South Dakota Revocable Trust for Married Couple

Description

How to fill out Revocable Trust For Married Couple?

Are you in a position where you frequently require documents for various business or personal purposes nearly every day.

There are numerous legal document templates available online, but finding ones you can rely on isn't easy.

US Legal Forms offers a wide array of form templates, such as the South Dakota Revocable Trust for Married Couple, designed to meet state and federal regulations.

Once you find the appropriate document, click on Get now.

Choose the pricing plan you prefer, fill in the required information to create your account, and place your order using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Afterwards, you can download the South Dakota Revocable Trust for Married Couple template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it corresponds to your relevant state/area.

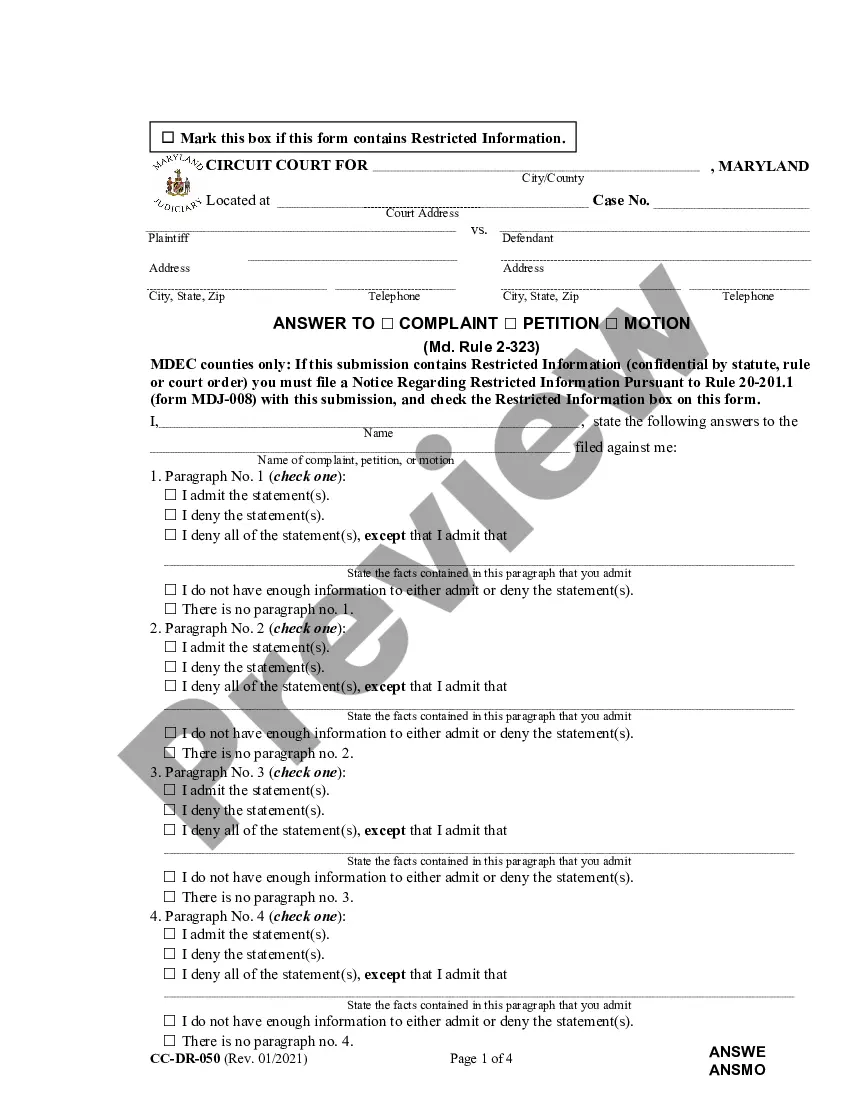

- Utilize the Preview button to review the document.

- Examine the details to confirm that you have selected the correct form.

- If the form isn't what you're looking for, use the Search field to find the document that suits your needs.

Form popularity

FAQ

When a spouse dies, the first step is to consult the South Dakota revocable trust for married couples to understand how the assets are managed and distributed. Gathering important documents, including the trust and any wills, is crucial for clarity. Next, reach out to an attorney specializing in estate planning to navigate the legal process effectively. This initial guidance can alleviate stress during a difficult time.

While a South Dakota revocable trust for married couples offers many benefits, it can also have drawbacks. One potential disadvantage is the requirement for both parties to agree on changes, which can lead to conflicts. Additionally, if one spouse becomes incapacitated, it may complicate management if both individuals do not have clear understanding. It’s important to weigh these factors carefully during the planning process.

One significant mistake parents often make with a trust fund is not clearly communicating their intentions to their children. Without understanding the purpose of the South Dakota revocable trust for married couples, beneficiaries may misinterpret its goals. It's vital to have open discussions with family members about the trust’s structure and benefits. This clarity helps prevent confusion and conflict later.

In a well-structured South Dakota revocable trust for married couples, the trust typically remains revocable even after one spouse passes away. The surviving spouse retains the ability to modify or dissolve the trust as necessary. This flexibility is crucial for adapting to changing circumstances down the line. Thus, it allows couples to retain control over their estate planning decisions.

A South Dakota revocable trust for married couples allows both partners to manage their assets collaboratively while retaining flexibility. Each spouse can make changes to the trust during their lifetime, ensuring it meets their needs. Upon the passing of one spouse, the surviving partner can continue to manage the trust without immediate court intervention. This setup simplifies asset distribution and provides peace of mind.

A joint spousal trust is a type of trust designed specifically for married couples, allowing them to manage their assets collectively. In the context of a South Dakota Revocable Trust for Married Couples, this type of trust can simplify the management of joint assets and streamline the transfer of wealth upon death. It offers flexibility and can provide significant tax benefits, making it a beneficial tool for estate planning. Couples should explore this option as a way to enhance their financial security and ease the management of their estate.

While a South Dakota Revocable Trust for Married Couples offers many benefits, it also has some downsides to consider. Trusts do not provide protection from creditors, meaning your assets could still be vulnerable. Furthermore, the process to establish the trust can be complex and may require legal assistance. It's essential to weigh these factors against your goals for estate planning.

When considering a South Dakota Revocable Trust for Married Couples, South Dakota often stands out as a top choice. The state offers favorable tax laws and a streamlined process for creating and managing trusts. Additionally, South Dakota has laws that protect assets and ensure privacy, making it an attractive option for married couples looking to safeguard their wealth. Overall, it provides a beneficial environment for estate planning.

South Dakota's trust laws are designed to be accommodating and beneficial, especially for those considering a South Dakota Revocable Trust for Married Couple. The state permits long-lasting trusts, allowing them to remain in place for many generations. Additionally, South Dakota provides robust asset protection features, which enhances the security of your trust assets.

A South Dakota Revocable Trust for Married Couple offers numerous benefits, including privacy, flexibility, and ease of management. For instance, your assets can avoid the lengthy probate process, ensuring a quicker transfer to your beneficiaries. Moreover, South Dakota's favorable trust laws protect your assets from creditors and help maintain control over distribution.