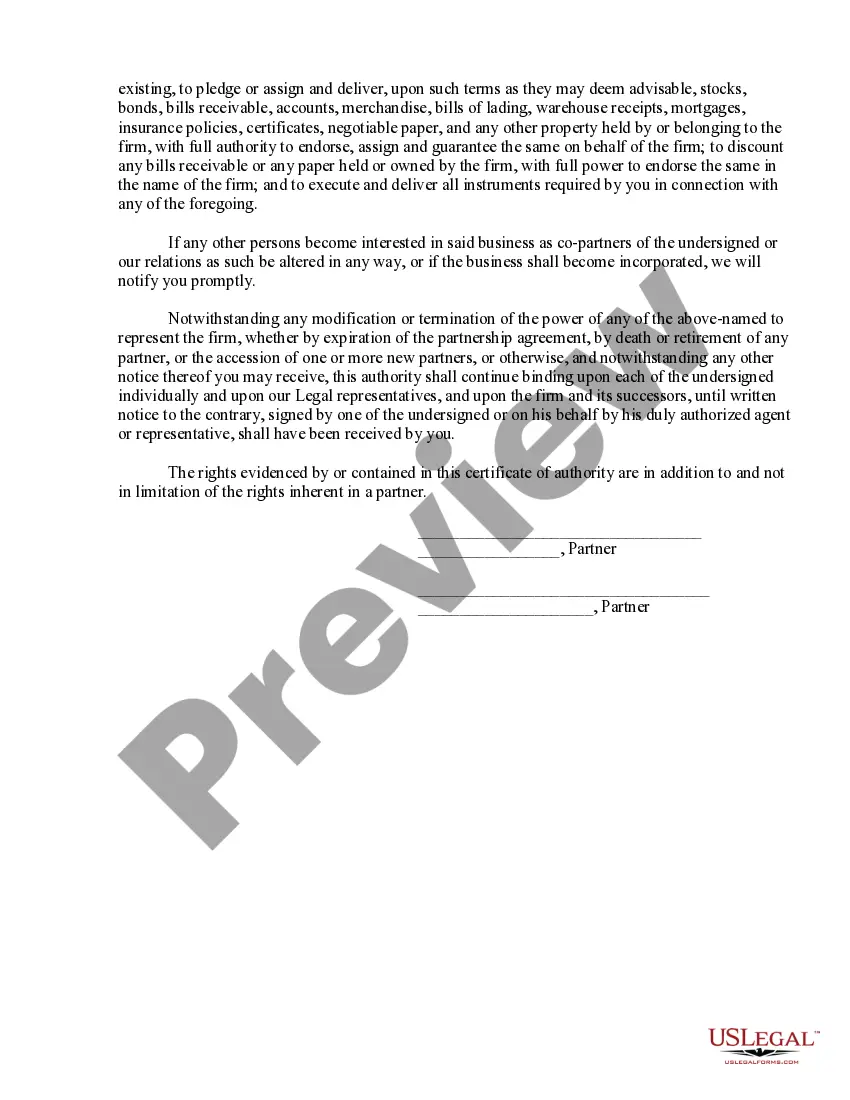

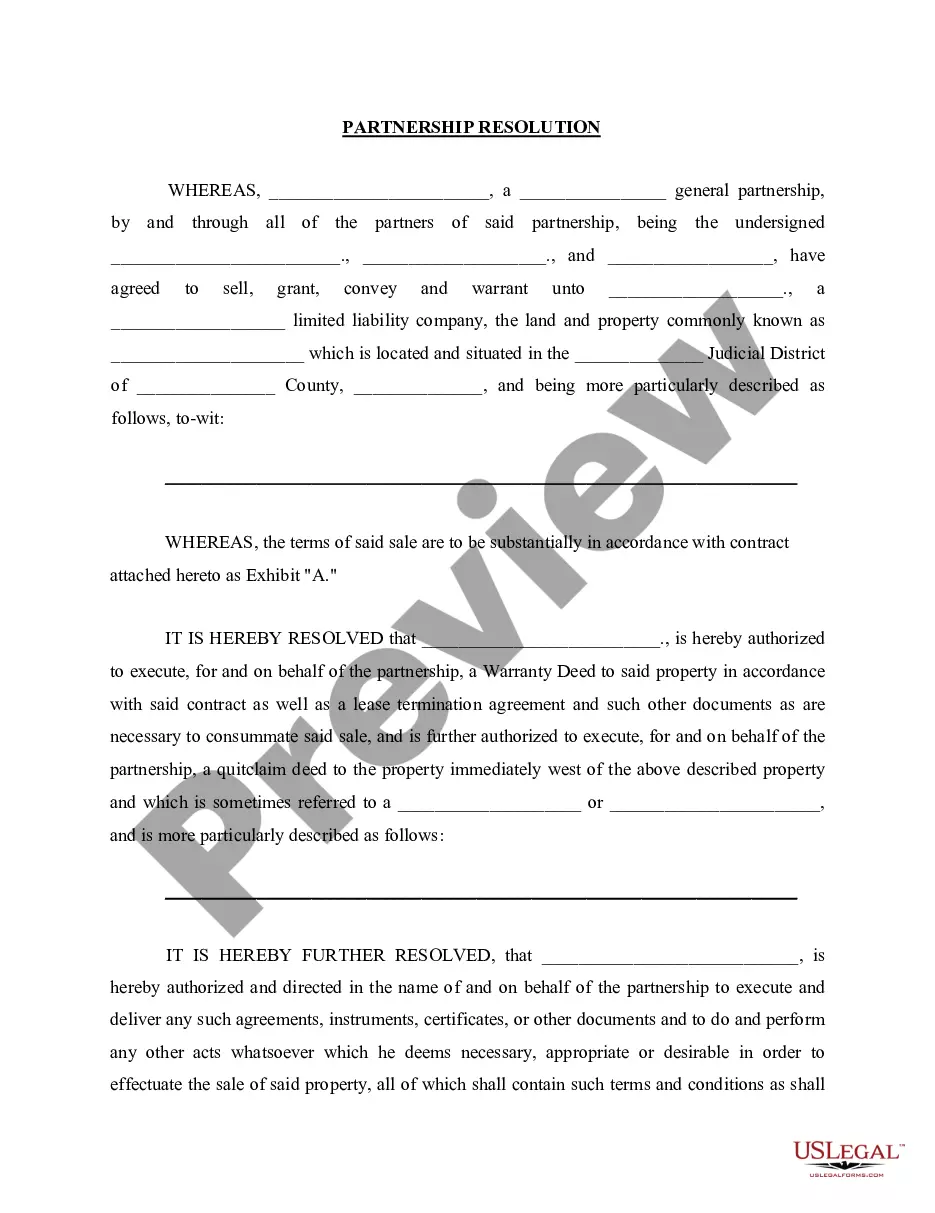

- Use the Review option to examine the content of the form.

- Check the form outline to confirm that you have picked the appropriate form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

Form popularity

FAQ

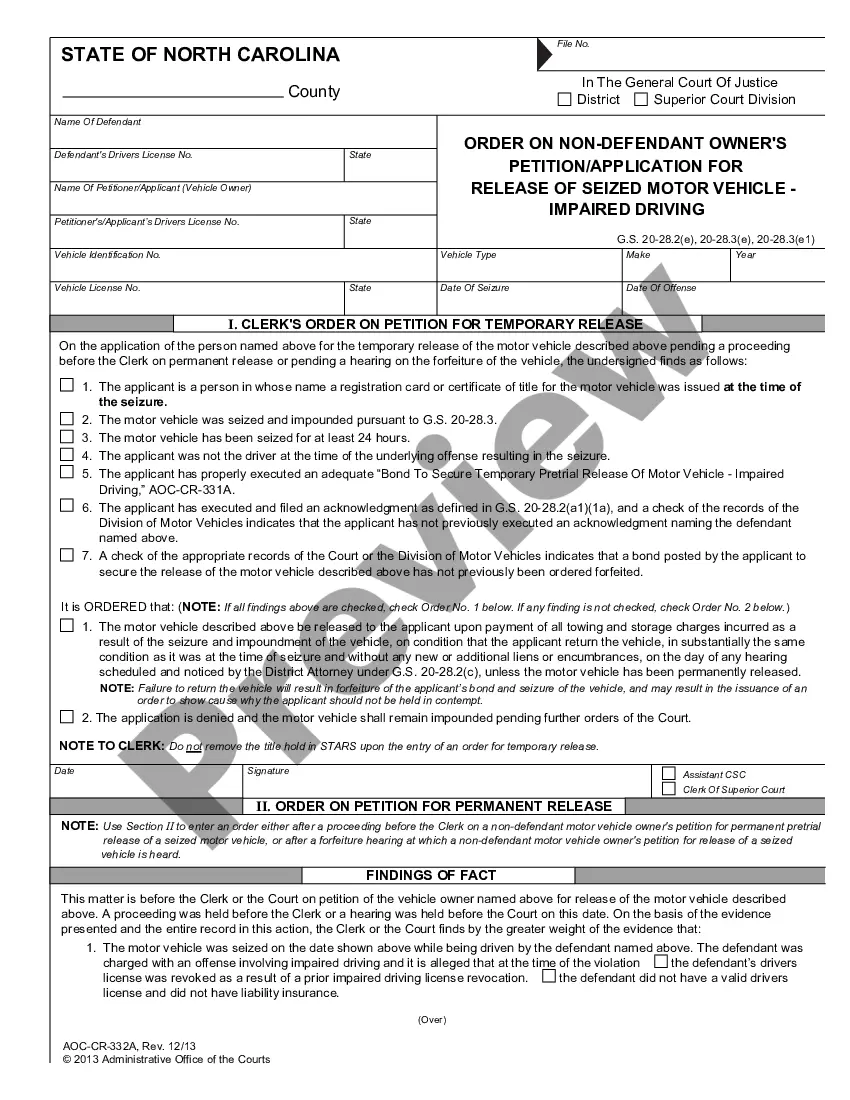

Under the Bank Secrecy Act (BSA), financial institutions are required to assist U.S. government agencies in detecting and preventing money laundering, such as:Keep records of cash purchases of negotiable instruments,File reports of cash transactions exceeding $10,000 (daily aggregate amount), and.More items...

One way to do this is by checking what's called the five C's of credit: character, capacity, capital, collateral and conditions. Understanding these criteria may help you boost your creditworthiness and qualify for credit. Here's what you should know.

Federal law requires a person to report cash transactions of more than $10,000 by filing IRS Form 8300 PDF, Report of Cash Payments Over $10,000 Received in a Trade or Business.

For cash of $3,000-$10,000, inclusive, to the same customer in a day, it must keep a record. more to the same customer in a day, regardless of the method of payment, it must keep a record. a record. The Bank Secrecy Act (BSA) was enacted by Congress in 1970 to fight money laundering and other financial crimes.

Recordkeeping Requirements For each payment order in the amount of $3,000 or more that a bank accepts as an originator's bank, the bank must obtain and retain the following records ( 31 CFR 1020.410(a)(1)(i)): Name and address of the originator. Amount of the payment order. Date of the payment order.

Standards may differ from lender to lender, but there are four core components the four C's that lender will evaluate in determining whether they will make a loan: capacity, capital, collateral and credit.

1 The Recordkeeping Rule currently requires that financial institutions collect and retain certain information for funds transfers of $3,000 or more, such as the originator's name and address, the amount and date of the payment order, payment instructions, and the identity of the beneficiary's bank.

The first C is characterthe applicant's credit history. The second C is capacitythe applicant's debt-to-income ratio. The third C is capitalthe amount of money an applicant has. The fourth C is collateralan asset that can back or act as security for the loan.

Banks don't lend out of deposits; nor do they lend out of reserves. They lend by creating deposits. And deposits are also created by government deficits.

For those transactions identified by issuers of money orders or traveler's checks from a review of clearance records or other similar records of money orders or traveler's checks that have been sold or processed, the threshold which triggers the reporting requirement is $5,000.