Georgia Recovery Services Contract - Self-Employed

Description

How to fill out Recovery Services Contract - Self-Employed?

You can spend hours online trying to locate the legal document template that meets the federal and state requirements you need.

US Legal Forms offers a multitude of legal forms that are reviewed by experts.

You can download or print the Georgia Recovery Services Contract - Self-Employed from my service.

- If you already have a US Legal Forms account, you can Log In and click the Obtain option.

- Then, you can fill out, modify, print, or sign the Georgia Recovery Services Contract - Self-Employed.

- Every legal document template you buy is yours forever.

- To get another copy of the purchased form, go to the My documents tab and click the corresponding option.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/area that you choose.

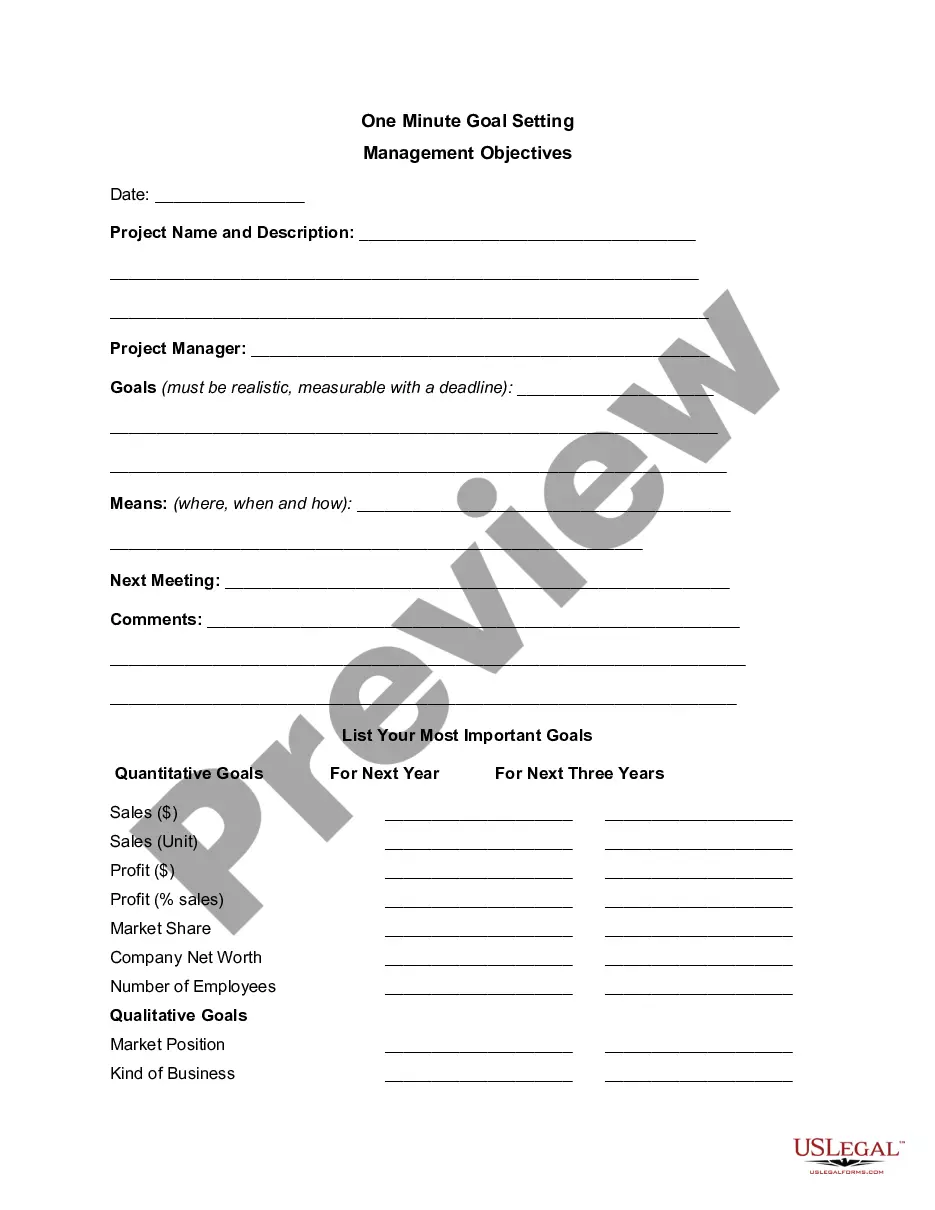

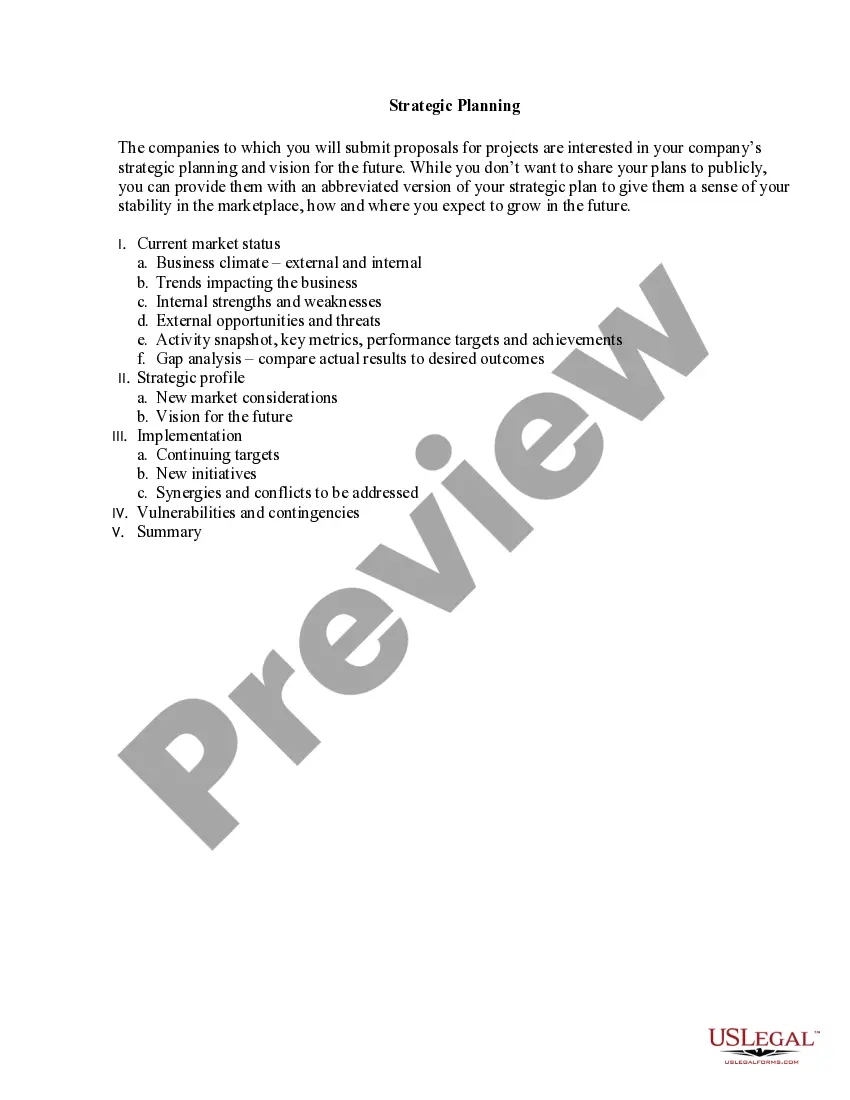

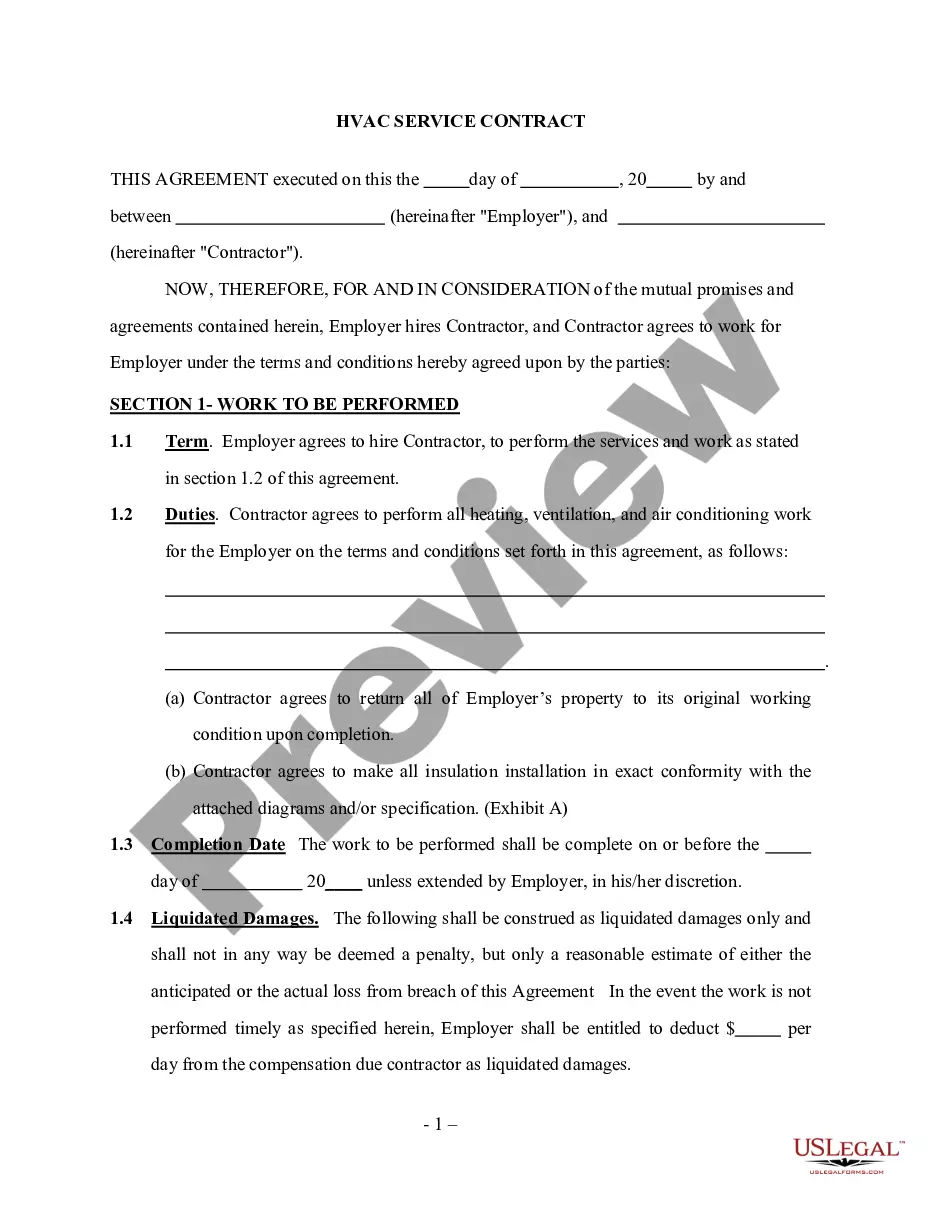

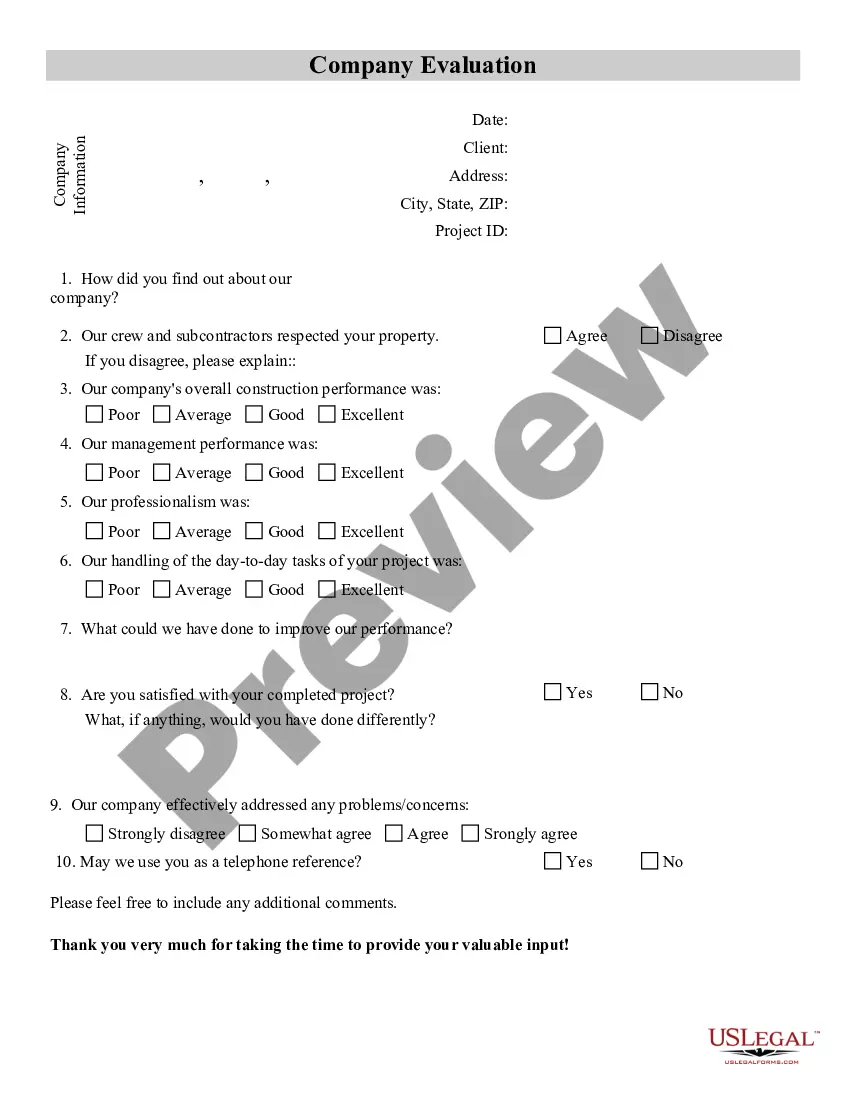

- Review the form outline to confirm you have selected the right form.

- If available, use the Review option to look through the document template as well.

- If you wish to find another version of the form, use the Search field to find the template that suits you and your needs.

- Once you have found the template you want, click Purchase now to proceed.

- Select the pricing plan you need, enter your credentials, and create your account on US Legal Forms.

- Complete the transaction.

- You can use your credit card or PayPal account to pay for the legal form.

- Select the format of the document and download it to your device.

- Make adjustments to your document if necessary.

- You can fill out, edit, sign, and print the Georgia Recovery Services Contract - Self-Employed.

- Obtain and print a variety of document templates using the US Legal Forms website, which offers the most extensive collection of legal forms.

- Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

To write a contract agreement for services, describe the services you will provide, specify payment details, and outline the timeline. Include any obligations for both you and the client, and clarify potential contingencies. A well-crafted agreement minimizes confusion and establishes trust. For easy access to templates and sample agreements, explore the resources offered by US Legal Forms to support your Georgia Recovery Services Contract - Self-Employed.

Yes, having a contract as a self-employed individual is crucial for clarity and protection. A contract outlines the agreements made with clients, defines the scope of work, and sets payment terms, helping to prevent disputes. It also serves as a legal document in the event of disagreements. Consider using US Legal Forms to craft a comprehensive Georgia Recovery Services Contract - Self-Employed that suits your specific needs.

To write a self-employment contract, start by clearly stating the services you will provide, payment terms, and duration of the contract. Specify any conditions for termination and include confidentiality clauses to protect sensitive information. This contract not only clarifies expectations but also safeguards your rights as a self-employed individual. For structured guidance, check out the offerings on US Legal Forms to streamline your contract creation.

You can show proof of being self-employed by maintaining records of your business income, filing a Schedule C with your taxes, and keeping invoices from clients. Documentation such as business licenses and permits also supports your self-employed status. If you need proper templates for invoicing or contracts, consider using US Legal Forms to ensure you meet all necessary requirements. This is especially helpful for a Georgia Recovery Services Contract - Self-Employed.

To write a contract for a 1099 employee, detail the project scope, payment structure, and deadlines clearly. Define the nature of the relationship and specify that the worker is an independent contractor, not an employee. Incorporating terms related to liability and confidentiality can offer additional protection. Utilizing resources from US Legal Forms can simplify this process for your Georgia Recovery Services Contract - Self-Employed.

Yes, you can write your own legally binding contract as long as it meets the legal requirements of your state. Be sure to include essential elements such as offer, acceptance, consideration, and mutual consent. It's wise to review state laws regarding contracts, particularly if you’re using it for a Georgia Recovery Services Contract - Self-Employed. Consulting resources like US Legal Forms can help you craft your contract correctly.

Writing a self-employed contract involves outlining the terms of the agreement between you and your client. Start by stating the services you will provide, the payment terms, and the timeline for the work. Be specific about roles and responsibilities to avoid misunderstandings. You can find templates or guidance online, including options on the US Legal Forms platform, to ensure you create a thorough document that's tailored to your needs.

Yes, contract work does count as self-employment. Engaging in contract work indicates that you are operating your own business, providing services in exchange for compensation. A Georgia Recovery Services Contract - Self-Employed further solidifies this status, laying out essential details about the job. Thus, ensuring clear agreements can lead to more successful and legally sound self-employment.

Recent changes have brought an increased focus on classification and rights for self-employed individuals. These rules affect aspects like taxation, benefits, and eligibility for assistance programs. When establishing a Georgia Recovery Services Contract - Self-Employed, it’s crucial to be aware of these updates as they influence how you operate and report income. Staying informed will help you make better decisions for your business.

Yes, you can and should have a contract if you're self-employed. A Georgia Recovery Services Contract - Self-Employed helps you to clearly define your responsibilities and compensatory terms. This contract acts as a safeguard for both you and your clients, ensuring that there are no misunderstandings. Having a written agreement promotes professionalism and trust in your business dealings.