Georgia Disability Services Contract - Self-Employed

Description

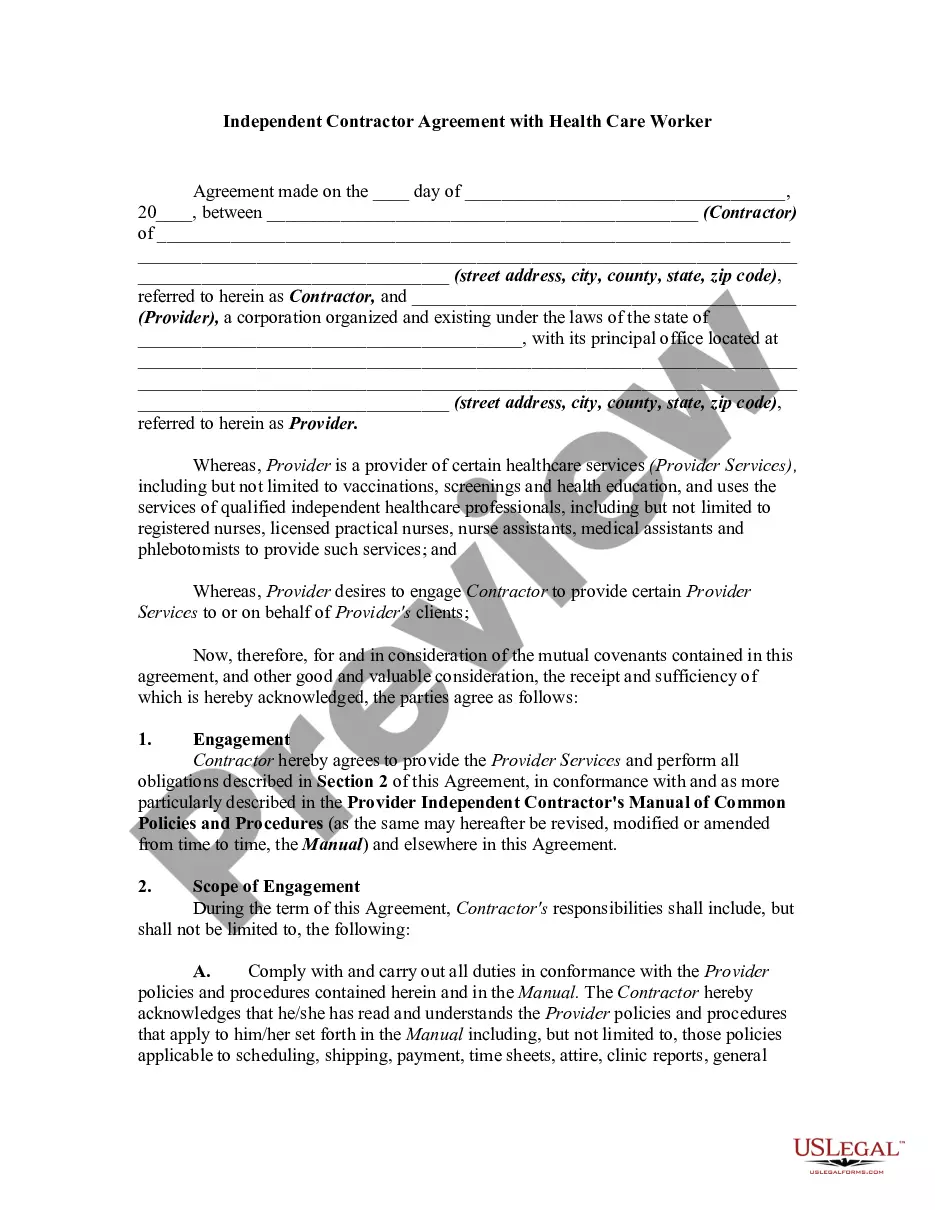

How to fill out Disability Services Contract - Self-Employed?

You can spend hours online searching for the official document template that meets the state and federal requirements you require. US Legal Forms provides a vast selection of official forms that are reviewed by experts.

You can download or print the Georgia Disability Services Contract - Self-Employed from the platform. If you already possess a US Legal Forms account, you may sign in and click on the Acquire button. After that, you can complete, modify, print, or sign the Georgia Disability Services Contract - Self-Employed. Each official document template you purchase is yours indefinitely.

To obtain an additional copy of the purchased form, navigate to the My documents section and click on the corresponding button. If you are using the US Legal Forms website for the first time, follow the straightforward instructions outlined below: First, ensure that you have selected the correct document template for the region/town of your choice. Review the form details to confirm you have chosen the appropriate form. If available, utilize the Preview button to examine the document template as well.

Utilize professional and state-specific templates to address your business or personal requirements.

- To find another copy of the form, use the Search field to locate the template that fits your needs and requirements.

- Once you have found the template you want, click Purchase now to proceed.

- Select the pricing plan you desire, enter your credentials, and register for an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the official document.

- Choose the format of the document and download it to your device.

- Make edits to your document if needed. You can complete, modify, sign, and print the Georgia Disability Services Contract - Self-Employed.

- Obtain and print numerous document templates using the US Legal Forms Website, which offers the largest collection of official forms.

Form popularity

FAQ

You can own a business and still collect SSDI, but you need to be mindful of how much you earn from that business. Your income must not exceed the limit set by SSDI to avoid losing benefits. Utilizing the Georgia Disability Services Contract - Self-Employed can help you maintain compliance while managing your business effectively.

Yes, you can receive disability benefits as an independent contractor, provided you meet the necessary criteria. Independent contractors must report their income accurately to ensure compliance with SSDI regulations. It's advisable to consult with professionals who understand the nuances of the Georgia Disability Services Contract - Self-Employed to maximize your benefits.

The easiest disabilities to get approved for often include conditions such as mental health disorders, musculoskeletal issues, and certain chronic illnesses. While each case is unique, these conditions generally have clearer medical documentation requirements. Remember that having the right support through resources like the Georgia Disability Services Contract - Self-Employed can enhance your chances of approval.

Yes, you can collect disability benefits as an independent contractor if you meet the eligibility requirements set by SSDI. Independent contractors need to demonstrate that their work does not exceed the allowed income limits while receiving benefits. It's essential to keep detailed records of your earnings. The Georgia Disability Services Contract - Self-Employed can assist you in understanding your rights and responsibilities.

To report self-employment income to SSDI, you need to fill out a form called the 'Self-Employment Income Report.' This form requires you to provide details about your earnings from your business. Additionally, you should keep accurate records of your income and expenses. Utilizing the Georgia Disability Services Contract - Self-Employed can help you navigate this process effectively.

Disability insurance can be a smart investment for self-employed individuals, providing peace of mind in case of unforeseen health issues. With the unpredictability of self-employment, having this protection ensures that you can maintain financial stability during difficult times. By considering the Georgia Disability Services Contract - Self-Employed, you can explore tailored options and benefits that cater to your unique situation. Ultimately, having this coverage allows you to focus on your business without the added worry of possible income loss due to disability.

The self-employment assistance program in Georgia offers resources and financial support to individuals who want to start their own businesses. Participants can receive training, mentorship, and assistance in creating business plans. This program is designed to empower individuals to become successful entrepreneurs, which aligns well with the Georgia Disability Services Contract - Self-Employed. By joining this program, you can gain the tools necessary to thrive as a self-employed individual in Georgia.