This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Guam Installment Promissory Note with Acceleration Clause and Collection Fees

Description

How to fill out Installment Promissory Note With Acceleration Clause And Collection Fees?

Are you currently in a situation where you require documents for both professional or personal purposes almost all the time.

There are many legitimate document templates accessible online, but finding ones you can rely on is not simple.

US Legal Forms offers a wide array of form templates, including the Guam Installment Promissory Note with Acceleration Clause and Collection Fees, that are designed to comply with federal and state regulations.

When you locate the correct form, click on Purchase now.

Choose the pricing plan you prefer, provide the necessary information to create your account, and pay for the purchase using your PayPal or Visa or Mastercard. Select a convenient paper format and download your copy.

- If you are currently familiar with the US Legal Forms website and possess an account, simply sign in.

- Then, you can download the Guam Installment Promissory Note with Acceleration Clause and Collection Fees template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific city/state.

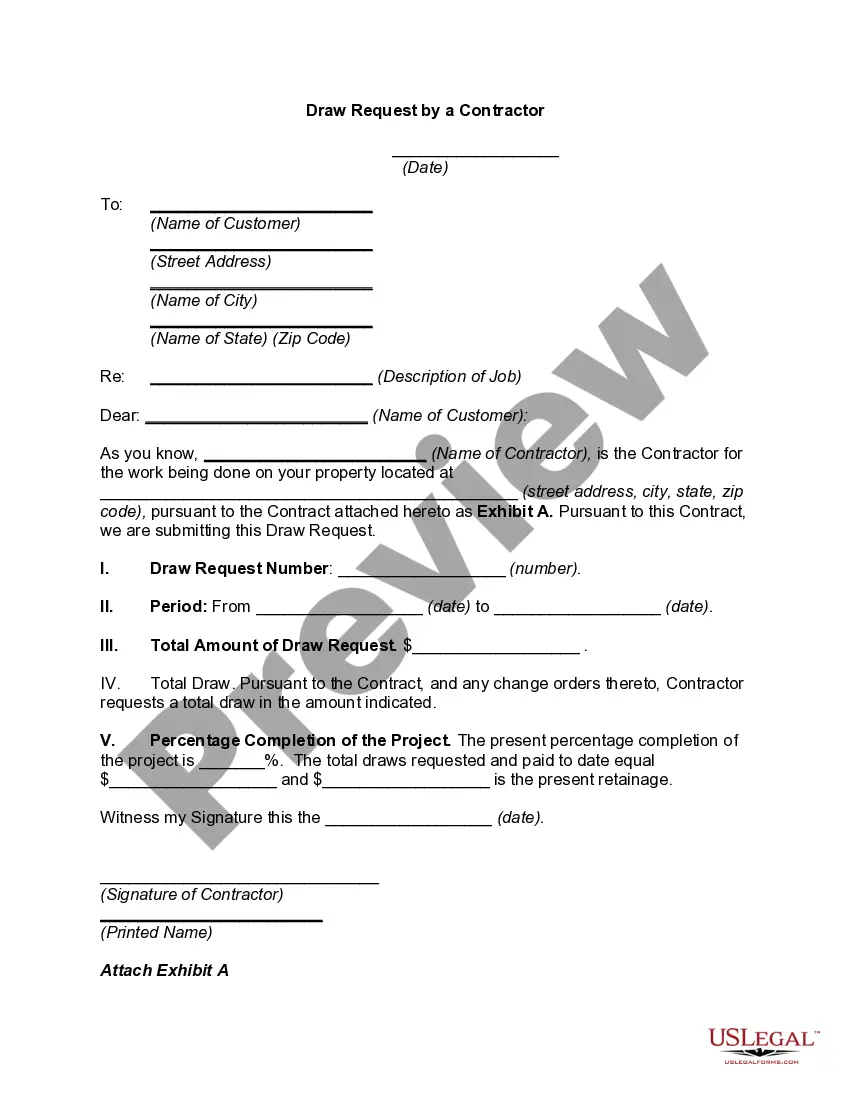

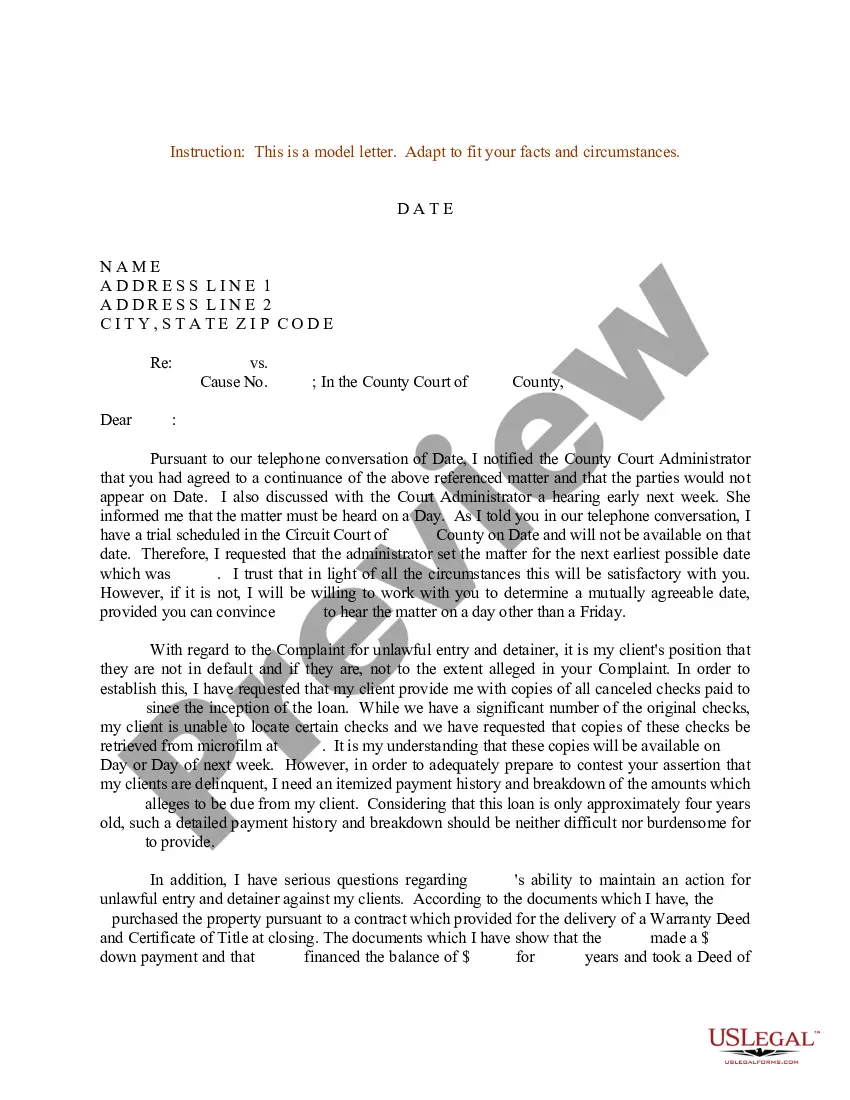

- Use the Review button to examine the form.

- Read the overview to confirm you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and criteria.

Form popularity

FAQ

Various types of promissory notes exist, including demand notes, installment notes, and balloon notes. Each type serves different purposes and repayment structures. A Guam Installment Promissory Note with Acceleration Clause and Collection Fees is specifically designed for installment repayment, making it vital to choose the right type based on your financial needs and agreements.

Yes, a promissory note can go to collections if the borrower fails to make payments as specified. When the borrower defaults, the lender may transfer the debt to a collection agency to recover the outstanding amount. In the context of a Guam Installment Promissory Note with Acceleration Clause and Collection Fees, this process highlights the importance of maintaining consistent payment schedules.

To accelerate a promissory note, the lender must formally invoke the acceleration clause, typically in response to a borrower's default. This action demands immediate repayment of the outstanding balance. With a Guam Installment Promissory Note with Acceleration Clause and Collection Fees, understanding this process is essential for managing risks associated with borrower defaults.

An installment note involves scheduled payments made over time, while a general promissory note may not specify payment timelines or amounts. In essence, all installment notes are promissory notes, but not all promissory notes are installment notes. Understanding this difference is important, especially when considering a Guam Installment Promissory Note with Acceleration Clause and Collection Fees, as it influences repayment strategies.

To accelerate a promissory note, follow the terms outlined within the document regarding default. If the borrower has missed payments, notify them as required, citing the Guam Installment Promissory Note with Acceleration Clause and Collection Fees. After this, you can pursue full repayment by taking appropriate legal actions if necessary.

Enforcing a promissory note legally involves a few essential steps. Start by reviewing the terms, such as those in the Guam Installment Promissory Note with Acceleration Clause and Collection Fees, to ensure compliance. If the borrower defaults, you may need to take legal action, potentially requiring assistance from a legal professional to initiate collection procedures.

The acceleration of a promissory note refers to the lender's right to require immediate repayment of the full remaining balance under specific circumstances. This often happens if the borrower defaults on the agreement outlined in the Guam Installment Promissory Note with Acceleration Clause and Collection Fees. Therefore, understanding the acceleration terms is vital for both borrowers and lenders.

An acceleration clause might state that if a borrower misses two consecutive payments on a Guam Installment Promissory Note with Acceleration Clause and Collection Fees, the entire balance becomes due immediately. This example illustrates how the clause functions to safeguard the lender’s interests. It is crucial for borrowers to recognize these terms to avoid unexpected financial obligations.

The acceleration clause in a Guam Installment Promissory Note with Acceleration Clause and Collection Fees allows the lender to demand full repayment of the remaining balance if the borrower defaults on the agreement. This provision protects lenders by providing a clear path to collect due amounts without lengthy legal proceedings. Understanding this clause is essential for both lenders and borrowers to navigate their financial agreements effectively.