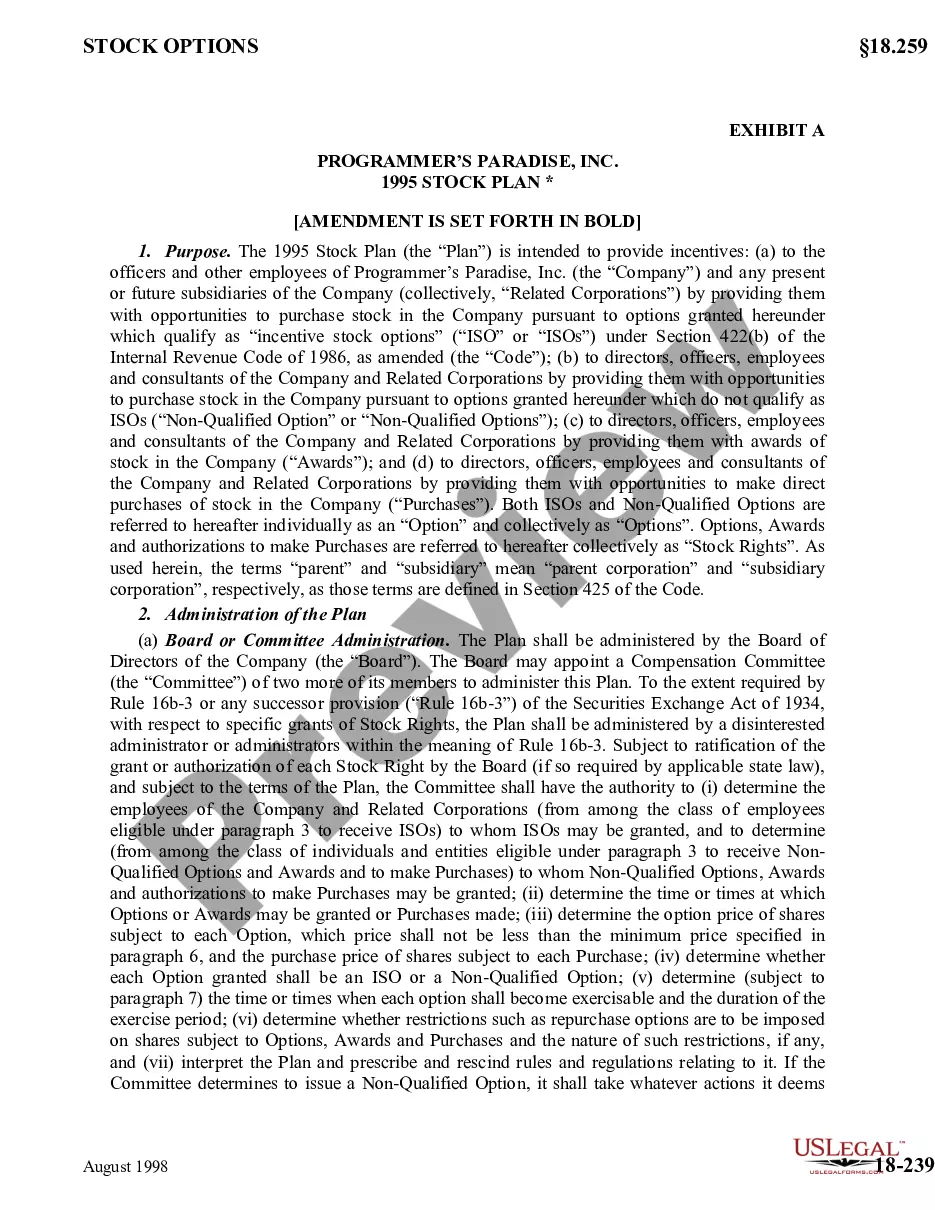

Georgia Director stock program

Description

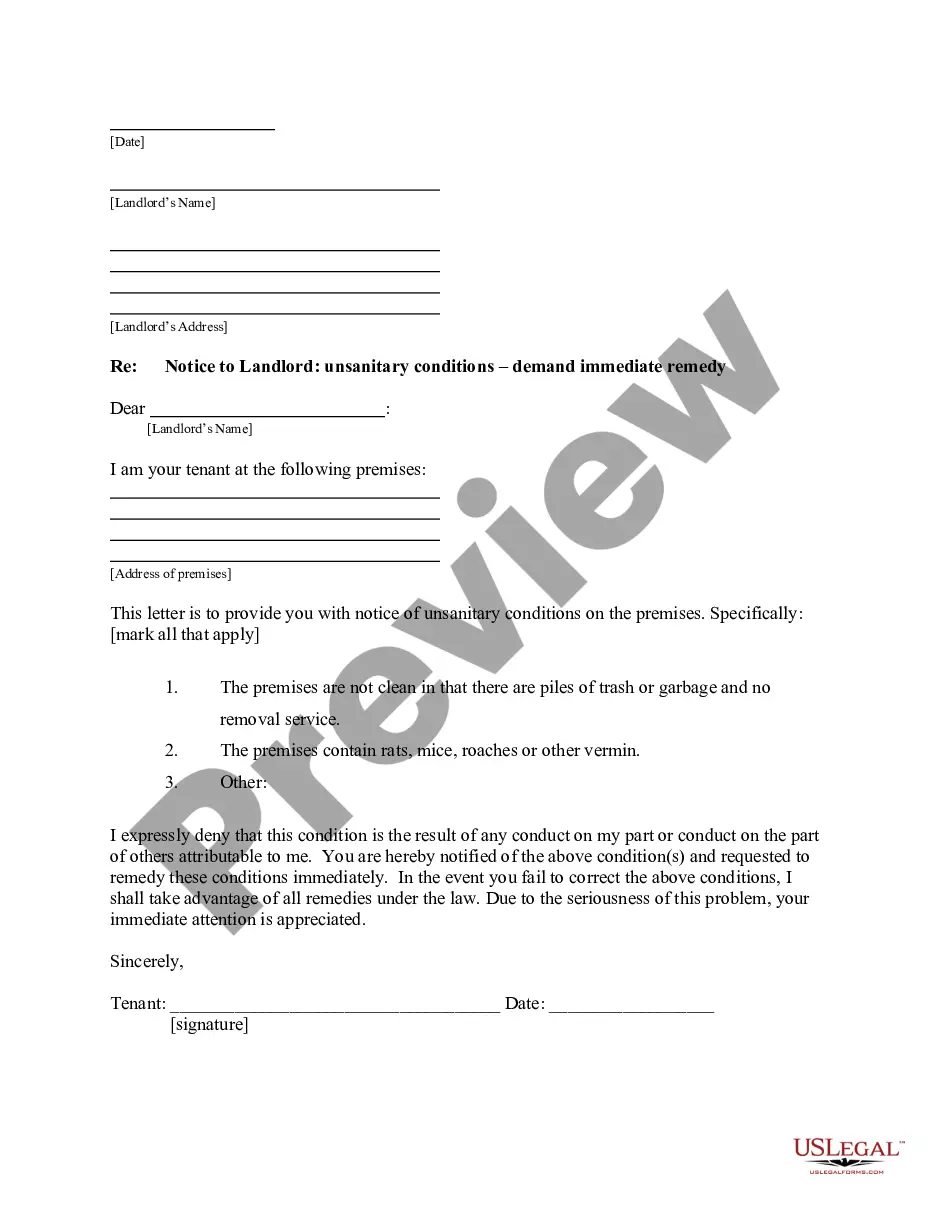

How to fill out Director Stock Program?

Are you presently within a situation where you need files for either organization or personal uses nearly every day? There are plenty of authorized file layouts available on the net, but discovering kinds you can depend on isn`t straightforward. US Legal Forms offers a huge number of form layouts, like the Georgia Director stock program, which can be published to satisfy state and federal specifications.

If you are currently acquainted with US Legal Forms web site and possess a merchant account, simply log in. Afterward, you can download the Georgia Director stock program template.

Should you not have an profile and want to begin to use US Legal Forms, abide by these steps:

- Obtain the form you need and make sure it is to the correct area/area.

- Make use of the Preview button to analyze the form.

- Browse the explanation to actually have selected the proper form.

- In case the form isn`t what you`re looking for, use the Lookup area to discover the form that fits your needs and specifications.

- Once you find the correct form, click on Acquire now.

- Select the costs prepare you desire, fill out the specified details to generate your money, and pay money for the transaction utilizing your PayPal or bank card.

- Pick a handy paper formatting and download your duplicate.

Find all the file layouts you might have bought in the My Forms food selection. You can aquire a additional duplicate of Georgia Director stock program at any time, if necessary. Just click on the needed form to download or produce the file template.

Use US Legal Forms, by far the most comprehensive variety of authorized forms, to save efforts and steer clear of mistakes. The support offers professionally manufactured authorized file layouts that can be used for an array of uses. Create a merchant account on US Legal Forms and begin making your life easier.

Form popularity

FAQ

How to Form an S-Corp in Georgia Appoint a Georgia Registered Agent. Hire the services of a Georgia registered agent with a local address to which all your business correspondence can be delivered. ... Apply for a Tax ID or EIN. ... Fill Out and Submit the S-Election Form.

Georgia LLC Approval Times Mail filings: In total, mail filing approvals for Georgia LLCs take 4-5 weeks. This accounts for the average 15 business day processing time, plus the time your documents are in the mail. Online filings: In total, online filing approvals for Georgia LLCs take 7-10 business days.

To form an S Corp in California, you must file Form 2553 (Election by a Small Business Corporation) with the IRS and then complete additional requirements with the state of California, including filing articles of incorporation, obtaining licenses and permits, and appointing directors.

Filing for S corp election doesn't cost anything at the federal or state level in Georgia. However, if you haven't yet formed an LLC or a corporation, you'll need to pay a filing fee of $100 for an LLC and $100 for a corporation.

Yes, Georgia allows you to be your own registered agent as long as you live in the state. If you operate a multi-member LLC, you can also choose one of the member's to act as the agent. The state also allows a family member or friend to act as the registered agent.

Minimum number. Corporations must have one or more directors. Residence requirements. Georgia does not have a provision specifying where directors must reside.

To form a Georgia S corp, you'll need to ensure your company has a Georgia formal business structure (LLC or corporation), and then you can elect S corp tax designation. If you've already formed an LLC or corporation, file Form 2553 with the Internal Revenue Service (IRS) to designate S corp taxation status.

Corporate Income Tax The rate of taxation is 5.75% of a corporation's Georgia taxable net income. If S Corporation status is recognized for Georgia purposes, the shareholders of the corporation pay the tax as opposed to the corporation paying the tax.