Are you inside a place that you will need papers for either business or personal purposes just about every working day? There are tons of legitimate papers templates available on the Internet, but finding ones you can rely is not simple. US Legal Forms gives 1000s of form templates, much like the Guam Assignment of Certificate of Deposit Agreement, that happen to be written to satisfy state and federal needs.

When you are currently familiar with US Legal Forms web site and get a merchant account, simply log in. Next, it is possible to down load the Guam Assignment of Certificate of Deposit Agreement design.

If you do not come with an bank account and would like to begin to use US Legal Forms, follow these steps:

- Obtain the form you need and make sure it is for your right metropolis/county.

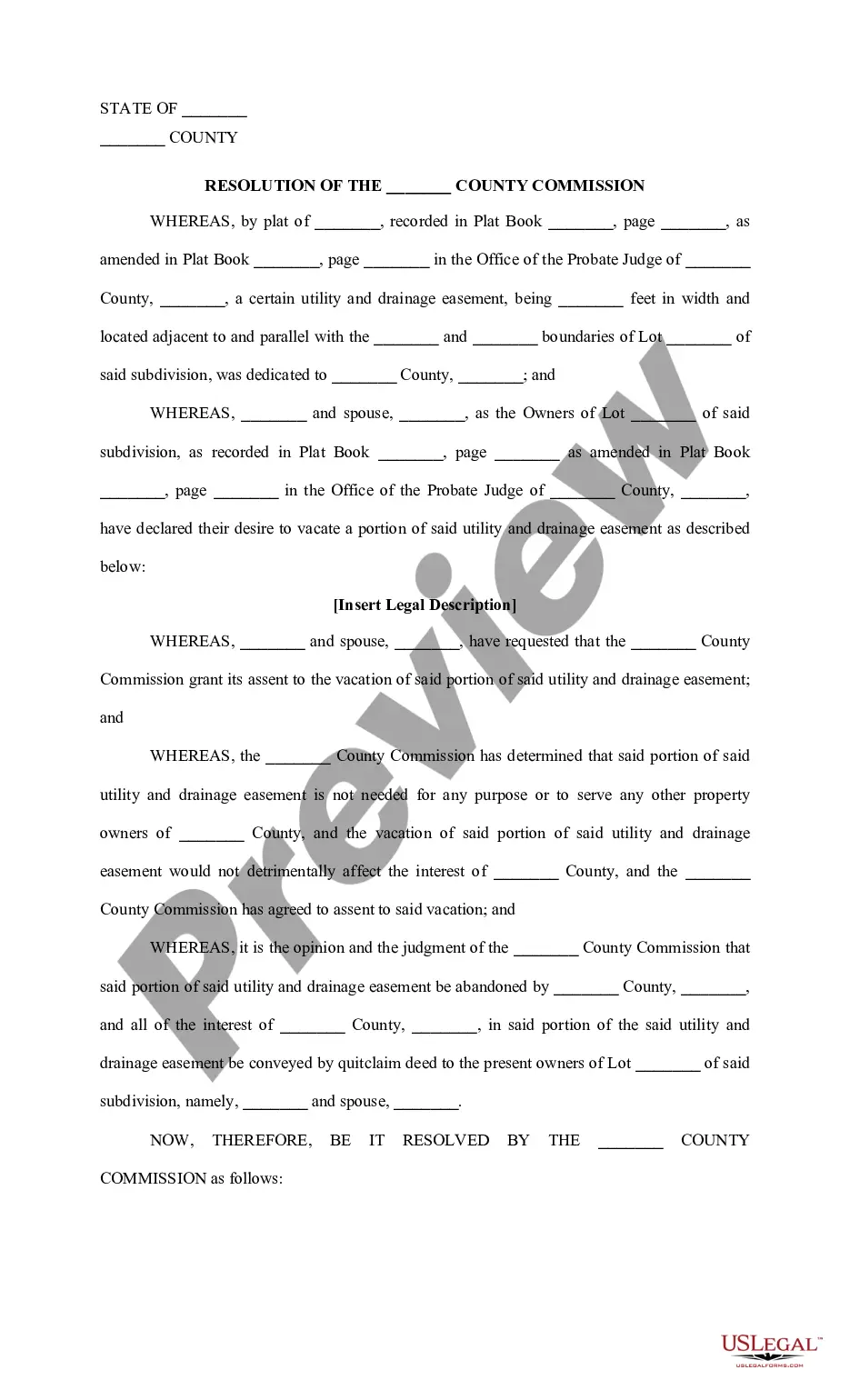

- Take advantage of the Review key to examine the form.

- Read the outline to ensure that you have selected the proper form.

- If the form is not what you are searching for, take advantage of the Research area to find the form that suits you and needs.

- When you find the right form, just click Get now.

- Pick the prices plan you want, fill out the desired info to produce your bank account, and pay for the transaction using your PayPal or Visa or Mastercard.

- Select a practical paper format and down load your copy.

Get all the papers templates you may have bought in the My Forms menu. You can obtain a extra copy of Guam Assignment of Certificate of Deposit Agreement at any time, if needed. Just select the needed form to down load or printing the papers design.

Use US Legal Forms, by far the most comprehensive collection of legitimate types, to save some time and steer clear of faults. The support gives appropriately created legitimate papers templates which you can use for a selection of purposes. Generate a merchant account on US Legal Forms and begin generating your life easier.