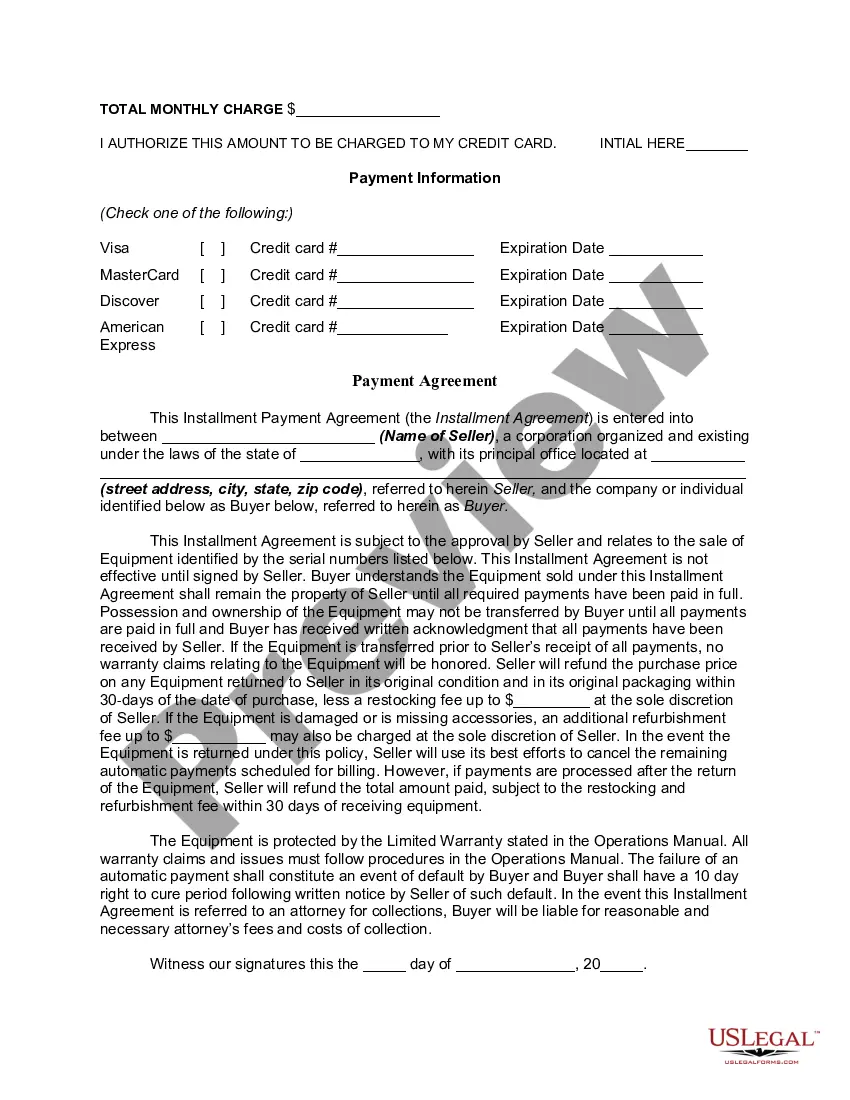

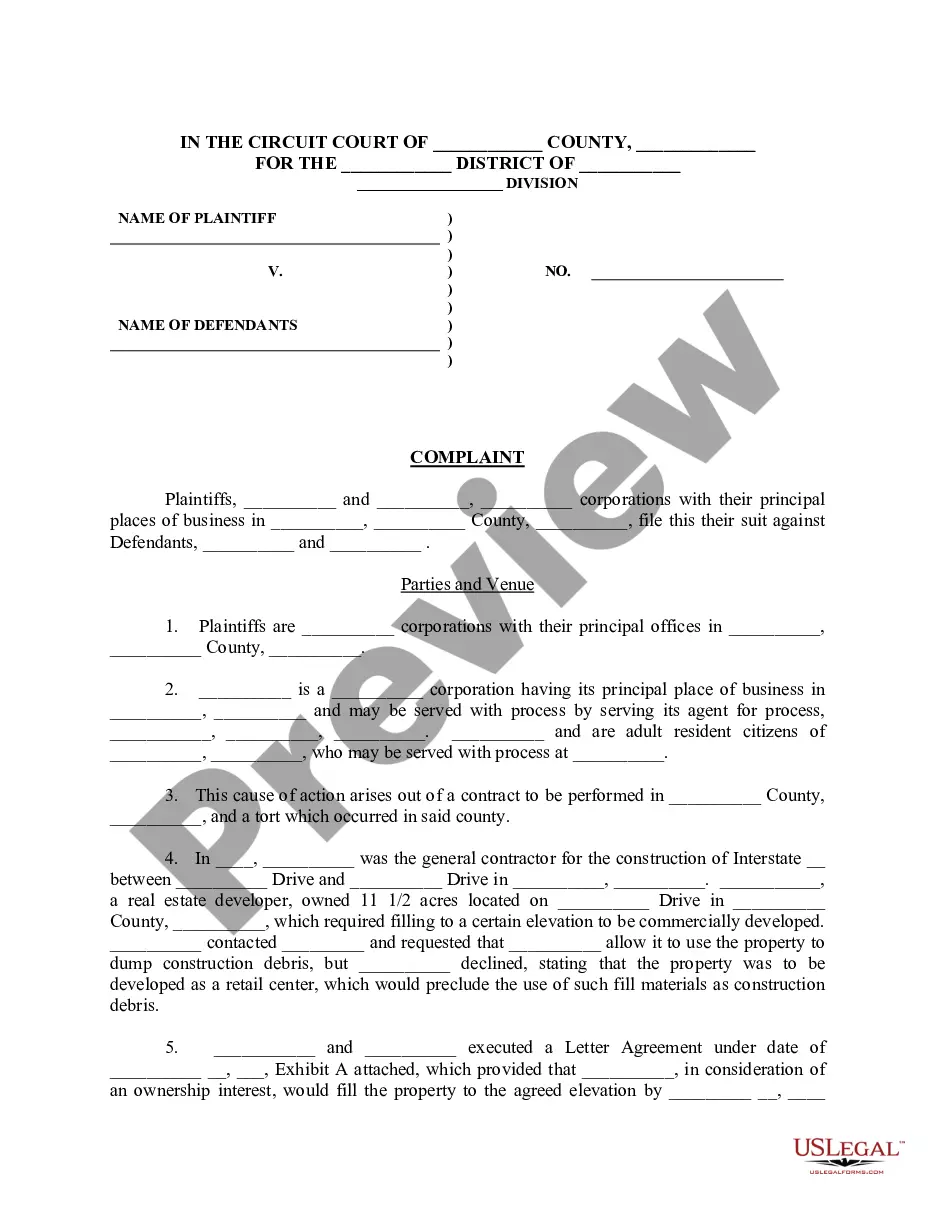

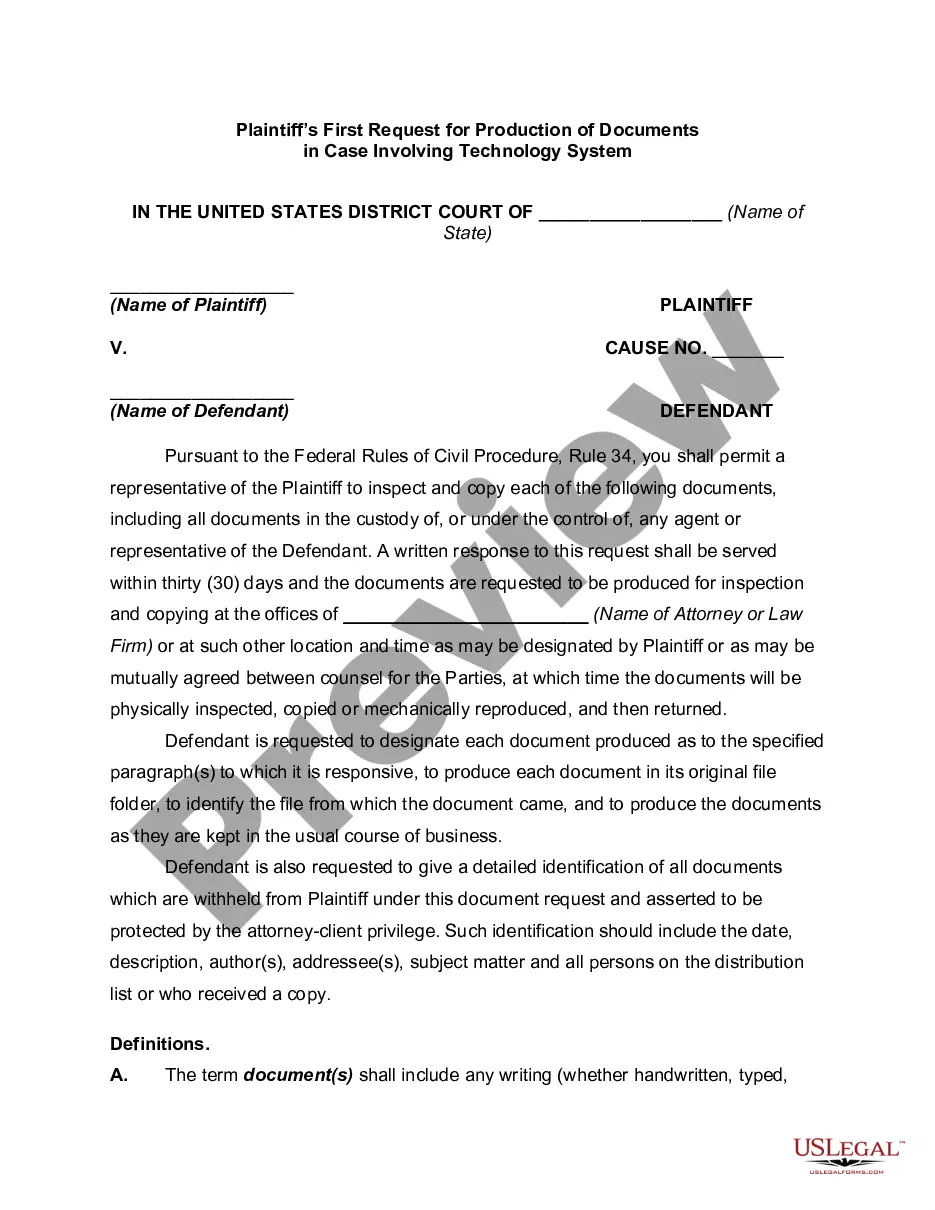

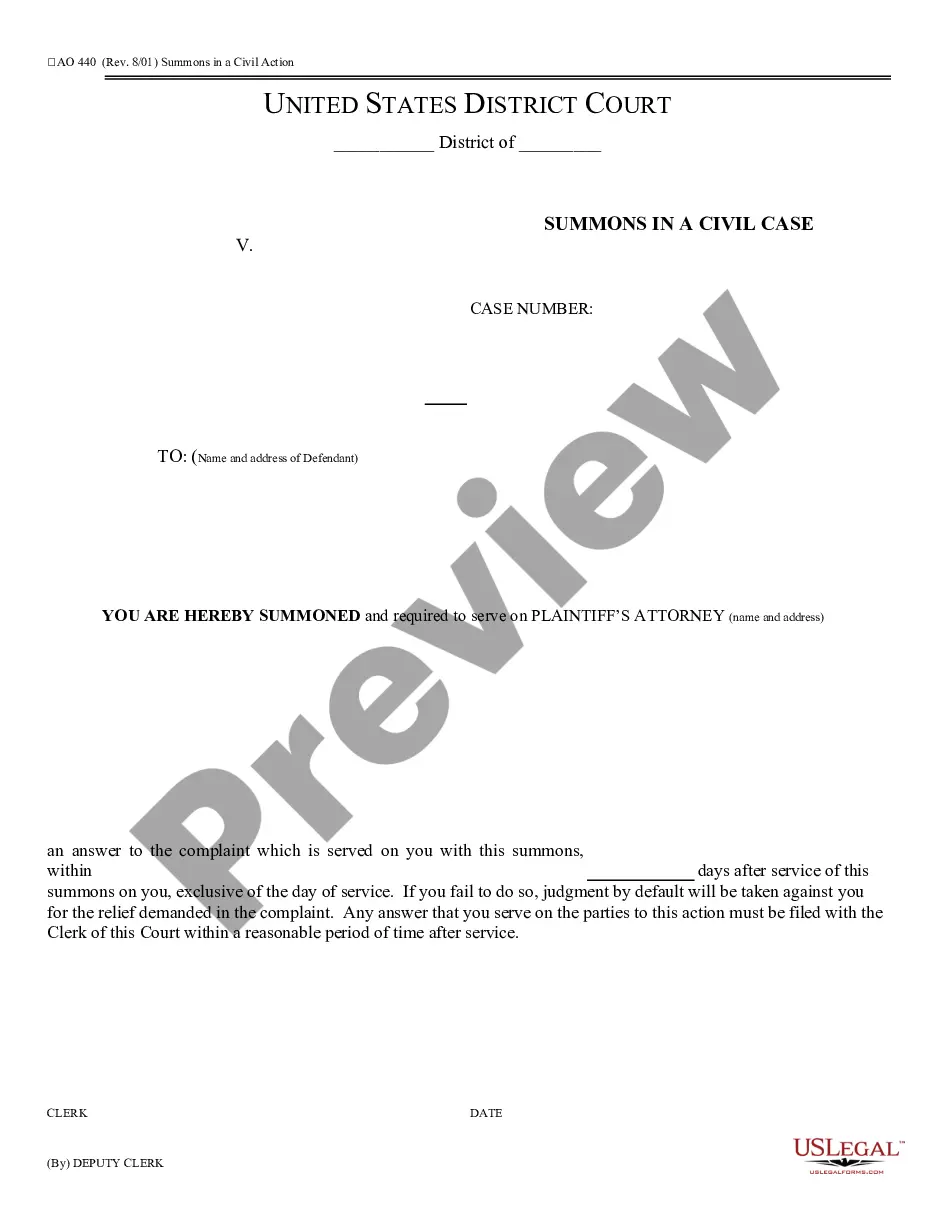

Georgia Installment Payment and Purchase Agreement

Description

How to fill out Installment Payment And Purchase Agreement?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a vast selection of legal form templates that you can download or print.

On the website, you can find thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can access the latest forms like the Georgia Installment Payment and Purchase Agreement in just a few minutes.

If you have a subscription, Log In and download the Georgia Installment Payment and Purchase Agreement from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously acquired forms in the My documents tab of your account.

Make modifications. Fill out, edit, print, and sign the downloaded Georgia Installment Payment and Purchase Agreement.

Every template you add to your account has no expiration date and is yours permanently. So, if you want to download or print another copy, just visit the My documents section and click on the form you desire.

- If you are using US Legal Forms for the first time, here are some simple instructions to help you get started.

- Ensure you have chosen the correct form for your area/region. Click the Preview button to review the content of the form. Check the form's details to confirm you have selected the right one.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- If you are happy with the form, confirm your selection by clicking the Buy now button. Then, choose your preferred pricing plan and provide your details to create an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the payment.

- Select the format and download the form onto your device.

Form popularity

FAQ

You can send your Georgia state tax payment to the Georgia Department of Revenue. For individuals, the mailing address is often specified on your tax return or payment voucher. It’s crucial to double-check the address each year to ensure you send your payment to the correct location.

General Information. If you owe a tax debt to the Georgia Department of Revenue and cannot afford to pay it all at once, you can request an installment payment agreement to settle your debt over time. Payment plans may not be for longer than 60 months and the minimum monthly payment is $25.

What is an instalment agreement? If you buy goods under an instalment agreement, the seller will give you the goods immediately and you will have to pay the price in instal- ments (smaller amounts of the full price) over a period of time.

You can apply for an installment agreement online, over the phone, or via various IRS forms. To some degree, you get to choose how much you want to pay every month. The IRS will ask you what you can afford to pay per month, encouraging you to pay as much as possible to reduce your interest and penalties.

Taxpayers can request their payment plan online using the Georgia Tax Center. Once logged into the system, individuals and businesses can propose a payment amount and schedule. With payment sent by electronic funds transfer (EFT), DOR charges a $50 dollar fee to set up the payment agreement.

An installment purchase agreement is a contract used to finance the acquisition of assets. Under the terms of such an agreement, the buyer pays the seller the full purchase price by making a series of partial payments over time. The payments include stated or imputed interest.

The Statute of Limitations (SOL) The DOR has five years from the date of assessment to file a tax lien if the assessment was issued on or after February 21, 2018. Once the DOR files a tax lien, they have ten years from that date to collect the unpaid taxes.

Taxpayers can request their payment plan online using the Georgia Tax Center. Once logged into the system, individuals and businesses can propose a payment amount and schedule. With payment sent by electronic funds transfer (EFT), DOR charges a $50 dollar fee to set up the payment agreement.

1. Log into the GTC website ( ). 2. Under the I Want To section, click the Request payment plan hyperlink.

The Late Payment penalty is 0.5% of the unpaid tax due and an additional 0.5% of the outstanding tax for each extra month. The maximum is up to a maximum of 25% of the tax due. The combined total of both penalties above cannot exceed 25% of the tax due on the return due date.