Georgia Qualified Investor Certification and Waiver of Claims

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status, take Investor statements regarding information, and waiver of claims.

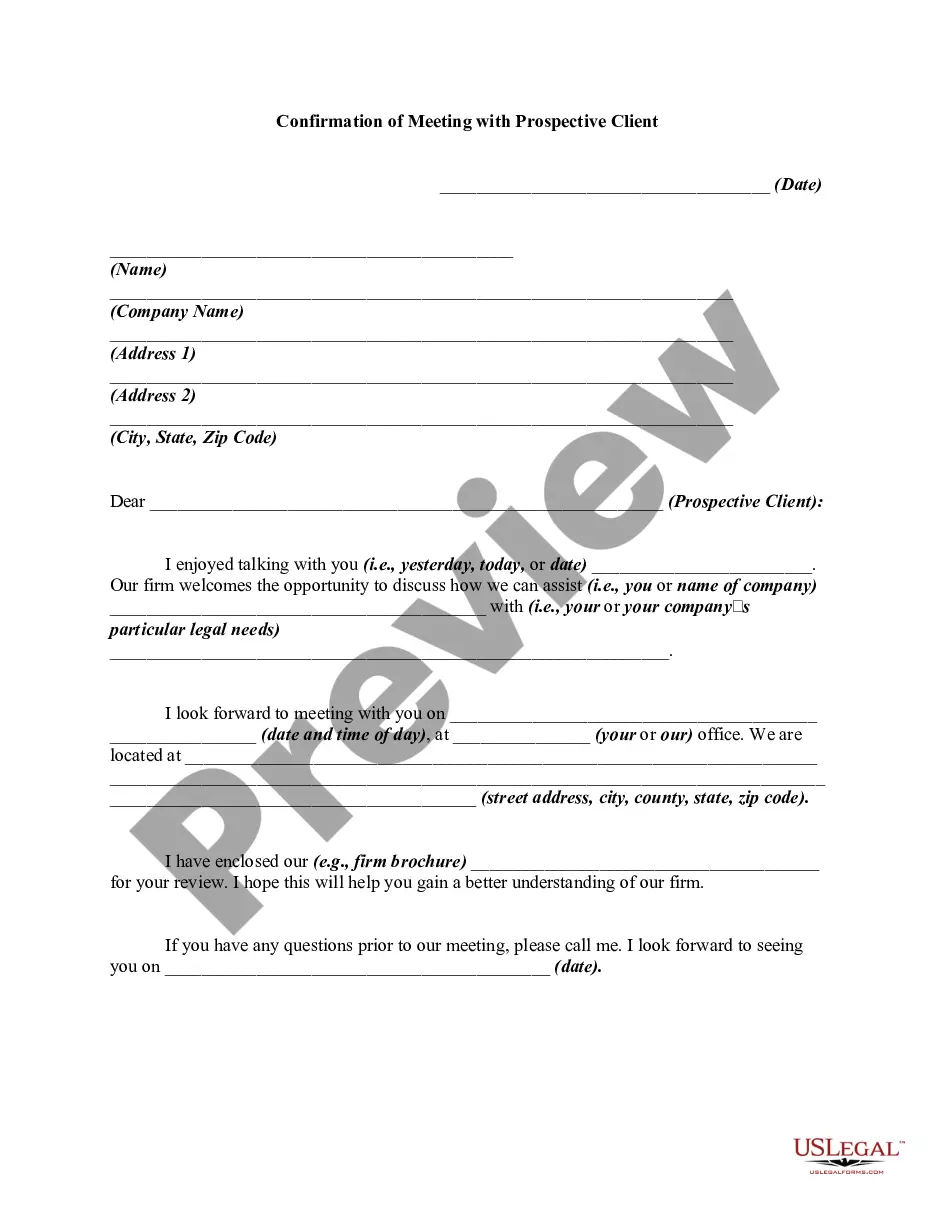

How to fill out Qualified Investor Certification And Waiver Of Claims?

Are you inside a placement where you will need documents for either business or specific reasons just about every day time? There are tons of legal file web templates available on the Internet, but discovering ones you can depend on is not simple. US Legal Forms provides a huge number of develop web templates, like the Georgia Qualified Investor Certification and Waiver of Claims, that happen to be created to satisfy federal and state specifications.

If you are currently familiar with US Legal Forms internet site and possess a free account, merely log in. Following that, it is possible to down load the Georgia Qualified Investor Certification and Waiver of Claims design.

Should you not provide an accounts and want to begin to use US Legal Forms, abide by these steps:

- Discover the develop you will need and make sure it is for your appropriate town/region.

- Use the Preview button to check the form.

- Look at the explanation to actually have selected the right develop.

- When the develop is not what you are looking for, take advantage of the Lookup area to discover the develop that suits you and specifications.

- If you obtain the appropriate develop, click Acquire now.

- Pick the rates program you desire, fill out the desired information and facts to generate your account, and buy the transaction making use of your PayPal or charge card.

- Pick a handy paper format and down load your copy.

Find all of the file web templates you might have purchased in the My Forms menus. You can obtain a more copy of Georgia Qualified Investor Certification and Waiver of Claims whenever, if needed. Just click the needed develop to down load or printing the file design.

Use US Legal Forms, probably the most extensive collection of legal types, to save lots of time and steer clear of faults. The support provides skillfully produced legal file web templates that you can use for a variety of reasons. Make a free account on US Legal Forms and initiate making your daily life easier.

Form popularity

FAQ

FEDERAL SCHEDULE L REQUIREMENT Schedule L must be completed on the Georgia copy of the Federal return even if it is not required for Federal purposes.

The depreciation adjustment for Georgia may be different if the taxpayer is subject to the passive loss rules and is not able to claim the additional bonus depreciation on the federal return. Georgia follows the I. RC. Section 461(l) loss limitation.

An addition to federal taxable income is required for the amount of any federal depreciation deduction, excluding amounts deducted under IRC Sec. 179, before the depreciation deduction is computed for Georgia purposes.

On April 26, 2022, Georgia Governor Brian Kemp signed into law HB 1437, which replaces the current graduated personal income tax with a flat rate of 5.49% effective January 1, 2024, with gradual reductions each year until the flat rate reaches 4.99%, effective January 1, 2029.

The Qualified Investor Tax Credit, also known as the ?Angel Investor Tax Credit,? became available to Georgia taxpayers in 2011. This law provides for a Georgia tax credit of up to $50,000 annually for investors of early-stage, startup companies in Georgia.

Schedule L is only used by taxpayers who are increasing their standard deduction by reporting state or local real estate taxes, taxes from the purchase of a new motor vehicle, or from a net disaster loss reported on Form 4684.

Mailing Address - Corporate/Partnership Income Tax Corporate/Partnership Income Tax FormsMailing Address600 and 600-T (refunds and payments)Georgia Dept. of Revenue PO Box 740397 Atlanta, GA 30374-0397600S (refunds and payments)Georgia Dept. of Revenue PO Box 740391 Atlanta, GA 30374-03917 more rows

Form 700 Partnership Tax Return applies to: Businesses are required to file a Georgia Income Tax Return Form 700 if your business is required to file a Federal Income Tax Form 1065 and your business: Owns property or does business in Georgia. Has income from Georgia sources; or. Has members domiciled in Georgia.