Guam Sample Letter regarding Finance Agreement

Description

How to fill out Sample Letter Regarding Finance Agreement?

If you need to full, acquire, or printing lawful record themes, use US Legal Forms, the biggest selection of lawful varieties, which can be found on the Internet. Use the site`s simple and practical look for to get the documents you require. Numerous themes for business and personal functions are categorized by classes and claims, or keywords and phrases. Use US Legal Forms to get the Guam Sample Letter regarding Finance Agreement in a handful of clicks.

In case you are currently a US Legal Forms buyer, log in to the accounts and click the Obtain switch to find the Guam Sample Letter regarding Finance Agreement. Also you can entry varieties you in the past delivered electronically inside the My Forms tab of your own accounts.

If you use US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have selected the shape for your proper metropolis/nation.

- Step 2. Use the Preview method to look over the form`s content material. Never overlook to read the information.

- Step 3. In case you are unhappy with the type, make use of the Look for discipline on top of the display screen to get other types of your lawful type format.

- Step 4. Upon having discovered the shape you require, go through the Purchase now switch. Opt for the rates program you prefer and add your references to sign up to have an accounts.

- Step 5. Process the purchase. You can use your charge card or PayPal accounts to complete the purchase.

- Step 6. Select the format of your lawful type and acquire it in your product.

- Step 7. Full, revise and printing or indicator the Guam Sample Letter regarding Finance Agreement.

Every single lawful record format you get is yours forever. You might have acces to every single type you delivered electronically within your acccount. Go through the My Forms area and select a type to printing or acquire again.

Remain competitive and acquire, and printing the Guam Sample Letter regarding Finance Agreement with US Legal Forms. There are many skilled and state-distinct varieties you can use to your business or personal demands.

Form popularity

FAQ

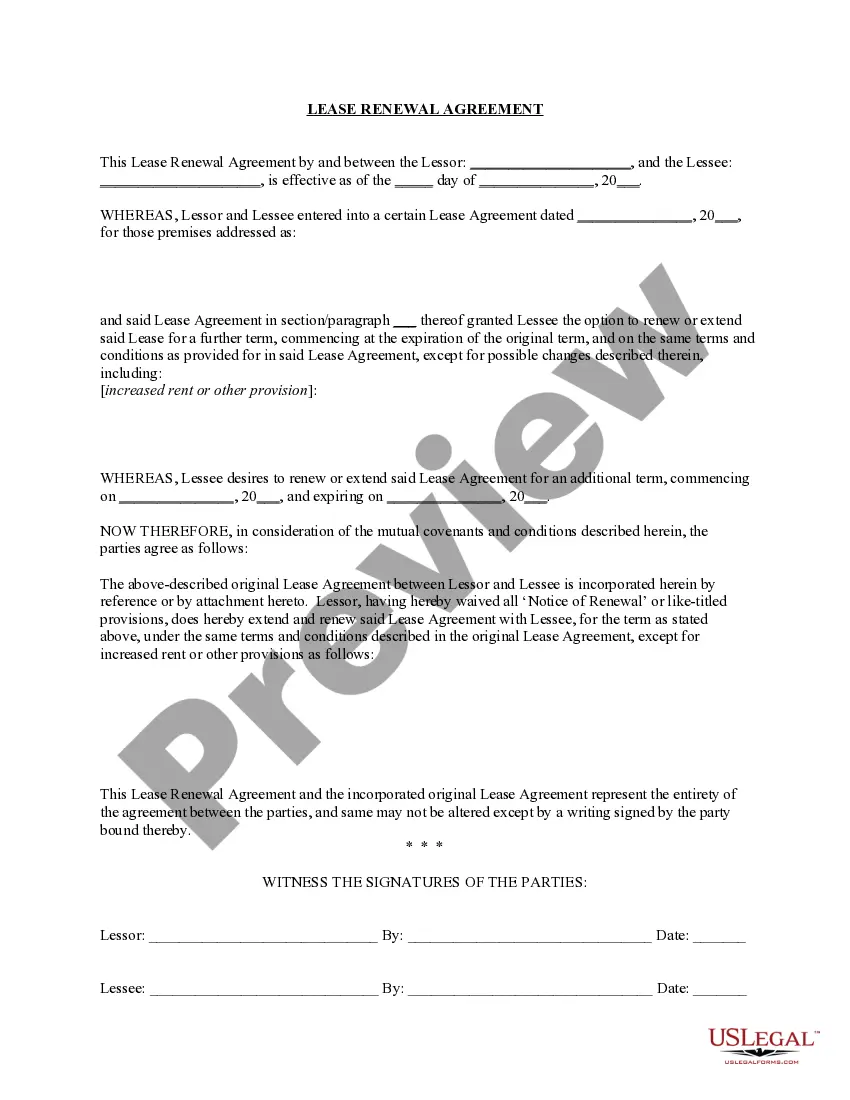

For a personal loan agreement to be enforceable, it must be documented in writing, as well as signed and dated by all parties involved. It's also a good idea to have the document notarized or signed by a witness.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid.

A loan agreement is a document, signed by both the lender and the borrower, that spells out the terms of the loan. These agreements are binding and can be simple or complex. The loan agreement lays out the repayment schedule, the costs to the borrower, and other rules or requirements.

Usually, an IOU and a promissory note form are only signed by the borrower, although they may be signed by both parties. A loan agreement is a single document that contains all of the terms of the loan, and is signed by both parties.

For example, if the note's terms are unclear or there is evidence that the note's maker did not intend to repay the debt, the court may invalidate the note. It is also possible for the payee to not be able to sign a promissory note if they knew the maker could not repay the debt at the time of signing it.