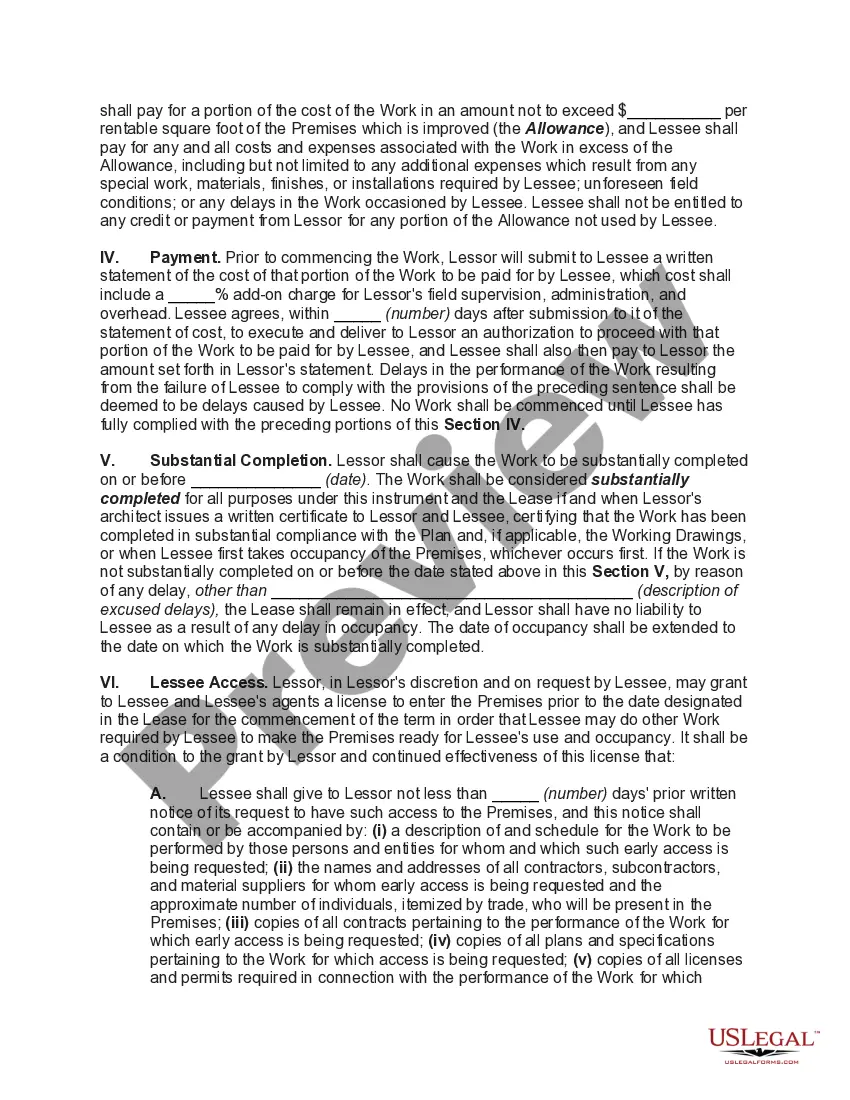

Guam Agreement by Lessee to Make Leasehold Improvements

Description

How to fill out Agreement By Lessee To Make Leasehold Improvements?

You can utilize the Internet to seek out the official document format that complies with the federal and state requirements you desire.

US Legal Forms offers a wide array of legal forms that are reviewed by professionals.

You can conveniently download or print the Guam Agreement by Lessee to Make Leasehold Enhancements from our platform.

First, ensure that you have selected the appropriate document format for your area/town of choice. Review the form description to confirm you have chosen the correct form. If available, use the Review option to inspect the document format as well.

- If you currently possess a US Legal Forms account, you may Log In and select the Obtain option.

- Then, you can complete, modify, print, or sign the Guam Agreement by Lessee to Make Leasehold Enhancements.

- Each legal document format you receive is yours permanently.

- To acquire an additional copy of any purchased form, visit the My documents tab and click the relevant option.

- If this is your initial time using the US Legal Forms website, follow the simple instructions below.

Form popularity

FAQ

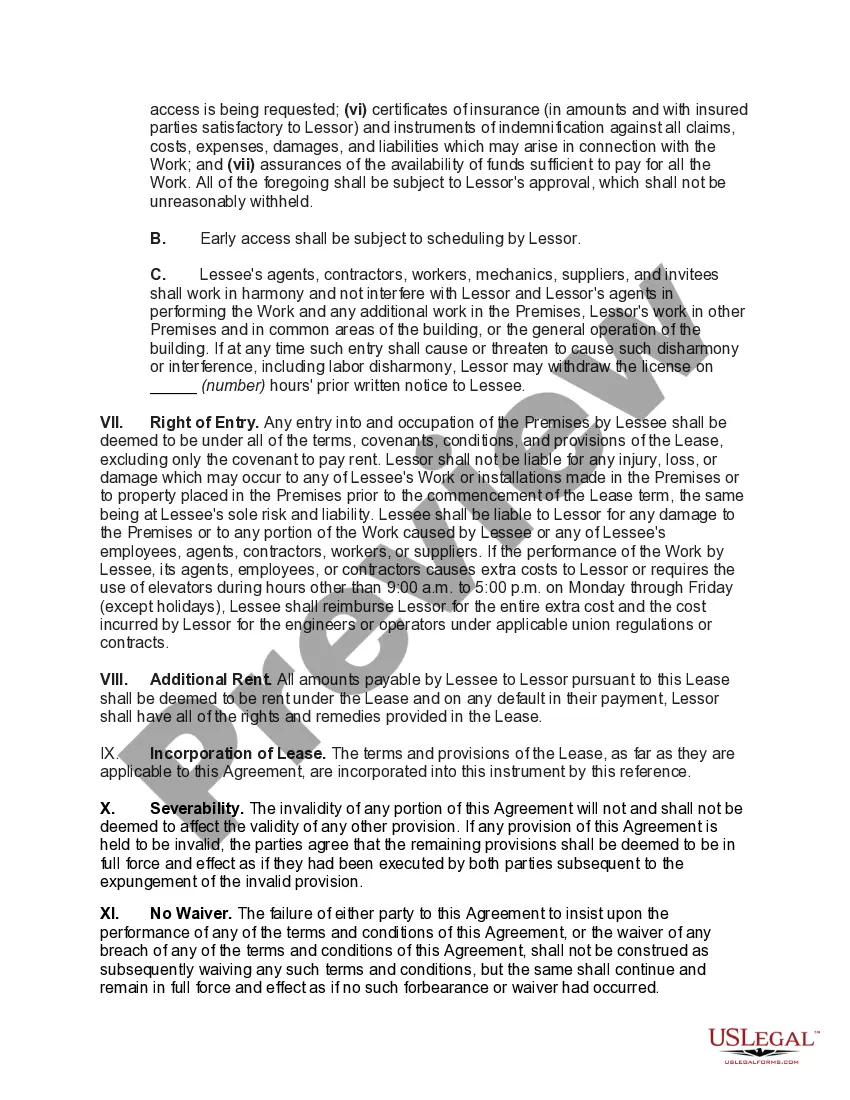

You expense capital assets over the useful life of the asset as designated by the IRS.Create an account called Leasehold Improvements in the assets section of your accounting general ledger.Record the entire cost of the leasehold improvements as an increase to the leasehold improvements account.More items...

Recording Leasehold Improvements You will set up an account on your balance sheet for leasehold improvement accumulated depreciation and a leasehold improvement depreciation expense on your income statement.

When you pay for leasehold improvements, capitalize them if they exceed the corporate capitalization limit. If not, charge them to expense in the period incurred. If you capitalize these expenditures, then amortize them over the shorter of their useful life or the remaining term of the lease.

Technically, leasehold improvements are amortized, rather than being depreciated. This is because the actual ownership of the improvements is by the lessor, not the lessee. The lessee only has an intangible right to use the asset during the lease term. Intangible rights are amortized, not depreciated.

Lease. legal document that defines conditions of rental agreement between tenant and landlord. security deposit.

A lease is an implied or written agreement specifying the conditions under which a lessor accepts to let out a property to be used by a lessee. The agreement promises the lessee use of the property for an agreed length of time while the owner is assured consistent payment over the agreed period.

Lease deed is generally required when the property is leased for a long time, ranging between 1-5 years or even for a longer period. In such cases, a lease deed agreement plays an important role in maintaining the relationship between the landlord and the tenant and lays down provisions that legally bind them.

The lease agreement is a contract between the lessor vs lessee for the use of the asset or property. It outlines the terms of the contract and sets the legal obligations associated with the use of the asset. Both parties are signatories to the agreement and are required to abide by its rules.

A lease agreement, as we know, is a contract between two parties, (a lessee and the lessor here, the lessee being the one who is renting/leasing the property, and the lessor, the owner), wherein, specific conditions are mentioned about renting or leasing the property.

Leasehold improvements are assets, and are a part of property, plant, and equipment in the non-current assets section of the balance sheet. Therefore, they are accounted for with other fixed assets in accordance with ASC 360.