Georgia Pipeline Service Contract - Self-Employed

Description

How to fill out Pipeline Service Contract - Self-Employed?

US Legal Forms - one of the largest repositories of legal documents in the country - provides a range of legal document templates that you can either download or print.

While navigating the site, you will encounter thousands of forms for both business and personal purposes, categorized by types, states, or keywords. You can obtain the latest editions of forms such as the Georgia Pipeline Service Contract - Self-Employed in moments.

If you already possess a monthly subscription, Log In to download the Georgia Pipeline Service Contract - Self-Employed from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms through the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the file format and download the form onto your device. Make adjustments. Fill out, edit, print, and sign the downloaded Georgia Pipeline Service Contract - Self-Employed. Each template added to your account has no expiration date and is yours indefinitely. Therefore, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Gain access to the Georgia Pipeline Service Contract - Self-Employed with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, follow these simple steps to get started.

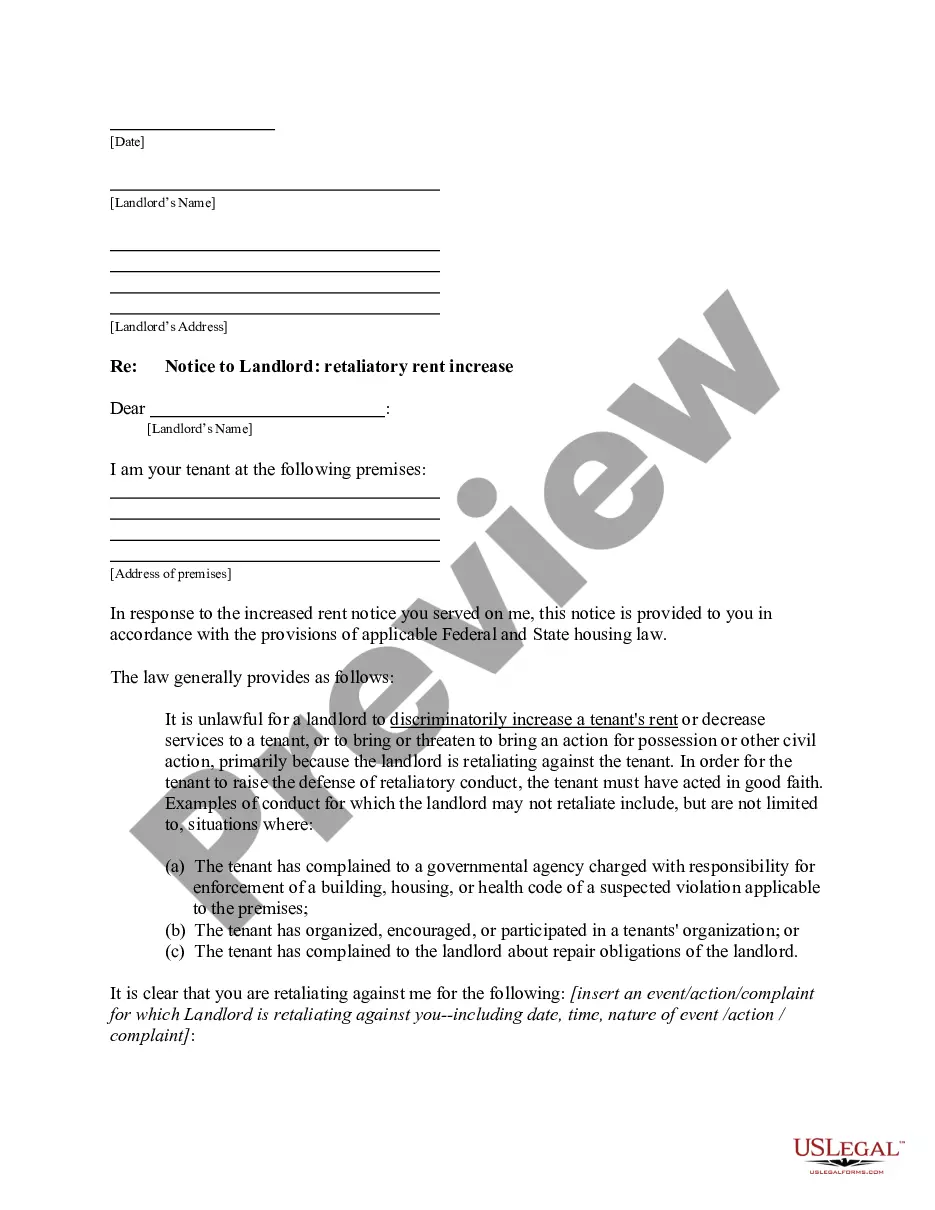

- Ensure you have selected the correct form for your city/state. Click on the Preview button to review the content of the form.

- Check the form details to confirm that you have chosen the right one.

- If the form does not meet your requirements, use the Search feature at the top of the screen to find one that does.

- Once you are satisfied with the form, validate your choice by clicking the Get now button.

- Next, select the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Writing a simple employment contract involves outlining the job title, duties, compensation, and terms of termination. You want to ensure clarity and simplicity to avoid misunderstandings. In the context of a Georgia Pipeline Service Contract - Self-Employed, it's important to define the working relationship accurately. For added convenience, uslegalforms provides templates and examples to guide you.

To write a self-employed contract, identify the specific services you will provide and articulate the payment terms clearly. Make sure to include details about deadlines, confidentiality, and intellectual property rights regarding your work. A Georgia Pipeline Service Contract - Self-Employed should reflect your professional standards and protect your interests. Uslegalforms offers useful templates to assist with this process.

Filling out an independent contractor form requires you to provide personal information, such as your name, address, and business details. Additionally, specify the project scope and payment arrangements. When dealing with a Georgia Pipeline Service Contract - Self-Employed, it is crucial to be accurate and thorough, as this form can affect your tax implications and legal standing. Check uslegalforms for helpful resources.

Writing a self-employment contract involves outlining the details of the services you will provide and the terms of payment. Begin with the project scope, including deadlines and deliverables. When drafting a Georgia Pipeline Service Contract - Self-Employed, be precise to ensure you and the other party have clear expectations. Resources like uslegalforms can help streamline your process with helpful templates.

Yes, you can write your own legally binding contract as long as it meets the necessary legal requirements. Ensure that it includes essential elements such as offer, acceptance, and consideration. When dealing with a Georgia Pipeline Service Contract - Self-Employed, using clear language and including all commitments can help safeguard both you and the contractor. Consider consulting with a legal professional for additional assurance.

To write a contract for a 1099 employee, start by defining the scope of work and payment terms clearly. Specify the responsibilities and deadlines to avoid confusion later. Make sure to include any relevant details about the Georgia Pipeline Service Contract - Self-Employed to ensure compliance and clarity for both parties. You can use platforms like uslegalforms for templates to guide your drafting process.

Yes, having a contract when you are self-employed is crucial. It outlines the services you provide, payment terms, and other essential details that help prevent disputes. A well-structured Georgia Pipeline Service Contract - Self-Employed can ensure that both you and your client are protected and clearly understand the agreement. Using professional platforms like uslegalforms can simplify the process of obtaining the right contract.

A 1099 employee, typically classified as an independent contractor, should have a contract to define the terms of their work. Without a contract, you may encounter challenges regarding payment and job duties. A Georgia Pipeline Service Contract - Self-Employed can provide clarity and protect your rights. Therefore, securing a written agreement is essential for a successful working relationship.

While it is possible to freelance without a contract, it is not advisable. Operating without a written agreement exposes you to misunderstandings regarding payment and the scope of work. A well-drafted contract, especially a Georgia Pipeline Service Contract - Self-Employed, can provide protection and set clear expectations for both you and your client. Thus, it's best to always use a contract.

Self-employed individuals provide services independently, while contracted workers operate under an agreement with a company or client. In essence, a contractor can be self-employed, but not every self-employed worker is a contractor. Understanding these distinctions is vital for structuring your Georgia Pipeline Service Contract - Self-Employed agreements and ensuring compliance with regulations.