Georgia Self-Employed Utility Services Contract

Description

How to fill out Self-Employed Utility Services Contract?

You can dedicate time online looking for the legal document format that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal templates that are reviewed by experts.

It is easy to download or print the Georgia Self-Employed Utility Services Agreement from my service.

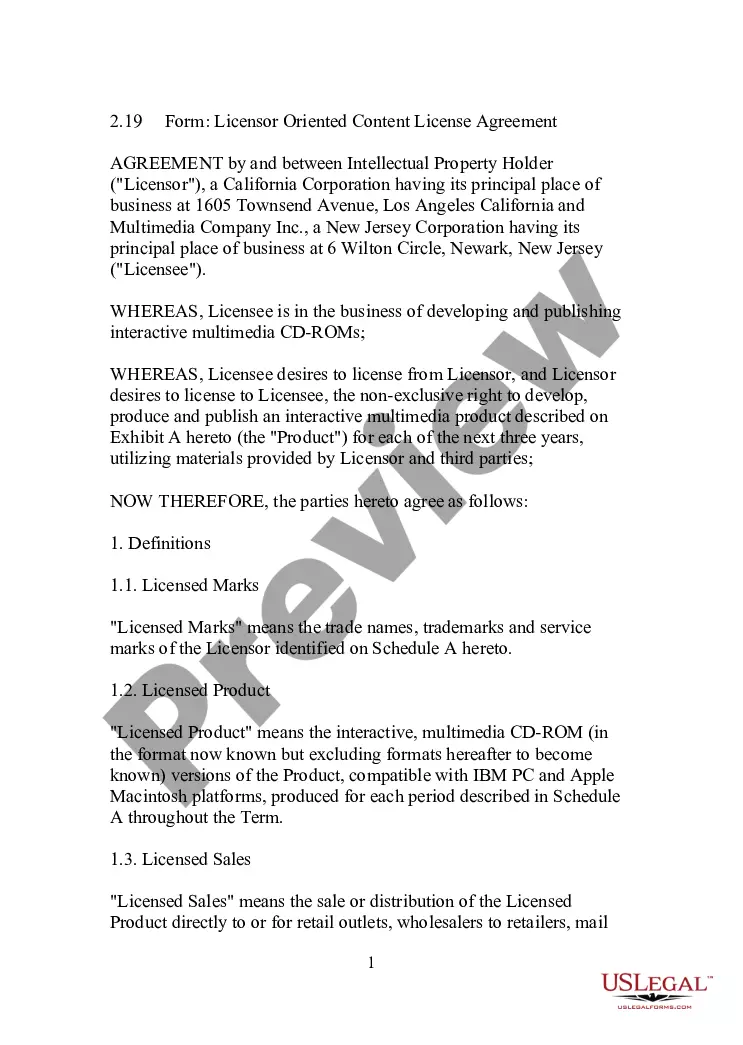

If available, utilize the Review button to browse through the format as well. If you wish to find another version of the form, use the Search field to locate the format that meets your needs and specifications. Once you have found the format you require, click Get now to proceed. Choose the pricing plan you want, enter your details, and register for your account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal document. Select the format of the document and download it to your device. Make changes to your document if necessary. You can complete, edit, sign, and print the Georgia Self-Employed Utility Services Agreement. Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal templates. Utilize professional and state-specific templates to address your business or personal needs.

- If you possess a US Legal Forms account, you can sign in and click on the Download button.

- After that, you can complete, modify, print, or sign the Georgia Self-Employed Utility Services Agreement.

- Every legal document format you purchase is yours permanently.

- To obtain another copy of any purchased form, navigate to the My documents section and click on the corresponding button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct format for the state/region of your choice.

- Review the form outline to make sure you have chosen the appropriate template.

Form popularity

FAQ

To obtain a utility license in Georgia, you must first determine the type of utility services you plan to offer. Then, contact the Georgia Public Service Commission for the specific licensing requirements. Completing the necessary forms and providing supporting documentation is crucial. Resources like USLegalForms can assist you in preparing a Georgia Self-Employed Utility Services Contract, which may be required during the licensing process.

Writing a self-employed contract requires clarity and specificity. Begin by outlining the services you will provide, including payment terms and project timelines. It’s essential to include legal protections for both parties, ensuring compliance with state regulations. Tools like USLegalForms offer templates for creating a Georgia Self-Employed Utility Services Contract, making the process straightforward and efficient.

Securing a contract with the state of Georgia involves registering your business with the Georgia Secretary of State and completing necessary certifications. You should regularly check the Georgia Procurement Registry for open bids that align with your services. Additionally, using USLegalForms can guide you through creating a solid proposal and navigating the requirements for a Georgia Self-Employed Utility Services Contract.

To find government contracts in Georgia, start by visiting the Georgia Procurement Registry. This platform lists available contracts and opportunities for businesses. You can also explore local government websites and attend procurement events. Utilizing resources like USLegalForms can help you understand the necessary documentation, such as the Georgia Self-Employed Utility Services Contract.

The purpose of an independent contractor agreement is to establish clear expectations and responsibilities between the contractor and the client. This document helps to prevent misunderstandings and provides a framework for resolving disputes if they arise. For those engaged in a Georgia Self-Employed Utility Services Contract, a well-drafted agreement is essential for outlining work scope, payment terms, and other key details, ensuring a smooth working relationship.

An independent contractor agreement in Georgia is a legal document that outlines the terms and conditions of the working relationship between the contractor and the client. This agreement details the scope of work, payment terms, and the responsibilities of both parties. When entering into a Georgia Self-Employed Utility Services Contract, having a clear agreement in place can help protect your interests and ensure a successful collaboration.

Yes, you can be your own General Contractor (GC) in Georgia, but you must ensure compliance with state regulations. As an independent contractor under a Georgia Self-Employed Utility Services Contract, you will need to manage all aspects of the project, which can be a rewarding experience. However, be prepared for the responsibilities that come with this role, including obtaining the necessary permits and licenses.

The independent contractor law in Georgia defines the relationship between independent contractors and the entities that hire them, focusing on the level of control exerted by the hiring party. This law helps determine the responsibilities and rights of independent contractors. If you're engaging in a Georgia Self-Employed Utility Services Contract, understanding this law can help you navigate your work arrangement effectively.

In Georgia, you can perform up to $2,500 worth of work without a contractor license, provided the work does not involve specific areas such as electrical or plumbing tasks. However, exceeding this limit requires you to obtain the necessary licensing. When entering into a Georgia Self-Employed Utility Services Contract, it’s essential to be aware of these regulations to ensure compliance and avoid penalties.

The new federal rule for independent contractors aims to clarify the criteria that determine whether individuals qualify as independent contractors or employees. This rule impacts how businesses classify workers, ultimately affecting their rights and benefits. Understanding this rule is crucial, especially for those involved in a Georgia Self-Employed Utility Services Contract, as it directly influences contract terms.