Guam Loan Agreement - Short Form

Description

How to fill out Loan Agreement - Short Form?

You can spend numerous hours online searching for the legal document template that meets the state and federal criteria you require. US Legal Forms offers thousands of legal templates that can be reviewed by professionals.

You can download or print the Guam Loan Agreement - Short Form from their service.

If you already have a US Legal Forms account, you may Log In and click on the Acquire button. After that, you can complete, modify, print, or sign the Guam Loan Agreement - Short Form. Every legal document template you purchase is yours permanently. To obtain an additional copy of any purchased form, go to the My documents tab and click on the corresponding button.

Make edits to your document if possible. You can complete, modify, sign, and print the Guam Loan Agreement - Short Form. Acquire and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you're using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/city of your choice. Review the form description to confirm you have chosen the right template. If available, use the Review button to look through the document template as well.

- If you want to find another variant of the form, use the Research field to locate the template that fits your needs and requirements.

- Once you have found the template you want, simply click Purchase now to move forward.

- Choose the pricing plan you prefer, enter your credentials, and register for an account on US Legal Forms.

- Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal document.

- Select the format of the document and download it to your device.

Form popularity

FAQ

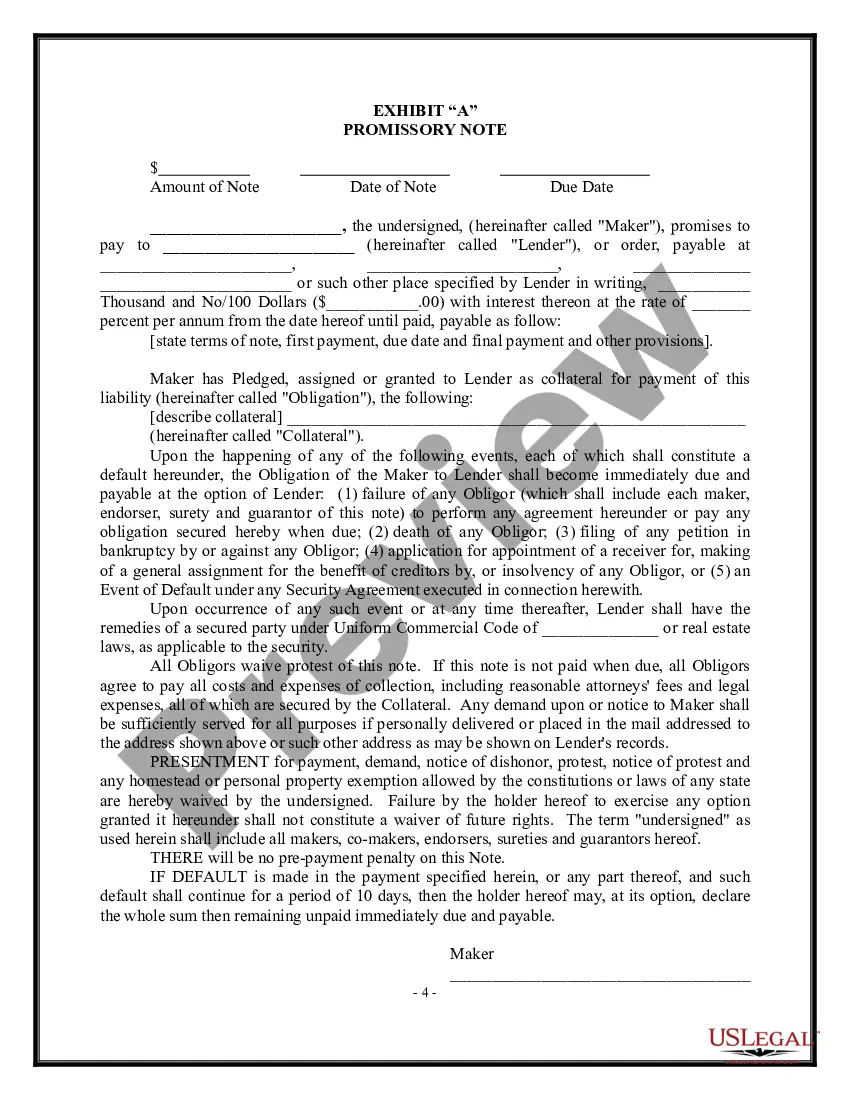

For a personal loan agreement to be enforceable, it must be documented in writing, as well as signed and dated by all parties involved. It's also a good idea to have the document notarized or signed by a witness.

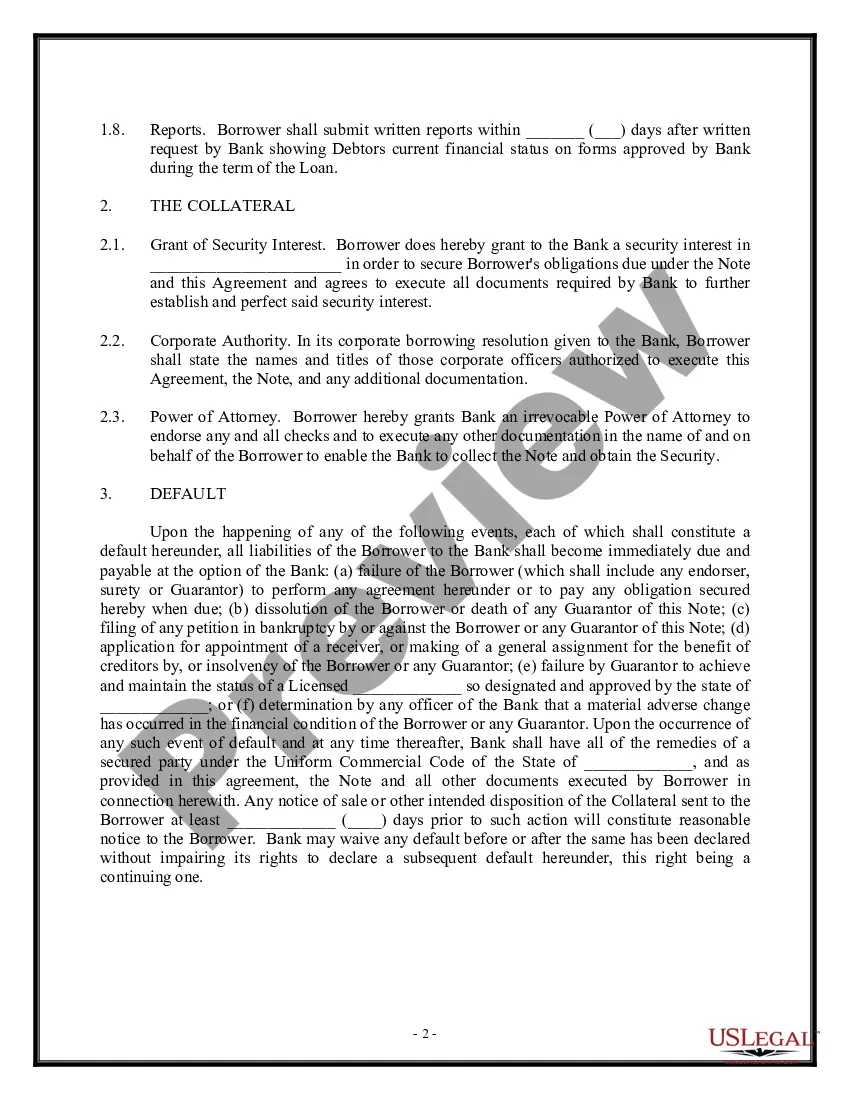

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

How to make a family loan agreement The amount borrowed and how it will be used. Repayment terms, including payment amounts, frequency and when the loan will be repaid in full. The loan's interest rate. ... If the loan can be repaid early without penalty, and how much interest will be saved by early repayment.

Common items in personal loan agreements. The name, address, and contact information of the borrower. The name, address, and contact information of the lender. A plan for loan payment, such as a monthly payment plan with start dates and due dates. The maturity date or the date that the final payment is due on the loan.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

How to Draft a Loan Agreement The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

Include key terms of the loan, such as the lender and borrower's contact information, the reason for the loan, what is being loaned, the interest rate, the repayment plan, what would happen if the borrower can't make the payments, and more. The amount of the loan, also known as the principal amount.

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.