Georgia Letter for Account Paid in Full

Description

How to fill out Letter For Account Paid In Full?

Are you currently in a circumstance where you need documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but locating reliable ones can be challenging.

US Legal Forms provides a vast array of document templates, including the Georgia Letter for Account Paid in Full, that are designed to comply with state and federal regulations.

You can obtain an additional copy of the Georgia Letter for Account Paid in Full at any time, if needed. Just click the necessary document to download or print the template.

Utilize US Legal Forms, one of the most extensive collections of legal documents, to save time and avoid mistakes. The service offers professionally designed legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Georgia Letter for Account Paid in Full template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for the correct city/state.

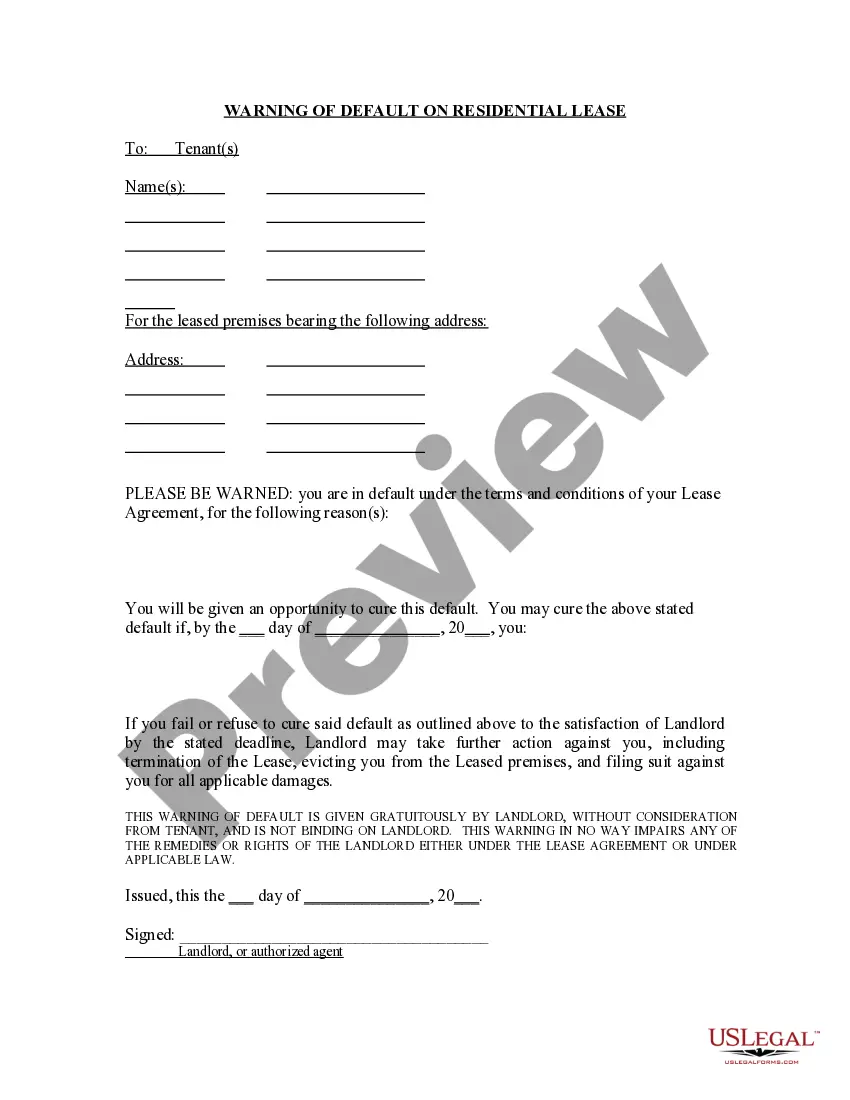

- Use the Preview button to review the form.

- Read the description to ensure you have selected the correct document.

- If the document isn’t what you are looking for, utilize the Search field to find the document that meets your needs and specifications.

- Once you find the appropriate document, click Purchase now.

- Select the payment plan you desire, fill out the required information to create your account, and pay for your order using your PayPal or credit card.

- Choose a convenient file format and download your version.

- Access all the document templates you have purchased in the My documents menu.

Form popularity

FAQ

You can file GA Form 500, which is the Georgia Individual Income Tax Return, either online or by mailing a paper copy. For online submissions, use the Georgia Department of Revenue's e-file system for a more efficient process. If you have received a Georgia Letter for Account Paid in Full, ensure that your form submission aligns with your payment status.

No, the Georgia Department of Revenue and the IRS are not the same. The Georgia Department of Revenue manages state taxes, while the IRS oversees federal taxes. Understanding this distinction is important, especially if you have received a Georgia Letter for Account Paid in Full, as it pertains specifically to your state tax obligations.

You can make a payment to the Department of Revenue easily through multiple methods. Online payments are available via their official website, where you can use credit cards or bank transfers. If you have received a Georgia Letter for Account Paid in Full, it may provide specific instructions regarding your payment options.

Receiving a letter from the tax commissioner can indicate various outcomes, such as confirming your tax return, notifying you of a balance due, or acknowledging your account status. The Georgia Letter for Account Paid in Full serves as a vital document, showing that you have fulfilled your tax obligations. It is important to read these letters carefully to understand their implications.

If you owe Georgia state taxes, it is crucial to address the situation promptly to avoid penalties and interest. The Georgia Letter for Account Paid in Full may help clarify your payment status once settled. You can seek assistance from the Georgia Department of Revenue to understand your balance and explore payment options tailored to your needs.

The state tax forgiveness program in Georgia aims to assist taxpayers struggling to meet their tax liabilities. This program allows eligible individuals to receive a reduction in their tax debt under certain conditions. If you qualify and complete the necessary steps, you will receive a Georgia Letter for Account Paid in Full, confirming that your tax obligations have been resolved. For more assistance, consider using the uslegalforms platform to navigate these processes smoothly.

The term 'paid in full' means that all obligations associated with a debt have been satisfied. In the context of a Georgia Letter for Account Paid in Full, it signifies that the creditor acknowledges no further payments are due. This status is crucial for your financial health and credit history.

To create a Georgia Letter for Account Paid in Full, start with a formal greeting and include your account information. Clearly state that you have paid the debt in full, and include the payment date along with any relevant transaction details. Conclude by requesting a written acknowledgment from the creditor.

Writing 'paid in full' on a letter requires clarity and formality. You should include the phrase prominently, along with the necessary account details and payment confirmation. For assistance, consider using templates from platforms like uslegalforms, which can help you draft a professional Georgia Letter for Account Paid in Full.

An example of a Georgia Letter for Account Paid in Full would include your name, the creditor's name, and a clear statement indicating that the total balance has been settled. It should also mention the payment date and include a request for confirmation. This letter serves as proof for your records.