Georgia Acquisition Due Diligence Report

Description

How to fill out Acquisition Due Diligence Report?

Finding the right legitimate papers web template could be a battle. Naturally, there are tons of layouts available online, but how do you obtain the legitimate type you will need? Use the US Legal Forms website. The assistance gives 1000s of layouts, such as the Georgia Acquisition Due Diligence Report, which can be used for business and personal requires. All of the types are examined by professionals and fulfill state and federal demands.

If you are previously registered, log in for your bank account and then click the Down load option to get the Georgia Acquisition Due Diligence Report. Use your bank account to appear throughout the legitimate types you may have purchased in the past. Visit the My Forms tab of the bank account and have another copy from the papers you will need.

If you are a new consumer of US Legal Forms, listed here are simple guidelines that you can adhere to:

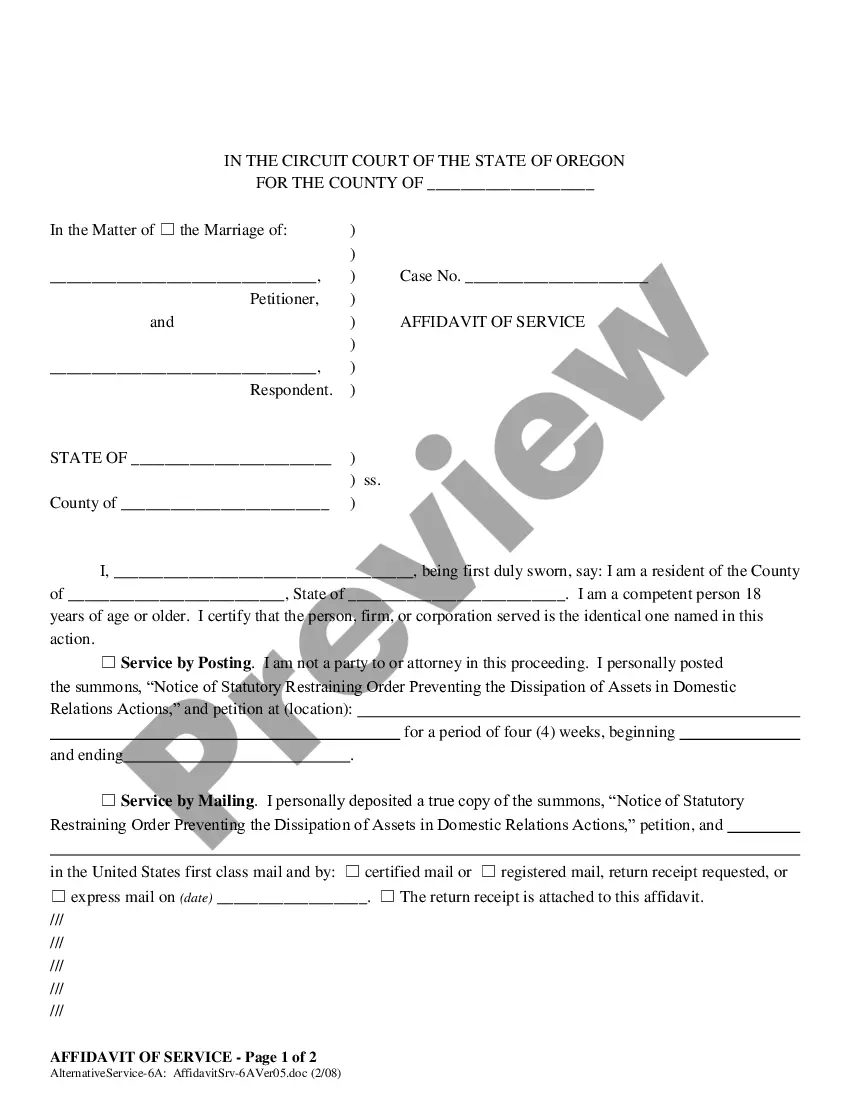

- First, make certain you have selected the correct type for your personal area/state. You are able to look through the form while using Review option and look at the form explanation to make certain it will be the right one for you.

- In the event the type will not fulfill your expectations, take advantage of the Seach field to discover the appropriate type.

- When you are certain the form is acceptable, select the Purchase now option to get the type.

- Choose the rates plan you want and enter in the necessary information. Make your bank account and purchase the transaction making use of your PayPal bank account or Visa or Mastercard.

- Select the document formatting and acquire the legitimate papers web template for your device.

- Complete, revise and print and indication the acquired Georgia Acquisition Due Diligence Report.

US Legal Forms is the biggest local library of legitimate types that you can see a variety of papers layouts. Use the company to acquire professionally-created papers that adhere to status demands.

Form popularity

FAQ

A day is also the entire day. So, for example, if a person has a ten (10) day Due Diligence Period from the Binding Agreement Date, it would end at midnight on the tenth day after the Binding Agreement Date.

What Should Be in a Due Diligence Report Checklist? Information on the finances of the company. ... Information about the company's employees. ... Information on the assets of the company. ... Information on partners, suppliers, and customers. ... Legal information about the company.

In Georgia, due diligence is the period when you are given an amount of time to get out of a purchase and sale agreement and still obtain your earnest money deposit back. This allows a buyer to carry out all the inspections of the home and the surroundings before coming to any conclusions.

Across most industries, a comprehensive due diligence report should include the company's financial data, information about business operations and procurement, and a market analysis. It may also include data about employees and payroll, taxes, intellectual property, and the board of directors.

Unless the buyer is purchasing ?as is? (usually not the case) the buyer has a ?DUE DILIGENCE PERIOD? ? typically somewhere between 7 and 14 days. During that time the buyer can terminate the contract for any reason or no reason at all.

Ing to a recent survey, the average cost for due diligence services is around $50,000. However, these costs can vary widely depending on the specific services needed, with some firms spending as much as $150,000 on due diligence professionals.

How long is the due diligence period in Georgia? The Georgia due diligence period is negotiated between the buyer and seller. Traditionally they lasted 10 to 14 business days, but we are seeing them as low as 1 to 3 days. Depending on the language of the contract, it can exclude federal holidays.

Continue reading for a list of each step of the due diligence process. Check out the area. ... Understand the property disclosures. ... Hire an inspector. ... Get an appraisal. ... Survey the property. ... Compare homeowners insurance.