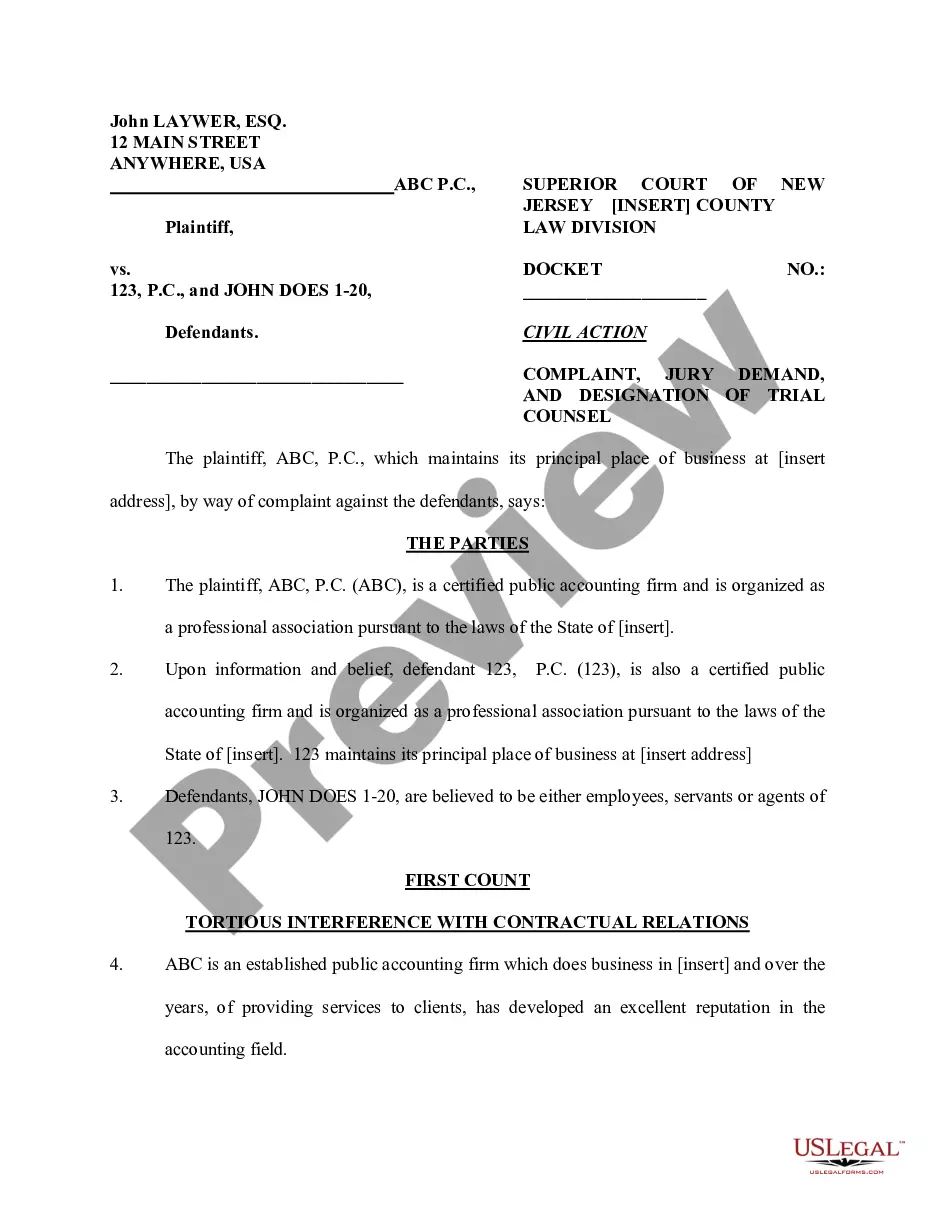

Georgia Collection Report

Description

How to fill out Collection Report?

Are you in the location where you need documents for business or personal usage nearly every day.

There is a multitude of legal document templates available online, but locating reliable ones can be challenging.

US Legal Forms offers thousands of form templates, including the Georgia Collection Report, designed to meet state and federal requirements.

Once you find the appropriate form, click on Purchase now.

Choose the pricing plan you prefer, fill in the necessary information to create your account, and complete the purchase using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Georgia Collection Report template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct state/region.

- Use the Review button to examine the form.

- Check the description to ensure you have selected the right form.

- If the form isn’t what you seek, utilize the Lookup box to find the form that meets your needs.

Form popularity

FAQ

When it comes to debt, the statute of limitations on credit card debt in Georgia is four years. After four years you can no longer be sued for the debt, legally, in a court of law.

In Georgia, a creditor can garnish the lesser of 25% of your disposable income or the amount by which your disposable earnings exceed 30% of federal minimum wage. If your disposable income is less than 30 times minimum wage, it cannot be garnished at all.

In Georgia, you will not go to prison or be held criminally liable for owing money. This is true provided that the debt is not the result of some criminal scheme or owed as restitution for injuries or damages caused by a crime for which you are convicted.

How long can a creditor chase a debt for? The standard time frame for a creditor to recover an unsecured debt is six years. This is known as the limitation period.

State and federal law protects some money, including wages, from garnishment even if it is in a bank. Some common exemptions are benefits from social security, supplemental security income, unemployment, workers' compensation, the Veterans' Administration, state pension, retirement funds, and disability income.

You can quickly and legally stop creditors from garnishing your earnings by filing for bankruptcy. As soon as you file a petition for Chapter 7 or Chapter 13 bankruptcy, the court will order your creditors to immediately stop all collection activities.

In Georgia, the statute of limitations on credit card debt is generally six years. After six years of non-payment on the debt, it becomes time-barred, meaning a collector or creditor cannot sue you to collect the debt.

To find out what you have in collections, you will need to check your latest credit reports from each of the 3 credit bureaus. Collection agencies are not required to report their account information to all three of the national credit reporting agencies.

Under the FDCPA, you have the right to sue a debt collector in state or federal court within one year from the date of the violation.

Unpaid credit card debt is not forgiven after 7 years, however. You could still be sued for unpaid credit card debt after 7 years, and you may or may not be able to use the age of the debt as a winning defense, depending on the state's statute of limitations. In most states, it's between 3 and 10 years.