Georgia Notice of Returned Check

Description

How to fill out Notice Of Returned Check?

US Legal Forms - one of the most notable collections of legal documents in the USA - provides a vast selection of legal template formats that you can download or create.

By using the website, you will obtain countless forms for business and personal purposes, organized by categories, states, or keywords.

You can access the latest versions of forms such as the Georgia Notice of Returned Check within moments.

If the form does not meet your requirements, utilize the Lookup field at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your selection by clicking on the Purchase now option. Then, select the payment plan you prefer and provide your details to register for an account.

- If you have an account, Log In and download the Georgia Notice of Returned Check from the US Legal Forms library.

- The Download option will appear on each form you view.

- You can access all previously saved forms in the My documents section of your account.

- If this is your first time using US Legal Forms, here are simple steps to get started.

- Ensure you have selected the correct form for your area/region.

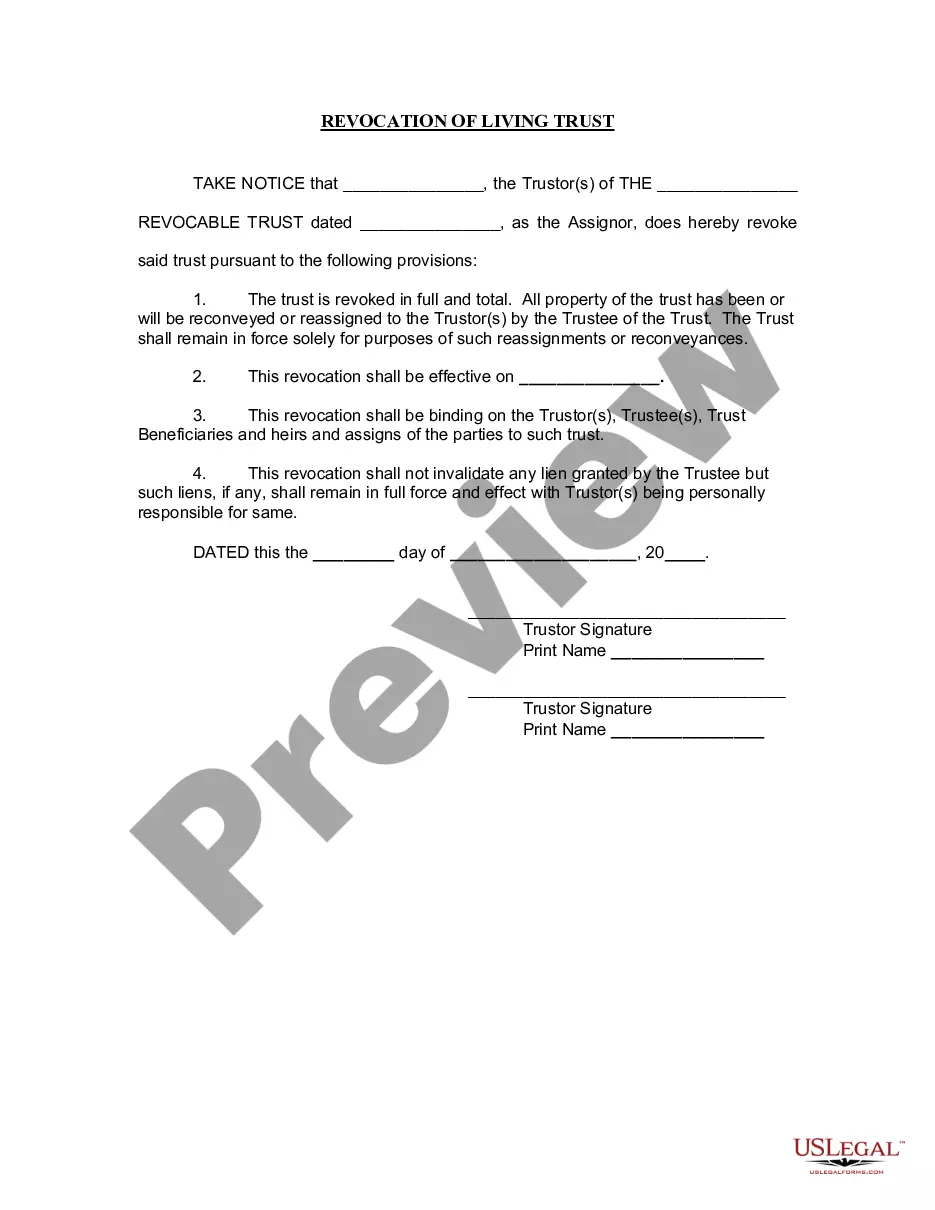

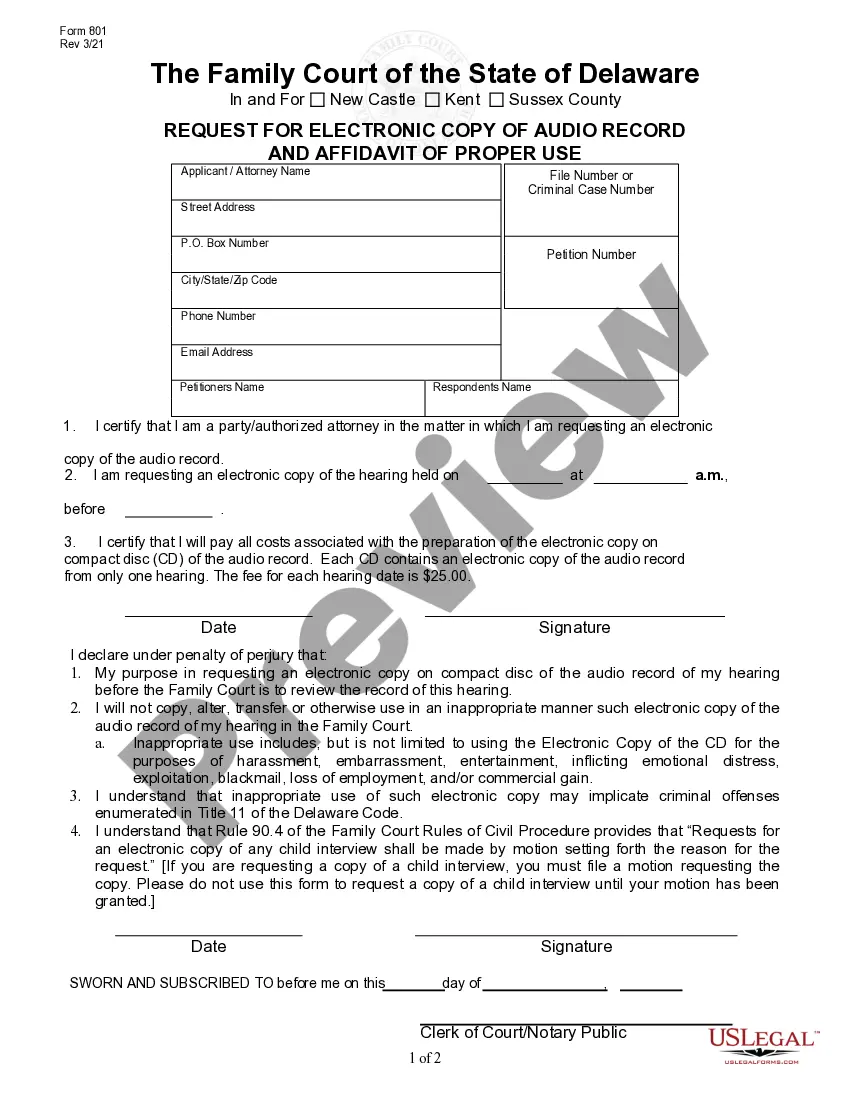

- Use the Review option to verify the form’s details.

Form popularity

FAQ

If someone writes you a bad check, the first step is to contact the check writer and notify them of the issue. If this does not work, consider drafting a Georgia Notice of Returned Check to formally communicate the situation. If necessary, legal action may follow, and being informed of your options can help you navigate the process smoothly.

Returned checks can result from insufficient funds, closed accounts, or errors in check writing. Understanding the reasons behind these returned checks can help you manage your finances and relationships better. It's wise to be aware of the legal implications, such as the necessity of a Georgia Notice of Returned Check, which can guide you in these situations.

When someone writes you a bad check in Georgia, consider discussing it with them directly first. If this does not lead to payment, you may need to pursue further action through a Georgia Notice of Returned Check. Additionally, it's advisable to keep records of all communications and transactions to strengthen your case if legal proceedings become necessary.

If you receive a bad check in Georgia, you should first contact the issuer to resolve the issue. Often, the writer may not be aware of the situation. If the matter does not get resolved, you can send a formal notice regarding the Georgia Notice of Returned Check, allowing them time to remedy the situation before pursuing legal action.

When dealing with a Georgia Notice of Returned Check, you may wonder about your filing obligations. If you received a returned check in Georgia, it's essential to keep records of these instances for your tax filings. You should take note of any potential income or losses related to these checks. Utilizing uslegalforms can guide you through the necessary documentation and ensure compliance with Georgia laws.

Politely informing someone that their check has bounced can be done through a friendly yet straightforward letter. Begin by stating the check details and mention that it was returned for insufficient funds. Express understanding while emphasizing the need for prompt payment, reminding them that failure to act could result in receiving a Georgia Notice of Returned Check.

To write a letter for a returned check, start with your contact details and the date. Clearly state the check details, such as the amount and the date it was issued, along with the reason it was returned. End the letter by requesting immediate payment, reminding the recipient that unresolved payments may lead to receiving a Georgia Notice of Returned Check.

Notifying a customer of a bounced check involves drafting a clear, direct, yet courteous letter. Provide specific details, including the check number, amount, and the reason for the return. It is essential to stress the importance of reissuing payment to prevent the issuance of a Georgia Notice of Returned Check and to maintain a good business relationship.

A returned check letter should politely inform the recipient that their check has bounced. Begin the letter with your contact information and the date, followed by a clear description of the bounced check, including the amount and the reason for the return. Mention the consequences of this action, such as potential fees, and advise them to resolve the issue promptly to avoid a Georgia Notice of Returned Check.

To write a demand letter for a bounced check, start by clearly identifying yourself and providing details about the transaction. Include the date of the check, the amount, and mention that the check was returned due to insufficient funds. Finally, state your expectation for payment and any deadlines, while reminding the recipient that they may receive a Georgia Notice of Returned Check if payment is not made.