Georgia Loan Agreement for Employees

Description

How to fill out Loan Agreement For Employees?

Discovering the right authorized record design can be quite a battle. Needless to say, there are tons of themes accessible on the Internet, but how will you get the authorized form you need? Make use of the US Legal Forms site. The services delivers 1000s of themes, such as the Georgia Loan Agreement for Employees, which you can use for business and personal needs. All the types are checked by experts and meet up with state and federal specifications.

When you are already listed, log in to the profile and click the Obtain button to get the Georgia Loan Agreement for Employees. Utilize your profile to check throughout the authorized types you possess purchased in the past. Go to the My Forms tab of your respective profile and get an additional version from the record you need.

When you are a whole new customer of US Legal Forms, listed below are basic guidelines that you should stick to:

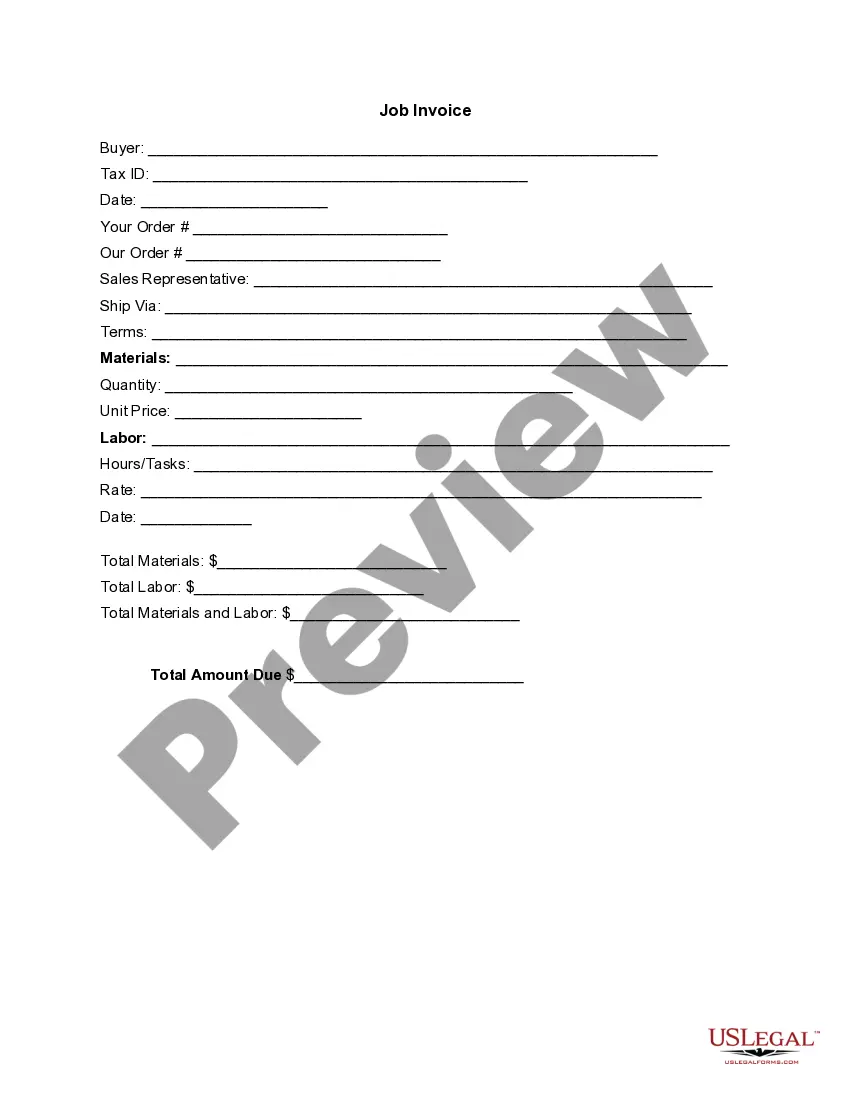

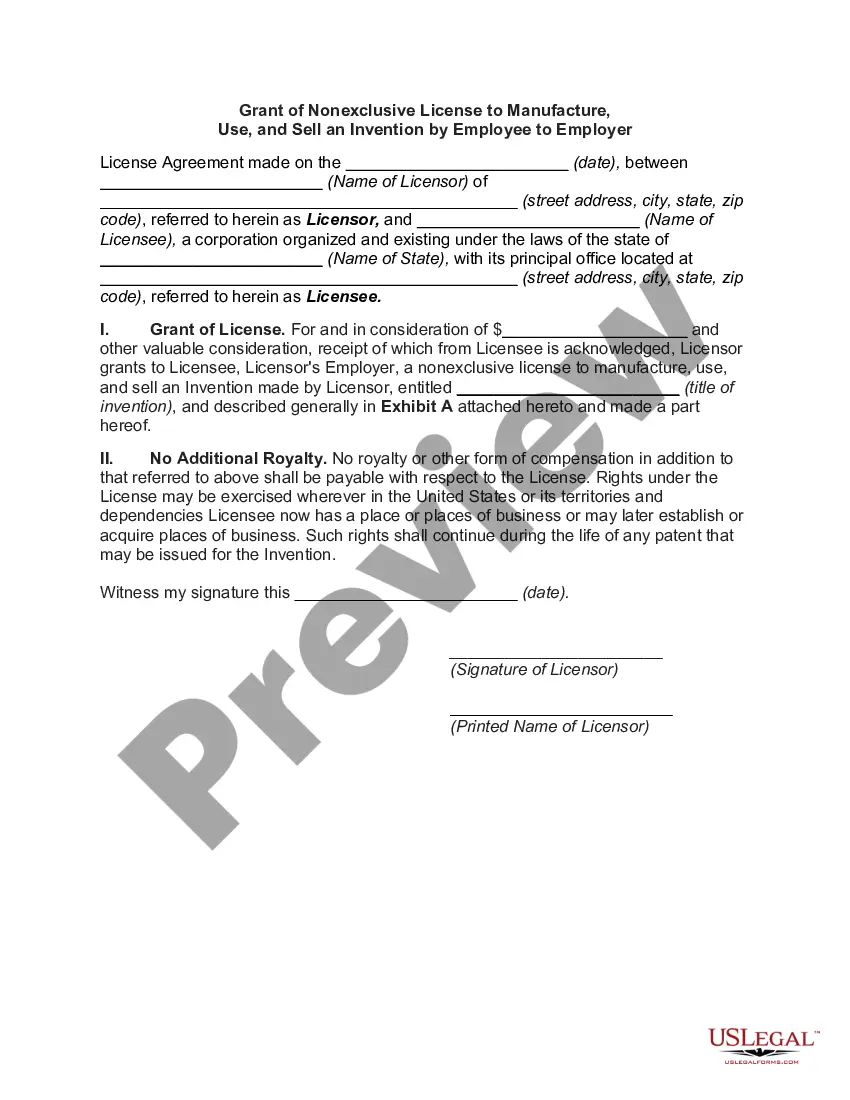

- Very first, ensure you have selected the appropriate form for your town/state. It is possible to check out the shape making use of the Preview button and browse the shape description to make sure this is basically the best for you.

- If the form does not meet up with your requirements, make use of the Seach area to find the right form.

- When you are certain that the shape is acceptable, click on the Purchase now button to get the form.

- Choose the rates prepare you need and enter the required info. Design your profile and buy the order with your PayPal profile or credit card.

- Choose the file file format and obtain the authorized record design to the gadget.

- Comprehensive, revise and print out and indication the received Georgia Loan Agreement for Employees.

US Legal Forms is definitely the most significant library of authorized types that you will find different record themes. Make use of the service to obtain appropriately-made paperwork that stick to express specifications.

Form popularity

FAQ

Categorizing loan agreements by type of facility usually results in two primary categories: term loans, which are repaid in set installments over the term, or. revolving loans (or overdrafts) where up to a maximum amount can be withdrawn at any time, and interest is paid from month to month on the drawn amount.

Loan agreements are binding contracts between two or more parties to formalize a loan process. There are many types of loan agreements, ranging from simple promissory notes between friends and family members to more detailed contracts like mortgages, auto loans, credit card and short- or long-term payday advance loans.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

A Loan Agreement is a legal contract regulating the terms and conditions of a loan, and can be used by both individuals and corporations to lend or borrow money. Shareholders can also draft a Loan Agreement to borrow money from a corporation.

An employee loan agreement is a contract that creates the framework of a loan borrowed by an employee from the company they work for.

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

You can write up a personal loan agreement by hand, with pen and paper, or draft it on your computer. Once the document looks good, it can be printed out and signed by both parties.