Guam Simple Equipment Lease

Description

How to fill out Simple Equipment Lease?

Are you presently in a situation where you require documents for either business or personal reasons almost all the time.

There are numerous authentic document templates available online, but finding reliable ones is not easy.

US Legal Forms provides a vast collection of form templates, such as the Guam Simple Equipment Lease, which can be completed to comply with federal and state regulations.

Once you find the correct form, click Acquire now.

Select the payment plan you desire, fill in the required details to create your account, and complete your purchase using PayPal or credit card.

- If you are already acquainted with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Guam Simple Equipment Lease template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the appropriate city/county.

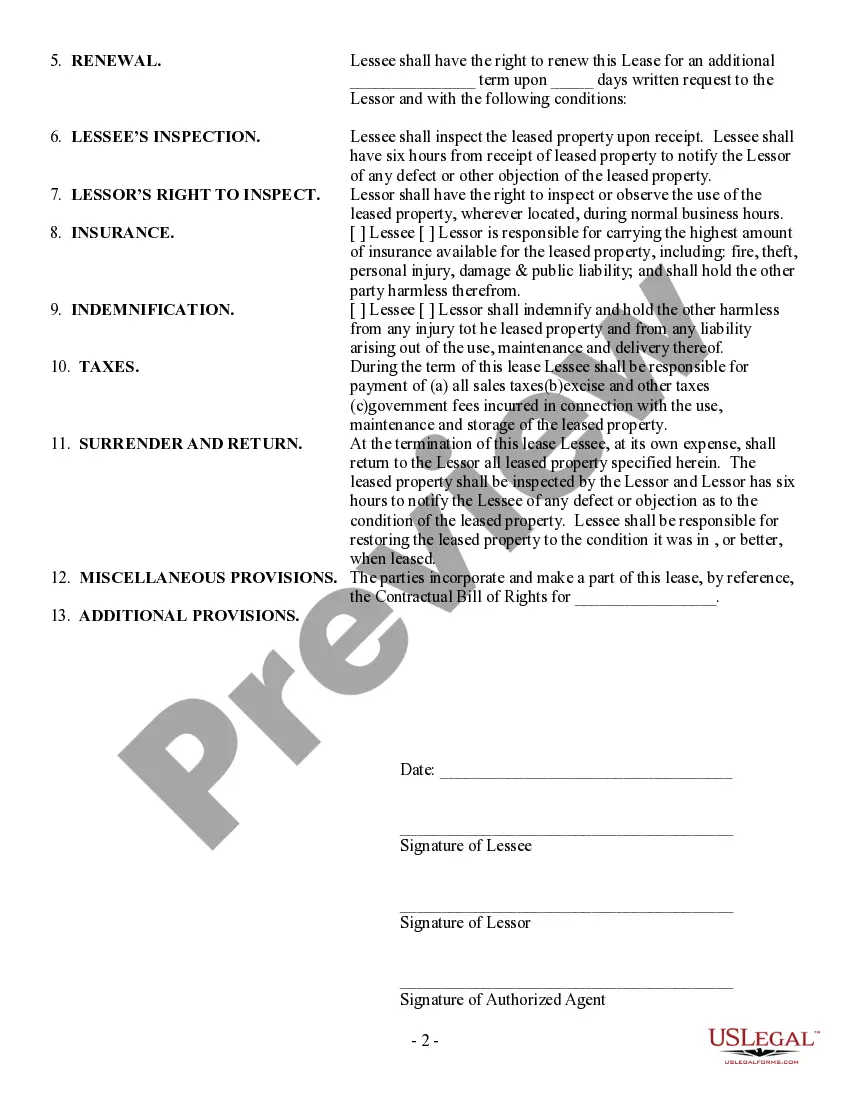

- Utilize the Preview button to review the form.

- Examine the description to confirm that you have chosen the correct form.

- If the form is not what you are looking for, use the Lookup field to find the form that suits your needs.

Form popularity

FAQ

Defaulting on an equipment lease can have serious consequences, including financial penalties. When you default on a Guam Simple Equipment Lease, the leasing company may take back the equipment and pursue outstanding payments. This can also negatively affect your credit. Keeping communication open with your lessor might help you find a solution before this occurs.

Exiting an equipment lease can be challenging, but options are available. Review the terms of your Guam Simple Equipment Lease to understand your obligations. Contacting your leasing company to discuss the situation might provide possible solutions, like transferring the lease or negotiating a buyout. Uslegalforms can assist you in understanding your rights and finding the best way forward.

Leasing equipment involves making regular payments to use the equipment without owning it. Generally, you sign a Guam Simple Equipment Lease that outlines the terms, including payment amount and duration. During the lease term, you get to use the equipment while the leasing company retains ownership. This setup allows you to manage costs and avoid large upfront expenses.

Breaking an equipment lease may lead to penalties, but it is possible. Situations like changing business needs or financial difficulties can arise. If you find yourself needing to break a Guam Simple Equipment Lease, carefully review the contract for any clauses regarding early termination. Additionally, consider contacting uslegalforms for advice on how to proceed without incurring excessive costs.

Equipment lease payments are calculated based on the initial value of the equipment, the lease term, and interest rates applied. The formula generally involves dividing the total lease amount by the number of months, adding in any fees or taxes. This offers a clear monthly payment, allowing you to budget effectively. For personalized assistance, US Legal Forms provides various resources to help you understand your lease calculations.

Creating a rental agreement for equipment under a Guam Simple Equipment Lease is straightforward. Start with identifying the parties involved and detailing the equipment being leased. Include important conditions like payment terms, duration of the lease, and maintenance responsibilities. Using a reliable platform like US Legal Forms can simplify this process, providing templates that ensure all essential aspects are covered.

Transferring equipment to an LLC can be a straightforward process. Begin by formally documenting the transfer, ensuring the equipment reflects ownership under the LLC's name. If the equipment was previously leased, consider converting the lease into a Guam Simple Equipment Lease, which can provide financial benefits. This transfer protects your individual assets and enhances your business's financial standing.

Leasing equipment to your LLC involves transferring the lease ownership under the business name. Start by establishing the lease agreement in the name of the LLC, which can include a Guam Simple Equipment Lease contract. It’s essential to document the lease terms thoroughly to avoid any misunderstandings. This approach ultimately protects your personal assets and aligns equipment usage with your business needs.

Setting up an equipment lease requires a few steps. First, identify the equipment you need and research leasing companies that offer a Guam Simple Equipment Lease. Once you find a suitable option, gather necessary documentation and negotiate the terms. Finally, review the lease agreement carefully before signing, ensuring it aligns with your business goals.

Yes, you can obtain a lease under your Limited Liability Company (LLC). The Guam Simple Equipment Lease might be a great choice for LLCs, as it allows you to separate personal and business assets. When applying for a lease, provide documentation of your LLC and its legitimacy. This process helps protect your personal finances while enabling your business to grow.