Georgia Nonexempt Employee Time Report

Description

How to fill out Nonexempt Employee Time Report?

Locating the appropriate legal document format can be quite challenging.

Of course, there are numerous templates accessible online, but how can you obtain the specific legal form you require.

Utilize the US Legal Forms website. The service offers a vast array of templates, such as the Georgia Nonexempt Employee Time Report, which you can utilize for both business and personal purposes.

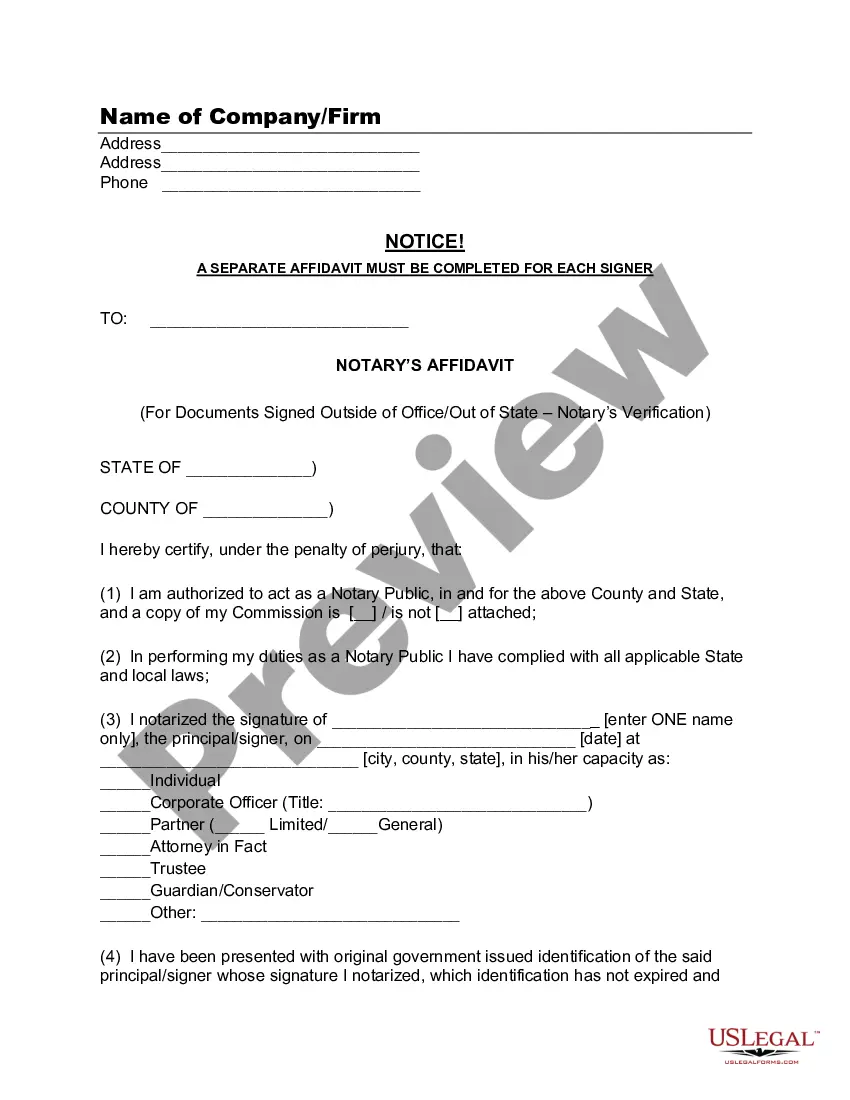

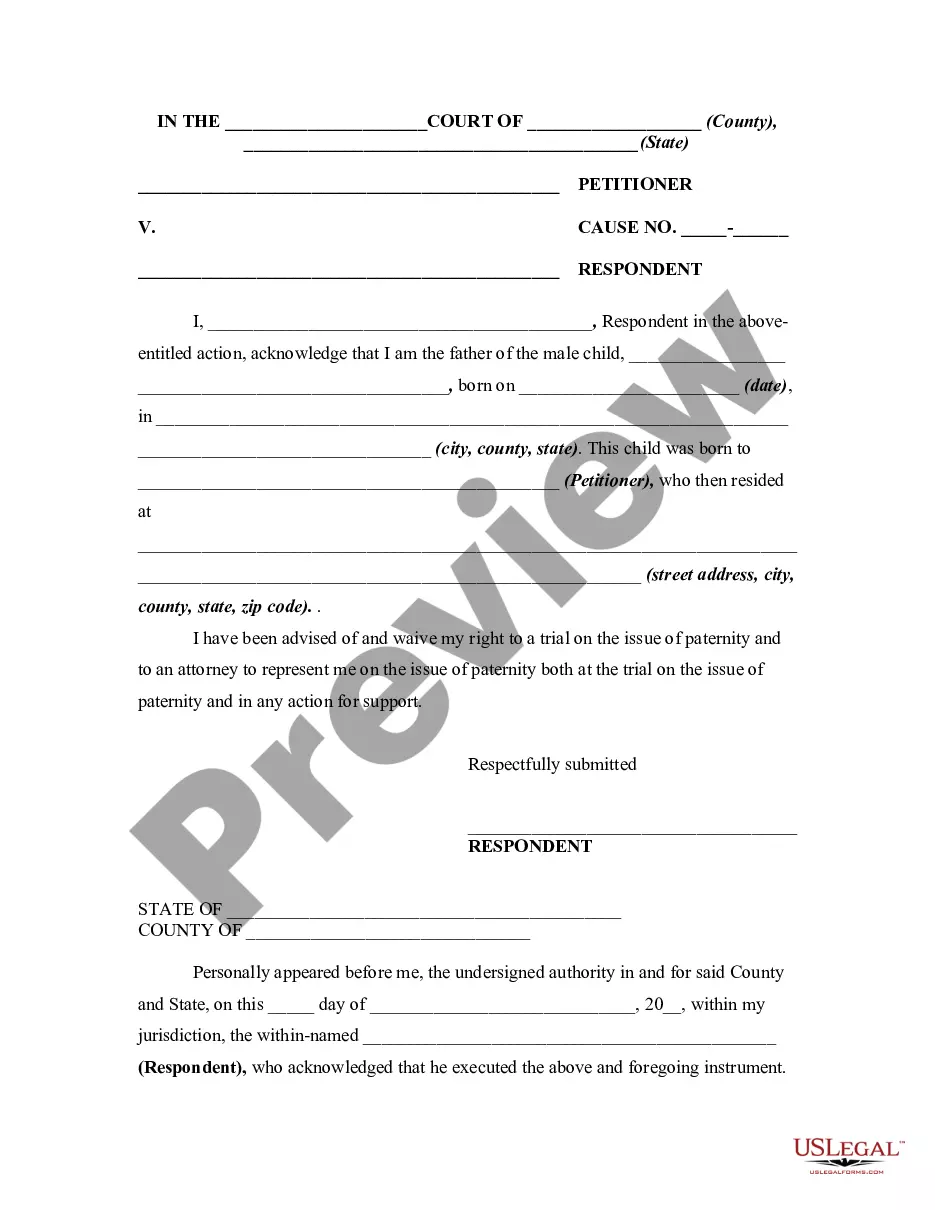

You can preview the form using the Review button and read its description to confirm it is suitable for your needs.

- All documents are vetted by experts and comply with state and federal regulations.

- If you are already a member, Log In to your account and click the Download button to retrieve the Georgia Nonexempt Employee Time Report.

- Use your account to review the legal documents you have previously obtained.

- Navigate to the My documents section of your account to download another copy of the document you require.

- If you are a new user of US Legal Forms, here are straightforward steps for you to follow.

- First, ensure you have selected the correct form for your area.

Form popularity

FAQ

Under federal overtime law and Texas overtime law, salaried employees must receive overtime pay for hours worked over 40 in any workweek unless two specific requirements are met: (1) the salary exceeds $455 per workweek; and (2) the employee performs duties satisfying one of the narrowly-defined FLSA overtime

If you are a non-exempt employee, your employer must pay you at least the federal minimum wage (currently $7.25 per hour in Texas and under federal law) and must pay you overtime pay at a rate of at least one and a half times your hourly pay rate for all hours worked over 40 in each workweek.

Overtime can be voluntary (it may be offered or requested by an employer during very busy periods) or compulsory (it can be guaranteed or non-guaranteed). It will depend on the terms and conditions of the contract whether overtime is: voluntary.

Unless specifically exempted, employees must receive overtime pay for hours worked in excess of 40 in a workweek at a rate of 1 and 1/2 their regular rates of pay.

Employees earning less than $23,600 per year or $455 per week, are nonexempt. Employees who earn more than $100,000 per year are almost certainly exempt under current law, however this is set to go up in 2016 too.

Employees can be required to work overtime, whether paid or unpaid, only if this is provided for in their contract of employment.

Examples of non-exempt employees include contractors, freelancers, interns, servers, retail associates and similar jobs. Even if non-exempt employees earn more than the federal minimum wage, they still take direction from supervisors and do not have administrative or executive positions.

Maximum hours an exempt employee can be required to work The law does not provide a maximum number of hours that an exempt worker can be required to work during a week. This means that an employer could require an exempt employee to work well beyond 40 hours a week without overtime compensation.

Overtime Exemptions in GeorgiaExecutives, administrators, and other professionals earning at least $455 per week do not have to be paid overtime under Section 13(a)(1) of the Fair Labor Standards Act.

Salary level test. Employees who are paid less than $23,600 per year ($455 per week) are nonexempt. (Employees who earn more than $100,000 per year are almost certainly exempt.)