Georgia Daily Accounts Receivable

Description

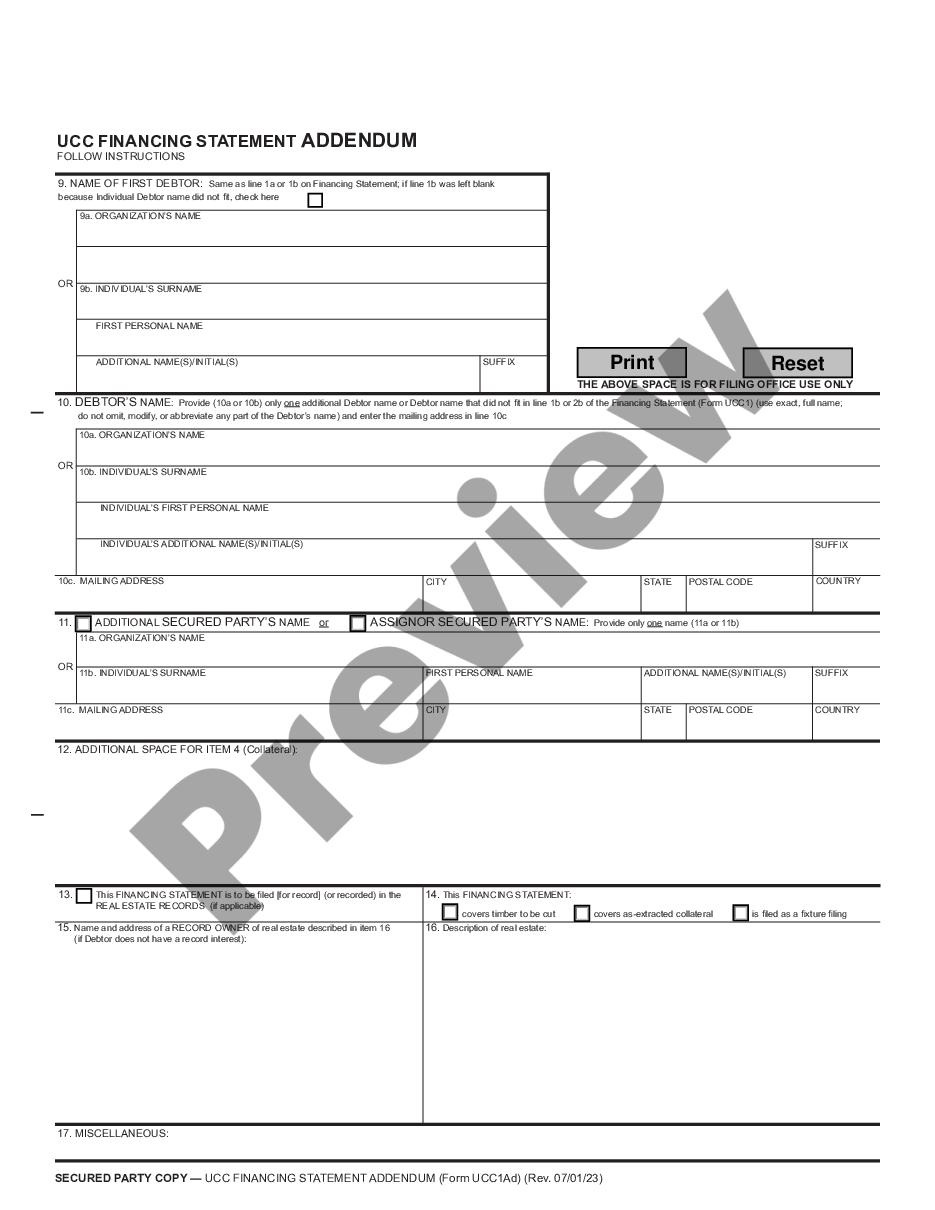

How to fill out Daily Accounts Receivable?

If you aim to aggregate, download, or print official document templates, utilize US Legal Forms, the most extensive collection of legal forms available on the web. Take advantage of the site’s straightforward and convenient search feature to locate the documents you need.

Numerous templates for commercial and personal purposes are organized by categories and titles, or keywords. Use US Legal Forms to access the Georgia Daily Accounts Receivable in just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click the Obtain button to secure the Georgia Daily Accounts Receivable. You can also find forms you previously acquired in the My documents tab of your account.

Every legal document template you obtain is your property indefinitely. You have access to each form you acquired within your account. Click on the My documents section and select a form to print or download again.

Compete, download, and print the Georgia Daily Accounts Receivable with US Legal Forms. There are numerous professional and state-specific templates you can use for your business or personal needs.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Always remember to check the details.

- Step 3. If you are not satisfied with the document, use the Search area at the top of the screen to find alternative versions of the legal form template.

- Step 4. After finding the form you need, click the Acquire now button. Choose the payment plan you prefer and enter your information to register for an account.

- Step 5. Complete the transaction. You can utilize your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Georgia Daily Accounts Receivable.

Form popularity

FAQ

When you receive the payment, record it as "paid" and enter it into your accounts receivables ledger. Make sure your customer records are matched squarely with your financial ledgers. In the accounts receivable world, it's vital to monitor who's paying you and when they're paying you.

Accounts receivable days is the number of days that a customer invoice is outstanding before it is collected.

Account Receivable is an account created by a company to record the journal entry of credit sales of goods and services, for which the amount has not yet been received by the company. The journal entry is passed by making a debit entry in Account Receivable and corresponding credit entry in Sales Account.

On a trial balance, accounts receivable is a debit until the customer pays. Once the customer has paid, you'll credit accounts receivable and debit your cash account, since the money is now in your bank and no longer owed to you. The ending balance of accounts receivable on your trial balance is usually a debit.

On a trial balance, accounts receivable is a debit until the customer pays. Once the customer has paid, you'll credit accounts receivable and debit your cash account, since the money is now in your bank and no longer owed to you. The ending balance of accounts receivable on your trial balance is usually a debit.

What Is the Journal Entry for Accounts Receivable? When a sale of goods or services is made to a customer, you use your accounting software to create an invoice that automatically creates a journal entry to credit the sales account and debit the accounts receivable account.

Accounts receivable days is the number of days that a customer invoice is outstanding before it is collected.

Account receivables are classified as current assets assuming that they are due within one year. To record a journal entry for a sale on account, one must debit a receivable and credit a revenue account. When the customer pays off their accounts, one debits cash and credits the receivable in the journal entry.

The formula for Accounts Receivable Days is: Accounts Receivable Days = (Accounts Receivable / Revenue) x Number of Days In Year.

You can find your accounts receivable balance under the 'current assets' section on your balance sheet or general ledger. Accounts receivable are classified as an asset because they provide value to your company. (In this case, in the form of a future cash payment.)