Guam Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name

Description

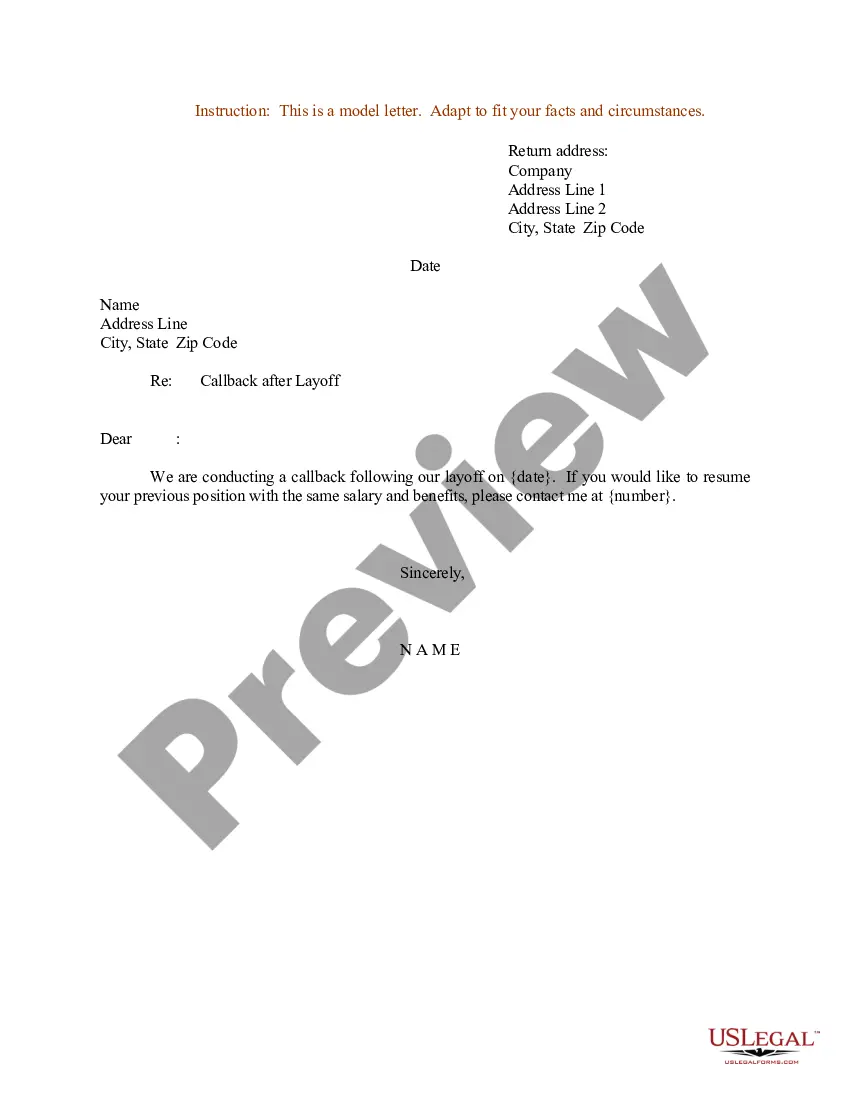

How to fill out Subrogation Agreement Authorizing Insurer To Bring Action In Insured's Name?

You can invest hours on-line trying to find the lawful papers template which fits the state and federal demands you will need. US Legal Forms supplies a huge number of lawful types that happen to be analyzed by specialists. You can easily download or produce the Guam Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name from our assistance.

If you have a US Legal Forms accounts, you can log in and then click the Download switch. Next, you can total, revise, produce, or signal the Guam Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name. Every lawful papers template you buy is the one you have permanently. To get one more backup for any purchased type, go to the My Forms tab and then click the related switch.

Should you use the US Legal Forms site the first time, keep to the simple guidelines below:

- Initially, make sure that you have chosen the right papers template to the area/area of your choosing. Look at the type explanation to ensure you have chosen the right type. If readily available, make use of the Review switch to check through the papers template as well.

- If you would like locate one more variation of your type, make use of the Lookup field to obtain the template that meets your requirements and demands.

- When you have identified the template you would like, click on Purchase now to continue.

- Pick the costs program you would like, type in your credentials, and register for a merchant account on US Legal Forms.

- Complete the financial transaction. You can utilize your Visa or Mastercard or PayPal accounts to fund the lawful type.

- Pick the formatting of your papers and download it for your product.

- Make alterations for your papers if possible. You can total, revise and signal and produce Guam Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name.

Download and produce a huge number of papers templates using the US Legal Forms website, that offers the greatest selection of lawful types. Use specialist and state-particular templates to handle your small business or specific requires.

Form popularity

FAQ

A subrogation receipt transferring the insured's entire causes of action to the insurer allows the insurer to recover in the insured's name for the entire loss, not just to the extent of its payment.

?Subrogation? refers to the act of one person or party standing in the place of another person or party. It is a legal right held by most insurance carriers to pursue a third party that caused an insurance loss in order to recover the amount the insurance carrier paid the insured to cover the loss.

3 Benefits of Subrogation in Car Insurance Speeds up the claims process for policyholders. Refunds insurers for claims if their customer wasn't at-fault. Keeps premiums low for policyholders who aren't responsible for damage.

Negotiate the claim. If you and your lawyer are unable to stop the subrogation claim altogether, it is possible to negotiate. Most insurance companies are willing to negotiate because they want to settle claims quickly and get their money.

Simply put, subrogation protects you and your insurer from paying for losses that aren't your fault. It's common in auto, health insurance and homeowners policies. It lets your insurer pursue the person at fault to recover the money paid out for a claim that wasn't your fault.

If you've been in an accident and filed a claim with your insurance company, you may have received a subrogation letter. This document allows the insurance company to pursue a claim against a third party that caused damage to their insured, after the insurance company has paid out a claim to the insured.

Subrogation is a term describing a right held by most insurance carriers to legally pursue a third party that caused an insurance loss to the insured. This is done in order to recover the amount of the claim paid by the insurance carrier to the insured for the loss.