Georgia Savings Plan for Employees

Description

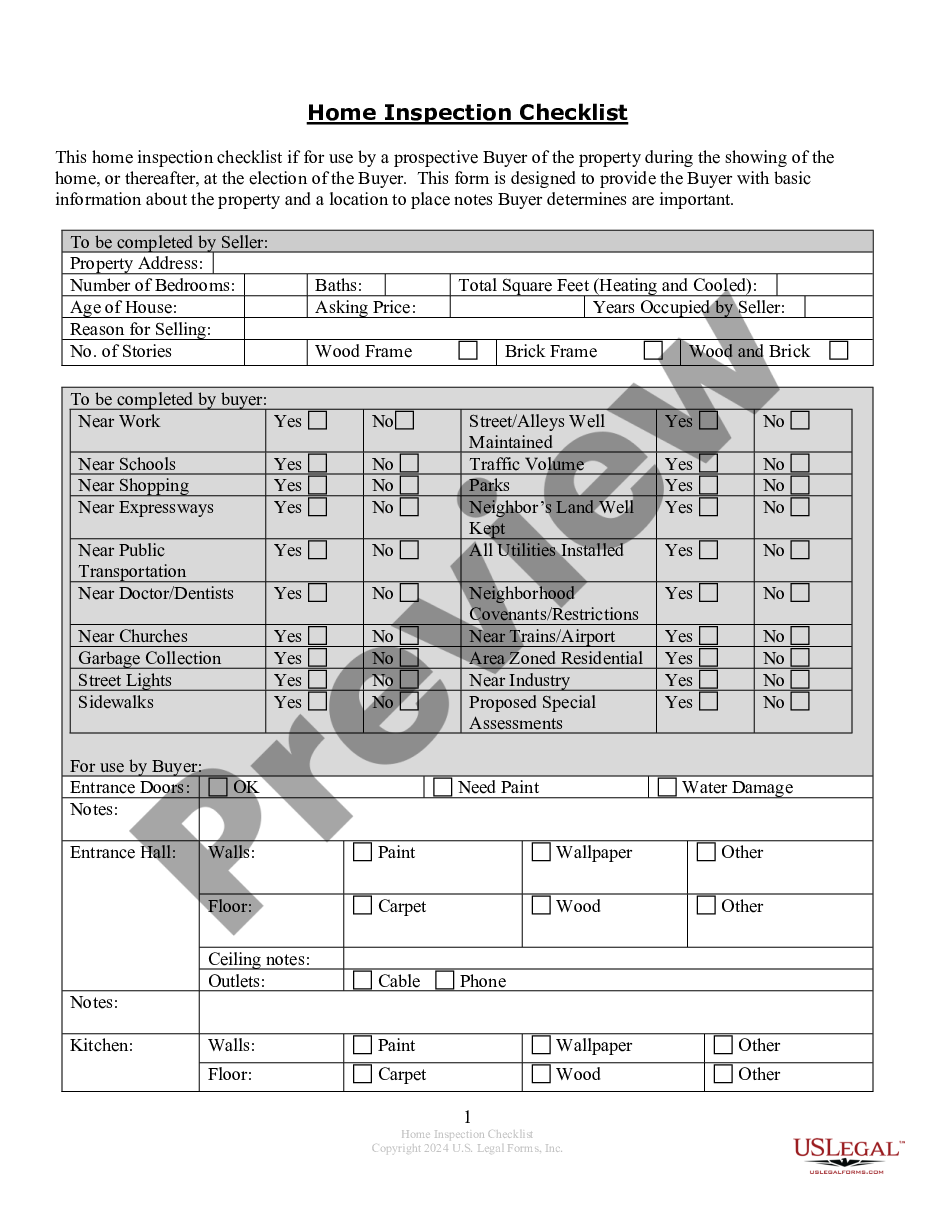

How to fill out Savings Plan For Employees?

Choosing the best legitimate document template can be quite a have difficulties. Obviously, there are plenty of templates available on the net, but how would you obtain the legitimate form you will need? Use the US Legal Forms site. The service delivers 1000s of templates, such as the Georgia Savings Plan for Employees, that you can use for company and private requires. All of the types are checked out by professionals and satisfy state and federal demands.

When you are currently authorized, log in to the profile and then click the Download switch to have the Georgia Savings Plan for Employees. Utilize your profile to appear from the legitimate types you possess purchased previously. Check out the My Forms tab of your respective profile and have yet another copy in the document you will need.

When you are a whole new end user of US Legal Forms, here are straightforward recommendations so that you can comply with:

- First, be sure you have selected the appropriate form for your personal city/state. You may look through the form while using Review switch and read the form description to ensure this is the best for you.

- When the form will not satisfy your preferences, make use of the Seach area to obtain the right form.

- Once you are certain the form would work, select the Get now switch to have the form.

- Opt for the pricing plan you desire and enter in the necessary info. Build your profile and pay money for an order utilizing your PayPal profile or charge card.

- Opt for the submit file format and down load the legitimate document template to the device.

- Full, change and produce and sign the attained Georgia Savings Plan for Employees.

US Legal Forms may be the biggest local library of legitimate types where you can discover numerous document templates. Use the service to down load expertly-manufactured papers that comply with state demands.

Form popularity

FAQ

A 401(k) Plan is a defined contribution plan that is a cash or deferred arrangement. Employees can elect to defer receiving a portion of their salary which is instead contributed on their behalf, before taxes, to the 401(k) plan. Sometimes the employer may match these contributions.

Vesting is 10 years minimum creditable service. *Average of the highest 24 consecutive calendar months of salary while a member of the retirement system.

The TRS Plan is a defined benefit pension plan. Your retirement benefit is based upon on a predetermined formula, using your length of service and average monthly salary based on your highest 24 months of earnings.

You are eligible to receive benefits upon reaching age 60. Once you reach 30 years of service or age 60, you are eligible for an immediate benefit without penalties.

This typically means that if you leave the job in five years or less, you lose all pension benefits. But if you leave after five years, you get 100% of your promised benefits. Graded vesting. With this kind of vesting, at a minimum you're entitled to 20% of your benefit if you leave after three years.

You become vested (retain ownership of every dollar contributed to your TRS account, even if you leave USG) after 10 years of service. Vesting is calculated using your length of service and average monthly salary (based on the highest 24 months). Sick leave credit can be added to your years of service upon retirement.

The Georgia State Employees' Pension and Savings Plan (GSEPS) combines a traditional pension plan with a 401(k) plan that includes an employer match. The 401(k) plan offers flexibility and ?portability? and the pension plan rewards state career longevity.

A 401(k) plan allows employees and employers to contribute to a tax-deferred retirement account. However, a defined benefit plan promises employees a specified benefit at retirement and places the risk of providing the benefit on the employer.