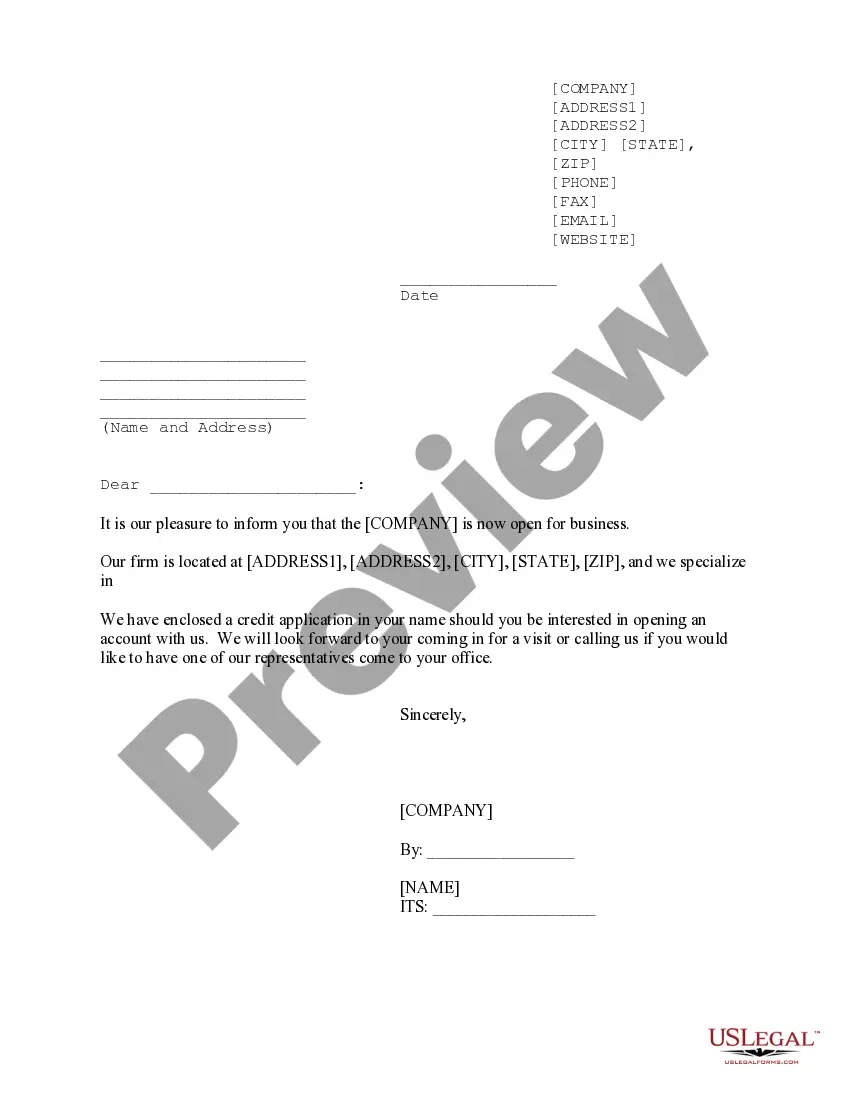

Georgia Sample Letter for New Business with Credit Application

Description

How to fill out Sample Letter For New Business With Credit Application?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords.

You can obtain the latest templates such as the Georgia Sample Letter for New Business with Credit Application in a matter of minutes.

Review the form information to ensure you have selected the appropriate form.

If the form doesn't meet your needs, use the Search field at the top of the display to find the one that fits.

- If you have a monthly subscription, Log In and download the Georgia Sample Letter for New Business with Credit Application from the US Legal Forms library.

- The Download button will appear on every form you see.

- You have access to all previously downloaded forms from the My documents tab in your account.

- To use US Legal Forms for the first time, follow these simple steps to get started.

- Ensure you have chosen the correct form for your location/region.

- Click the Preview button to review the content of the form.

Form popularity

FAQ

Filling a letter of credit application form requires providing detailed information, such as the applicant's personal and business information, terms of credit, and required supporting documentation. Accuracy is vital to facilitate smooth processing. Using a Georgia Sample Letter for New Business with Credit Application can simplify this process and ensure you don’t miss any important details.

To write a credit application letter, start by clearly stating your business name, the amount of credit you are requesting, and outlining your business operations. Include relevant financial information and an assurance of timely repayment. A Georgia Sample Letter for New Business with Credit Application can provide structure and clarity for your application.

Establishing business credit for the first time involves opening a business credit account and ensuring timely payments on all financial obligations. It is beneficial to build a solid credit history by using credit responsibly. A Georgia Sample Letter for New Business with Credit Application can also enhance your credibility with lenders.

An example of a letter of credit could include a document that states the amount to be covered, the terms of payment, and identification of the buyer and seller. This example serves as a valuable reference for new businesses to craft their own. For further assistance, refer to a Georgia Sample Letter for New Business with Credit Application.

Filling out a letter of credit involves providing essential information such as the buyer's details, payment terms, and necessary financial documentation. It is important to ensure accuracy to avoid delays and complications. Utilizing a Georgia Sample Letter for New Business with Credit Application can guide you through the required steps.

A letter of credit for a new business is a document that serves as a guarantee from a bank or financial institution, providing assurance that a business will fulfill its payment obligations. This can be crucial for new ventures that need to build trust with suppliers and investors. For more clarity, consider using a Georgia Sample Letter for New Business with Credit Application as a guide.

You do not need an LLC to start a small business in Georgia; however, forming an LLC offers benefits such as limited liability protection and potential tax advantages. Using resources like the Georgia Sample Letter for New Business with Credit Application can help you establish a formal structure for obtaining business credit whether you decide on an LLC or another business form. Ultimately, the choice between forming an LLC or another structure should align with your business goals.

To successfully start a small business, you need a clear business idea, a comprehensive business plan, and adequate financing. It's also important to have essential documents organized, such as the Georgia Sample Letter for New Business with Credit Application, which can assist in managing your business’s credit. Building a network and seeking support can also contribute greatly to your business's success.

To register your business in Georgia, visit the Georgia Secretary of State's website and complete the necessary forms. You may also need to submit the Georgia Sample Letter for New Business with Credit Application if opening business credit accounts. Ensuring you have all your documentation in order will make this process smoother and faster.

Starting a small business in Georgia requires several key steps. You must choose your business structure, register with the Georgia Secretary of State, and obtain any permits your business may need. Don’t forget the importance of the Georgia Sample Letter for New Business with Credit Application, as it can be a vital tool in establishing credit relationships early on.