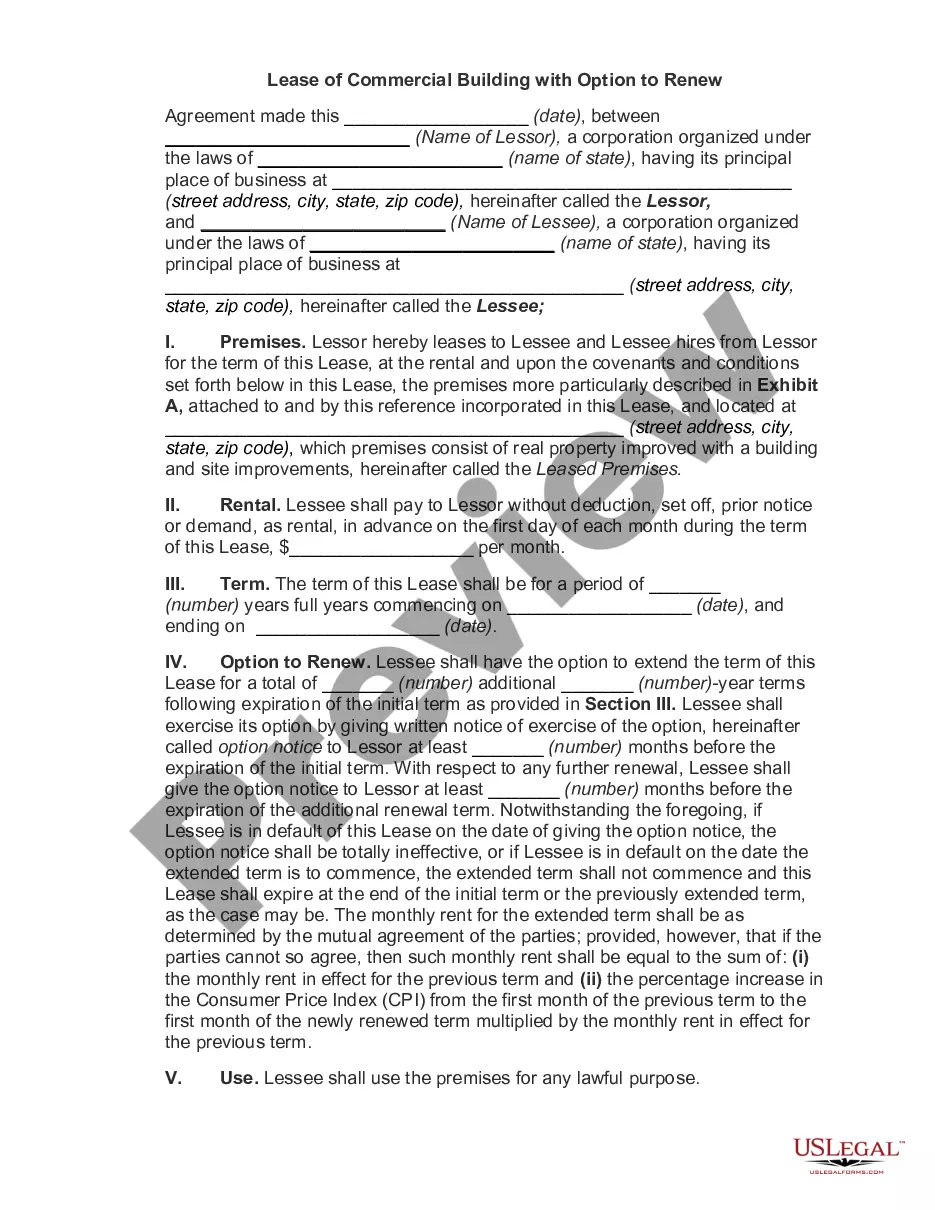

This office lease form is regarding the renewal or other extension of the lease as it relates to the "Base Year Taxes" and the "Base Year for Operating Expenses".

Georgia Option to Renew that Updates the Tenant Operating Expense and Tax Basis

Description

How to fill out Option To Renew That Updates The Tenant Operating Expense And Tax Basis?

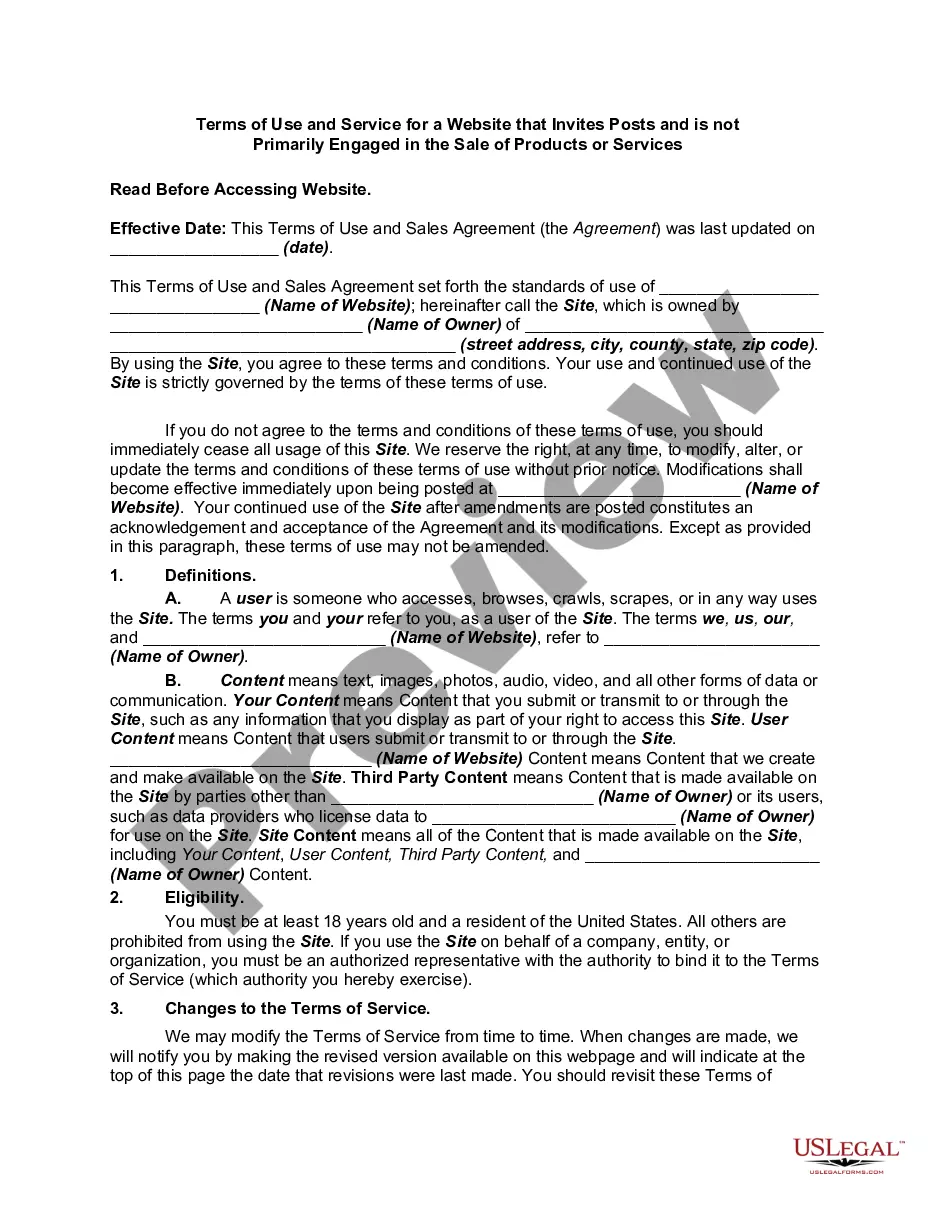

US Legal Forms - one of the greatest libraries of lawful kinds in the States - provides a wide array of lawful document web templates it is possible to download or print. Utilizing the internet site, you can get thousands of kinds for organization and individual uses, sorted by categories, says, or key phrases.You will find the most up-to-date versions of kinds much like the Georgia Option to Renew that Updates the Tenant Operating Expense and Tax Basis within minutes.

If you already have a subscription, log in and download Georgia Option to Renew that Updates the Tenant Operating Expense and Tax Basis from your US Legal Forms collection. The Acquire option can look on each and every develop you look at. You get access to all formerly downloaded kinds within the My Forms tab of your bank account.

If you would like use US Legal Forms the first time, listed below are straightforward guidelines to get you began:

- Make sure you have picked the right develop for the city/area. Go through the Preview option to analyze the form`s content. Read the develop description to actually have chosen the correct develop.

- In case the develop does not satisfy your requirements, utilize the Look for industry towards the top of the display to discover the one who does.

- When you are happy with the shape, confirm your choice by simply clicking the Purchase now option. Then, select the rates prepare you want and provide your qualifications to sign up on an bank account.

- Procedure the deal. Make use of bank card or PayPal bank account to accomplish the deal.

- Pick the file format and download the shape on your product.

- Make alterations. Load, edit and print and indication the downloaded Georgia Option to Renew that Updates the Tenant Operating Expense and Tax Basis.

Every template you included with your account lacks an expiration particular date and is your own property eternally. So, if you would like download or print one more duplicate, just go to the My Forms section and click about the develop you want.

Get access to the Georgia Option to Renew that Updates the Tenant Operating Expense and Tax Basis with US Legal Forms, probably the most comprehensive collection of lawful document web templates. Use thousands of specialist and state-distinct web templates that satisfy your small business or individual requirements and requirements.

Form popularity

FAQ

A renewal agreement is a new contract, usually for another fixed term. The tenancy terms may not be exactly the same as your current fixed term tenancy. Before you sign, check important things like the: rent. length of the fixed term.

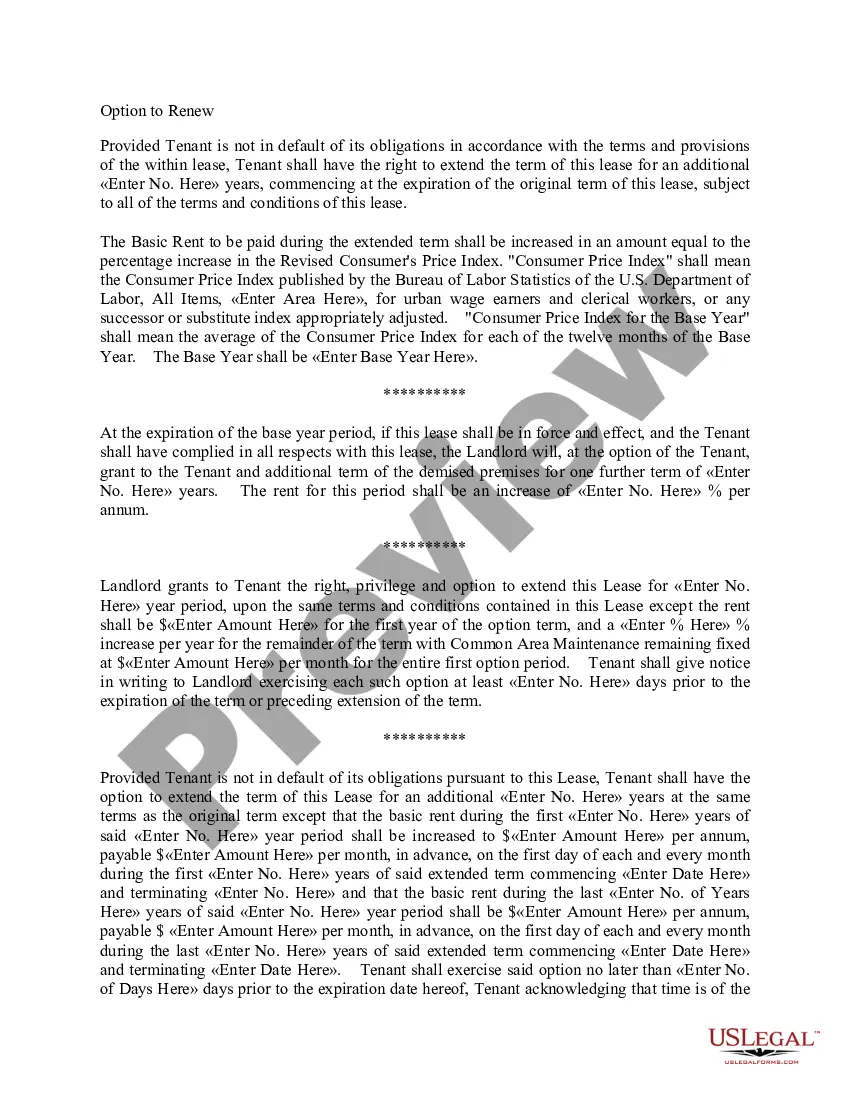

'Base year' is the first calendar year of a tenant's commercial rental period. It is especially important as all future rent payments are calculated using base year. It's additionally important to note that base year is crafted to favor landlords.

An option to renew confers on the tenant a right to continue to rent the property for a fresh term after the expiry of the current term, i.e. to renew the existing tenancy. With an option to renew, the tenant obtains another term of tenancy and the landlord is somewhat secured with rental income as agreed beforehand.

A base year refers to a type of expense stop in which the landlord pays for all operating expenses in the first year. After that first year, Phelps explained, the tenant is responsible for all operating expenses over and above the first year's established base year expenses.

Suppose that a tenant signs a lease in an office building for 5,000 square feet of space. The base rental amount is $10 per square foot. In year one of the lease, the landlord pays for all of the building operating expenses and the total comes out to $10,000. This is the base year expense stop amount.

The Base Year is a year that is tied to the actual amount of expenses for property taxes, insurance and operating expenses (sometimes called CAM) to run the property in a specified year. In a new lease, the Base Year is most often the year the lease is executed or the year in which the lease commences.

Renew: A lease may allow you to renew by signing a new lease. A landlord can offer the tenant a new lease with different terms, including an increase in rent. Georgia law does not limit the amount of rent a landlord can charge or the amount by which rent can be increased.

A gross lease rate consists of a base rent per square foot and additional operating expenses per square foot set during the base year. The base year is typically the year the lease is signed. As such, a gross lease rental rate is inclusive of rent and the first year's operating expenses.