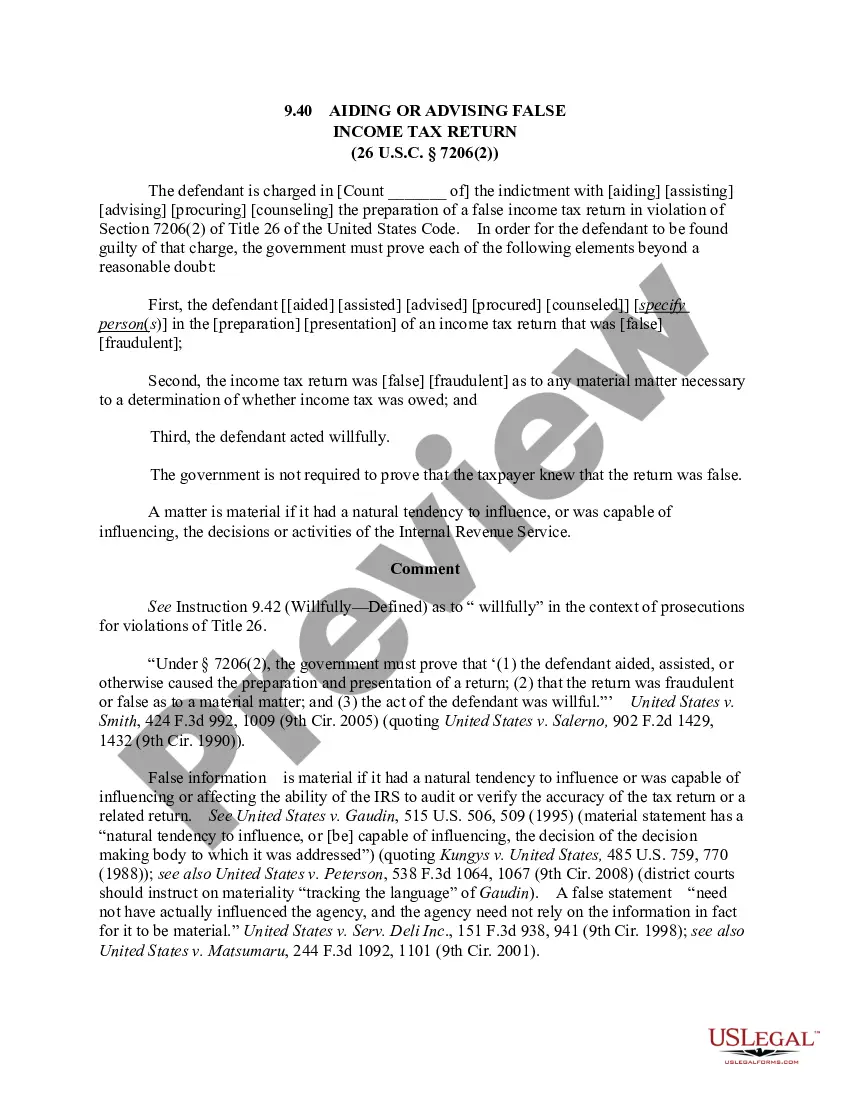

Georgia Jury Instruction - Aiding And Abetting Filing False Return

Description

How to fill out Jury Instruction - Aiding And Abetting Filing False Return?

US Legal Forms - one of many greatest libraries of lawful varieties in America - delivers an array of lawful file themes you may down load or print. While using web site, you may get a huge number of varieties for business and individual reasons, sorted by categories, says, or keywords and phrases.You will discover the most recent types of varieties just like the Georgia Jury Instruction - Aiding And Abetting Filing False Return within minutes.

If you currently have a subscription, log in and down load Georgia Jury Instruction - Aiding And Abetting Filing False Return through the US Legal Forms collection. The Obtain option will appear on each develop you see. You have accessibility to all previously saved varieties inside the My Forms tab of your own account.

If you would like use US Legal Forms the first time, here are straightforward directions to help you started off:

- Be sure to have selected the best develop for the metropolis/area. Select the Preview option to review the form`s content material. See the develop information to ensure that you have selected the right develop.

- In the event the develop does not match your needs, take advantage of the Research industry near the top of the monitor to obtain the the one that does.

- In case you are pleased with the shape, confirm your selection by simply clicking the Get now option. Then, opt for the prices prepare you prefer and supply your references to sign up to have an account.

- Procedure the transaction. Utilize your Visa or Mastercard or PayPal account to finish the transaction.

- Select the format and down load the shape on the device.

- Make changes. Load, modify and print and signal the saved Georgia Jury Instruction - Aiding And Abetting Filing False Return.

Each and every design you put into your bank account lacks an expiry day and it is yours forever. So, if you wish to down load or print an additional version, just go to the My Forms area and click on around the develop you require.

Get access to the Georgia Jury Instruction - Aiding And Abetting Filing False Return with US Legal Forms, the most comprehensive collection of lawful file themes. Use a huge number of professional and state-certain themes that satisfy your small business or individual requirements and needs.

Form popularity

FAQ

The court may instruct the jury before or after the arguments are completed, or at both times.

Penalty for Tax Evasion in California Tax evasion in California is punishable by up to one year in county jail or state prison, as well as fines of up to $20,000. The state can also require you to pay your back taxes, and it will place a lien on your property as a security until you pay.

This means that the prosecution must convince the jury that there is no other reasonable explanation that can come from the evidence presented at trial. In other words, the jury must be virtually certain of the defendant's guilt in order to render a guilty verdict.

While the IRS does not pursue criminal tax evasion cases for many people, the penalty for those who are caught is harsh. They must repay the taxes with an expensive fraud penalty and possibly face jail time of up to five years.

If you cannot afford to pay your taxes, the IRS will not send you to jail. However, you can face jail time if you commit tax evasion or fraud. The tax attorneys at The W Tax Group can help you navigate the tax code. If you're having trouble with the IRS, contact us today.

(August 2023) In fiscal year 2022, there were 401 tax fraud offenders sentenced under the guidelines. The number of tax fraud offenders has decreased by 22.4% since fiscal year 2018.

Judge's Instructions on the Law This is the judge's instruction to the jury. You have to apply that law to the facts, as you have heard them, in arriving at your verdict. You must consider all of the instructions and give them equal consideration.

That's something to keep in mind when you're wondering what is the penalty for tax evasion. For fraud and tax evasion, the tax law dictates that if you're convicted, you may be fined up to $100,000 and sent to jail for up to five years.