Guam Revocable Trust for Property

Description

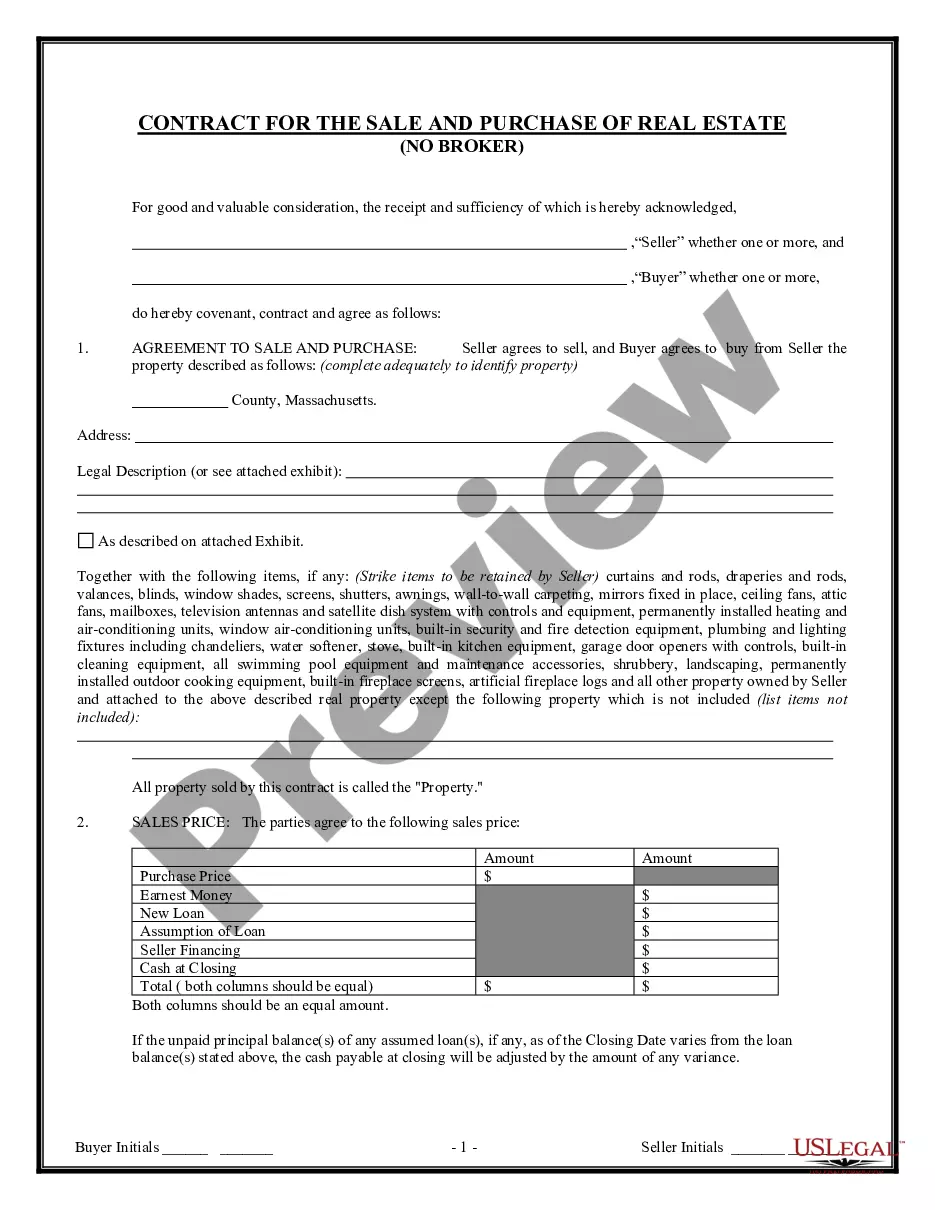

How to fill out Revocable Trust For Property?

Have you ever found yourself in a circumstance where you require documentation for both business or personal purposes almost every workday.

There are numerous legal document templates accessible online, but discovering trustworthy ones can be challenging.

US Legal Forms offers thousands of form templates, such as the Guam Revocable Trust for Property, which are designed to meet federal and state requirements.

Select the pricing plan you want, complete the necessary details to create your account, and pay for your order using PayPal or a credit card.

Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Guam Revocable Trust for Property template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the right city/county.

- Use the Review button to view the form.

- Check the details to confirm you have chosen the correct form.

- If the form isn’t what you’re looking for, use the Search field to find the form that meets your needs and requirements.

- Once you locate the correct form, click on Acquire now.

Form popularity

FAQ

Yes, a revocable trust typically becomes irrevocable upon the death of the grantor. At that point, the assets held in the trust cannot be altered or revoked by anyone. This transition is essential for establishing clear directives for managing and distributing assets, making a Guam Revocable Trust for Property a vital tool in estate planning.

Choosing the best trust type depends on your specific needs. A revocable trust offers flexibility and control, while an irrevocable trust ensures greater asset protection and tax benefits. If you prioritize ease of management, a Guam Revocable Trust for Property may be the preferred choice. However, if asset protection is your goal, consider the benefits of irrevocable trusts.

One of the most common mistakes parents make when setting up a trust fund is failing to communicate their intentions to the heirs. Without clear instructions and expectations, beneficiaries might misunderstand the purpose of the trust. It's critical to discuss the creation of a Guam Revocable Trust for Property openly, so all parties involved fully grasp their roles and the trust's objectives.

The key difference between a revocable and an irrevocable trust lies in control. A revocable trust allows the grantor to modify or revoke the trust at any time, maintaining control over the assets. In contrast, an irrevocable trust cannot be altered once established, offering more asset protection. This distinction is vital when contemplating a Guam Revocable Trust for Property, which provides flexibility.

The most significant advantage of an irrevocable trust is its ability to protect assets from creditors and estate taxes. By transferring assets to an irrevocable trust, you legally remove them from your estate, thus lowering your tax burden. This aspect may appeal to individuals considering long-term financial planning and wealth preservation, particularly in the context of a Guam Revocable Trust for Property.

The primary downside of an irrevocable trust is that once you create it, you cannot change or dissolve it without consent from the beneficiaries. This means you lose control over the assets placed in the trust, which can be frustrating if your circumstances change. Understanding this limitation is crucial when deciding on using a Guam Revocable Trust for Property, as it may offer more flexibility.

To qualify for a living trust in Guam, you must be a legal resident or non-resident property owner in the region. It is essential to have assets you wish to place in the trust, such as real estate or financial accounts. Additionally, it is advisable to work with a legal professional who specializes in Guam Revocable Trust for Property to ensure all documents are correctly drafted and executed.

The disadvantage of a family trust lies in its complexity, which may overwhelm some families accustomed to simpler arrangements. A Guam Revocable Trust for Property can require ongoing oversight and legal comprehension. Additionally, if family dynamics are strained, a trust can exacerbate existing tensions. Utilizing supportive resources like USLegalForms can streamline the process and provide necessary guidance.

One negative aspect of a trust is the potential for family strain, particularly if beneficiaries are unhappy with terms. A poorly structured Guam Revocable Trust for Property can lead to confusion and conflict among heirs. Moreover, trusts can sometimes lack flexibility, making adjustments difficult. Therefore, clear communication and professional assistance are crucial.

Setting up a trust can come with pitfalls, including administrative costs and potential tax implications. A Guam Revocable Trust for Property requires careful management to avoid unexpected fees. Additionally, families may misinterpret trust terms, leading to complications in asset distribution. To mitigate these risks, consider tools that guide you through the process, like USLegalForms.