Illinois Promissory Note

What this document covers

A promissory note is a legal document in which one party (the borrower) promises in writing to pay a stated sum of money to another party (the lender) under specified terms. This form serves as evidence of a loan agreement and establishes the borrower's commitment to repay the loan, including any interest and fees. Unlike informal IOUs, a promissory note outlines clear repayment terms, making it enforceable in court if necessary.

Key components of this form

- Principal Amount: The total loan amount being borrowed.

- Interest Rate: The percentage of the loan charged as interest over time.

- Payment Schedule: Details on how and when the borrower will repay the loan.

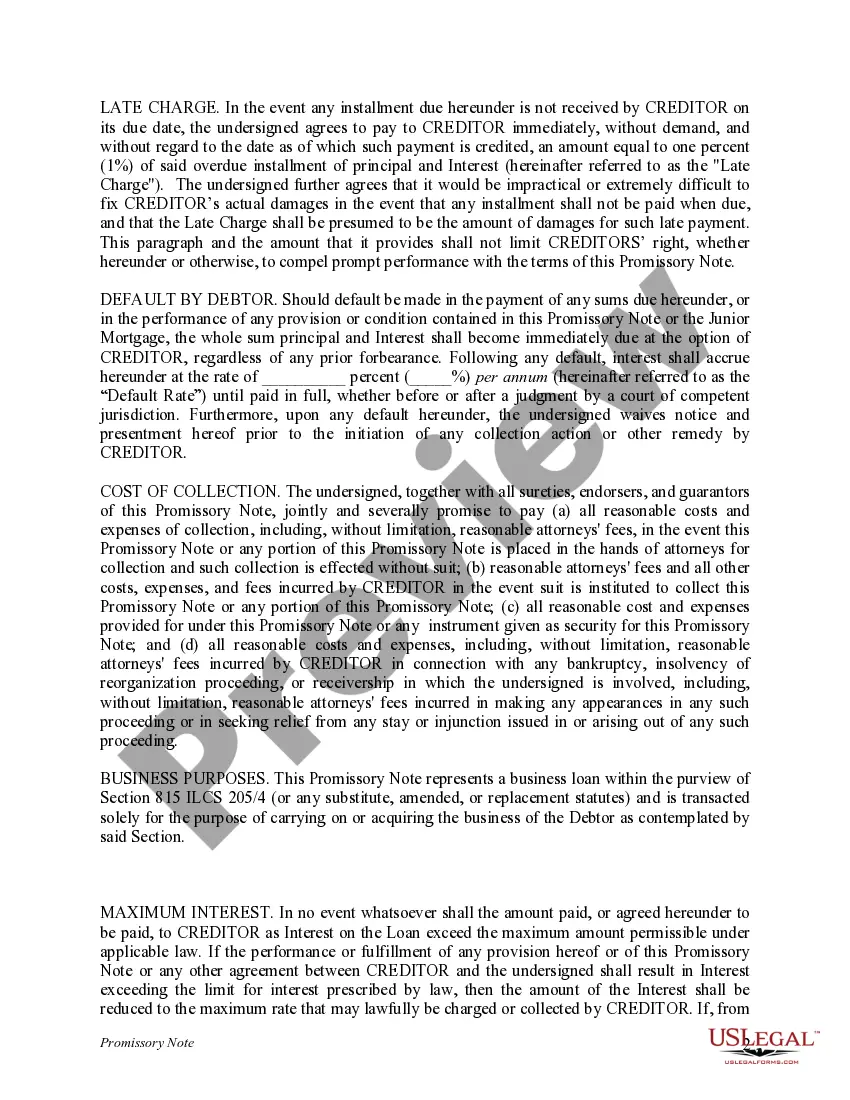

- Late Charges: Fees incurred if payments are not made on time.

- Prepayment Privilege: The ability for the borrower to pay off the loan early without penalty.

- Default Clause: Conditions under which the loan becomes immediately due if payments are missed.

When to use this document

This form is needed when a lender provides a loan to a borrower and wishes to formalize the terms of repayment. It is commonly used in personal lending situations, business loans, or any transaction where a financial obligation is established. If you are borrowing money from family, friends, or business partners, using a promissory note can help clarify repayment expectations and protect both parties.

Who should use this form

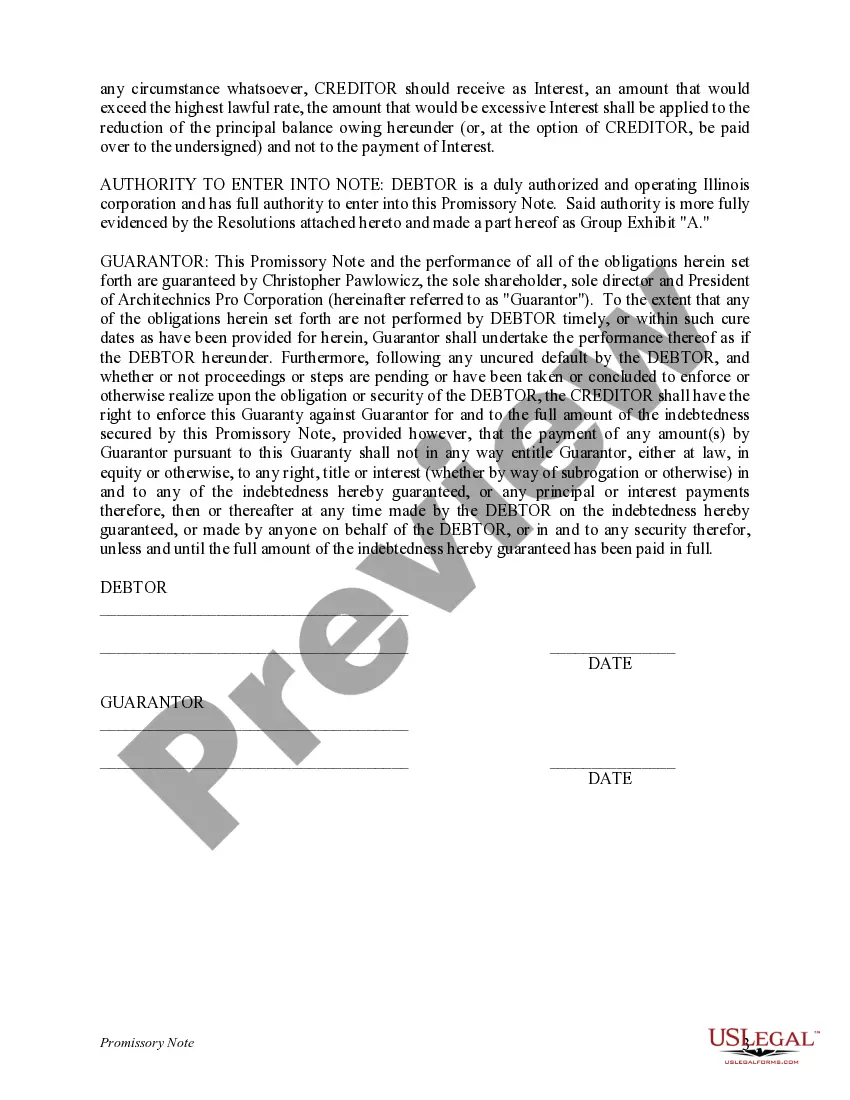

- Individuals borrowing money from friends or family.

- Business owners seeking a loan from investors or banks.

- Borrowers aiming to document loan agreements to avoid misunderstandings.

- Lenders wanting legal assurance of repayment terms.

Instructions for completing this form

- Identify the parties involved: the creditor (lender) and debtor (borrower).

- Enter the principal amount of the loan to be borrowed.

- Specify the interest rate and calculate the total repayment amount.

- Outline the payment schedule, including due dates and amounts.

- Include any applicable fees such as late charges or finance fees.

- Ensure both parties sign and date the document for validation.

Does this form need to be notarized?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to specify the interest rate or payment schedule.

- Not signing the promissory note, which can render it unenforceable.

- Using informal language that may lead to ambiguities.

- Neglecting to include penalties for late payments.

Benefits of completing this form online

- Convenience of filling out the document from home.

- Editability allows for customization based on individual needs.

- Access to templates drafted by licensed attorneys for reliability.

Looking for another form?

Form popularity

FAQ

A valid Illinois promissory note must contain specific elements, including the principal amount, interest rate, due date, and the names of the parties involved. Additionally, it should be in writing and signed by the maker of the note. These essentials ensure clarity and enforceability.

A Promissory Note must always be written by hand. It must include all the mandatory elements such as the legal names of the payee and maker's name, amount being loaned / to be repaid, full terms of the agreement and the full amount of liability, beside other elements.

Writing the Promissory Note Terms You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

Borrower and Lender Details. A promissory note outlines information about both parties including the names, streets addresses, city, state and zip code of each party. Loan Information. Legal Language. Signatures. Warnings.

A promissory note basically includes the name of both parties (lender and borrower), date of the loan, the amount, the date the loan will be repaid in full, frequency of loan payments, the interest rate charged on the loan payments, and any security agreement.

Amount of repayment. Repayment terms. Interest rate. Default penalties.

However, it is still smart to contact a lawyer to help you prepare a personal promissory note, even if you already used an online template. A lawyer can prepare and/or review the note to ensure that all state law requirements are included. This will help with enforceability if there are any issues down the road.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.