Guam Sale of Partnership to Corporation

Description

How to fill out Sale Of Partnership To Corporation?

Are you in a location where you need documentation for either professional or particular purposes nearly every day.

There are numerous official document templates accessible online, but locating reliable ones is not easy.

US Legal Forms offers thousands of form templates, such as the Guam Sale of Partnership to Corporation, designed to fulfill state and federal requirements.

Once you locate the appropriate form, click Buy now.

Select the pricing plan you desire, provide the necessary information to create your account, and complete your purchase using PayPal or a credit card.

- If you are familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Guam Sale of Partnership to Corporation template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

- Utilize the Review button to examine the form.

- Read the summary to ensure you have selected the correct document.

- If the form is not what you are seeking, utilize the Search field to find the form that meets your needs.

Form popularity

FAQ

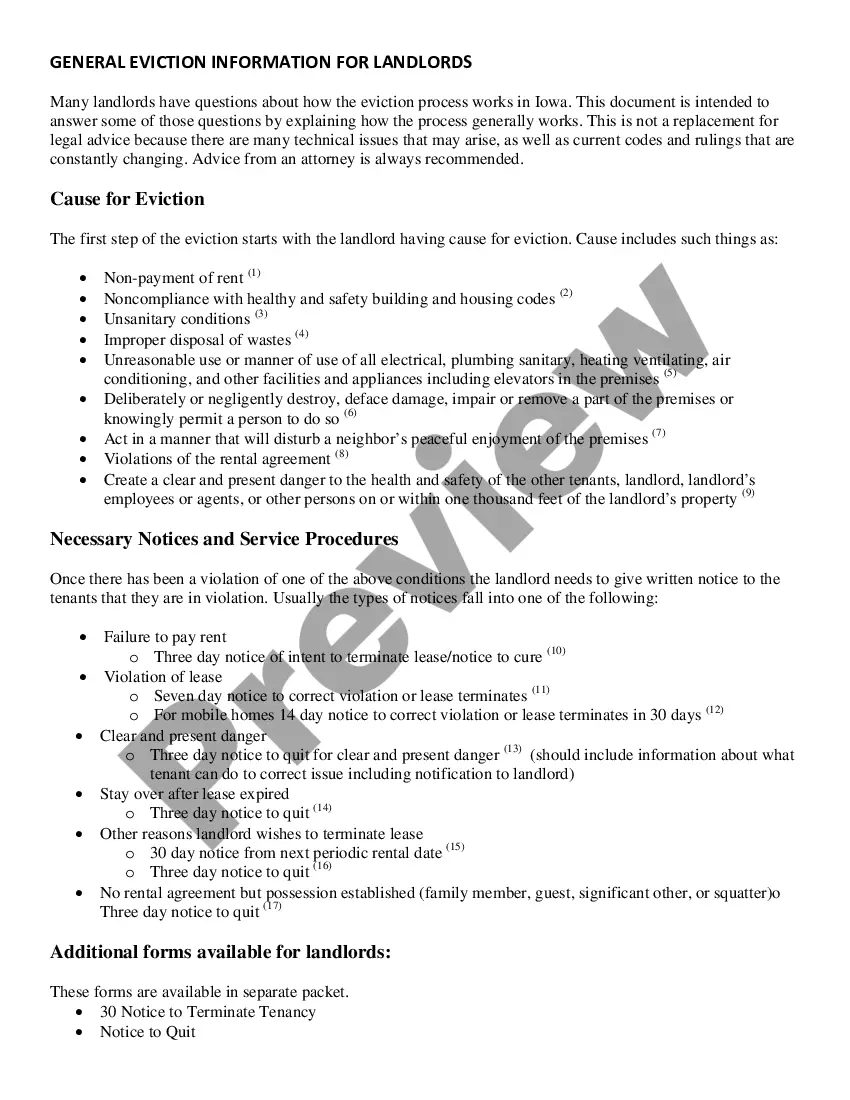

Transitioning from a partnership to a corporation involves several steps, including legal documentation and state filings. You will need to create a new corporate entity and transfer assets from your partnership. For a smooth Guam Sale of Partnership to Corporation, consider using US Legal Forms, a reliable platform that simplifies the documentation process.

The 7-year rule in partnerships refers to a tax provision that can impact your tax obligations when converting from a partnership to another business structure. It primarily affects how gains and losses are treated during the conversion process. Understanding the implications of the 7-year rule is crucial when considering a Guam Sale of Partnership to Corporation.

Choosing between a partnership and a corporation depends on your business goals. Partnerships often provide simplicity and pass-through taxation, while corporations offer liability protection and potential for growth. If you are contemplating a Guam Sale of Partnership to Corporation, weighing these benefits is essential for your long-term success.

Yes, you can convert a partnership to a corporation in Guam. This process typically involves drafting a formal plan of conversion and filing necessary documents with the appropriate authorities. A Guam Sale of Partnership to Corporation can offer you liability protection and other benefits that a corporation provides.

Yes, you need a business license to operate legally in Guam. This process ensures compliance with local laws and regulations. Obtaining a business license also enhances your credibility, especially if you are considering a Guam Sale of Partnership to Corporation in the future.

Yes, a partnership can elect to be taxed as a corporation under specific conditions. This choice can offer distinct advantages, especially concerning liability and tax treatment. If you're contemplating the Guam Sale of Partnership to Corporation, it is beneficial to evaluate the best tax structure for your business with the help of our expert resources.

When a partnership converts to a corporation, it typically results in a complete change in business structure. This may involve transferring assets, liabilities, and obligations to the new entity. It's important to prepare for this transition correctly, especially in the context of the Guam Sale of Partnership to Corporation, to avoid potential legal and financial pitfalls.

Yes, Guam is considered U.S. territory for tax purposes, though it has its own tax system. Taxpayers must comply with both federal and local tax laws. Understanding these regulations is crucial when you're involved in complex transactions like the Guam Sale of Partnership to Corporation, ensuring you remain compliant with all applicable laws.

You can switch from a partnership to an S-Corp, but it requires following specific regulatory guidelines. Doing so can provide various benefits, such as liability protection and potential tax savings. If you are exploring options for a Guam Sale of Partnership to Corporation, our platform offers resources to help you navigate this transition effectively.

Yes, you can file your Guam tax online, making the process more convenient and efficient. The Guam Department of Revenue and Taxation offers electronic filing options for various forms. This feature simplifies filing during significant transitions, such as a Guam Sale of Partnership to Corporation, allowing you to focus on growing your business.