Guam Joint Trust with Income Payable to Trustors During Joint Lives

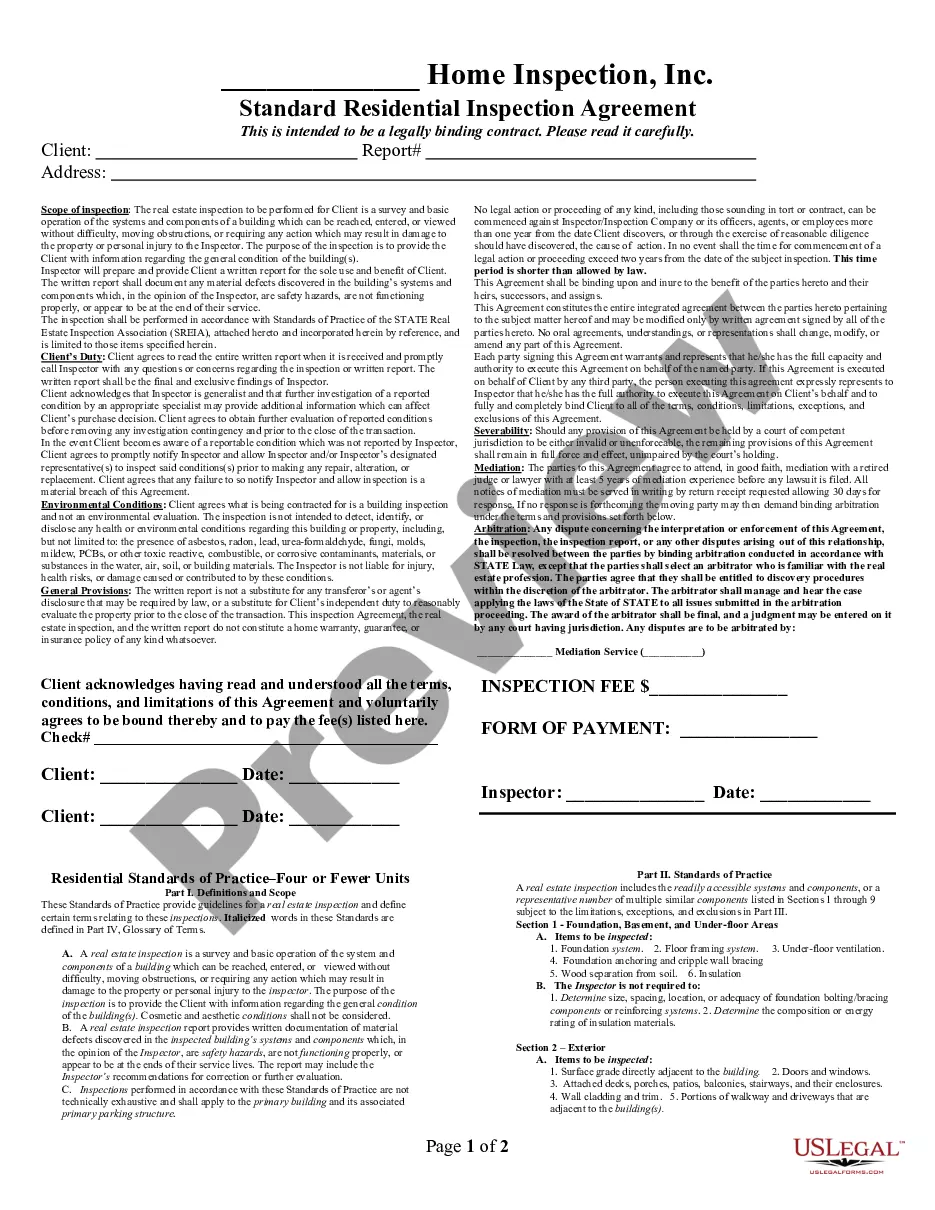

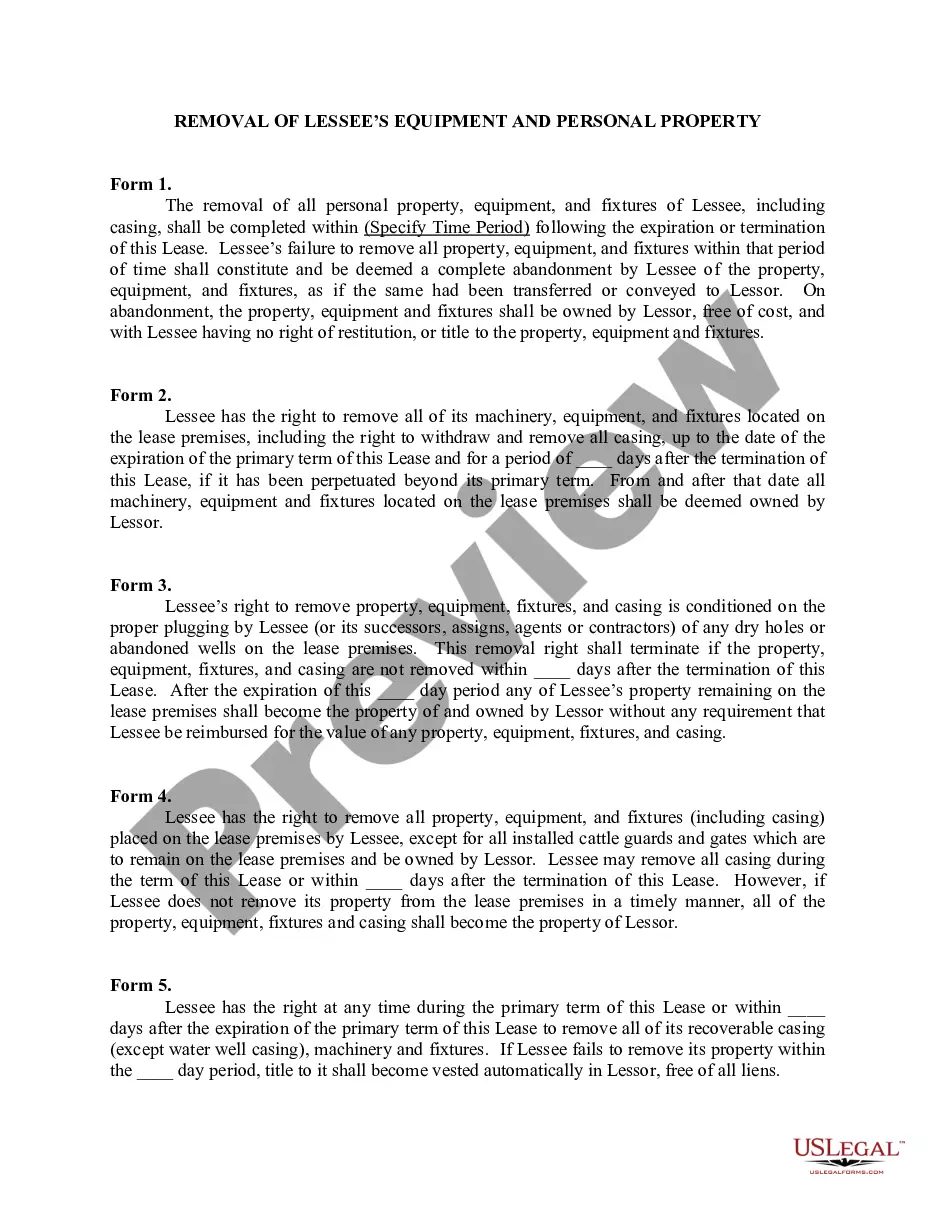

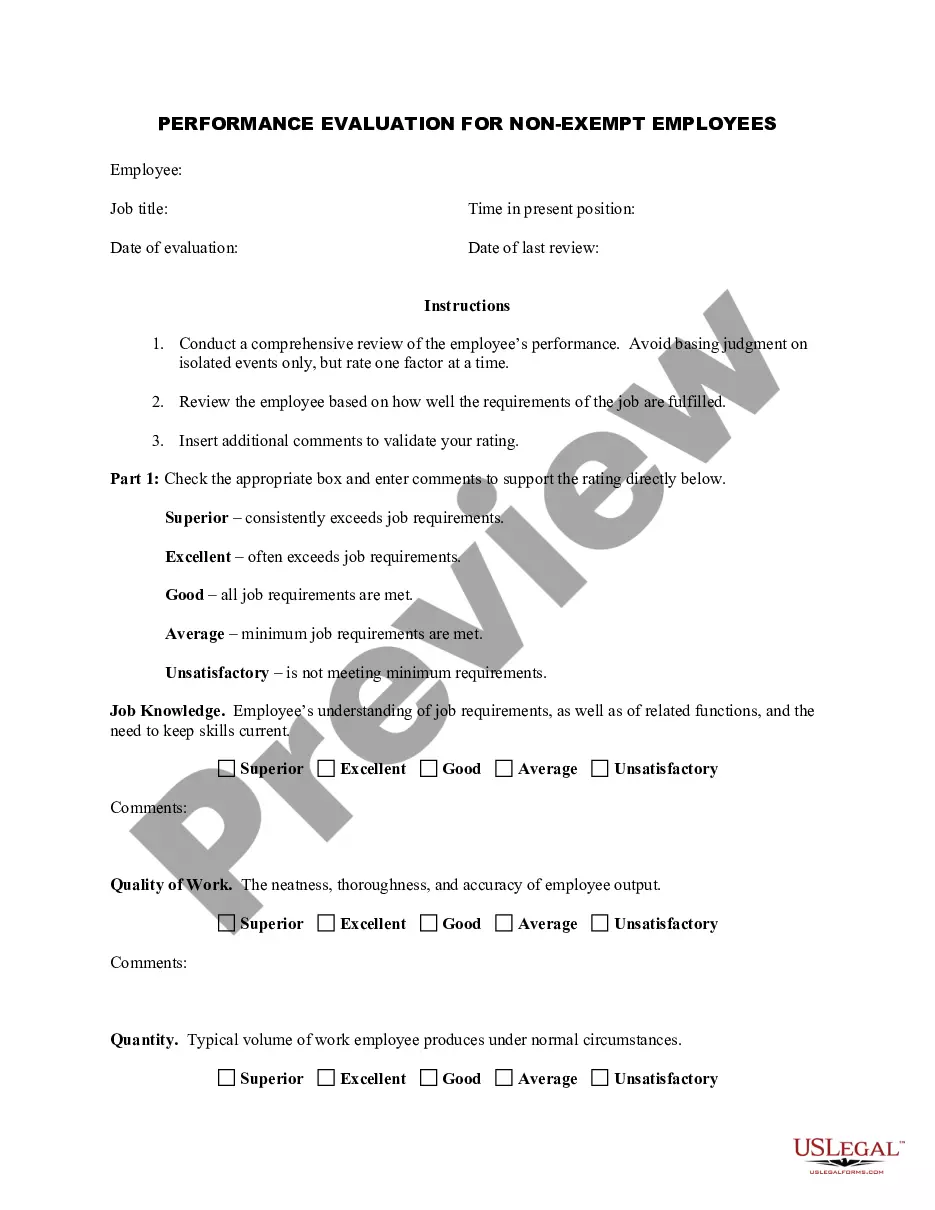

Description

How to fill out Joint Trust With Income Payable To Trustors During Joint Lives?

Selecting the optimal authorized document template can be a challenge. Certainly, there are numerous templates accessible online, but how do you discover the legal form you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Guam Joint Trust with Income Payable to Trustors During Joint Lives, suitable for business and personal needs. All forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Obtain button to receive the Guam Joint Trust with Income Payable to Trustors During Joint Lives. Use your account to access the legal forms you have previously acquired. Go to the My documents section of your account and download another copy of the document you require.

Select the document format and download the legal document template to your device. Finally, complete, modify, print, and sign the acquired Guam Joint Trust with Income Payable to Trustors During Joint Lives. US Legal Forms is the largest library of legal forms where you can access various document templates. Use the service to download properly crafted documents that adhere to state regulations.

- First, ensure you have selected the correct form for your city/state.

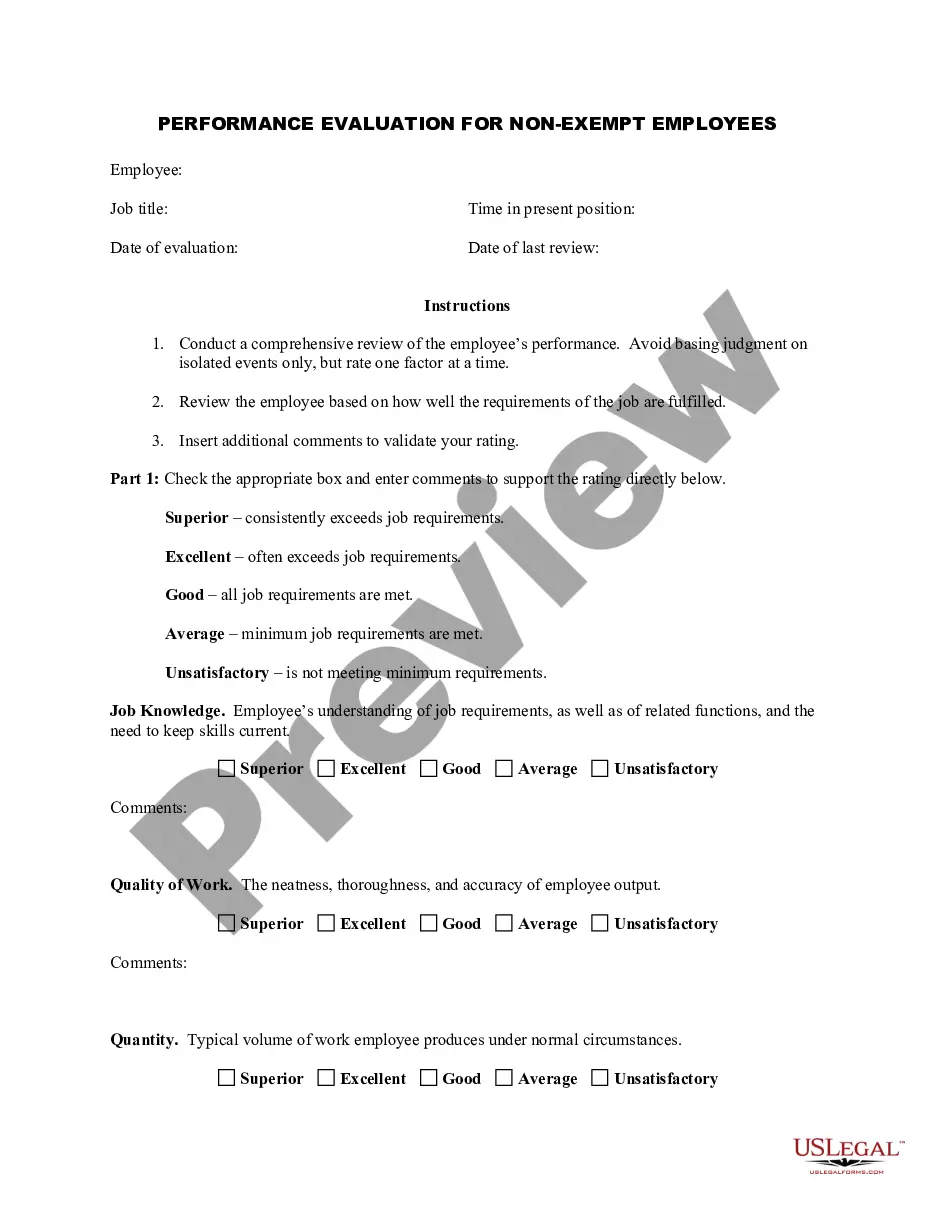

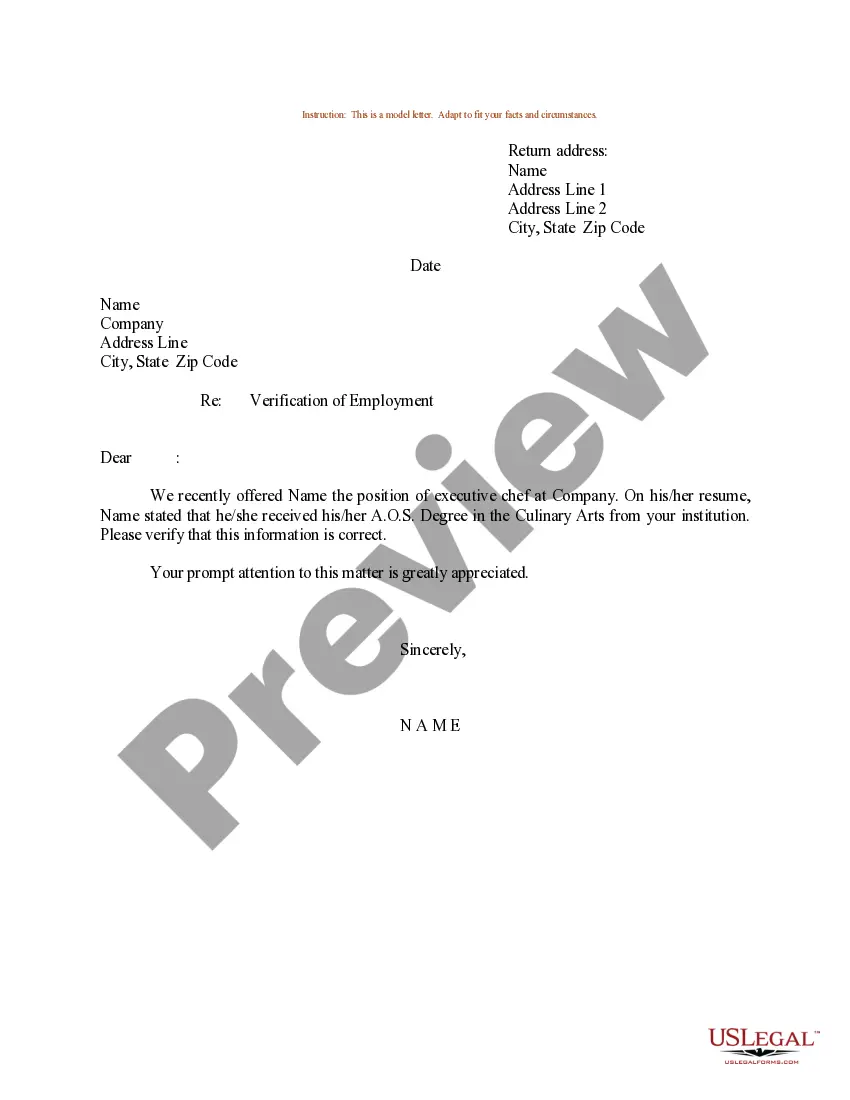

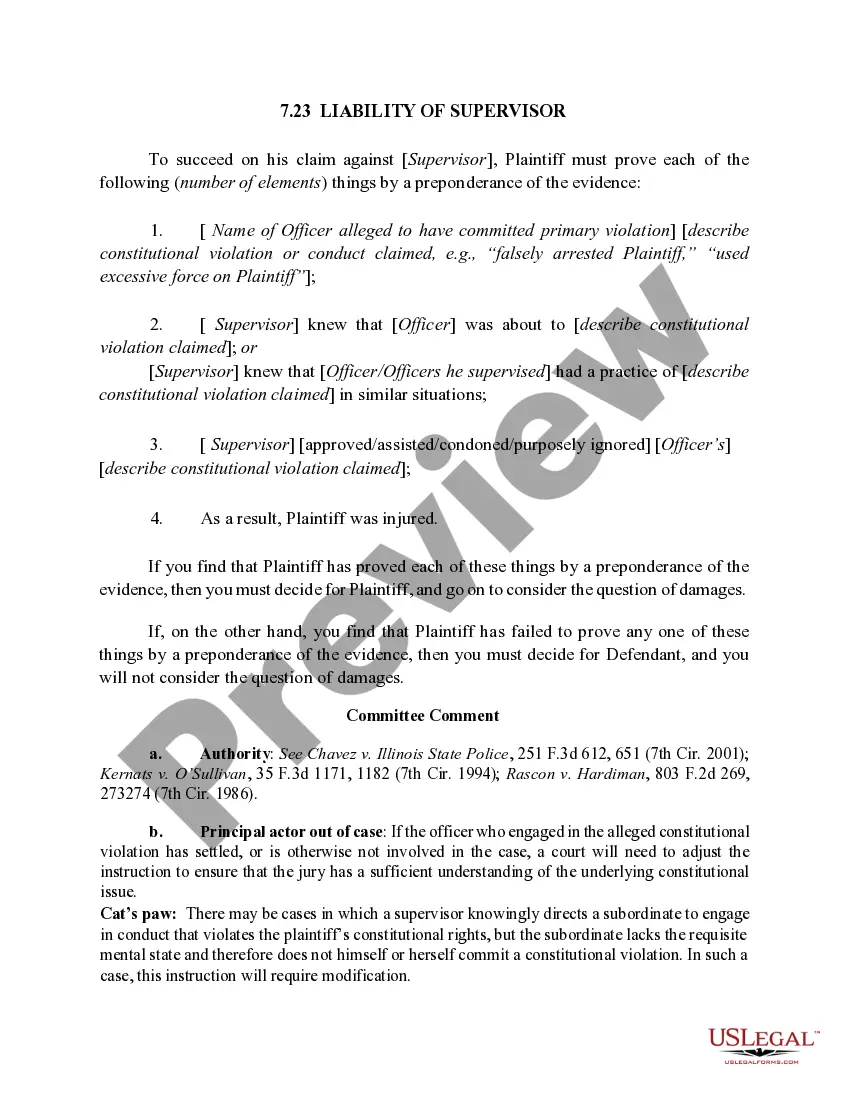

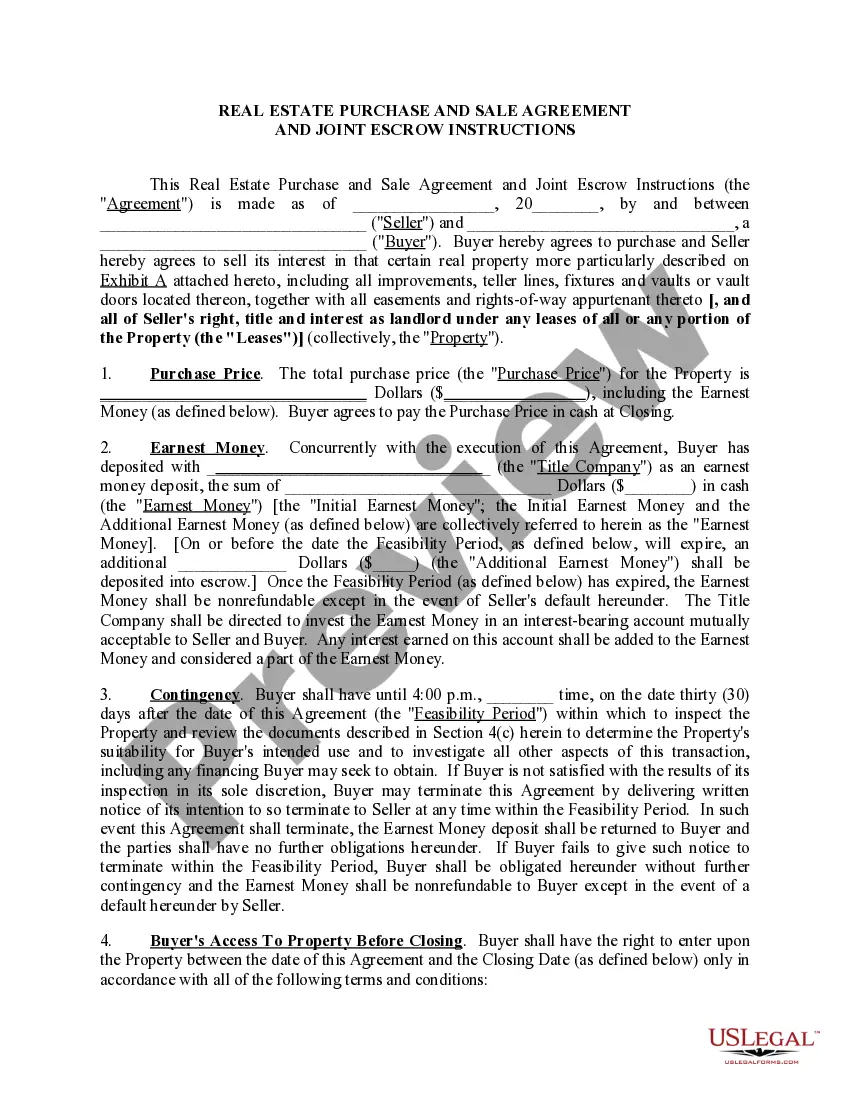

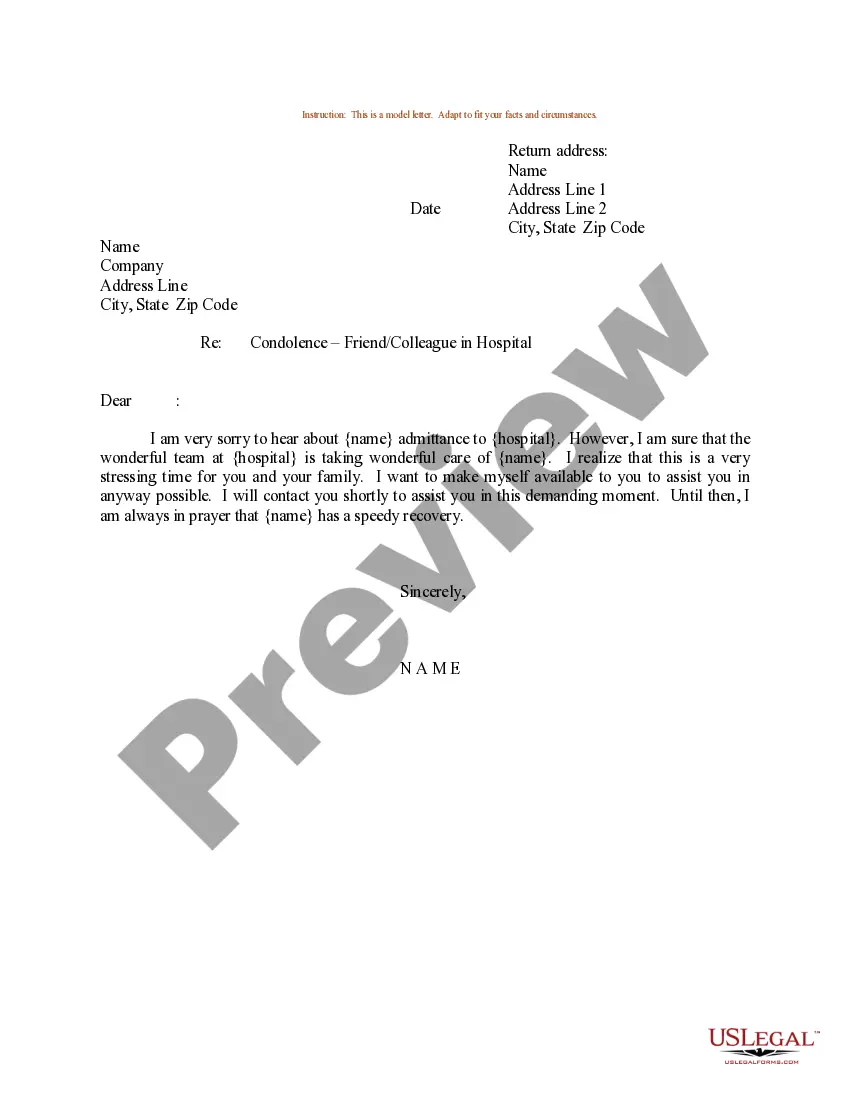

- You can preview the form using the Review button and read the form details to confirm it is the right one for you.

- If the form does not fit your needs, use the Search field to find the appropriate form.

- Once you are certain the form is suitable, click on the Buy now button to purchase the form.

- Choose the pricing plan you prefer and fill in the required information.

- Create your account and complete the transaction using your PayPal account or credit card.

Form popularity

FAQ

The trust remains revocable while both spouses are alive. The couple may withdraw assets or cancel the trust completely before one spouse dies. When the first spouse dies, the trust becomes irrevocable and splits into two parts: the A trust and the B trust.

What happens in this type of trust is that the trust is a joint revocable trust when both spouses are alive. When one of the spouses dies, the trust will then split into two trusts automatically. Each trust will have half the assets of the trust along with the separate property of the spouse.

A revocable living trust becomes irrevocable once the sole grantor or dies or becomes mentally incapacitated. If you have a joint trust for you and your spouse, then a portion of the joint trust can become irrevocable when the first spouse dies and will become irrevocable when the last spouse dies.

Trustees have a duty to exercise reasonable care. Trustees have a duty to act jointly where more than one (and subject to the specific provisions of the Trust).

Drawbacks of a Living TrustPaperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork.Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required.Transfer Taxes.Difficulty Refinancing Trust Property.No Cutoff of Creditors' Claims.

Under typical circumstances, the surviving spouse would become the sole trustee after the death of one spouse. The surviving spouse would control the shared property, and the personal property of the deceased spouse would be distributed to the beneficiaries.

Worse yet, under the default rules of California Trust law, co-trustees must act unanimously if they are to act at all. This means that one Trustee cannot simply break a deadlock by acting on his own. One of the Co-Trustees does not have the power and authority to act alone.

Trustees have a duty to exercise reasonable care. Trustees have a duty to act jointly where more than one (and subject to the specific provisions of the Trust).

After one spouse dies, the surviving spouse is free to amend the terms of the trust document that deal with his or her property, but can't change the parts that determine what happens to the deceased spouse's trust property.

Joint trusts are also revocable living trusts, set up to hold all of the assets of a married couple and to provide access to the trust assets for both. Typically, at the first death, half of the assets receive a step-up in basis, but all of the assets stay in the trust.