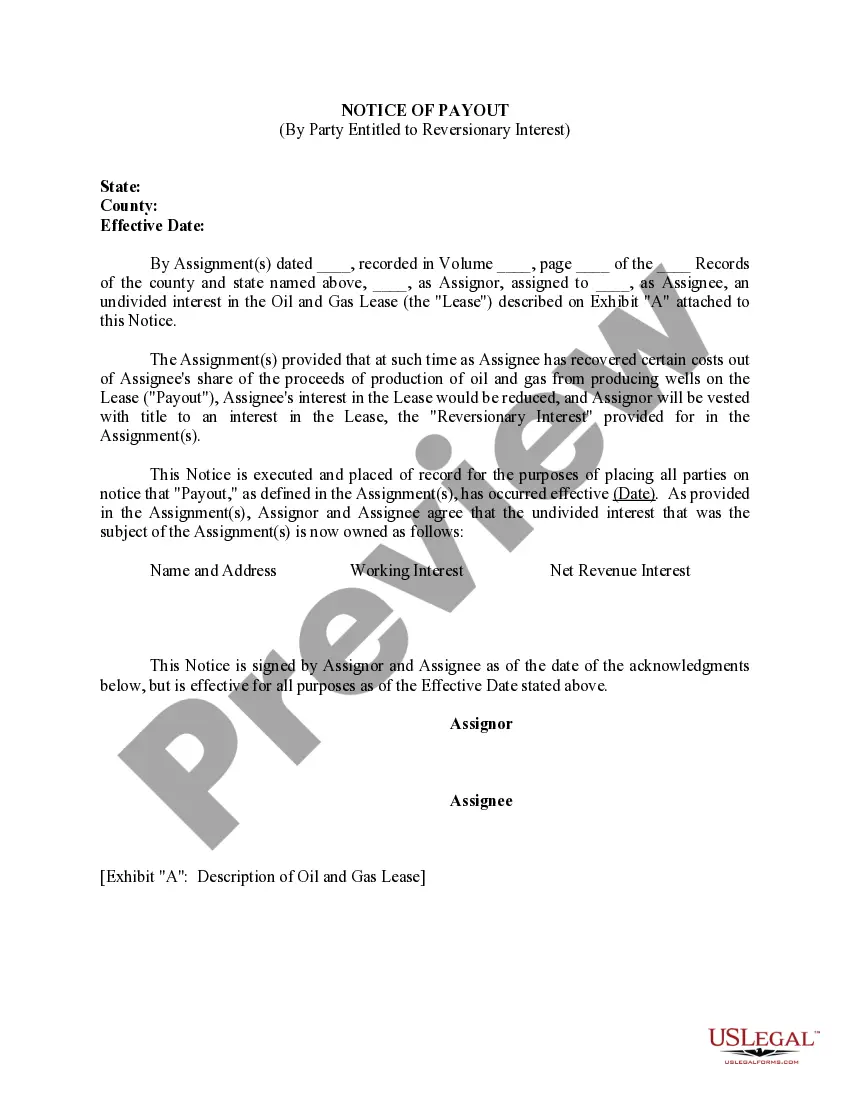

Georgia Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest

Description

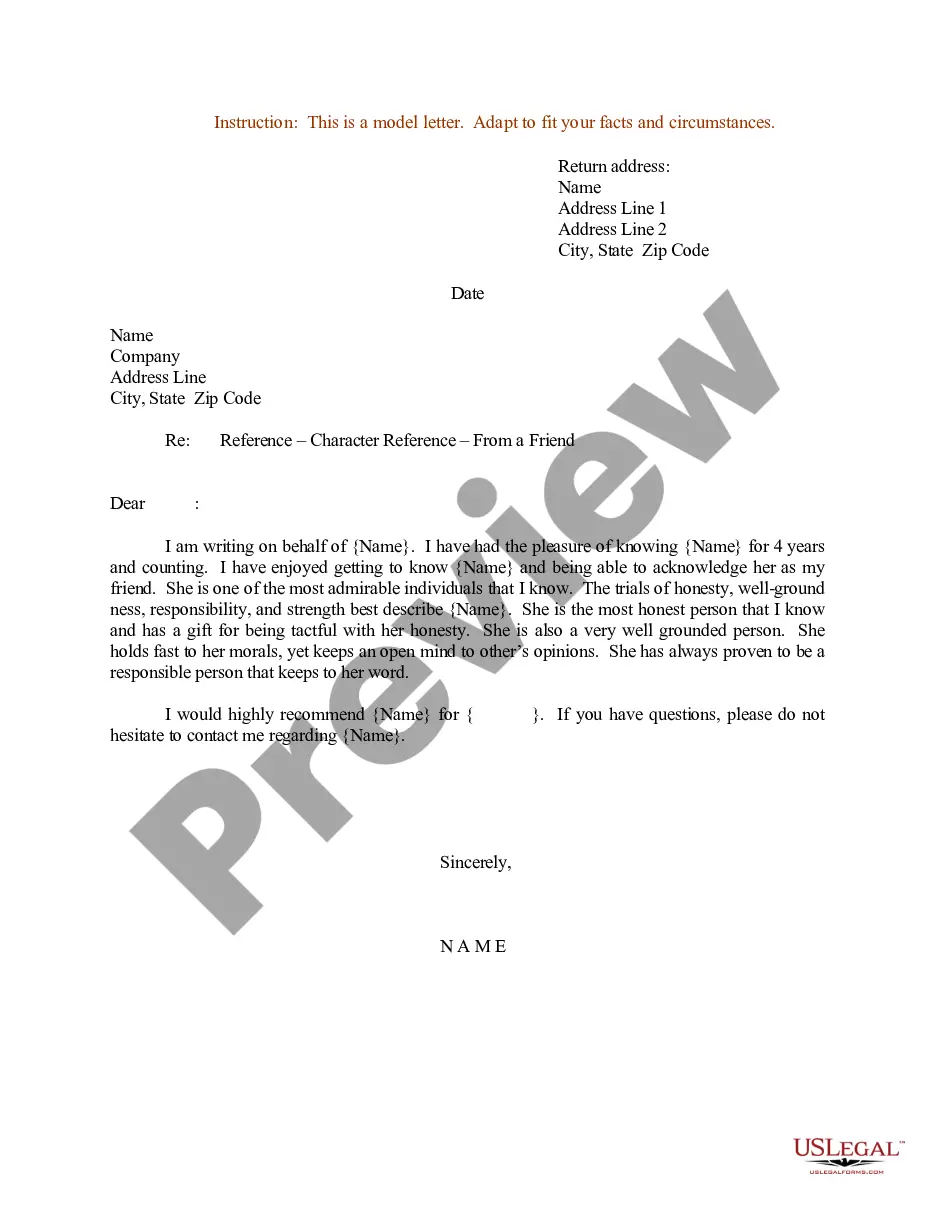

How to fill out Notice Of Payout, Election To Convert Interest To Party With Right To Convert An Overriding Royalty Interest To A Working Interest?

US Legal Forms - one of the greatest libraries of legitimate kinds in America - gives an array of legitimate file web templates you are able to down load or print out. Making use of the website, you will get a large number of kinds for organization and individual functions, sorted by categories, claims, or key phrases.You can get the most up-to-date versions of kinds such as the Georgia Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest within minutes.

If you already have a monthly subscription, log in and down load Georgia Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest from the US Legal Forms local library. The Download button can look on each and every type you look at. You gain access to all in the past saved kinds inside the My Forms tab of your respective bank account.

If you would like use US Legal Forms the first time, here are simple directions to help you began:

- Be sure you have chosen the right type for the town/area. Select the Review button to review the form`s content material. See the type outline to actually have selected the correct type.

- If the type does not suit your specifications, take advantage of the Look for industry on top of the screen to find the one which does.

- Should you be happy with the shape, verify your choice by clicking on the Get now button. Then, choose the pricing strategy you like and give your credentials to register for an bank account.

- Method the financial transaction. Use your credit card or PayPal bank account to accomplish the financial transaction.

- Choose the file format and down load the shape in your system.

- Make changes. Load, revise and print out and sign the saved Georgia Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest.

Every design you put into your account lacks an expiry day and is also your own property forever. So, if you would like down load or print out another backup, just check out the My Forms section and click on in the type you require.

Gain access to the Georgia Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest with US Legal Forms, probably the most considerable local library of legitimate file web templates. Use a large number of expert and state-particular web templates that satisfy your small business or individual demands and specifications.

Form popularity

FAQ

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

Overriding Royalty Interest Conveyance means an assignment, in the form attached hereto as Exhibit F, pursuant to which Subsidiary Borrower grants to Lender a cost-free overriding royalty interest equal to a percentage determined pursuant to Section 8.5 of the Hydrocarbons and other minerals attributable to Subsidiary ...

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.