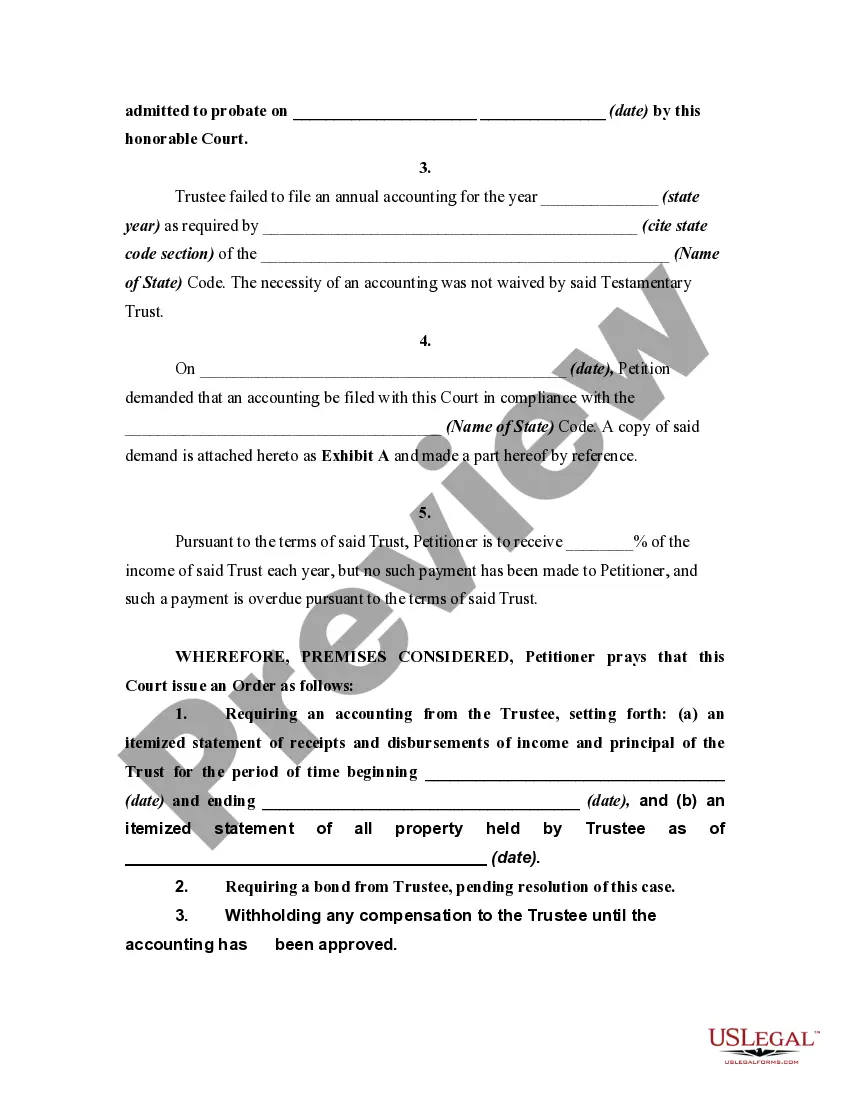

An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

Guam Petition to Require Accounting from Testamentary Trustee

Description

How to fill out Petition To Require Accounting From Testamentary Trustee?

You may devote several hours on-line trying to find the authorized document design which fits the federal and state needs you require. US Legal Forms offers a large number of authorized types which can be reviewed by experts. It is possible to download or produce the Guam Petition to Require Accounting from Testamentary Trustee from my service.

If you have a US Legal Forms bank account, you are able to log in and click on the Obtain button. Next, you are able to full, change, produce, or indication the Guam Petition to Require Accounting from Testamentary Trustee. Each and every authorized document design you purchase is the one you have eternally. To get yet another duplicate associated with a purchased develop, check out the My Forms tab and click on the related button.

If you use the US Legal Forms website for the first time, stick to the simple recommendations listed below:

- First, make certain you have chosen the right document design for your state/city of your choosing. Browse the develop outline to ensure you have selected the right develop. If accessible, use the Preview button to look throughout the document design also.

- If you wish to locate yet another edition of the develop, use the Search industry to obtain the design that fits your needs and needs.

- After you have discovered the design you want, click on Acquire now to continue.

- Find the pricing program you want, enter your credentials, and sign up for an account on US Legal Forms.

- Comprehensive the deal. You can use your bank card or PayPal bank account to pay for the authorized develop.

- Find the structure of the document and download it to the device.

- Make alterations to the document if needed. You may full, change and indication and produce Guam Petition to Require Accounting from Testamentary Trustee.

Obtain and produce a large number of document layouts using the US Legal Forms site, that offers the largest assortment of authorized types. Use skilled and condition-particular layouts to tackle your company or individual demands.

Form popularity

FAQ

Guam Probate Court Closing Costs $10 for the first $1,000. $50 for the next $1,000. $80 for the next $2,000.

The Executor Must Pay All Final Debts and File All Tax Returns. The estate assets will typically be used to pay final medical bills, funeral expenses, estate administration fees and reasonable debts. A state inheritance and a federal estate tax return must also be filed.

The length of time an executor has to settle an estate in Pennsylvania can vary considerably, typically spanning from several months to over a year, depending on factors like the size and complexity of the estate, the clarity of the will, and whether the probate process is contested.

General overview of the probate process in Guam. Usually if there is a Will, the Decedent names a person in the Will to serve as the executor, or person entrusted by the Decedent to carry out the instructions in the Will. The executor is the person who initiates the probate process and handles the probate process.

Can An Executor Sell Estate Property Without Getting Approval From All Beneficiaries? The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

Under Pennsylvania law, executors have a duty to provide an accounting to beneficiaries. An accounting is a detailed report that outlines the assets, liabilities, income, and expenses associated with the estate, as well as the executor's actions in managing and distributing the estate.

As a beneficiary, you are entitled to review the trust's records including bank statements, the checking account ledger, receipts, invoices, etc. Before the trust administration is complete, it is recommended you request and review the trust's records which support the accounting.