Georgia Directors Stock Appreciation Rights Plan of American Annuity Group, Inc.

Description

How to fill out Directors Stock Appreciation Rights Plan Of American Annuity Group, Inc.?

It is possible to devote several hours on the Internet trying to find the authorized file format that fits the federal and state specifications you need. US Legal Forms offers a huge number of authorized types that are reviewed by specialists. You can easily acquire or print the Georgia Directors Stock Appreciation Rights Plan of American Annuity Group, Inc. from our assistance.

If you currently have a US Legal Forms account, you are able to log in and click on the Download option. After that, you are able to full, modify, print, or sign the Georgia Directors Stock Appreciation Rights Plan of American Annuity Group, Inc.. Each authorized file format you acquire is yours eternally. To acquire another duplicate of any purchased kind, proceed to the My Forms tab and click on the related option.

If you use the US Legal Forms web site the first time, keep to the straightforward recommendations beneath:

- Initially, be sure that you have chosen the correct file format for your area/metropolis of your choosing. See the kind description to make sure you have selected the appropriate kind. If offered, take advantage of the Preview option to appear throughout the file format too.

- If you want to discover another variation in the kind, take advantage of the Look for discipline to get the format that meets your requirements and specifications.

- After you have located the format you want, click Buy now to move forward.

- Pick the rates plan you want, enter your accreditations, and register for a free account on US Legal Forms.

- Complete the deal. You may use your charge card or PayPal account to cover the authorized kind.

- Pick the file format in the file and acquire it to your product.

- Make adjustments to your file if possible. It is possible to full, modify and sign and print Georgia Directors Stock Appreciation Rights Plan of American Annuity Group, Inc..

Download and print a huge number of file layouts while using US Legal Forms web site, which provides the greatest selection of authorized types. Use professional and condition-certain layouts to take on your company or person requirements.

Form popularity

FAQ

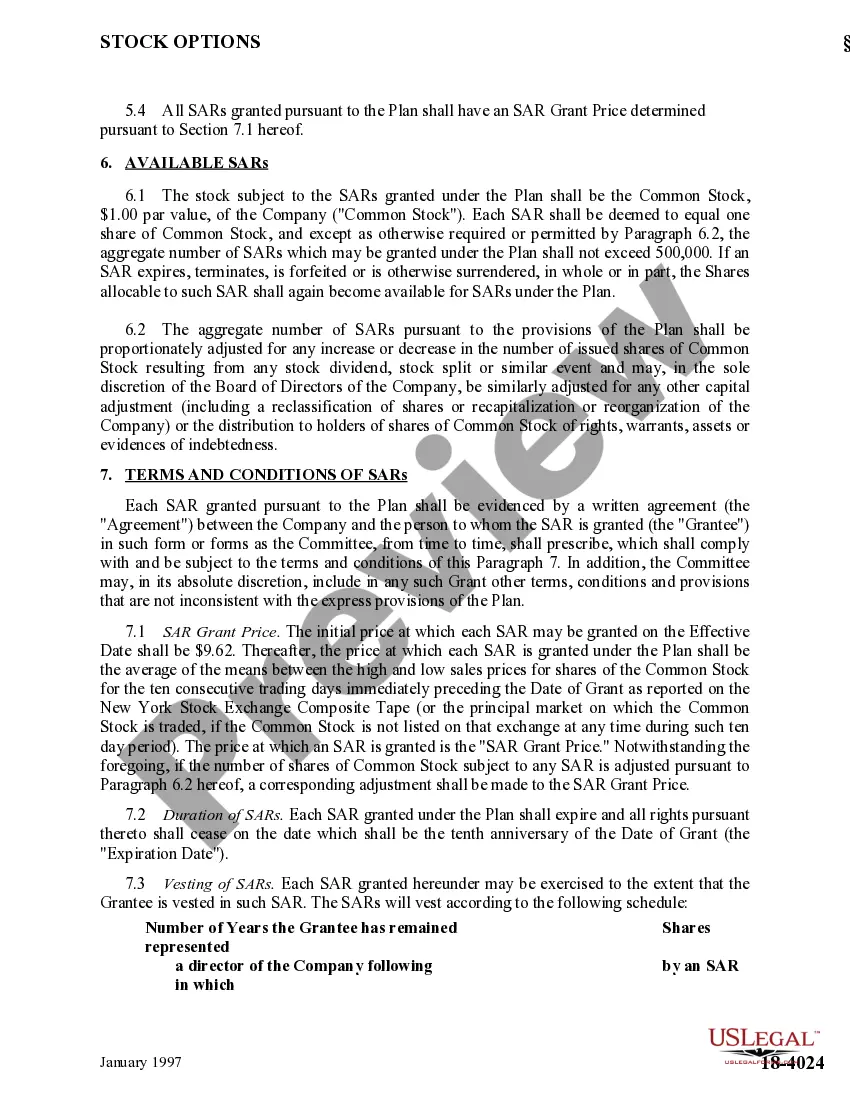

A SAR is very similar to a stock option, but with a key difference. When a stock option is exercised, an employee has to pay the grant price and acquire the underlying security. However, when a SAR is exercised, the employee does not have to pay to acquire the underlying security.

However, when a stock appreciation right is exercised, the employee does not have to pay to acquire the underlying security. Instead, the employee receives the appreciation in value of the underlying security, which would equal the current market value less the grant price.

Stock Appreciation Right (SAR) entitles an employee, who is a shareholder in a company, to a cash payment proportionate to the appreciation of stock traded on a public exchange market. SAR programs provide companies with the flexibility to structure the compensation scheme in a way that suits their beneficiaries.

A ?Stock Appreciation Right? is the right to receive a payment from the Company in an amount equal to the ?Spread,? which is defined as the excess of the Fair Market Value (as defined in Plan) of one share of common stock, $1.00 par value (the ?Stock?) of the Company at the Exercise Date (as defined below) over a ...

Stock Appreciation Rights plans do not result in equity dilution because actual shares are not being transferred to the employee. Participants do not become owners. Instead, they are potential cash beneficiaries in the appreciation of the underlying company value.

Stock Appreciation Right (SAR) entitles an employee, who is a shareholder in a company, to a cash payment proportionate to the appreciation of stock traded on a public exchange market. SAR programs provide companies with the flexibility to structure the compensation scheme in a way that suits their beneficiaries.