Georgia Separation Notice for Independent Contractor

Description

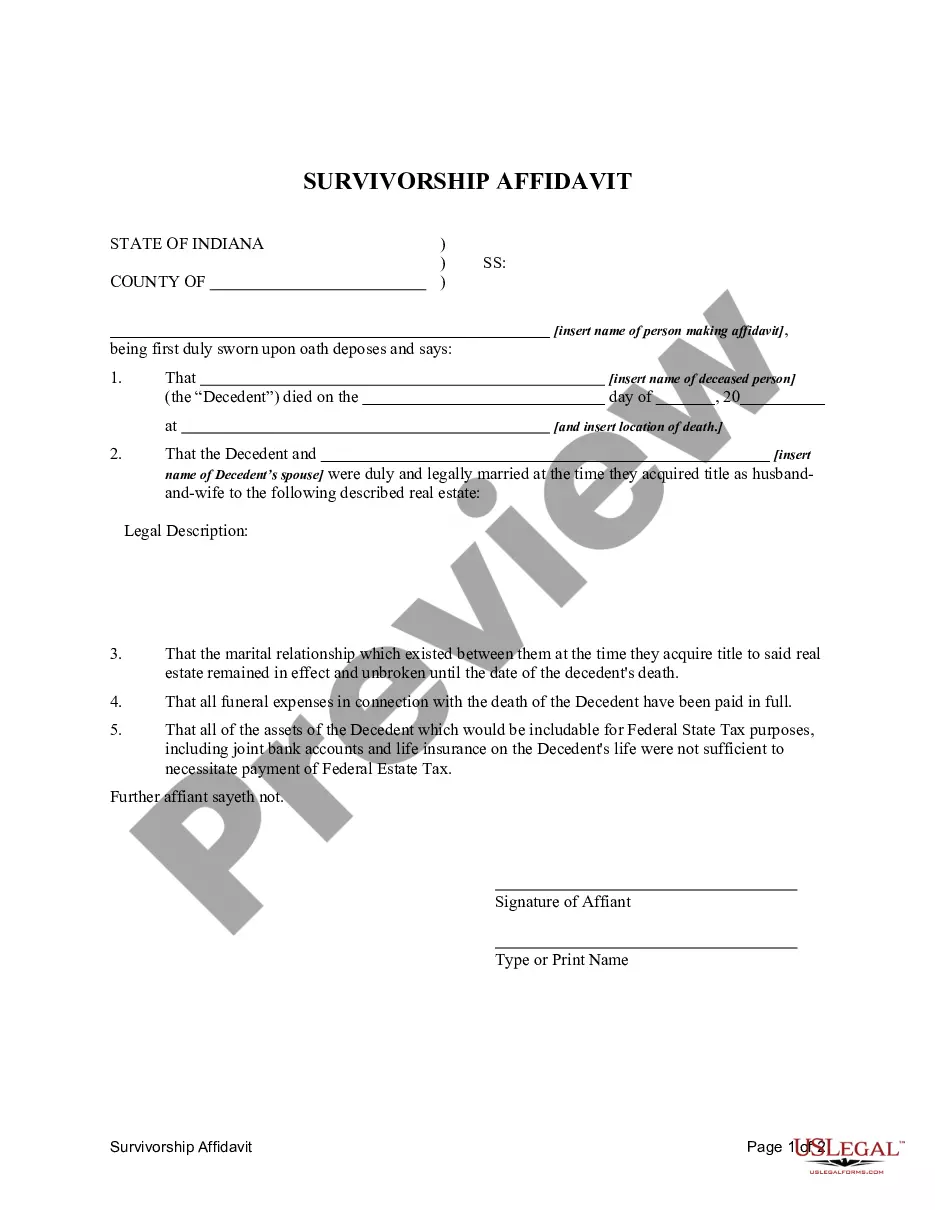

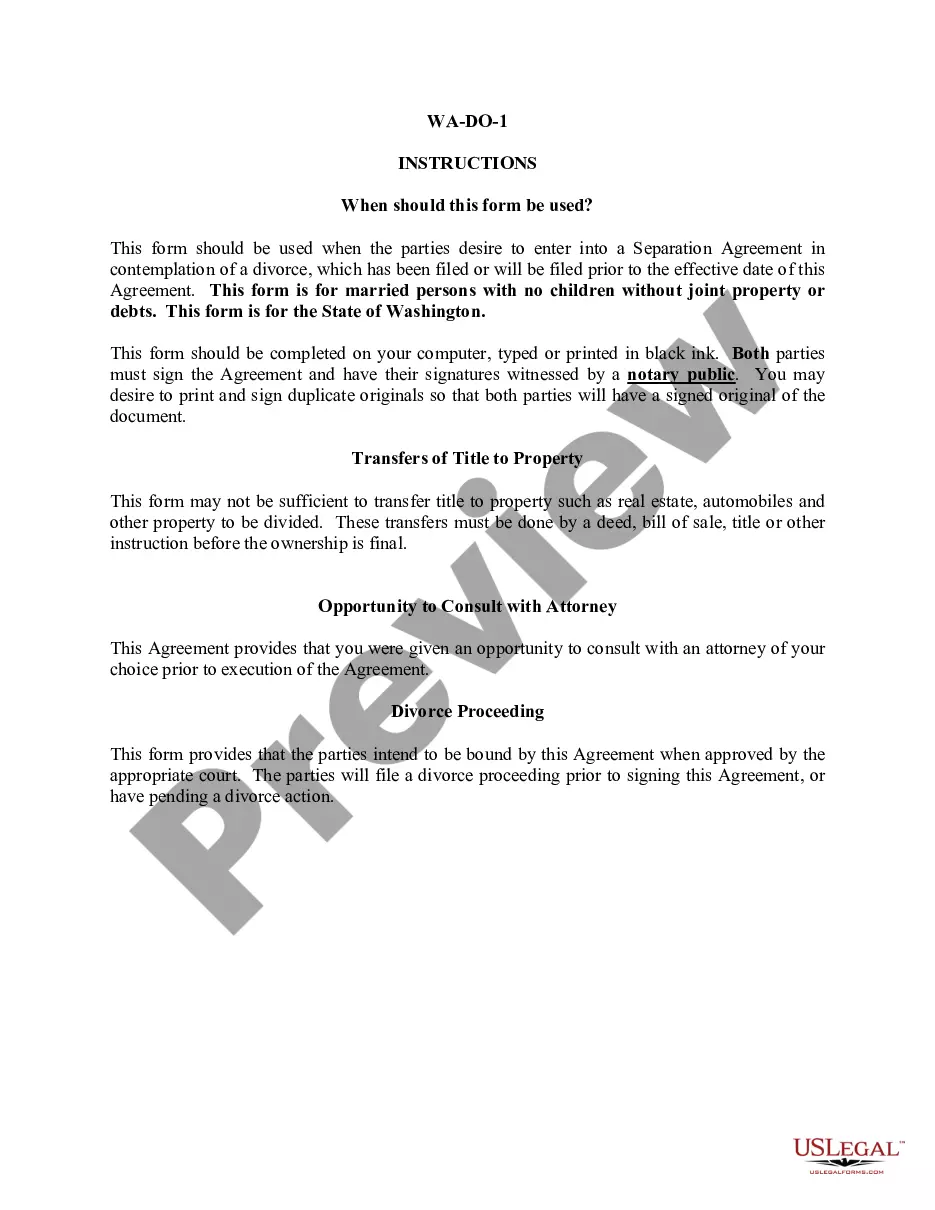

How to fill out Separation Notice For Independent Contractor?

If you want to finalize, acquire, or print legal document templates, utilize US Legal Forms, the largest compilation of legal forms available online.

Take advantage of the site's user-friendly and straightforward search to find the documents you need.

Various templates for business and personal use are organized by categories and states, or keywords.

Step 5. Process the payment; you may use your credit card or PayPal account to complete the transaction.

Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Georgia Separation Notice for Independent Contractor. Each legal document template you purchase is yours indefinitely. You have access to every form you downloaded in your account. Visit the My documents section and select a form to print or download again. Compete and acquire, and print the Georgia Separation Notice for Independent Contractor with US Legal Forms. There are numerous professional and state-specific forms at your disposal for your business or personal needs.

- Use US Legal Forms to locate the Georgia Separation Notice for Independent Contractor in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Acquire button to obtain the Georgia Separation Notice for Independent Contractor.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, refer to the following instructions.

- Step 1. Ensure that you have selected the form appropriate for your city/state.

- Step 2. Utilize the Review option to examine the form's details; do not forget to read the summary.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

- Step 4. After locating the required form, click the Get now button. Choose your preferred pricing plan and provide your information to register for an account.

Form popularity

FAQ

The original Separation Notice should be given to the separating employee on the employee's last working day, and no later than 3 days after separation. For employees who have quit without notice, the form should be mailed to the employee's last known home address.

An employer is not responsible for your unemployment benefits if you are an independent contractor. While employees are always eligible for unemployment benefits if they are laid off, an independent contractor will only be eligible if they pay separately into the state unemployment fund.

In Georgia, when the employment relationship ends, employers are required to provide departing employees with a separation notice. Separation notices must be provided if an employee is fired, laid off, or quits.

A general separation notice is a written communication from an employer or an employee saying that the employment relationship is ending.

Reasons your Georgia unemployment claim might be deniedYou quit your job or you were fired. To collect benefits, you must be laid off or let go through no fault of your own. You are not actively conducting a job search. You are not certifying and claiming your weeks in a timely manner.

NOTICE TO EMPLOYEE OCGA SECTION 34-8-190(c) OF THE EMPLOYMENT SECURITY LAW REQUIRES THAT YOU TAKE THIS NOTICE TO THE GEORGIA DEPARTMENT OF LABOR FIELD SERVICE OFFICE IF YOU FILE A CLAIM FOR UNEMPLOYMENT INSURANCE BENEFITS.

In Georgia, when the employment relationship ends, employers are required to provide departing employees with a separation notice. Separation notices must be provided if an employee is fired, laid off, or quits.

Do independent contractors qualify for unemployment insurance? Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

The American Rescue Plan Act of 2021 was signed into law March 11, 2021 to extend unemployment benefits for the Pandemic Emergency Unemployment Compensation (PEUC), Pandemic Unemployment Assistance (PUA), and Federal Pandemic Unemployment Compensation (FPUC) programs through September 6, 2021.

While employees are always eligible for unemployment benefits if they are laid off, an independent contractor will only be eligible if they pay separately into the state unemployment fund. However, if your status as an independent contractor is questionable, filing for unemployment may be worth a try.