Georgia Installment Promissory Note with Bank Deposit as Collateral

Description

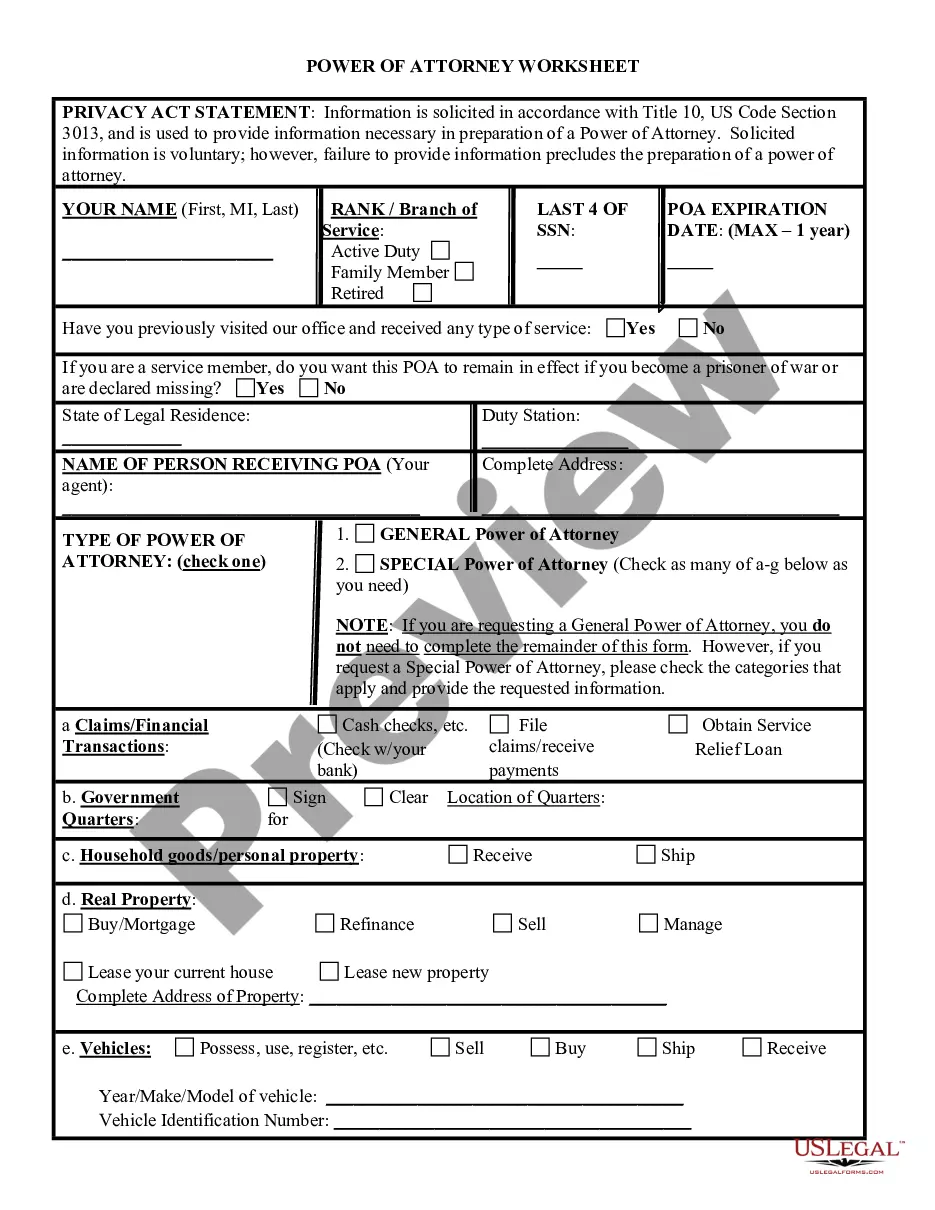

How to fill out Installment Promissory Note With Bank Deposit As Collateral?

Locating the appropriate sanctioned document template can be a challenge.

Naturally, there are numerous designs available online, but how can you discover the sanctioned form you require.

Utilize the US Legal Forms website.

If you are already a registered user, Log In to your account and click the Download button to access the Georgia Installment Promissory Note with Bank Deposit as Collateral. Use your account to browse through the legal forms you have previously purchased. Visit the My documents section of your account to obtain another copy of the document you require. If you are a new user of US Legal Forms, follow these simple steps: First, ensure you have selected the correct form for your area/county. You can review the document using the Preview button and read the document description to confirm it is indeed the right one for you. If the form does not meet your criteria, utilize the Search field to find the appropriate form. Once you are confident that the form is suitable, click the Buy now button to purchase the form. Choose the payment plan you need and input the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained Georgia Installment Promissory Note with Bank Deposit as Collateral. US Legal Forms is the largest repository of legal forms where you can find a variety of document formats. Use the service to download professionally crafted documents that comply with state regulations.

- The platform provides thousands of designs, including the Georgia Installment Promissory Note with Bank Deposit as Collateral, suitable for business and personal purposes.

- All documents are reviewed by professionals and comply with federal and state regulations.

Form popularity

FAQ

In the context of a Georgia Installment Promissory Note with Bank Deposit as Collateral, the security agreement is the document that links the promissory note to the collateral. This critical document details the terms, rights, and responsibilities regarding the collateral, ensuring that both parties are on the same page. By utilizing this document effectively, you can protect your interests in the agreement.

To write a promissory note to a bank, you should include essential details like the amount to be borrowed, the interest rate, repayment schedule, and the collateral description, such as a Georgia Installment Promissory Note with Bank Deposit as Collateral. Clearly stating these details helps ensure that all parties understand their obligations and rights. You may also want to consult templates available on platforms like UsLegalForms for guidance.

The security agreement is the primary document that connects a Georgia Installment Promissory Note with Bank Deposit as Collateral to the collateral itself. This agreement outlines the terms under which the collateral secures the promissory note. By defining the terms clearly, both parties can confidently navigate the agreement.

When dealing with a Georgia Installment Promissory Note with Bank Deposit as Collateral, you will typically need several legal documents. These can include the promissory note itself, a security agreement, and possibly evidenced bank statements showing the collateral. Understanding these documents ensures that you have the right protections in place for your financial transactions.

A promissory note is a legally binding document, provided it meets specific criteria under state law. This binding nature ensures that both the lender and the borrower have clear obligations to one another. If the terms of the note are not met, legal action can be taken for recovery. Using a Georgia Installment Promissory Note with Bank Deposit as Collateral further solidifies the enforceability of the agreement.

Many promissory notes are backed by collateral to reduce risk for the lender. This collateral often includes tangible assets or accounts, such as bank deposits. Having collateral increases the chances of repayment, as the lender can claim the asset if needed. A Georgia Installment Promissory Note with Bank Deposit as Collateral is a practical example of this kind of arrangement.

Yes, banks can issue promissory notes, typically for purposes like personal loans or business financing. A Georgia Installment Promissory Note with Bank Deposit as Collateral can be an essential part of this process. It formalizes your debt obligations and outlines repayment conditions. If you need guidance, platforms like US Legal Forms can assist in navigating this banking process.

To secure a promissory note with real property, you typically create a mortgage or deed of trust. In the case of a Georgia Installment Promissory Note with Bank Deposit as Collateral, the real property serves as backing in case of default. This not only enhances the borrower's credibility but also reassures lenders of the investment's safety. Effective documentation is crucial for this arrangement.

A key disadvantage of a promissory note involves the potential for default, which can occur if the borrower fails to repay. If you opt for a Georgia Installment Promissory Note with Bank Deposit as Collateral, understand that nonpayment can lead to the loss of your collateral. Additionally, the terms can sometimes be rigid, leaving less room for negotiation. Always weigh your options carefully before proceeding.

Yes, many banks accept promissory notes as a form of collateral. Specifically, they may consider a Georgia Installment Promissory Note with Bank Deposit as Collateral for securing loans. Banks evaluate the note's terms and the borrower’s creditworthiness before acceptance. If you clarify your needs, a bank can help you navigate this process.