Guam Sample Letter for Note and Deed of Trust

Description

How to fill out Sample Letter For Note And Deed Of Trust?

Choosing the right lawful papers design can be a battle. Obviously, there are tons of templates available on the net, but how can you get the lawful develop you want? Use the US Legal Forms internet site. The service offers a large number of templates, for example the Guam Sample Letter for Note and Deed of Trust, which can be used for company and personal demands. All of the kinds are checked out by professionals and fulfill federal and state requirements.

If you are already listed, log in to your account and click the Down load key to have the Guam Sample Letter for Note and Deed of Trust. Utilize your account to search with the lawful kinds you possess ordered formerly. Go to the My Forms tab of your account and have an additional copy from the papers you want.

If you are a whole new customer of US Legal Forms, listed below are straightforward guidelines for you to adhere to:

- Initial, make sure you have selected the right develop to your city/area. You may look through the form making use of the Preview key and look at the form description to make sure it will be the right one for you.

- In case the develop does not fulfill your preferences, use the Seach industry to obtain the correct develop.

- When you are sure that the form is proper, click on the Purchase now key to have the develop.

- Pick the rates strategy you would like and enter the essential information. Make your account and buy the order utilizing your PayPal account or bank card.

- Pick the submit structure and obtain the lawful papers design to your system.

- Full, edit and print out and indicator the obtained Guam Sample Letter for Note and Deed of Trust.

US Legal Forms is definitely the most significant local library of lawful kinds where you can find different papers templates. Use the service to obtain professionally-made documents that adhere to state requirements.

Form popularity

FAQ

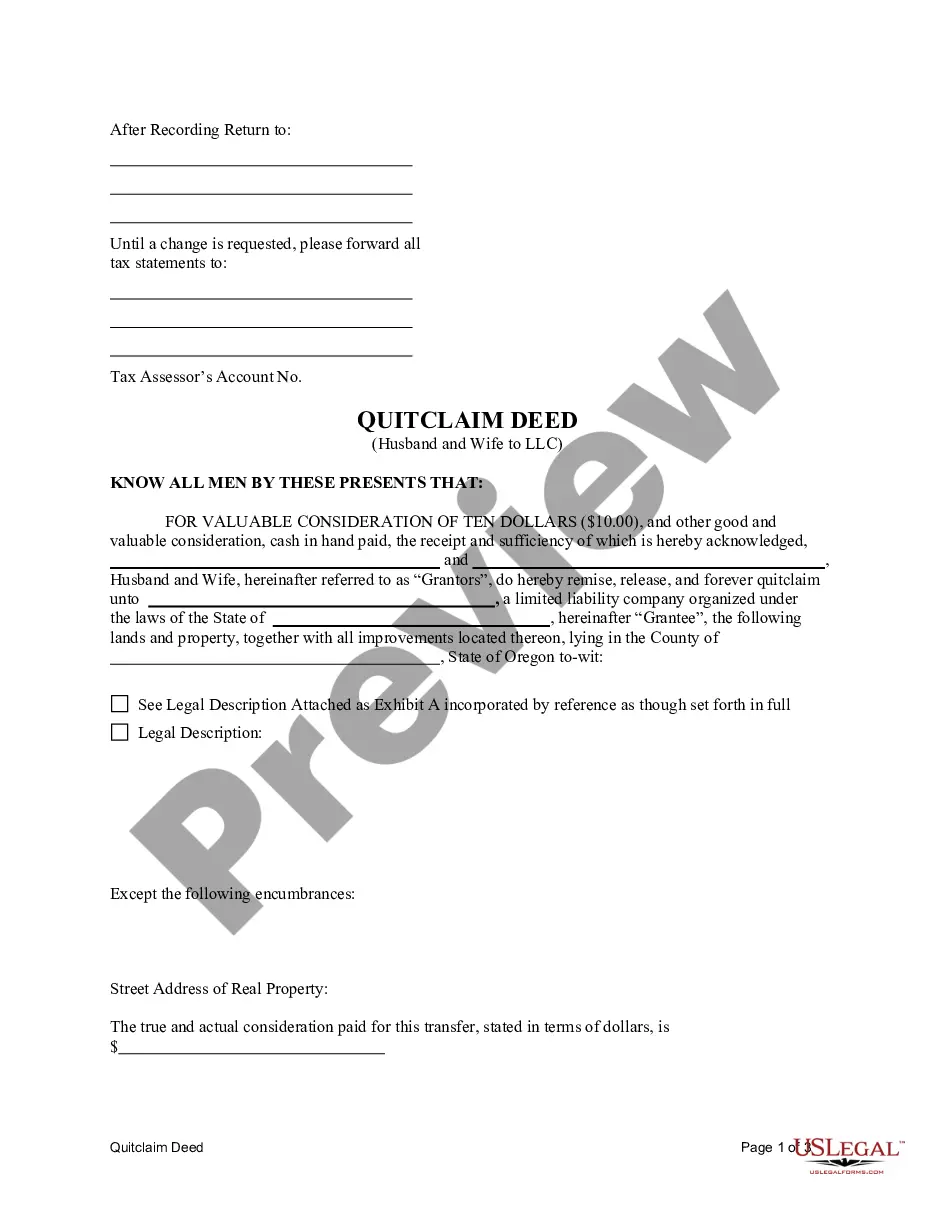

What Is Assignment in a Deed of Trust? In real estate law, "assignment" is simply the transfer of a deed of trust from one party to another. This usually happens when the beneficiary of a trust deed sells their loan to another lender.

The main difference between a deed and a deed of trust is that a deed is a transfer of ownership, while a deed of trust is a security interest. A deed of trust is used to secure a loan, while a deed is used to transfer ownership of a property.

An All Inclusive Trust Deed (AITD) is a new deed of trust that includes the balance due on the existing note plus new funds advanced; also known as a wrap-around mortgage. A wrap-around mortgage, more-commonly known as a ?wrap?, is a form of secondary financing for the purchase of real property.

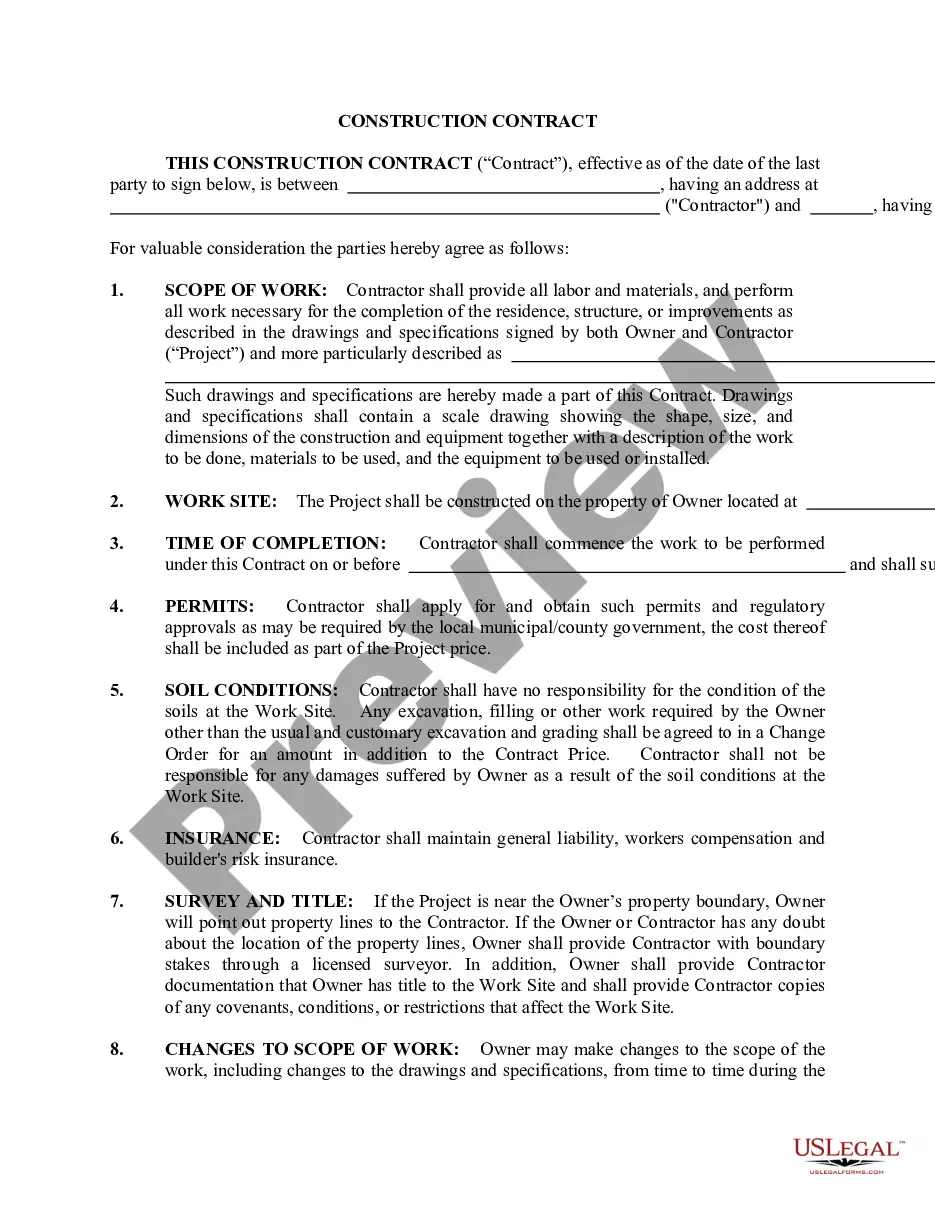

A mortgage note is a legal document that sets out all the terms of the mortgage between a borrower and their lending institution. It includes terms such as: The total amount of the home loan. The down payment amount. Whether monthly or bimonthly payments are required.

With a deed of trust, the lender gives the borrower the funds to make the home purchase. In exchange, the borrower provides the lender with a promissory note. The promissory note outlines the terms of the loan and the borrower's promise (hence the name) to pay.

The property owner signs the note, which is a written promise to repay the borrowed money. A trust deed gives the third-party ?trustee? (usually a title company or real estate broker) legal ownership of the property.

The Deed is a recorded document memorializing the transfer of property from the Grantor to the Grantee. The Note is an unrecorded paper that binds an individual who has assumed debt through a promise-to-pay instrument.

With a deed of trust, the lender gives the borrower the funds to make the home purchase. In exchange, the borrower provides the lender with a promissory note. The promissory note outlines the terms of the loan and the borrower's promise (hence the name) to pay.