Georgia LLC Agreement - Open Source

Description

How to fill out LLC Agreement - Open Source?

It is possible to invest hours on the Internet attempting to find the authorized file format that meets the state and federal requirements you will need. US Legal Forms gives 1000s of authorized forms that are analyzed by pros. You can easily download or produce the Georgia LLC Agreement - Open Source from your assistance.

If you already possess a US Legal Forms accounts, you can log in and click the Obtain button. Following that, you can complete, modify, produce, or indication the Georgia LLC Agreement - Open Source. Every authorized file format you acquire is the one you have for a long time. To have another version of any obtained form, check out the My Forms tab and click the corresponding button.

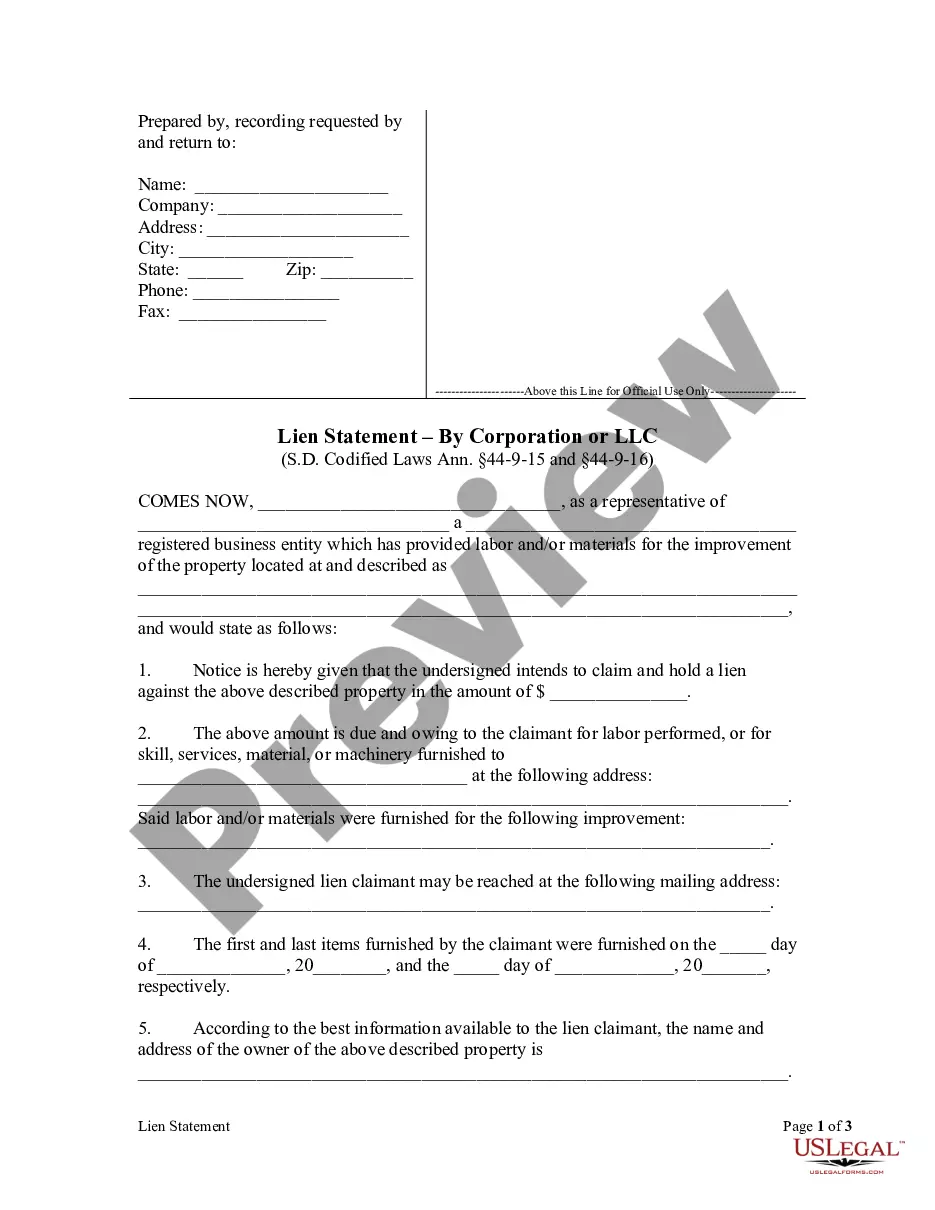

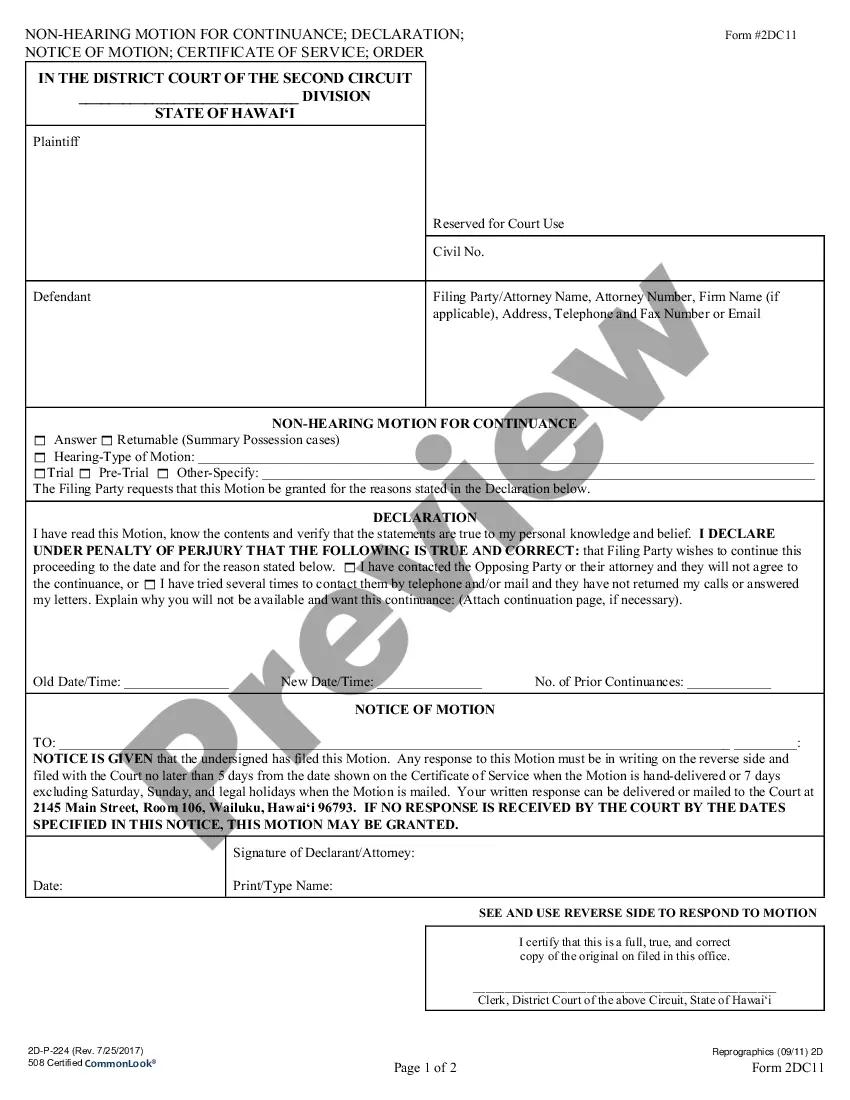

If you work with the US Legal Forms website initially, keep to the straightforward instructions beneath:

- First, ensure that you have selected the best file format for your region/town that you pick. Read the form description to make sure you have chosen the appropriate form. If available, make use of the Preview button to search from the file format as well.

- In order to get another edition of your form, make use of the Research industry to find the format that suits you and requirements.

- When you have identified the format you want, click Get now to carry on.

- Choose the rates prepare you want, type in your accreditations, and sign up for your account on US Legal Forms.

- Complete the transaction. You may use your credit card or PayPal accounts to cover the authorized form.

- Choose the formatting of your file and download it for your device.

- Make changes for your file if possible. It is possible to complete, modify and indication and produce Georgia LLC Agreement - Open Source.

Obtain and produce 1000s of file web templates making use of the US Legal Forms site, that provides the largest collection of authorized forms. Use professional and status-certain web templates to take on your small business or personal demands.

Form popularity

FAQ

The corporate Georgia LLC tax rate is six percent of Georgia taxable income. It is payable by the LLC if C corporation status is elected, and by the members if S corporation status is elected. The net worth tax is also assessed, if the net worth of the LLC is more than $100,000.

Disadvantages Georgia LLCs taxed as corporations must pay an annual corporate tax and net worth tax. Georgia payroll taxes are relatively high compared to other states for LLCs with employees. LLCs require more paperwork than a sole proprietorship or general partnership.

Yes, Georgia allows you to be your own registered agent as long as you live in the state. If you operate a multi-member LLC, you can also choose one of the member's to act as the agent. The state also allows a family member or friend to act as the registered agent.

All Georgia businesses need a business license issued by the city or county where their main office is. Contact your locality for specific forms, fees and requirements.

Georgia LLC Cost. The primary cost to start an LLC in Georgia is the state registration fee of $100 ($110 for in person or mailed filings). This won't be your only expense. That's why it is important to know what you're getting yourself into when starting your LLC in Georgia.

Georgia does not require any LLC to have an Operating Agreement. This applies to single-member and multi-member LLCs. You can still create your own for use in your company, however.

Processing Time: Visit the Secretary of State's online services page. Create a user account. Select ?Submit Paper Filing Online." Select "Domestic Business Formation - Limited Liability Company." Fill out the required information about your business entity and upload the required documents in the designated section.

Georgia Business License and Permit Requirements Before you start doing business, you must secure the necessary state, federal or local business licenses and permits to operate your LLC. Some of the fees will only need to be paid once, while others may be ongoing charges.