Georgia Articles of Association of Unincorporated Charitable Association

Description

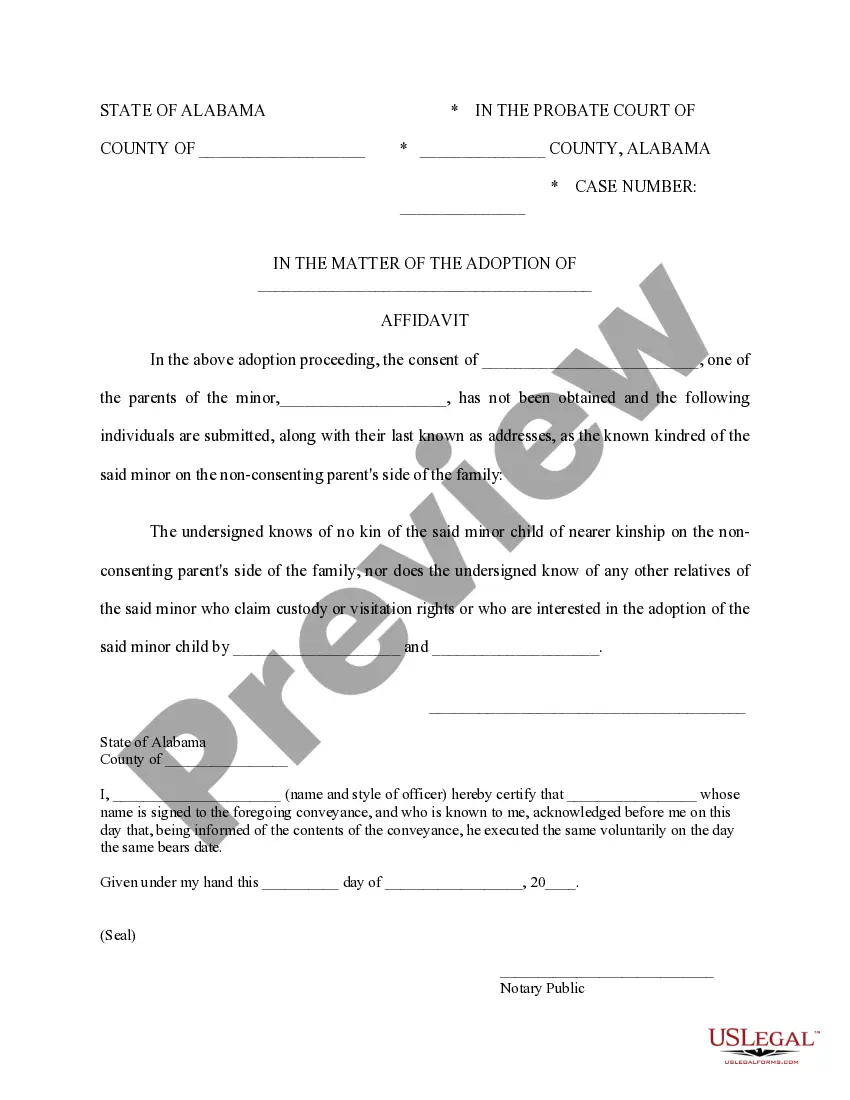

How to fill out Articles Of Association Of Unincorporated Charitable Association?

If you need to acquire comprehensive, download, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the website’s straightforward and convenient search feature to locate the documents you require.

Various templates for both business and personal applications are organized by categories and states, or keywords.

Step 4. Once you find the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to find the Georgia Articles of Association of Unincorporated Charitable Association in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and select the Download button to obtain the Georgia Articles of Association of Unincorporated Charitable Association.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Verify that you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form’s articles. Remember to read the summary.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find other types of the legal document template.

Form popularity

FAQ

The Articles of Association for a non-profit organization outline the organization's purpose, structure, and rules for operation. This document serves as a crucial framework for your charitable goals and ensures compliance with state regulations. When creating your Georgia Articles of Association of Unincorporated Charitable Association, it’s essential to include key provisions to safeguard your mission. Using US Legal Forms can assist you in drafting these articles accurately and efficiently.

The time to obtain Articles of Incorporation in Georgia can vary. Typically, the process takes about 15 to 20 business days when filed online. However, if you choose to send your application via mail, it may take longer. To expedite this process, consider using resources like US Legal Forms, which can help you streamline your filing for the Georgia Articles of Association of Unincorporated Charitable Association.

In Georgia, a nonprofit organization must have at least three board members to meet state requirements. These board members must be individuals and should not be related to maintain independence. Having the proper structure in your Georgia Articles of Association of Unincorporated Charitable Association ensures good governance and compliance with state laws.

Articles of Incorporation in Georgia are legal documents that formally establish a nonprofit organization. They outline the organization’s purpose, governance structure, and key operational details. By filing these articles, you create your Georgia Articles of Association of Unincorporated Charitable Association, which is necessary for compliance and recognition as a legal entity.

The Articles of Incorporation typically contain essential information such as the organization’s name, purpose, board of directors, and details regarding registered agents. You may also include provisions for asset distribution and management structures. These components are vital for your Georgia Articles of Association of Unincorporated Charitable Association, as they outline how your organization will function.

In your Articles of Incorporation, you must include the name of the organization, the purpose of the organization, and the addresses of the initial board members. Additionally, you need to indicate whether the nonprofit will have members. Ensuring these details in your Georgia Articles of Association of Unincorporated Charitable Association is essential for compliance with state laws.

The Articles of Incorporation in Georgia must include the organization's name, purpose, registered agent, and the names and addresses of the initial board members. Additionally, you must detail any provisions regarding the management of the organization. Including these elements ensures that your Georgia Articles of Association of Unincorporated Charitable Association meets state requirements.

Yes, a 501(c)(3) organization does need Articles of Incorporation to operate legally. These articles serve as the foundational document that defines the organization’s purpose and structure. When filing for tax-exempt status, the Georgia Articles of Association of Unincorporated Charitable Association must be submitted along with IRS forms to demonstrate compliance with state laws.

The basic governing document that must be filed in the state of Georgia is the Articles of Incorporation. This document establishes your organization as a legal entity and outlines its purpose, structure, and governance. The Georgia Articles of Association of Unincorporated Charitable Association provide a foundation for managing your charitable activities effectively.

Nonprofits can qualify for tax-exempt status in Georgia, but they must meet specific criteria and apply for it. If your organization has a Georgia Articles of Association of Unincorporated Charitable Association, you may be eligible to enjoy several tax benefits. Understanding the application process is vital to ensure compliance with both state and federal regulations. Consult the IRS guidelines and state resources to navigate your tax-exempt status effectively.