Guam Revocable Trust for Real Estate

Description

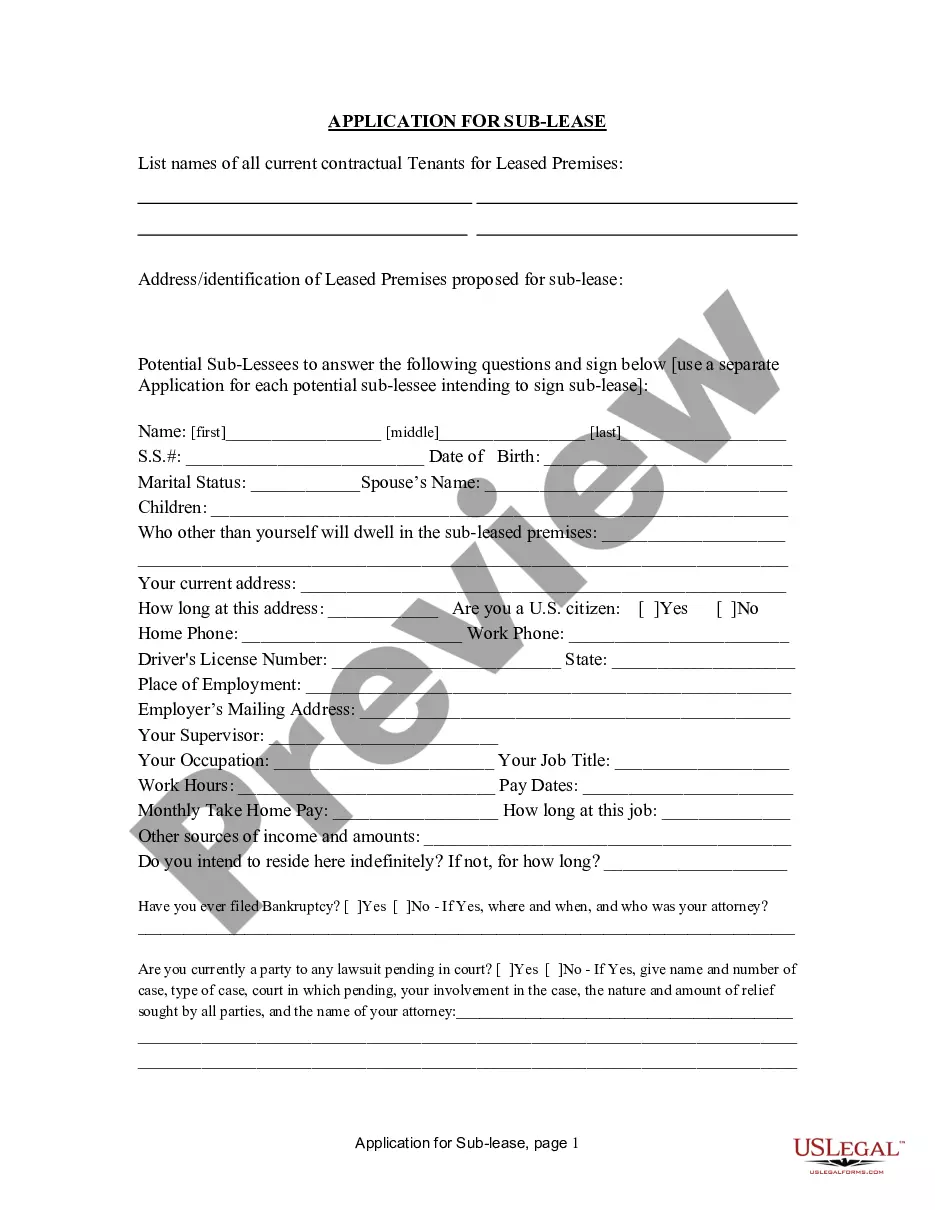

How to fill out Revocable Trust For Real Estate?

You might spend hours online searching for the legal document template that meets your federal and state needs. US Legal Forms offers thousands of legal forms reviewed by experts.

You can download or print the Guam Revocable Trust for Real Estate from our platform.

If you have an account with US Legal Forms, you can Log In and click the Acquire button. After that, you can complete, modify, print, or sign the Guam Revocable Trust for Real Estate. Every legal document template you buy is yours forever. To obtain another copy of a purchased form, go to the My documents section and click the relevant button.

Choose the format of the document and download it to your device. Make alterations to your document as necessary. You can complete, modify, sign, and print the Guam Revocable Trust for Real Estate. Acquire and print thousands of document templates using the US Legal Forms website, which offers the best selection of legal forms. Utilize professional and state-specific templates to handle your business or personal needs.

- Make sure you have selected the correct document template for the state/region you choose.

- Review the form description to ensure you have chosen the right one.

- If available, use the Preview button to review the document template as well.

- If you want to find another version of the form, use the Search box to locate the template that meets your needs.

- Once you find the template you want, click Purchase now to proceed.

- Select the pricing plan you prefer, enter your details, and sign up for an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to purchase the legal form.

Form popularity

FAQ

To qualify for a living trust in Guam, you typically need to be a legal adult and possess assets you wish to manage or protect. Establishing a Guam Revocable Trust for Real Estate requires you to name a trustee, which can often be yourself, to oversee the trust's assets. Consulting with a legal expert or using a reputable platform like US Legal Forms can streamline this process.

Certain assets may not be suitable for a revocable trust. For example, retirement accounts or life insurance policies often have specific beneficiary designations. It's usually best to keep these assets outside of your Guam Revocable Trust for Real Estate, as they may complicate the distribution process.

The best software for creating a revocable living trust should be user-friendly and offer solid legal guidance. Many platforms, including US Legal Forms, provide templates and step-by-step assistance for setting up a Guam Revocable Trust for Real Estate. This helps ensure that your trust is legally valid and tailored to your unique needs.

The best state for a revocable living trust often depends on your specific circumstances. Guam allows for effective administration of revocable trusts, especially when it comes to real estate. You should consider local laws and consult with an expert when setting up your Guam Revocable Trust for Real Estate.

Whether an irrevocable trust is better depends on your goals. A revocable trust offers flexibility, allowing you to change it as needed, while an irrevocable trust provides asset protection and tax benefits. If your primary concern is retaining control over your assets, a Guam Revocable Trust for Real Estate may be a better fit for you.

A revocable trust allows you to maintain control over your assets while you are alive. You can modify or dissolve this trust at any time. In contrast, an irrevocable trust cannot be easily changed or revoked after it is established. This means that with a Guam Revocable Trust for Real Estate, you have the flexibility to adapt to changing circumstances.

Certain assets may be better off outside of a Guam Revocable Trust for Real Estate. For example, retirement accounts, like 401(k)s and IRAs, often have specific transfer rules that may not align with your trust structure. Additionally, assets that benefit from payable-on-death designations should remain separate to ensure smooth transfers. Always consult a legal expert to determine the best approach for your situation.

While a Guam Revocable Trust for Real Estate offers many benefits, it also has some disadvantages. One major concern is that it does not provide asset protection; creditors can still reach the assets in your trust. Additionally, managing the trust requires time and effort, which may be a burden for some individuals. It's important to weigh these factors before deciding on a Guam Revocable Trust for Real Estate.

Generally, a revocable trust does not need to be registered with the IRS as long as you remain the trustee. However, you should report any income generated from assets within the trust, especially if it involves a Guam Revocable Trust for Real Estate. It's beneficial to keep comprehensive records for tax purposes. To ensure compliance, consider using tools provided by uslegalforms for efficient management.

To register a revocable trust, you need to draft a trust agreement and then fund it with your assets. This includes title transfers for real estate held under a Guam Revocable Trust. While registration might not be mandatory in some cases, recording the trust can provide additional legal clarity. Consulting resources available through uslegalforms will help ensure you meet local requirements effectively.