Guam Option of Remaining Partners to Purchase

Description

How to fill out Option Of Remaining Partners To Purchase?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a selection of legal form templates that you can download or create.

Using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest versions of forms such as the Guam Option of Remaining Partners to Purchase in just a few minutes.

If you already possess a subscription, Log In and download the Guam Option of Remaining Partners to Purchase from the US Legal Forms library. The Download option will be available on every form you view. You can access all previously saved forms from the My documents section of your account.

Process the purchase. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make edits. Fill out, modify, and print and sign the downloaded Guam Option of Remaining Partners to Purchase. Each template you add to your account does not expire and belongs to you forever. So, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the Guam Option of Remaining Partners to Purchase with US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/state.

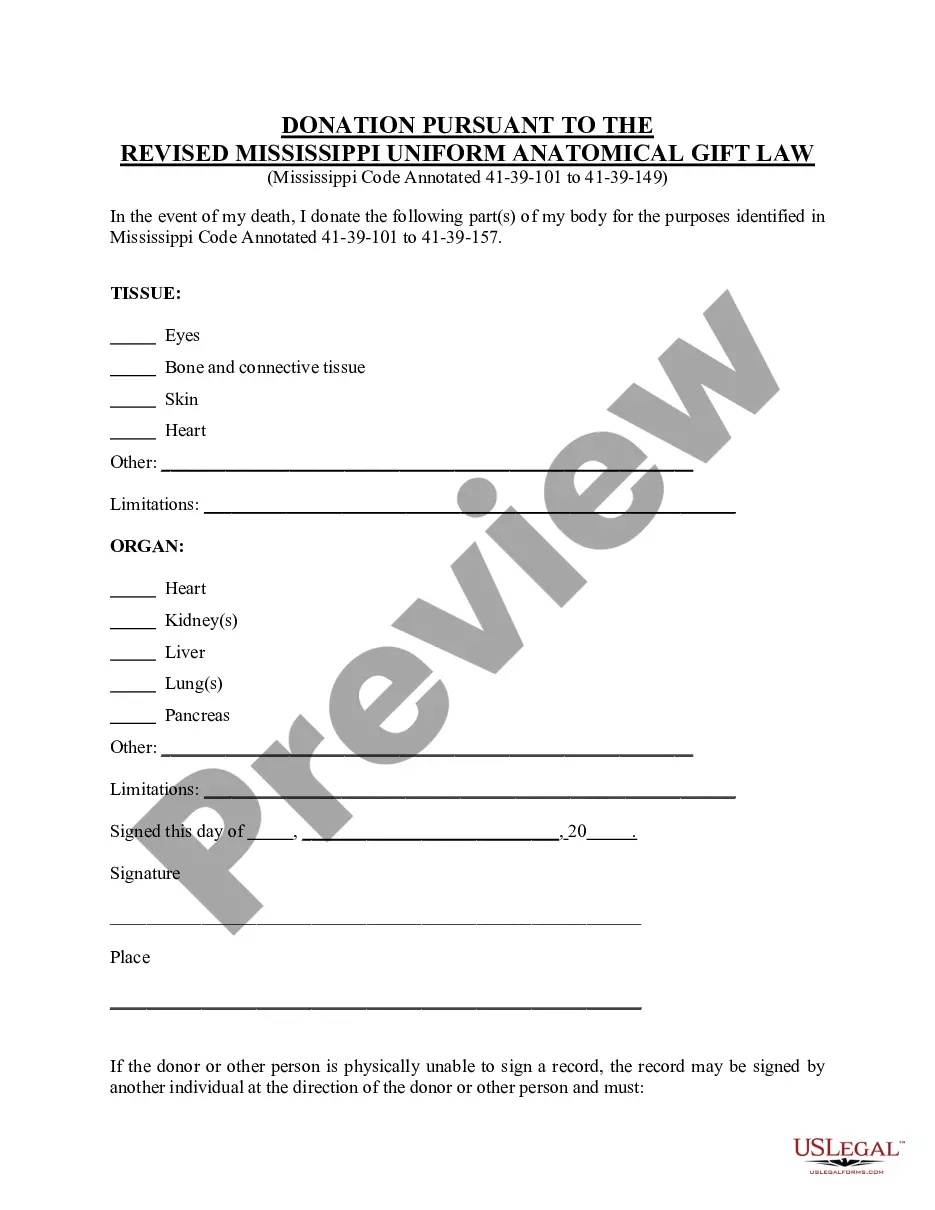

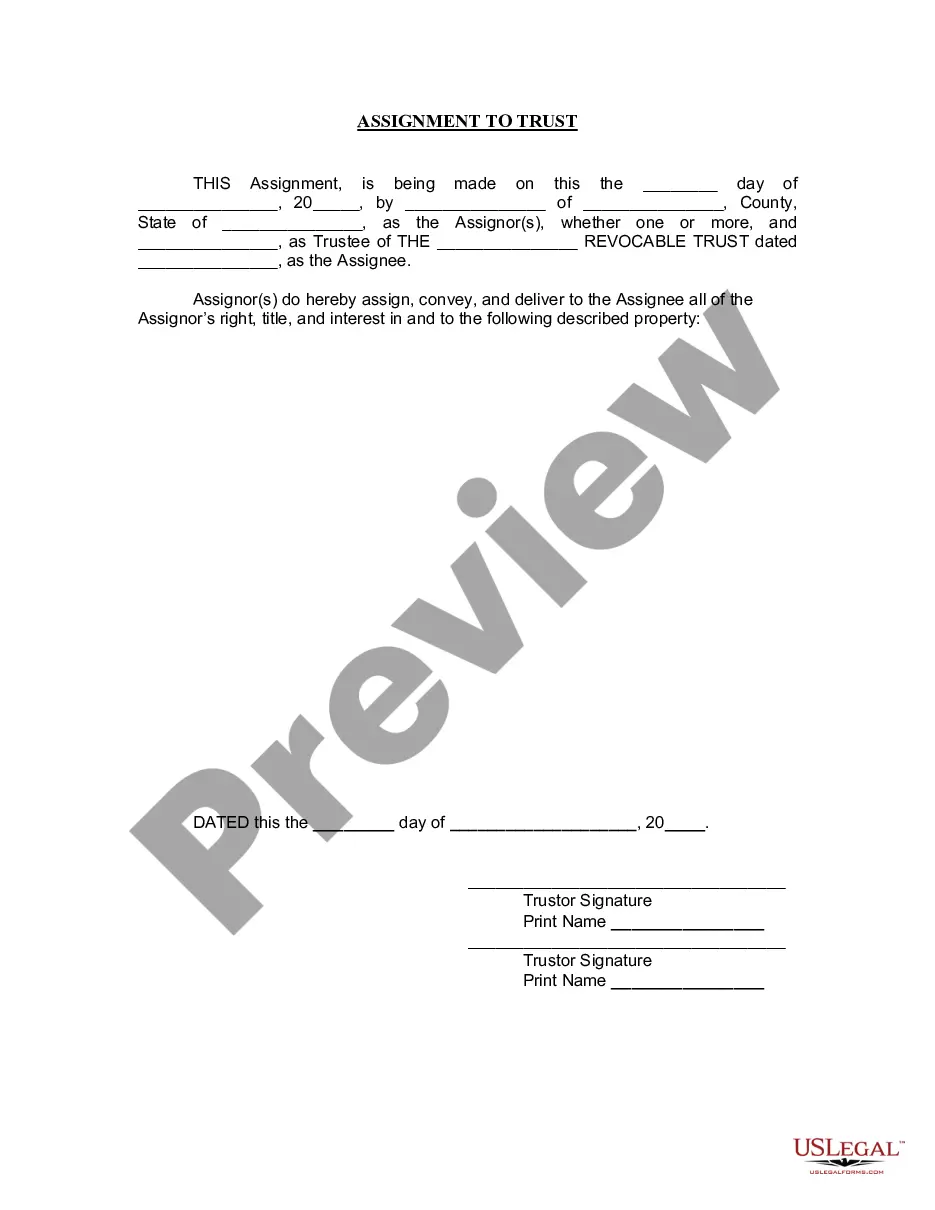

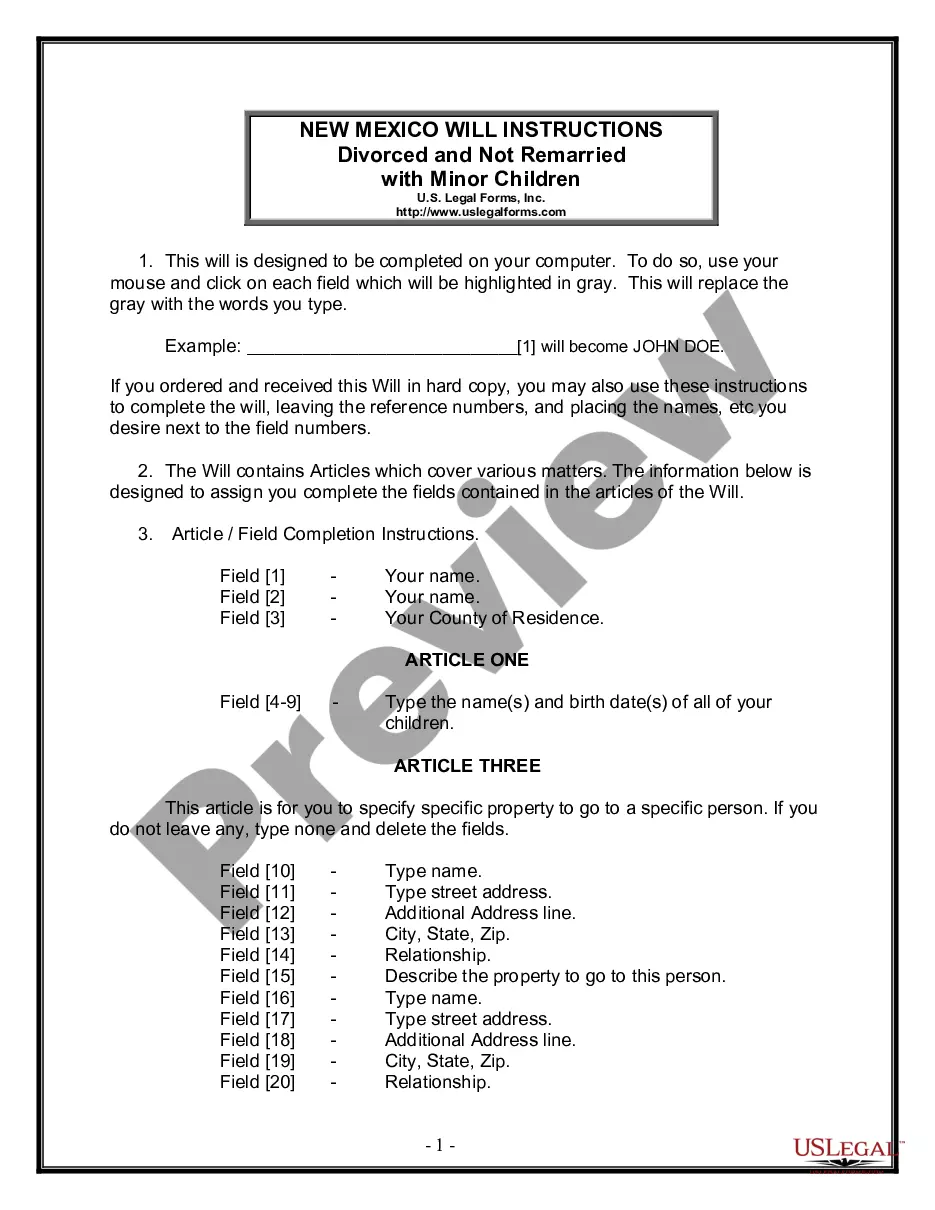

- Choose the Preview option to review the form's details.

- Examine the form overview to confirm you have chosen the right form.

- If the form does not fulfill your requirements, utilize the Search box at the top of the page to find the one that does.

- If you are content with the form, confirm your selection by clicking on the Buy now button.

- Then, select your preferred pricing plan and provide your credentials to register for an account.

Form popularity

FAQ

Submitting W-8BEN tax informationUnder the Payments tab, select Profile.Next, click on the Submit Tax Information link.Submit No as your answer in Certification of US activities.Select the appropriate country of incorporation or organization.Select the type of beneficial owner.Enter your address.More items...

Form W-8BEN is used by foreign individuals who receive nonbusiness income in the U.S., whereas W-8BEN-E is used by foreign entities who receive this type of income.

Bona fide residents of Guam are subject to special U.S. tax rules. In general, all individuals with income from Guam will file only one returneither to Guam or the United States. If you are a bona fide resident of Guam during the entire tax year, file your return with Guam.

The No Lapse Rule Under IRC Sec 7701(b)(2)(B)(iii) if after departing and terminating U.S. tax residency in one calendar tax year, a nonresident alien returns to the U.S. and resumes U.S. tax residency (under SPT) at any time during the subsequent calendar tax year, the intervening period between non-residency and

The No Lapse Rule Under IRC Sec 7701(b)(2)(B)(iii) if after departing and terminating U.S. tax residency in one calendar tax year, a nonresident alien returns to the U.S. and resumes U.S. tax residency (under SPT) at any time during the subsequent calendar tax year, the intervening period between non-residency and

The W-8BEN-E is an IRS form used by foreign companies doing business in the United States. Only corporations and partnerships need to file this form. Individuals and sole proprietors need to file the W-8BEN form.

How to complete W-8BEN-E Form for a Small Canadian Corporation?Part I 1 Enter your corporation's name.Part I 2 Enter the country of incorporation (Canada)Part I 4 Check CorporationPart I 5 Check Active NFFE.Part I 6 Enter corporation's address.More items...?

The six-year rule allows for payment of living expenses that exceed the CFS, and allows for other expenses, such as minimum payments on student loans or credit cards, as long as the tax liability, including penalty and interest, can be full paid in six years.

All businesses with sales over $500,000 per year must file monthly GRT reports and pay 4% GRT on all sales to the Treasurer of Guam. All businesses with sales less than or equal to $500,000 per year must file monthly GRT rep01is and pay 4% GRT on all sales over $50,000 to the Treasurer of Guam.

It has most of the required fields, but they are quite easy to fill in.Name of your organization. Just write your full Company name.Country of incorporation of your organization.Name of a disregarded entity, receiving the payment.Your Entity Chapter 3 Status.Your entity FATCA status.Permanent residence address.