Guam Revocable Trust for Asset Protection

Description

How to fill out Revocable Trust For Asset Protection?

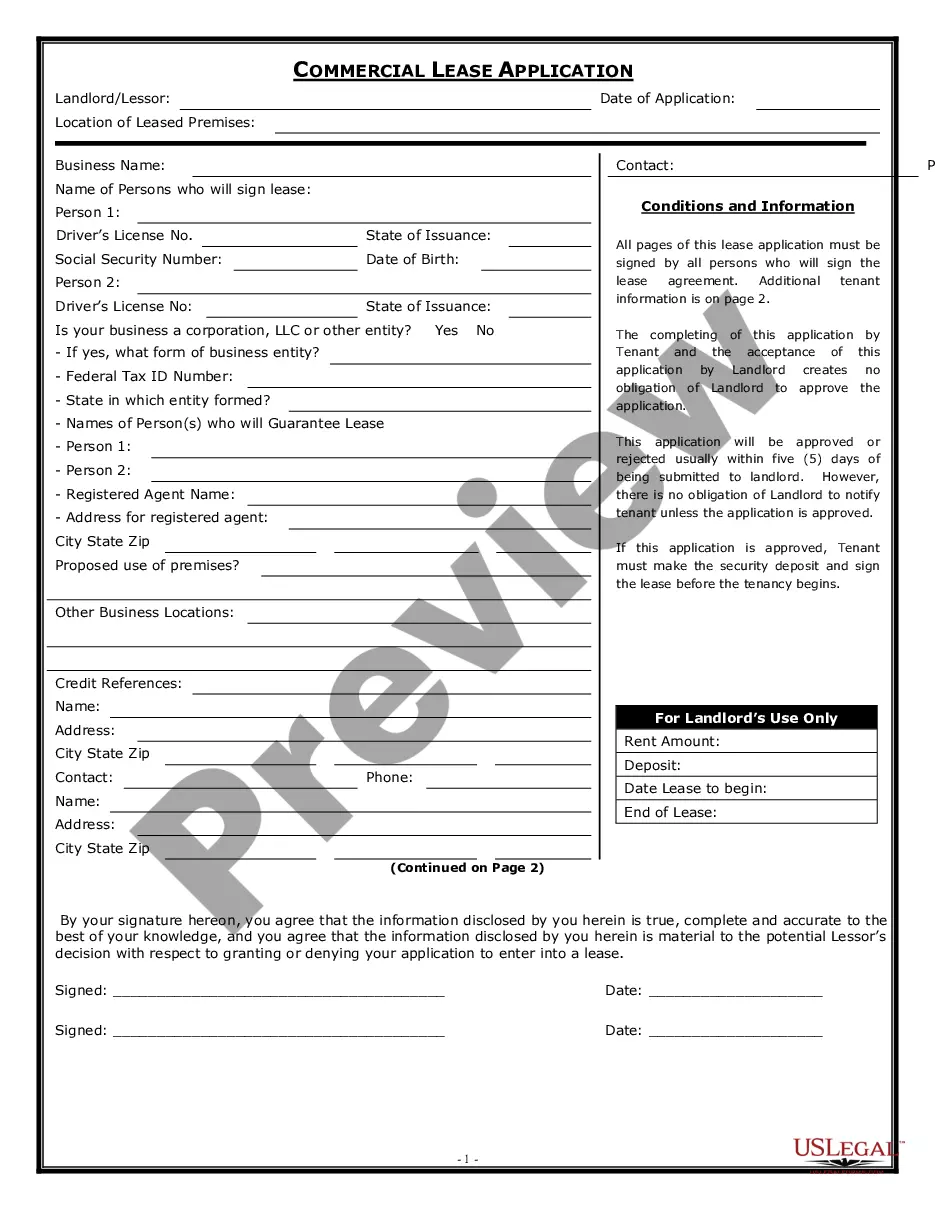

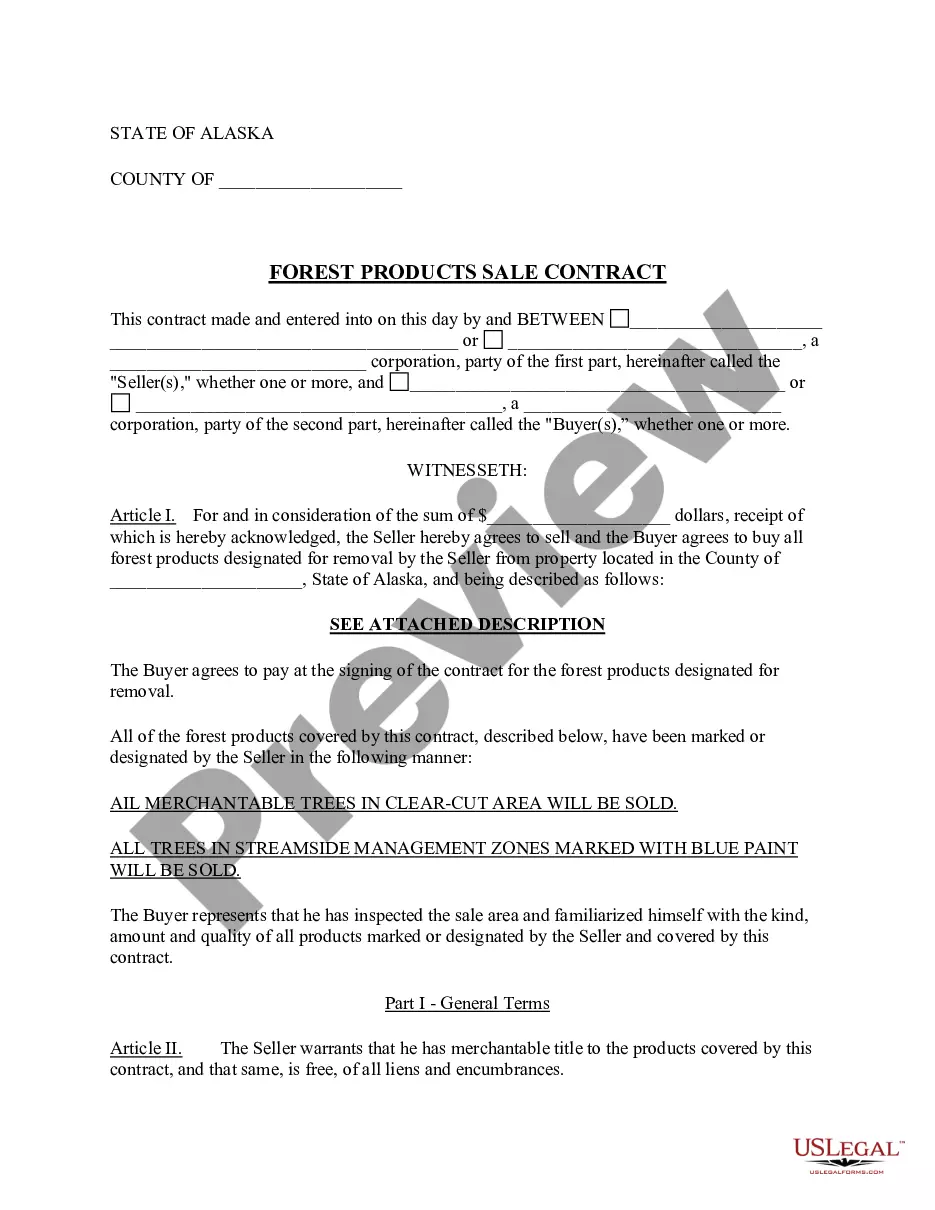

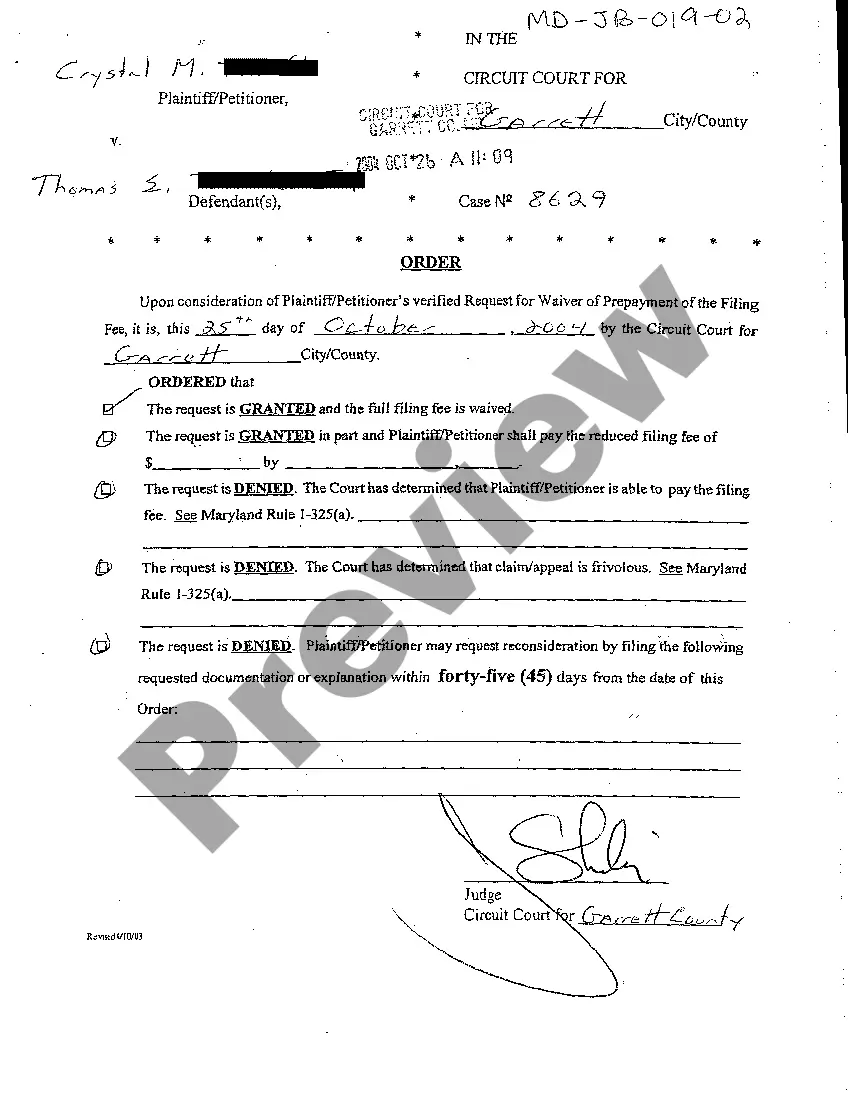

If you require thorough, download, or create legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the site’s user-friendly and convenient search to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find other versions in the legal form template.

Step 4. Once you have located the form you require, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for the account.

- Use US Legal Forms to obtain the Guam Revocable Trust for Asset Protection in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Get button to find the Guam Revocable Trust for Asset Protection.

- You can also access forms you previously acquired from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview function to review the form’s content. Remember to read the description.

Form popularity

FAQ

Writing an asset protection trust, such as a Guam Revocable Trust for Asset Protection, involves outlining the trust's objectives, designating assets, and naming a trustee. You must draft trust documents that reflect your wishes and comply with legal requirements in Guam. Using a reputable platform like UsLegalForms can provide templates and guidance, making the writing process much simpler.

One of the biggest mistakes parents make when creating a trust fund is not clearly communicating their intentions with beneficiaries. This can lead to confusion and disputes in the future. When considering the Guam Revocable Trust for Asset Protection, it's essential to involve all parties early in the process to ensure everyone understands the trust's purpose and benefits.

Setting up a protective trust begins with selecting the right legal framework, often a Guam Revocable Trust for Asset Protection, tailored to your situation. Next, you'll want to list your assets and determine specific provisions that meet your goals. Finally, working with a legal expert can ensure that all terms comply with local laws and provide the protection you seek.

A Guam Revocable Trust for Asset Protection often stands out as an ideal structure, primarily due to its flexibility and control over the assets. This type of trust allows you to modify terms during your lifetime, making it responsive to your changing needs. Additionally, it offers various benefits, such as privacy and potential tax advantages, when structured correctly.

To establish a Guam Revocable Trust for Asset Protection, you need to define the trust’s purpose clearly, choose a reliable trustee, and identify your assets. It's vital to ensure that the trust complies with Guam's specific laws and regulations. Furthermore, active management and proper documentation of the trust terms will enhance its effectiveness in protecting your assets.

To set up a trust that protects your assets, start by identifying your goals and the types of assets you wish to protect. If a Guam Revocable Trust for Asset Protection is suitable for you, you can create one through USLegalForms, where you'll find guidance and resources to help navigate the process. Working with a legal professional is essential to understand the terms and ensure the trust meets legal requirements. Take the first step towards safeguarding your wealth by exploring your options today.

While a Guam Revocable Trust for Asset Protection offers benefits like avoiding probate, it does not provide strong asset protection. The trust assets remain vulnerable to claims by creditors since you have the ability to alter the trust. If you seek to shield your assets from legal or financial risks, consider other forms of trusts that offer superior protection. Consult with a legal expert who specializes in estate planning to discuss your options.

A Guam Revocable Trust for Asset Protection does not inherently protect your assets from creditors or lawsuits. Because you maintain control, the assets are still considered part of your estate. If asset protection is your primary concern, exploring other types of trusts or legal strategies may be necessary. It is vital to assess your needs and seek tailored advice to achieve your goals.

For asset protection, an irrevocable trust is often more effective than a revocable trust. Unlike a Guam Revocable Trust for Asset Protection, an irrevocable trust removes assets from your estate, making them less accessible to creditors. If your goal is to safeguard your wealth from potential claims, an irrevocable trust provides stronger protection. Consult with a legal expert to evaluate which type of trust aligns best with your financial situation.

One downside of a revocable trust is that it does not provide full asset protection during your lifetime. The assets within a Guam Revocable Trust for Asset Protection can still be reached by creditors because you retain control over them. Additionally, since you can change or revoke the trust, this may limit some protective features. Always consider your unique circumstances and consult a professional to explore alternative options.