Georgia Summary of Terms of Proposed Private Placement Offering

Description

How to fill out Summary Of Terms Of Proposed Private Placement Offering?

If you wish to total, obtain, or print out lawful record web templates, use US Legal Forms, the greatest assortment of lawful kinds, that can be found online. Use the site`s simple and convenient research to find the papers you require. Various web templates for business and personal uses are sorted by types and says, or keywords. Use US Legal Forms to find the Georgia Summary of Terms of Proposed Private Placement Offering in a handful of mouse clicks.

When you are presently a US Legal Forms customer, log in in your profile and click the Acquire option to obtain the Georgia Summary of Terms of Proposed Private Placement Offering. You can also access kinds you earlier downloaded inside the My Forms tab of your profile.

Should you use US Legal Forms the first time, follow the instructions below:

- Step 1. Be sure you have selected the shape for that appropriate city/nation.

- Step 2. Use the Preview choice to look through the form`s content. Do not overlook to read through the outline.

- Step 3. When you are unsatisfied with all the develop, make use of the Lookup industry on top of the screen to locate other types from the lawful develop web template.

- Step 4. Upon having identified the shape you require, click the Purchase now option. Pick the pricing strategy you prefer and add your credentials to sign up to have an profile.

- Step 5. Process the financial transaction. You can use your bank card or PayPal profile to perform the financial transaction.

- Step 6. Pick the structure from the lawful develop and obtain it on your own device.

- Step 7. Complete, revise and print out or indication the Georgia Summary of Terms of Proposed Private Placement Offering.

Every lawful record web template you purchase is the one you have for a long time. You possess acces to each and every develop you downloaded with your acccount. Click on the My Forms area and decide on a develop to print out or obtain once again.

Be competitive and obtain, and print out the Georgia Summary of Terms of Proposed Private Placement Offering with US Legal Forms. There are many professional and state-distinct kinds you may use to your business or personal requirements.

Form popularity

FAQ

A private placement is a sale of stock shares or bonds to pre-selected investors and institutions rather than publicly on the open market. It is an alternative to an initial public offering (IPO) for a company seeking to raise capital for expansion.

A Private Placement Memorandum (PPM) is a securities disclosure document used by a company (issuer) that is engaged in a private offering of securities. A PPM serves as a single, comprehensive document outlining the material details about the offering.

Hear this out loud PauseA true certified copy of Resolution passed by Members of Company. An Explanatory Statement of Resolution by members of Company. An approved offer letter of Private Placement. Form PAS-5 with a detailed list of Allottees.

Hear this out loud PauseA Private Placement Memorandum (PPM) is a securities disclosure document used by a company (issuer) that is engaged in a private offering of securities. A PPM serves as a single, comprehensive document outlining the material details about the offering.

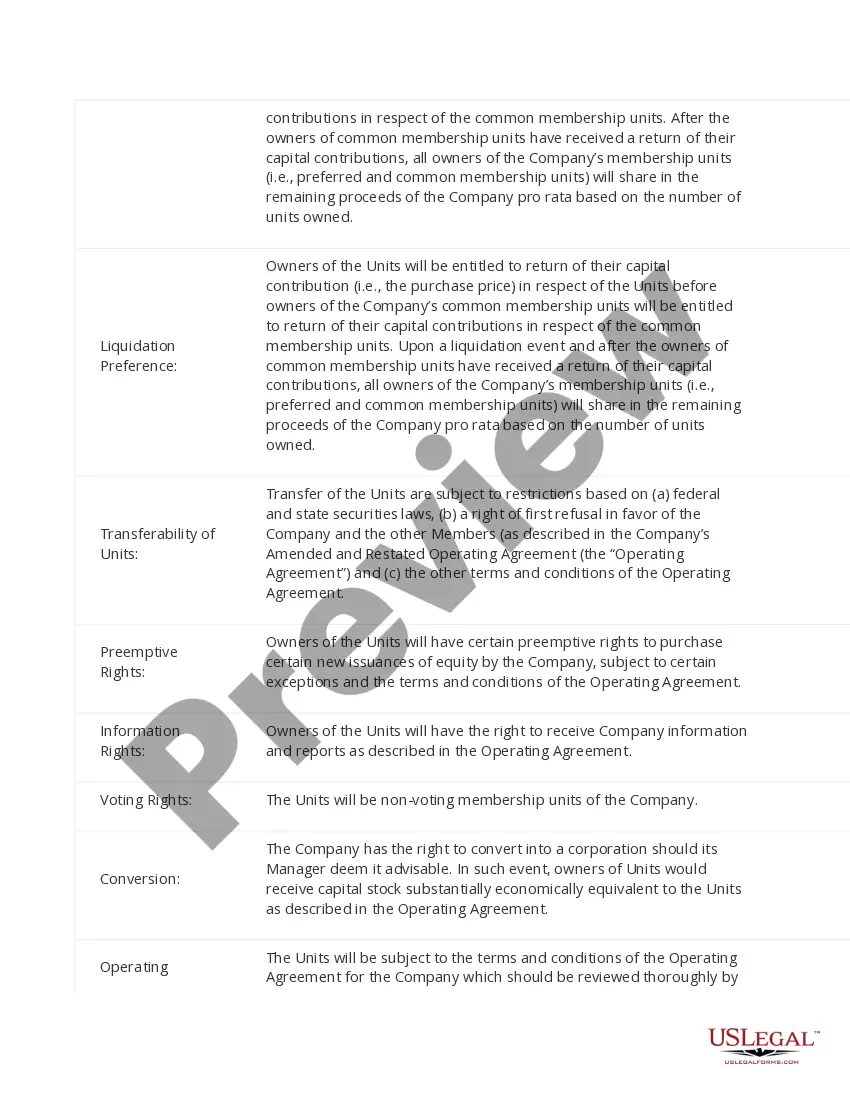

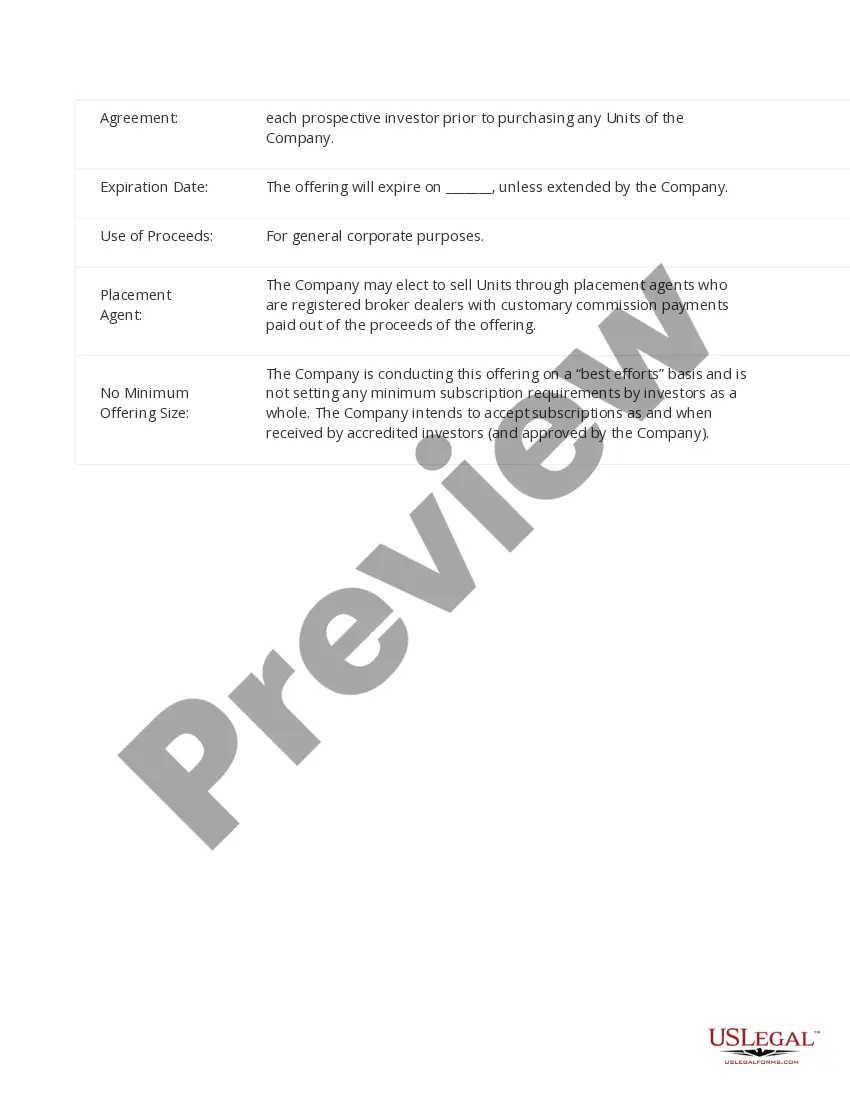

Hear this out loud PauseTypically PPMs contain: a complete description of the security offered for sale, the terms of the sales, and fees; capital structure and historical financial statements; a description of the business; summary biographies of the management team; and the numerous risk factors associated with the investment.

??? ????????? ??????? ?? ? ?????? ?? ??? ????????? ???? ?????????? ??? ??? ??? ?????? ??? ????? ???????? ???????. ??? ????????? ??????? ?????? ?? ??????? ?? ?????? ?????????.

Hear this out loud PauseExecutive Summary An overarching goal in this section of the private placement is to give investors an overview of the transaction, the high level structure of the investment and details on the market and opportunities.

A private placement is a security that's sold to an investor. Some common examples of private placements include: Real Estate Investment Trusts (REITs) Non-Traded REITs.