Georgia Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock

Description

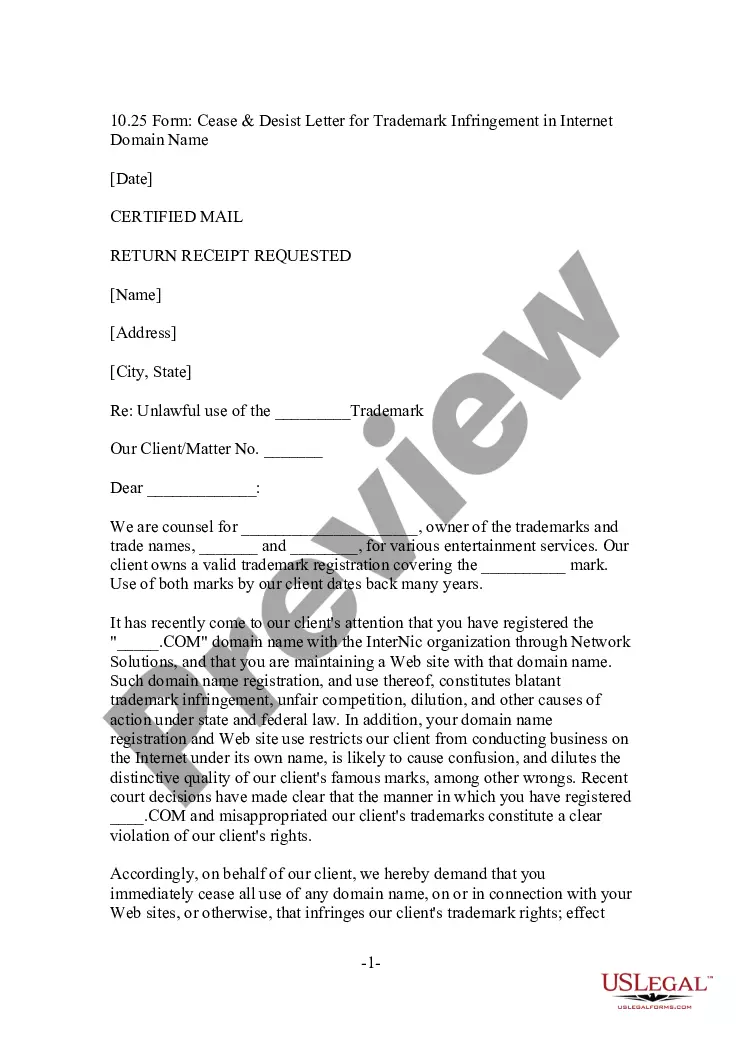

How to fill out Notice And Proxy Statement To Effect A 2-for-1 Split Of Outstanding Common Stock?

If you have to complete, acquire, or printing authorized papers web templates, use US Legal Forms, the most important variety of authorized varieties, that can be found on the Internet. Take advantage of the site`s basic and handy lookup to get the files you want. Different web templates for enterprise and individual functions are categorized by classes and claims, or key phrases. Use US Legal Forms to get the Georgia Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock in just a few click throughs.

Should you be previously a US Legal Forms buyer, log in to your account and click on the Download option to find the Georgia Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock. You may also gain access to varieties you formerly downloaded from the My Forms tab of your account.

Should you use US Legal Forms the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the shape for that right city/country.

- Step 2. Take advantage of the Review option to look over the form`s content. Don`t overlook to read through the explanation.

- Step 3. Should you be unsatisfied with the kind, make use of the Lookup field towards the top of the screen to get other variations in the authorized kind format.

- Step 4. Once you have discovered the shape you want, click the Purchase now option. Pick the costs plan you favor and include your references to sign up for an account.

- Step 5. Procedure the deal. You may use your charge card or PayPal account to complete the deal.

- Step 6. Select the formatting in the authorized kind and acquire it in your gadget.

- Step 7. Comprehensive, modify and printing or indication the Georgia Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock.

Every single authorized papers format you get is your own for a long time. You have acces to each and every kind you downloaded within your acccount. Click the My Forms portion and select a kind to printing or acquire yet again.

Contend and acquire, and printing the Georgia Notice and Proxy Statement to effect a 2-for-1 split of outstanding common stock with US Legal Forms. There are many specialist and express-particular varieties you can use for your personal enterprise or individual requirements.

Form popularity

FAQ

When a company completes a reverse stock split, each outstanding share of the company is converted into a fraction of a share. For example, if a company declares a one for ten reverse stock split, every ten shares that you own will be converted into a single share.

In some reverse stock splits, small shareholders are "cashed out" (receiving a proportionate amount of cash in lieu of partial shares) so that they no longer own the company's shares. Investors may lose money as a result of fluctuations in trading prices following reverse stock splits.

A reverse stock split may be used to reduce the number of shareholders. If a company completes a reverse split in which 1 new share is issued for every 100 old shares, any investor holding fewer than 100 shares would simply receive a cash payment.

Or, in a 3-for-2 split, the company would give you three shares with a market-adjusted worth of about $66.67 in exchange for two existing $100 shares, leaving you with 15 shares. While you now have more shares than you started with, the total value of those shares is the same as it was before the split: $1,000.

The most common split ratios are 2-for-1 or 3-for-1 (sometimes denoted as or ). This means for every share held before the split, each stockholder will have two or three shares, respectively, after the split.

Here's how a reverse split works: Say a company announces a 2 reverse split. Once approved, investors will receive one share for every 200 shares they own.

One way is to buy shares of the company before the reverse split occurs with the plan to sell them soon afterwards. This can be profitable if the company's stock price increases after the split. Another way to make money from a reverse stock split is to short sell the stock of the company.

One of the few and arguably best trades in the market, is to short a stock that is going through a reverse stock split ? it will go invariably back down. This is because the stock performed so horribly, that the board of directors had to sit down and create a new facelift for the company.